The Fed’s $7 Billion Repo Day: Liquidity Tuning, Not a New QE

Every time the Federal Reserve appears in the news with a large dollar figure next to the word injection, markets react. Social media threads light up with claims that a new wave of easy money is coming, that the Fed is secretly restarting quantitative easing (QE), or that this is a sign of hidden stress in the banking system. The latest example is the announcement that the Fed will provide roughly 6.8–7 billion USD in liquidity via repurchase agreements, or repos, in a single day.

At first glance, this looks like fresh money entering the financial system. In reality, it is something more routine and more technical: a very short-term loan backed by high-quality collateral, designed to keep short-term interest rates stable and money markets functioning smoothly. It tells us something about liquidity conditions, but it is not the same as creating new money through QE.

This article breaks down what repo actually is, how it differs from QE, why these operations are common at year-end, and what they really signal about the state of the financial system going into 2025. The goal is educational: to give you the tools to interpret headlines calmly instead of reacting to the loudest narrative.

1. What the Fed Is Actually Doing: A One-Day Collateralized Loan

A repo (repurchase agreement) is essentially a secured overnight loan. The mechanics look like this:

- Banks and other eligible institutions bring high-quality securities (typically US Treasury bills, notes or bonds) to the Fed.

- The Fed provides cash in exchange for those securities as collateral.

- On the next business day, the institution buys back its securities at a slightly higher price, which reflects an overnight interest rate.

Economically, the Fed has lent cash overnight and received government securities as collateral. The key features are:

- Very short term: often just one day, occasionally a bit longer for term repos.

- Fully collateralized: the Fed holds safe assets that can be sold if the borrower fails.

- Self-reversing: by design, the transaction unwinds in a predictable way as the cash is repaid.

When you see a headline that the Fed is providing 7 billion USD through repo tomorrow, what it really means is that up to 7 billion USD of reserves will temporarily flow into the banking system, then be pulled back the moment those repos mature. It is closer to a short-term bridge loan than to a long-term stimulus program.

2. Repo vs. QE: Temporary Liquidity vs. Lasting Expansion

Because both repos and QE involve the Fed interacting with Treasury securities and the banking system, they are easy to confuse. But they are fundamentally different tools with different goals.

2.1 What QE does

Under quantitative easing, the Fed:

- Buys Treasury securities and other assets outright from the market.

- Pays for them by crediting the banking system with new reserves.

- Holds those assets on its balance sheet for an extended period, often years.

This is a lasting expansion of the Fed’s balance sheet. The new reserves stay in the system until the Fed actively reduces its holdings (through quantitative tightening or letting bonds mature). QE is meant to lower longer-term interest rates, support asset prices and ease financial conditions broadly.

2.2 What repo does

Under a repo operation, the Fed:

- Lends cash against high-quality collateral for a short, defined period.

- Expects to be repaid quickly, at which point the reserves disappear from the system.

- Uses this tool mainly to keep short-term rates aligned with its policy target and to smooth daily liquidity.

Repos are therefore a form of temporary liquidity management. They are part of the Fed’s day-to-day toolkit, not a structural policy shift. The 7 billion USD provided tomorrow will not sit permanently on the Fed’s balance sheet. It comes in and goes out like oil in an engine, keeping things running smoothly rather than redesigning the machine.

So while commentators may label any Fed action involving billions of dollars as 'QE', it is important to distinguish between short-term stabilization and long-term monetary expansion.

3. Why Now? Year-End Liquidity and Market 'Plumbing'

Repo operations tend to attract more attention around year-end and other balance-sheet dates. That is not a coincidence.

At certain times of the year, banks face extra demands on their cash:

- Corporations pay taxes, bonuses or dividends, which moves deposits around the system.

- Regulators and internal risk teams look closely at year-end balance sheets, encouraging banks to hold extra liquidity.

- Money market funds adjust their portfolios, sometimes preferring to hold very short-term instruments instead of longer ones.

These seasonal patterns can lead to temporary tightness in funding markets. Short-term interest rates might try to drift above the Fed’s target if there is not enough cash available relative to demand. Rather than let that happen, the Fed uses repos to provide just enough reserves to relieve the pressure.

Think of it as preventative maintenance. The central bank knows that the plumbing of the financial system gets strained at predictable times, so it proactively opens the taps to ensure that everyone who needs overnight funding can get it at reasonable rates. When conditions normalize, the extra support naturally rolls off as repos mature.

4. How Big Is 7 Billion USD in Context?

Seven billion dollars is an impressive number in everyday life, but in the context of the US financial system it is relatively small. Several comparisons help put it into perspective:

- The Fed’s total balance sheet is measured in trillions of dollars.

- Daily trading volume in US Treasury markets alone can exceed hundreds of billions.

- Large QE programs have added hundreds of billions to trillions in assets over months and years.

By comparison, a single-day repo of 6.8–7 billion USD is more like adjusting the air conditioning than rebuilding the house. It matters for short-term conditions in funding markets, but it is not large enough to redefine the entire monetary stance.

This does not mean it is irrelevant. The fact that institutions are choosing to borrow from the Fed at all tells us something about liquidity preferences and the availability of cash from private sources. But it is a far cry from a structural shift that would, by itself, remake the macro landscape.

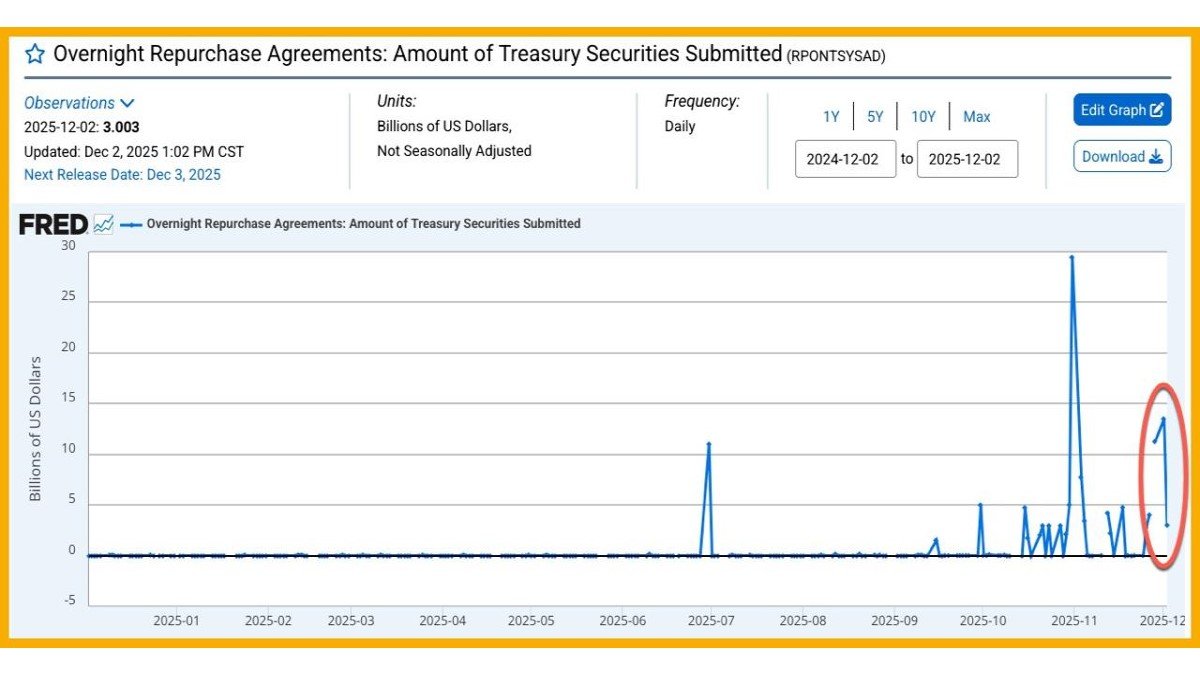

5. What Repo Activity Signals About Liquidity Stress

So, if it is not QE, what does this repo operation tell us about the health of the financial system?

There are a few key interpretations:

• Liquidity is tight enough for banks to tap the Fed, but not in crisis. If funding were extremely abundant, institutions might not bother using the Fed’s repo facility. The fact that there is demand suggests some degree of tightness, especially around year-end.

• The Fed prefers proactive smoothing over reactive firefighting. By offering repos in advance, the central bank reduces the risk of sudden spikes in short-term rates that could ripple through markets.

• The stress is short-term and technical, not obviously systemic. An overnight repo backed by high-quality collateral is very different from emergency lending to institutions in distress.

In other words, repo activity is a sign that liquidity remains a constraint worth managing, but it is not necessarily a red flag that something has already broken. It is a reminder that the post-QE world, where the Fed has been shrinking its balance sheet, requires more active fine-tuning of reserves to keep markets comfortable.

6. Does This Help Risk Assets and Crypto?

Whenever there is talk of the Fed supplying cash, investors quickly ask what it might mean for equities, bonds and digital assets. It is tempting to assume that any injection is automatically positive for prices. The reality is more subtle.

Because repos are short-lived, their direct impact on medium- and long-term asset pricing is limited. However, they can matter in several indirect ways:

- Stabilizing short-term rates: By preventing funding stress, the Fed helps avoid sudden jumps in overnight rates that could force institutions to sell assets in a hurry.

- Reducing the risk of accidents: Some of the worst market episodes in history have started in money markets. Routine repo operations are part of the toolkit designed to avoid those accidents.

- Supporting overall confidence: When professional investors see that the central bank is actively managing liquidity, they can be more comfortable taking long-term views instead of worrying about immediate funding risk.

For digital assets such as Bitcoin or other cryptocurrencies, the connection is second-order. Crypto markets do not borrow directly from the Fed, but they are influenced by global liquidity conditions, risk appetite and interest rate expectations. A well-managed repo market can reduce the probability of broad funding shocks that spill over into all risk assets. At the same time, it does not carry the same long-term easing signal that a new QE program would.

In short, a 7 billion USD repo day is better characterized as preventing unnecessary stress than as deliberately boosting asset prices.

7. Why This Is Not 'Money Printing'

A recurring misconception is that any operation where the Fed provides cash equals 'printing money'. Repos are a good example of why that intuition can mislead.

In a standard money-printing narrative, the central bank creates new base money that stays in the system, supporting credit creation and potentially increasing inflation over time. With repos, the cash is created and then extinguished when the loan is repaid, often within 24 hours.

From an accounting perspective, the Fed’s balance sheet swells by the size of the repo for one day, then shrinks back when it unwinds. The banking system’s reserves follow the same pattern. Unless these operations are repeated on a massive and sustained scale, they do not amount to the kind of persistent monetary expansion people usually mean when they talk about money printing.

This distinction matters for investors trying to infer the Fed’s broader policy direction. A one-off or seasonal repo operation is a statement about tactical liquidity management, not about a strategic decision to ease financial conditions for months or years.

8. How to Read Repo Headlines More Calmly

Given how often these stories appear, it is useful to have a simple mental checklist for interpreting them. When you see a headline about the Fed injecting liquidity via repo, ask yourself:

• Time horizon: Is this an overnight or very short-term operation, or a multi-month bond-buying program? Short-term usually means technical, not structural.

• Size: How big is the number relative to the Fed’s balance sheet and to past QE programs? Billions are not the same as hundreds of billions.

• Context: Is this around quarter-end or year-end, when liquidity is often tight? Seasonal effects are common.

• Collateral: Are we talking about high-quality government securities posted by healthy institutions, or emergency loans against less liquid assets?

• Messaging: What are Fed officials saying about the purpose of the operation and the broader policy outlook?

Working through these questions can help distinguish between a genuine policy pivot and routine maintenance. Most repo activity falls in the second category.

9. Educational Takeaways

From an educational standpoint, the current focus on a 6.8–7 billion USD repo operation is an opportunity to deepen our understanding of how the modern financial system works. Several key lessons stand out:

• Not all liquidity is created equal. There is a difference between temporary, collateralized loans and lasting expansions of central bank balance sheets.

• Market plumbing matters. Even in a world of sophisticated derivatives and global portfolios, the basic functioning of overnight funding markets is crucial for stability.

• Headlines can exaggerate. Large numbers and emotionally charged phrases can obscure the technical nature of many central bank actions.

• Short-term support and long-term policy are separate questions. The Fed can simultaneously keep markets functioning smoothly while still pursuing a cautious or restrictive stance on interest rates overall.

• For long-term investors, signal and noise differ. Understanding which actions change the long-term cost of capital and which simply smooth the path can help avoid overreacting to every new announcement.

When looked at through this lens, tomorrow’s repo operation looks less like a dramatic turning point and more like a necessary, technical adjustment. It acknowledges that liquidity is still a constraint in a post-QE environment, but it does not rewrite the narrative for inflation, interest rates or long-term asset valuations by itself.

For anyone following macro and markets, the most productive response is not to assume hidden stimulus or hidden crisis, but to treat repo headlines as data points about how the Fed is managing the transition from years of abundant reserves to a more finely tuned system.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Monetary policy and financial markets are complex, and conditions can change rapidly. Always conduct your own research and consult a qualified professional before making financial decisions.