Silver at $70, GDP at 4.3%: Hard Assets Roar While Crypto Regroups

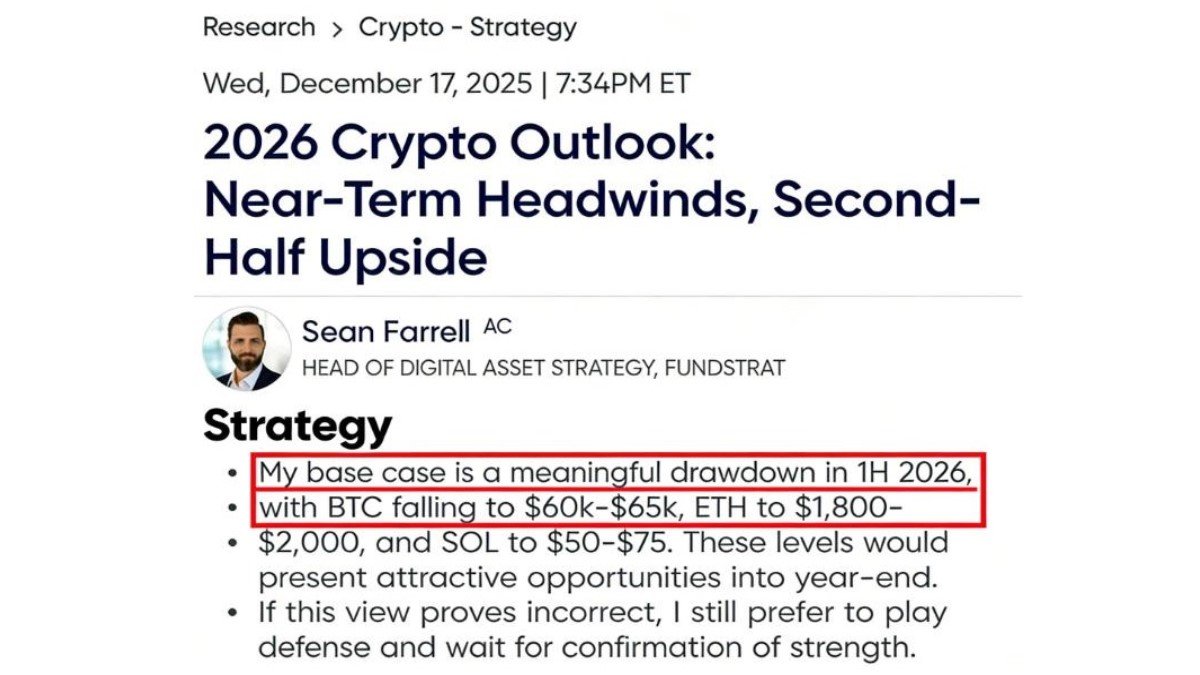

Silver has surged to a new all-time high near 70 USD, gold has pushed further into record territory and U.S. GDP just printed 4.3% for Q3. At the same time, BitMine is quietly adding tens of millions of dollars in ETH, USDC supply keeps expanding and regulators from Arizona to Moscow are rethinking their stance on digital assets. This wrap connects the dots between hard-asset euphoria, political pressure on the Fed and the evolving structure of crypto markets.

Read more →