From Gold to Wall Street, From Bitcoin to Ethereum: Who Owns Digital Finance in the Next Decade?

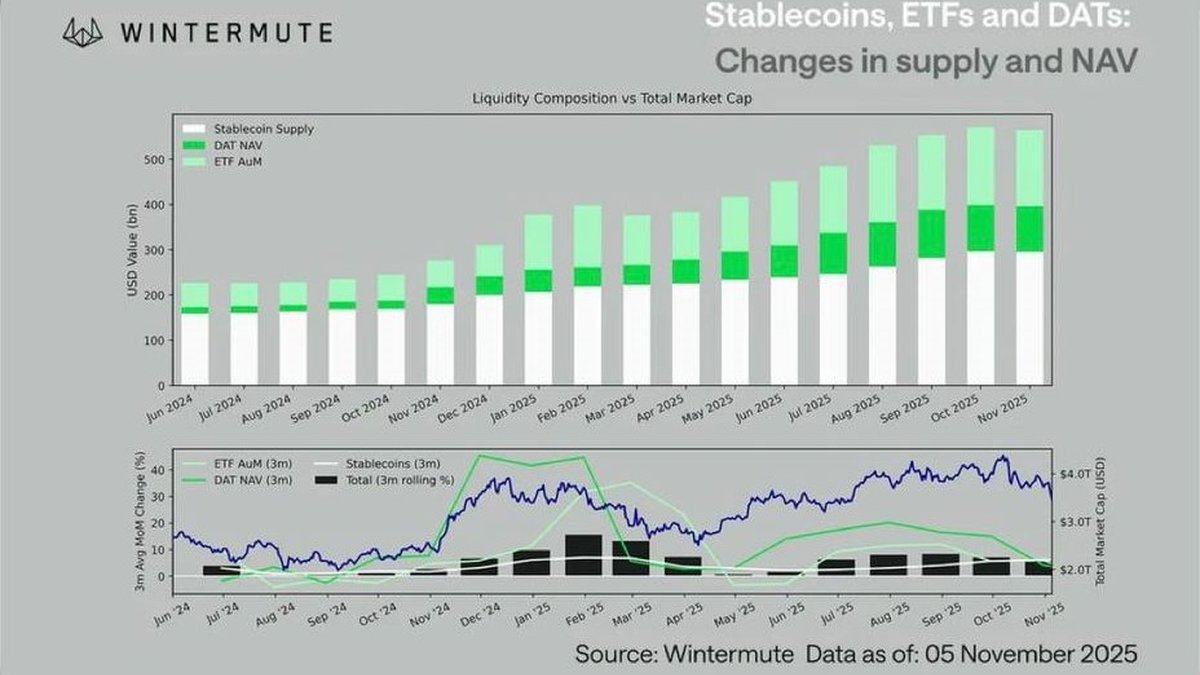

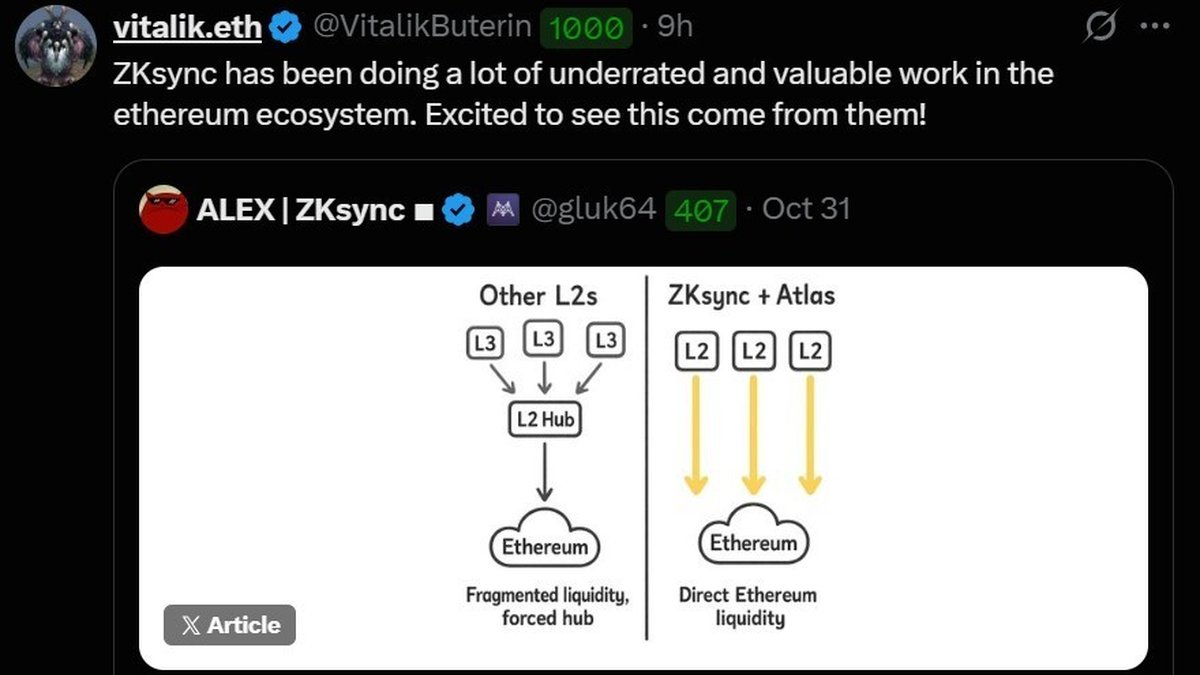

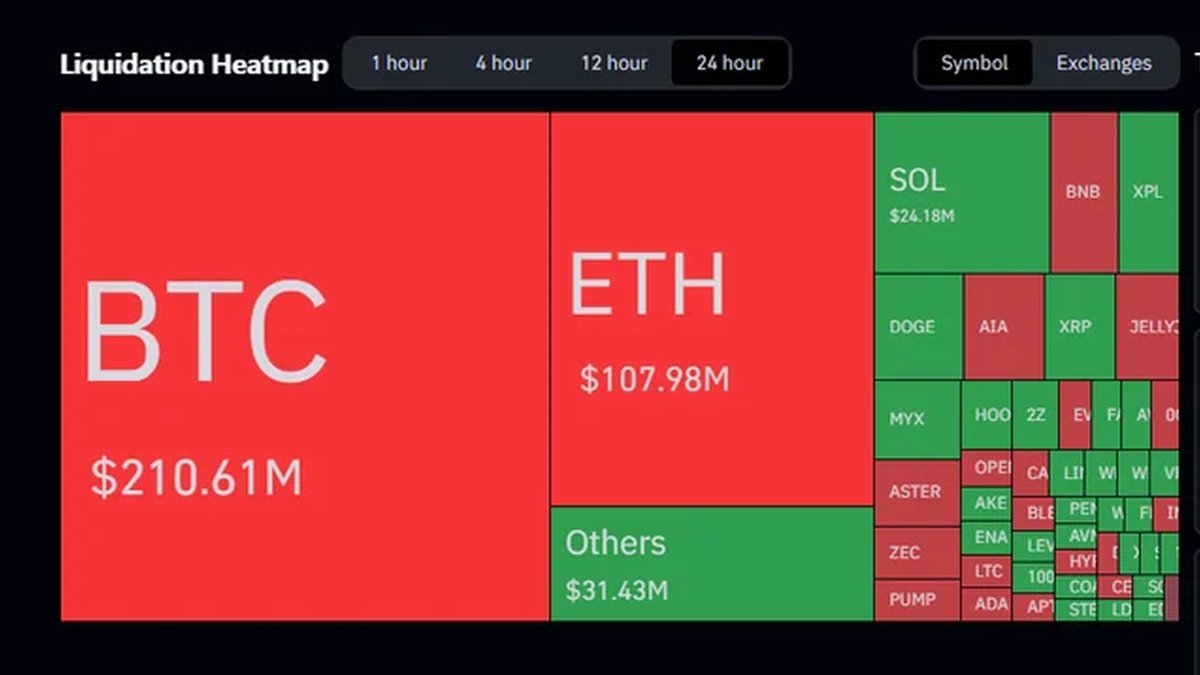

Fifty years after the U.S. left the gold standard, Wall Street turned scarcity into systems: derivatives, bond markets, and financial plumbing that scaled capitalism. Tom Lee argues crypto is replaying that split. Bitcoin is digital gold—scarce, inert, pristine collateral—while Ethereum is the programmable Wall Street where stablecoins, DeFi, and tokenized assets live. We examine whether that division of labor can propel BTC toward $2 million and ETH toward $60,000 by 2030, what could break the analogy, and how investors should position.

Read more →