From Hashrate to Compute: What Hut 8’s $7B AI Deal Signals for Bitcoin Miners

For most of the last decade, Hut 8 was known primarily as a Bitcoin mining company: a capital-intensive, energy-hungry business whose fortunes rose and fell with the price of BTC and the difficulty of the network. That narrative is now being rewritten. The firm has signed a 15-year agreement worth roughly $7 billion to lease out artificial-intelligence data-center capacity in Louisiana, positioning itself as a key infrastructure provider to the AI boom rather than just a participant in digital-asset mining.

Under the contract, infrastructure customer Fluidstack will lease 245 megawatts (MW) of power capacity from Hut 8’s new campus. The financial structure is reinforced by a powerful backstop: Google is providing a payment guarantee, meaning that if Fluidstack encounters financial difficulty, Google steps in to ensure that lease payments continue. The first phase of the data center is expected to come online in the second quarter of 2027, with most of the construction funded via bank debt rather than equity dilution.

This is not an isolated story. Core Scientific and Galaxy Digital have recently signed multi-billion-dollar AI hosting agreements of their own. Taken together, these developments suggest that Bitcoin miners are becoming an important bridge between excess energy and the exploding demand for AI compute. The question is what this transition actually looks like in practice, and what it implies for investors, for the Bitcoin network, and for the long-term relationship between crypto and AI.

1. Inside the Hut 8–Fluidstack–Google Structure

On the surface, the headline numbers are simple: a 15-year lease, $7 billion in contracted revenue and 245 MW of power capacity. The details, however, highlight why this deal is so significant for Hut 8’s risk profile.

First, the tenor of the agreement matters. Mining contracts and hosting agreements in the Bitcoin world are rarely locked in for more than a few years, given how quickly hardware efficiency and network difficulty change. A 15-year term resembles utility-scale power purchase agreements more than typical crypto arrangements. It gives Hut 8 visibility into cash flows that reaches far beyond a single halving cycle.

Second, the credit quality of the counterparties is unusually high for the digital-asset sector. Fluidstack is taking on the lease, but Google’s payment guarantee effectively wraps the agreement in big-tech credit. For lenders funding the construction of the Louisiana site, that guarantee is almost as important as the power infrastructure itself; it signals that default risk on the revenue line is low, provided Hut 8 meets its operational obligations.

Third, the project is being financed largely with bank loans rather than fresh equity. That choice is double-edged. On the one hand, it allows Hut 8 to scale into AI infrastructure without significantly diluting shareholders. On the other hand, it increases leverage and raises execution risk: the company must complete construction on time and maintain high uptime levels over many years to service the debt comfortably.

Viewed together, the contract is less a speculative side project and more a deliberate transformation of the business model. Hut 8 is choosing to become a long-term seller of secure power and space to AI workloads, not just a miner with opportunistic side revenue.

2. Why Bitcoin Miners Are Natural AI Infrastructure Providers

At first glance, Bitcoin mining and AI training seem like very different industries. One secures a decentralized network through hash computations; the other runs complex models that classify images, generate text or power recommendation engines. Yet the underlying resource they both demand is the same: large amounts of reliable, competitively priced electricity paired with specialized hardware and cooling.

Over years of operation, miners like Hut 8 have learned to do several things extremely well:

• Secure low-cost power. Mining is a margin-sensitive business. Operators scour the world for locations with abundant energy, favourable tariffs and supportive local authorities. The Louisiana site fits this pattern, leveraging regional power resources and regulatory support.

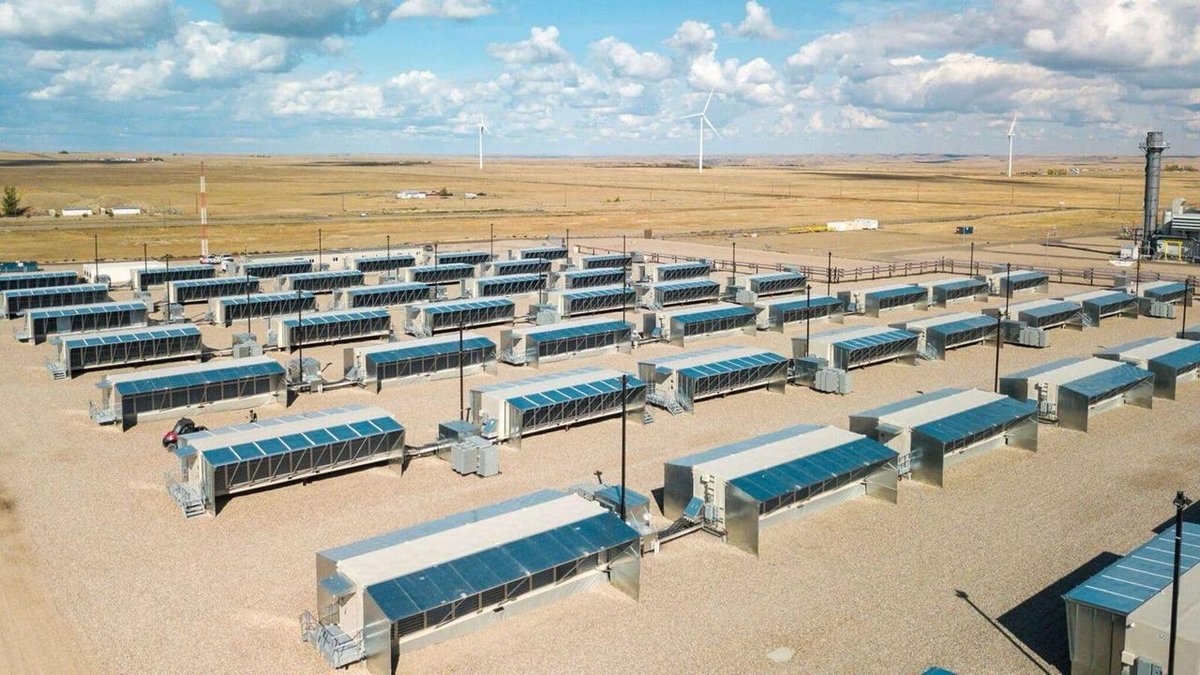

• Build modular, high-density facilities. Mining farms are essentially industrial-scale data centers tuned for a single type of workload. They feature optimized airflow, cooling and power distribution at densities that overlap with modern AI clusters.

• Operate in volatile markets. Miners have endured halving events, price drawdowns and wide swings in network difficulty. This has forced them to build expertise in risk management, treasury operations and scenario planning.

As AI demand grows faster than traditional data-center construction can keep up, large technology firms and compute providers are looking for partners who already have land, power and at least some infrastructure in place. Bitcoin miners, especially those with public-company governance frameworks, are now logical counterparties for this wave of demand.

3. Shifting Revenue from Volatile to Contracted

For Hut 8’s shareholders, the most important shift is not just from crypto to AI, but from variable to contracted revenue.

In a pure mining business, revenue per megawatt is highly sensitive to three factors outside the company’s control: the price of Bitcoin, total network hashrate and block rewards. A downturn in any of these – such as after a halving or during a price correction – can quickly squeeze margins, especially if electricity prices are fixed.

By contrast, a 15-year AI lease provides:

- Predictable cash flows. As long as the facility operates reliably and meets agreed-upon service levels, Hut 8 can model revenue over more than a decade.

- Improved financing terms. Banks are far more comfortable lending against contracted leases backed by a technology giant than against uncertain mining revenue. This can reduce the cost of capital.

- Portfolio diversification. Hut 8 does not need to abandon mining entirely. Instead, it can balance a set of AI infrastructure contracts with a smaller but higher-quality mining operation, smoothing out earnings.

There are trade-offs. Fixed-price contracts can become less attractive if market rates for AI compute rise dramatically, leaving money on the table. Long-term obligations also reduce flexibility: once the power is committed to Fluidstack and other AI customers, it is no longer available for opportunistic mining expansion. But overall, the shift from exposure purely to Bitcoin’s cycle toward a mix of BTC-linked upside and AI-linked stability can make the company more resilient.

4. A Broader Trend: Miners as Energy-Tech Companies

Hut 8 is not alone. Core Scientific and Galaxy Digital have announced their own large AI-oriented hosting agreements, each measured in billions of dollars. The pattern is clear: mining companies are repositioning themselves as energy-tech firms whose core asset is not just computing hardware, but the entire chain from land and permits to power purchase agreements and cooling systems.

In practical terms, this rebranding matters because it changes how mainstream investors and lenders view the sector. A business that depends solely on a single digital asset is harder to value and finance than one that sells essential infrastructure to diversified clients, including household-name technology companies.

It also influences strategic decisions. Instead of measuring success purely by exahashes per second, miners now track metrics familiar to real-estate investment trusts and utility operators: contracted megawatts, average remaining lease term, and the proportion of revenue backed by investment-grade counterparties.

5. What This Means for the Bitcoin Network

One natural question is whether the migration of miners toward AI hosting threatens the security or decentralization of the Bitcoin network. The answer depends on the scale and speed of the shift.

If miners were to shut off large portions of their hashrate overnight and repurpose facilities entirely for AI, network difficulty would fall, reducing the cost of a potential attack. In reality, the transition is more gradual and nuanced. Most companies are layering AI contracts on top of, rather than instead of, their mining operations. They may retire older, less efficient machines, redirect some power capacity, or design new campuses with a mixed-use model from the start.

Over the long term, this could actually strengthen Bitcoin’s resilience in several ways:

• Improved miner balance sheets. Companies with stable AI income are better positioned to withstand crypto bear markets without liquidating large BTC holdings or shutting off machines entirely.

• More sustainable energy use. Many AI clients require transparent reporting on energy sources and efficiency. This can encourage miners to deepen investments in renewable or low-emission power, aligning with broader environmental expectations.

• Diversified revenue reduces concentration risk. When survival does not depend solely on block rewards, miners may be less tempted to take excessive financial or operational risk.

There is still a balance to strike. If AI hosting becomes far more profitable than mining, some firms may gradually exit the latter. That would not end Bitcoin, but it could change the composition of its security providers. Observers will need to watch whether smaller, more specialized miners step in to fill any gaps.

6. The AI Side of the Equation: Why Deals Like This Exist

From the AI industry’s perspective, the Hut 8 deal is a response to a different constraint: a shortage of suitable power and rack space. Training and running large models require vast amounts of electricity and specialized cooling. Building new data centers from scratch is slow, especially in regions with complex permitting processes or limited grid capacity.

Bitcoin miners help solve that problem by offering:

• Existing sites with power interconnections already in place. The most time-consuming part of a data-center project is often securing land, environmental approvals and grid connections. Mining firms have already done much of that work.

• Experience with high-density deployments. AI workloads pack far more compute into each rack than traditional enterprise applications. Miners are used to managing similar densities for ASIC hardware.

• Flexible contractual arrangements. Because miners are familiar with volatile markets, they are often open to creative deal structures, including revenue-sharing and performance-based incentives.

The presence of a company like Google as a financial guarantor underscores how strategic this capacity has become. Large technology firms are willing to backstop third-party agreements to secure the compute they need, rather than waiting for internal projects alone to catch up.

7. Local and Macro Implications: Louisiana as a Test Case

The Louisiana campus is also a case study in how AI and crypto infrastructure intersect with regional economies. A 245 MW facility is not just a room full of servers; it is a multi-year construction project, a source of ongoing technical employment and a new large customer for local utilities.

For state and local governments, projects like this present both opportunities and questions:

- Opportunities in the form of new tax revenue, skilled jobs and the potential to attract related businesses such as chip suppliers, networking firms and service providers.

- Questions around grid capacity, environmental impact and land use. Authorities need to ensure that heavy industrial loads do not crowd out residential or commercial demand, and that energy sourcing aligns with climate commitments.

If the Hut 8 build-out proceeds smoothly and meets performance expectations, it could become a template for other regions seeking to repurpose or expand energy infrastructure for both digital assets and AI workloads.

8. What Investors Should Watch Next

For market participants tracking this emerging convergence between crypto and AI, several indicators will be worth monitoring over the next few years:

• Construction milestones. Does the Louisiana facility reach its first operational phase on schedule by the second quarter of 2027? Delays or cost overruns would affect the expected return profile.

• Debt levels and interest coverage. With bank financing as a key component, how comfortably can Hut 8 service its obligations from contracted revenue, especially before the campus is fully ramped?

• Balance between mining and AI revenue. Over time, what percentage of Hut 8’s income comes from hosting versus Bitcoin block rewards and transaction fees?

• Follow-on deals in the sector. Do other miners pursue similar long-term agreements, and are new entrants able to compete on price and scale?

These metrics will help distinguish between one-off headline deals and a durable structural shift in how digital-asset infrastructure companies earn their returns.

9. A Convergence Story, Not a Departure

It is tempting to frame Hut 8’s AI push as a departure from Bitcoin. In reality, it may be more accurate to see it as a convergence story. The same capabilities that allowed miners to secure the Bitcoin network – expertise in power markets, cooling, and large-scale hardware deployment – are now valuable inputs to the next wave of AI innovation.

Rather than abandoning crypto, companies like Hut 8, Core Scientific and Galaxy Digital are extending their skills into adjacent markets where demand is exploding and long-term contracts are available. If executed well, this could provide a more stable financial foundation from which to continue supporting Bitcoin, even through future cycles of volatility and halving events.

For observers, the main lesson is that the boundaries between sectors such as mining, cloud computing and AI are increasingly porous. The labels may change – from 'miner' to 'data-center operator' to 'infrastructure partner' – but the underlying economic drivers remain the same: securing low-cost power, building efficient facilities and aligning with customers who need that capacity for years to come.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets and AI-related infrastructure involve risk, and readers should conduct their own research and consult qualified professionals before making financial decisions.