SoftBank Buys DigitalBridge: Building the Data Center Empire for the AI Decade

Artificial intelligence is starting to look less like a single technology and more like a new layer of economic infrastructure. Models need chips; chips need power; power and connectivity converge inside highly specialized data centers. That simple chain explains why SoftBank’s decision to acquire DigitalBridge for roughly $4 billion, paying $16 per share (about a 15% premium), is drawing attention far beyond the world of real-estate investment trusts.

For Masayoshi Son, this is not just another portfolio company. After exiting its high-profile stake in Nvidia to free capital for what he calls an "AI revolution", SoftBank is now targeting the hard assets that every AI player depends on. DigitalBridge is an investment platform managing about $108 billion in digital infrastructure, spanning data centers, towers, fiber networks and related assets. Bringing that platform in-house gives SoftBank something it has often lacked in previous AI waves: direct control over critical infrastructure rather than only financial exposure to software or chip designers.

This article unpacks what the deal signals about the next phase of AI growth: why data centers are becoming the new "strategic high ground", how DigitalBridge fits into SoftBank’s ambitions, what this says about global competition for compute capacity, and where the main risks still lie.

1. From Owning Chips to Owning the Whole Stack

SoftBank has long been willing to make concentrated bets on technology trends. Its early backing of Arm and the now-famous stake in Nvidia were expressions of a simple thesis: if compute becomes the core resource of the digital economy, then owning key chip providers offers outsized leverage.

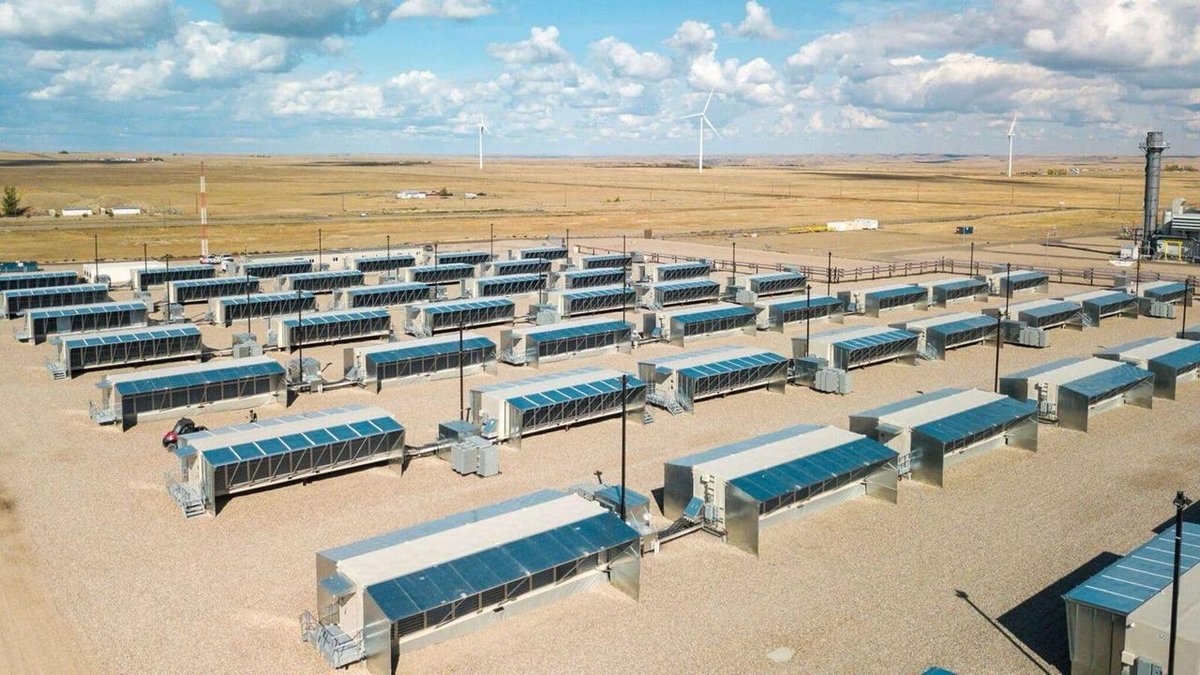

But the AI boom of the mid-2020s has shifted the bottleneck. Even if advanced chips are available, they are only useful when paired with power, cooling, connectivity and reliable operations at scale. Cloud platforms, hyperscalers and specialized AI clusters are all competing for the same scarce ingredients: suitable land, stable energy contracts, and data center capacity capable of hosting dense, high-heat workloads.

By agreeing to buy DigitalBridge, SoftBank is signaling a move one layer down the stack. Instead of focusing solely on semiconductor intellectual property or individual AI applications, it is positioning itself as an owner and allocator of the physical infrastructure that all of those businesses require. In that sense, the transaction aligns with a "picks-and-shovels" strategy for the AI era.

2. What Exactly Is SoftBank Buying?

DigitalBridge is not a single data center company; it is an infrastructure investment manager focused on digital assets. Its portfolio includes stakes in operators of data centers, fiber networks, cell towers and related platforms around the world. The firm’s scale—about $108 billion in assets under management across funds and vehicles—gives it reach into multiple segments of the digital economy.

For SoftBank, this offers several advantages:

• Diversification across the digital stack. Instead of owning just one operator or one region, SoftBank gains exposure to a broad set of assets: hyperscale data center campuses, edge facilities, tower portfolios and more.

• An existing pipeline of projects. DigitalBridge already sources, finances and operates new infrastructure projects. SoftBank can plug its AI vision—and its large balance sheet—directly into that deal flow.

• Relationships with institutional capital. DigitalBridge manages capital on behalf of pensions, sovereign funds and other large investors. Under SoftBank, those relationships could become channels for co-investment into AI-oriented infrastructure.

In short, SoftBank is not merely buying buildings and servers; it is acquiring an entire platform for building and owning the next generation of AI-ready infrastructure.

3. Why Data Centers Are Becoming the New Strategic Asset

Masayoshi Son has framed the deal as a way to "strengthen the foundation for next-generation AI data centers". That phrase captures a wider shift in how markets view this type of infrastructure.

Classic data centers were primarily about hosting enterprise IT workloads, websites and cloud applications. The new wave of AI facilities looks very different:

• Extreme power density. Training and running large models requires racks filled with power-hungry accelerators. Facilities must support much higher power per square meter than traditional enterprise data centers.

• Advanced cooling. Air cooling is often insufficient for dense AI clusters; operators are pivoting to liquid cooling, immersion systems and other techniques that require fresh capital expenditure and specialized expertise.

• Grid integration and energy strategy. Access to reliable, affordable electricity is now a defining competitive advantage. Data center operators are negotiating long-term power contracts, investing in on-site generation and engaging directly with utilities.

• Network proximity. AI workloads need low-latency connectivity to end users, data sources and other cloud platforms, which increases the value of well-connected facilities and fiber assets.

The acquisition of DigitalBridge allows SoftBank to place itself at the center of these trends. Rather than being just another customer of hyperscale providers, SoftBank can help design, finance and own the campuses that emerging AI companies will rent space from.

4. Reading the $4 Billion Price Tag

The headline number—$4 billion, or $16 per share, representing around a 15% premium—positions the transaction as a friendly takeover rather than a distressed bargain. SoftBank is effectively paying up for strategic control of a scaled digital infrastructure specialist.

Several financial angles stand out:

• From public equity volatility to infrastructure cash flows. By swapping some exposure to AI chip designers and high-growth software firms for infrastructure assets with multi-year contracts, SoftBank may be seeking a base of more stable cash flows to support its broader investment program.

• Embedded optionality. If AI demand continues to climb, well-positioned data centers can raise pricing, expand capacity and capture new clients, offering upside beyond traditional infrastructure returns.

• Reuse of capital recycled from Nvidia. Having previously exited its Nvidia stake, SoftBank is using part of that capital to acquire an asset that serves the same AI wave from a different angle—less exposed to product cycles, more tied to long-lived infrastructure.

From a portfolio standpoint, the move resembles a transition from owning only "growth engines" to also holding the "roads and power lines" those engines run on.

5. A Snapshot of Global AI Infrastructure Competition

The acquisition also needs to be seen against the backdrop of a worldwide race to secure AI compute capacity. Governments and corporations across North America, Europe and Asia are announcing plans for national AI clouds, sovereign data centers and dedicated AI clusters. Constraints on chip exports, energy availability and cross-border data flows all play into this competition.

In this context, SoftBank’s move has at least three strategic implications:

1. Positioning Japan in the AI infrastructure race. Although many of DigitalBridge’s assets are outside Japan, control by a Japanese conglomerate provides Tokyo with a stronger voice in how and where some future AI capacity gets built.

2. Offering an alternative to hyperscale-dominated models. Cloud giants currently lead in AI infrastructure, but asset managers like DigitalBridge work with a broader range of tenants: telecom operators, independent cloud providers, content networks and enterprise clients. Under SoftBank, that multi-tenant approach may be tailored to AI-native startups and regional providers that do not want to depend entirely on a single hyperscaler.

3. Deepening the convergence of finance and infrastructure. As AI demand reshapes real estate and power markets, sophisticated capital allocators will play a growing role in deciding which regions and technologies scale first. SoftBank is effectively inserting itself into that decision-making layer.

6. Opportunities: What SoftBank Can Build on Top of DigitalBridge

The immediate effect of the transaction is to give SoftBank a seat at the infrastructure table. The more interesting question is what it might build on top of that platform.

6.1 AI-focused data center clusters

DigitalBridge already backs operators that run modern facilities. With SoftBank’s capital and network of AI portfolio companies, those facilities could be expanded or redesigned with AI workloads as the default use case: higher-density racks, optimized networking layouts, and direct connectivity to cloud and telecom partners.

6.2 Integrated capital solutions for AI startups

SoftBank’s history with the Vision Fund has given it a broad view of startup financing—both the upside and the pitfalls. Pairing that experience with control of infrastructure could lead to new models where AI companies receive not only equity investment but also structured access to compute capacity, connectivity and storage on favorable terms.

For smaller AI teams, negotiating data center capacity can be as daunting as raising capital. A combined SoftBank–DigitalBridge platform could bundle the two, effectively acting as a "full stack" accelerator for compute-intensive businesses.

6.3 Partnerships in energy and sustainability

Another potential avenue is energy. Data centers are central to debates about grid stability and emissions. Large owners are increasingly expected to sign long-term renewable energy agreements, invest in efficiency and collaborate with utilities on grid planning. SoftBank, through DigitalBridge, can use its scale to negotiate innovative models—such as co-locating data centers with renewable generation, deploying advanced cooling technologies, or exploring new energy sources as they become viable.

Done correctly, this could turn sustainability from a constraint into a competitive advantage, making AI capacity more resilient during periods of energy price volatility.

7. Key Risks: Execution, Cycles and Governance

No acquisition, especially one in a fast-moving sector, comes without challenges. Several risks merit close attention.

7.1 Integration and strategic clarity

DigitalBridge already operates as a complex, global investment manager. Integrating that culture and process into SoftBank’s broader organization is not trivial. The risk is that overlapping mandates or shifting priorities could confuse employees, partners and clients. To avoid that, SoftBank will need a clear articulation of how DigitalBridge will be governed, how investment decisions will be made, and where the AI thesis fits into its traditional infrastructure mandates.

7.2 Exposure to interest rates and real-asset cycles

Data centers are long-lived assets financed partly with debt. Their valuations are sensitive to interest rates and to changes in capital markets’ appetite for infrastructure risk. If funding conditions tighten or if demand for generic data center capacity slows, returns could compress. Betting on an endless AI boom without acknowledging potential cycles would be a mistake.

7.3 Regulatory and geopolitical complexity

Digital infrastructure touches multiple regulatory domains: telecommunications, energy, environmental rules, foreign investment screening and, increasingly, data governance. As a Japanese group owning assets across different jurisdictions, SoftBank will need to navigate an evolving patchwork of rules around where sensitive workloads can be hosted, who can own which facilities and how data flows across borders.

8. What the Deal Signals for Investors and the AI Ecosystem

For investors, the transaction is another datapoint in a growing pattern: capital is migrating from purely software or token-based AI bets toward tangible infrastructure plays. Those include chip fabrication, specialized data centers, energy generation and high-capacity networks.

The logic is straightforward:

- Software models may evolve quickly, and individual applications can face intense competition.

- In contrast, well-sited, well-powered infrastructure often enjoys multi-year contracts and high switching costs.

- As AI adoption deepens, demand for these physical resources is likely to remain robust even as specific model architectures change.

For the AI ecosystem itself, a SoftBank-controlled DigitalBridge could become a key player in deciding where and how fast AI capacity scales. Regions that secure investment in energy and land can become hubs for model training and deployment. Developers may increasingly choose locations not just based on cloud pricing, but on regulatory comfort, energy mix and latency to key markets.

9. Conclusion: A Long-Term Bet on the Plumbing of Intelligence

SoftBank’s agreement to acquire DigitalBridge is far more than a headline about a $4 billion deal at a 15% premium. It marks a shift in strategy from backing only the "faces" of AI—chip designers, platforms and applications—to owning part of the plumbing that makes those businesses possible.

By bringing a $108 billion digital infrastructure manager under its umbrella, SoftBank is assembling the pieces needed to build and control next-generation AI data centers around the world. If Masayoshi Son’s vision plays out, the combination of capital, infrastructure expertise and AI-focused partnerships could position the group as a central player in the physical backbone of machine intelligence.

Success is not guaranteed. Integration, interest-rate dynamics and regulatory complexity all pose real challenges. But the basic intuition behind the move is hard to ignore: in an era where AI is becoming a general-purpose technology, owning the environments where models are trained and served may prove just as strategic as owning the models themselves.

For observers, the lesson is clear. The AI story is no longer confined to algorithms and user interfaces. It now includes land deals, power contracts, cooling technologies and multi-billion-dollar infrastructure platforms. SoftBank’s purchase of DigitalBridge is one of the clearest signs yet that the race for AI leadership will be decided as much in server rooms and substation yards as in research labs.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment or legal advice. Investments in infrastructure, technology and digital assets carry significant risks and may not be suitable for every investor. Always perform your own research and consider seeking guidance from a qualified professional before making financial decisions.