Are AI Companies a Bubble? Untangling the Hype, the Hardware, and the Real Risks

Few topics divide markets right now as sharply as artificial intelligence. On one side are those who see AI as a once-in-a-generation platform shift that will reshape entire industries. On the other side are skeptics who look at soaring valuations, huge chip budgets, and crowded data centers and ask a blunt question: is this starting to look like a bubble?

Part of the confusion comes from the way money flows through the ecosystem. A large share of the capital moving around AI does not yet come from end users paying directly for software. Instead, it often circulates inside the stack itself: companies raise funds, spend heavily on chips and infrastructure, which boosts the revenue and valuations of hardware suppliers, which then helps justify even more funding being raised and reinvested.

At the same time, it would be a mistake to dismiss the entire sector as purely speculative. The chips are physical, the data centers are running, the models are real, and many enterprises are already integrating AI into workflows. The question is not whether AI exists, but whether the pace and scale of investment are aligned with sustainable demand.

This article explores why some observers believe AI has entered bubble territory, why that accusation is not as straightforward as it sounds, and which warning signs would indicate that the risk of a sharp valuation adjustment is rising.

1. The AI Money Loop: When Capital Circulates Inside the Stack

One of the main reasons critics talk about an AI bubble is the way capital currently moves through the ecosystem. A simplified version of the loop looks like this:

- AI companies raise large funding rounds or commit to significant infrastructure spending.

- They use a substantial portion of that capital to buy chips and data center services.

- Chip makers and infrastructure providers report strong revenue growth, which boosts their valuations.

- Higher valuations help them and their partners raise even more capital.

- New capital is then reinvested into even larger AI projects, which again spend heavily on chips and data centers.

In other words, a lot of the money currently flowing through AI remains inside the AI supply chain itself. While there is growing revenue from end users, the most explosive part of the story so far is often the business of selling tools and infrastructure to other AI builders and platforms.

For skeptics, this looks uncomfortably similar to past periods where an industry partially financed its own growth narrative. They argue that as long as that loop keeps spinning faster than final demand from customers, the risk of overbuilding and overvaluation increases.

2. Why Some People See a Bubble Forming

Calling something a "bubble" is more than a way to express caution. It implies a specific pattern: prices and investment levels move far ahead of what can be justified by current or reasonably expected cash flows. In the case of AI, several features feed this perception.

2.1 Valuations rising faster than profits

Many leading AI companies carry valuations that assume extremely rapid growth in revenue and margins for many years into the future. So far, usage metrics and top line growth have been impressive, but in many cases the profitability profile still lags far behind the market capitalization.

That does not automatically mean those valuations are wrong. High growth companies often experience a lag between investment and profitability. However, when valuation curves steepen much more quickly than the actual earnings trajectory, it becomes easier for critics to argue that expectations are outrunning fundamentals.

2.2 Heavy spending based on future expectations

AI at scale is fundamentally capital intensive. Training and serving large models requires significant investment in chips, networking, data, and energy. Today, many companies are committing to multi year infrastructure plans based on expected future demand, not just on what customers are paying for right now.

From a strategic standpoint, this makes sense. No one wants to be left behind in an AI arms race. But from a risk management standpoint, it means the sector is front loading a lot of spending before long term revenue patterns are fully proven.

2.3 Ecosystem relationships that loop back on themselves

In a mature market, the path from producer to customer is relatively clear. In the current AI landscape, the relationships are more tangled. Many companies are simultaneously:

- Customers of larger AI platforms.

- Providers of tools or services back to those same platforms.

- Partners in joint infrastructure or research projects.

This dense web of cross investment and cross selling can support rapid growth, but it also makes it harder to see how much of the revenue is ultimately grounded in independent end user demand versus internal ecosystem activity.

2.4 Spending first on infrastructure, waiting for revenue later

Another feature that triggers bubble concerns is the sequence of cash flows. In many AI projects, the largest expenses arrive early: buying chips, fitting out data centers, securing energy, and hiring specialized teams. The business models, pricing strategies, and recurring enterprise contracts that will eventually justify this spend are still evolving.

This is not inherently irrational. History is full of periods where societies built infrastructure ahead of complete clarity about how it would be monetized. The internet fiber buildout and early mobile networks followed a similar pattern. But in each case, there were phases where capacity clearly exceeded short term demand, and valuations had to adjust.

3. Why "Bubble" Does Not Mean "Fake"

It is important to separate two ideas that often get conflated:

- Financial bubbles occur when expectations about future returns are stretched too far.

- Fake activity would mean the underlying assets or operations are not real.

In AI, the risk discussed by serious analysts is almost always about the first, not the second. The current AI wave is built on very tangible components:

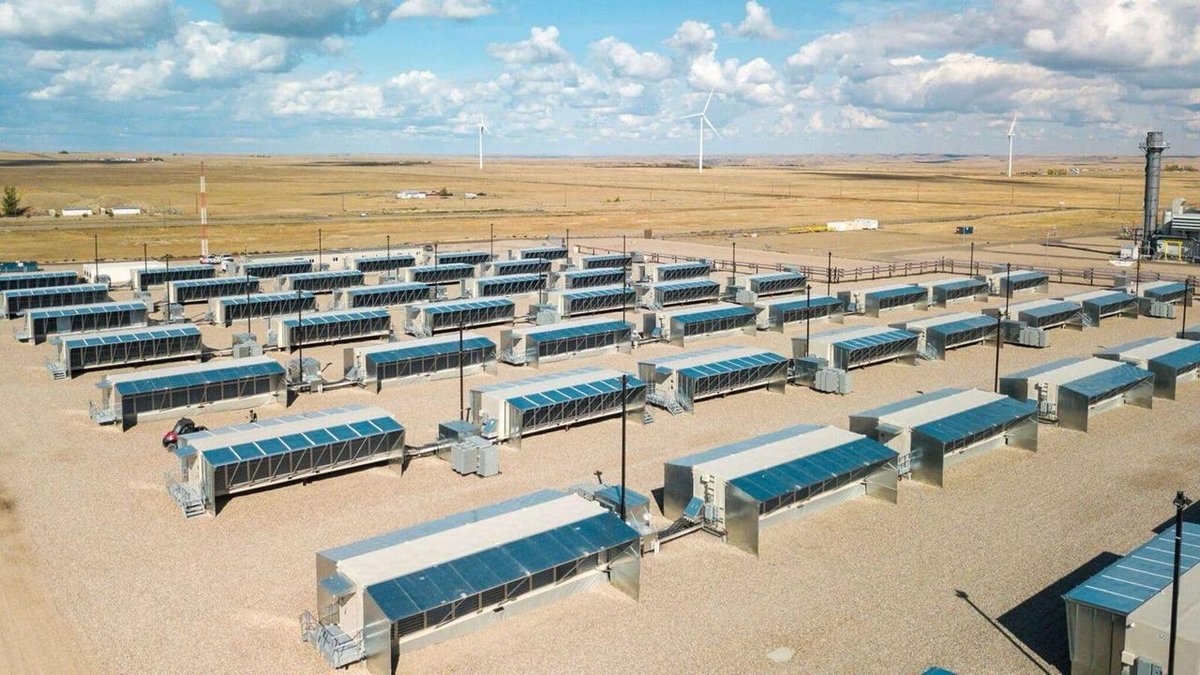

- Chips are real – advanced processors are being manufactured, shipped, and installed.

- Data centers are real – new facilities are being constructed or upgraded, often with significant power and cooling requirements.

- Models are real – they are trained, benchmarked, and deployed in thousands of products and services.

- Enterprises are really using AI – from customer support assistants to analytics and coding tools, adoption is not just marketing slides.

What critics worry about is not that these things are imaginary, but that the volume and timing of investment may be misaligned with what the economy can sustainably absorb in the near term. In other words, the structures may be real but could be built too quickly or in too much quantity.

4. The Core Risk: Building Too Much, Too Early

When you strip away jargon, the key systemic risk can be summarized simply: overbuilding. If the sector builds out far more AI capacity than the market needs in the next few years, several problems can follow.

First, unused or underused infrastructure ties up capital that could have been deployed elsewhere. That shows up as lower returns on invested capital and can trigger a revaluation of companies that led the buildout.

Second, if many firms are racing to deploy similar capabilities, but only a subset manages to turn those capabilities into durable cash flow, the rest may end up in a weaker position, forced to cut spending or sell assets at a discount.

Third, overcapacity can put downward pressure on pricing. If many providers compete to sell similar AI services or compute capacity, they may have to lower prices to fill their pipelines, which reduces margins just as depreciation and operating costs stay high.

None of this means the long term future of AI is in doubt. Rather, it suggests that the path from here to that future may include a period where the market has to digest excess capacity and adjust valuations to more modest expectations.

5. Warning Signs That the Market May Be Overextended

How would observers know if the AI sector is tipping from aggressive buildout into bubble territory? Several indicators would be especially important to monitor.

5.1 Revenue growth slows while spending keeps rising

One classic warning sign is when top line growth starts to flatten, but capital expenditure and operating costs continue to climb. If companies keep ordering hardware and building facilities at the same pace even as customer demand decelerates, the gap between expectation and reality widens.

In a healthy environment, surging infrastructure investment should be accompanied by equally strong and broad based revenue growth from customers who are paying for real value. If that link weakens, it suggests capacity is being added based more on narrative than on measurable demand.

5.2 Underused data centers and idle capacity

Another sign of strain would be significant data center capacity that remains underutilized for an extended period. Short term fluctuations are normal, but if many operators report low usage levels while expansion continues, it may indicate that the sector has overestimated how quickly workloads would grow.

Unlike software licenses, physical infrastructure is not easy to reconfigure overnight. Power contracts, cooling systems, and specialized facilities tend to be long lived. Underused facilities would weigh on the financials of operators and their backers.

5.3 Softening demand for advanced chips

High end chips are currently in strong demand. If, over time, chip makers begin to report slower order growth, rising inventories, or customer deferrals on previously announced capacity plans, that would be another signal that the pace of spending is cooling.

This would not necessarily mean AI is over. It might simply reflect a transition from a "buy everything you can" phase to a more cautious, utilization driven phase. But when combined with other signs of overcapacity, it could reinforce bubble concerns.

5.4 Companies reassessing or cutting AI budgets

Finally, if a growing number of enterprises and platforms start to scale back AI budgets, delay projects, or narrow the range of experiments they are willing to fund, that would indicate that the initial wave of enthusiasm is being tempered by cost benefit analysis.

Early experimentation is healthy, and some level of pullback is natural as organizations learn which use cases provide the most value. The risk would be if reductions become widespread and rapid, leaving infrastructure buildouts unsupported by revenue.

6. Possible Paths Forward: Not Just Boom or Bust

It is tempting to think in all or nothing terms: either AI continues in a straight line upward, or it collapses in a dramatic bust. Reality is likely to be more nuanced. Several scenarios can coexist or follow one another over time.

6.1 Gradual normalization

In a benign scenario, the current period of intense investment is followed by a phase of consolidation and normalization. Infrastructure that looks expensive today could be absorbed over several years as more applications mature, enterprises sign long term contracts, and AI tools become standard across industries.

Valuations might cool somewhat, but without a severe shock. Companies that manage their spending carefully and align capacity with clear demand could emerge as durable leaders.

6.2 Localized corrections

Another possibility is that certain segments of the AI landscape experience sharp local corrections, while others remain relatively resilient. For example, some providers of undifferentiated services might struggle, while specialized platforms with strong customer relationships and clear economics remain in demand.

In this view, the question is less whether there is an "AI bubble" in general, and more which parts of the stack are priced as if they will capture a very large share of future value, even though only a handful of firms can realistically do so.

6.3 A classic boom and bust cycle

A more severe outcome would look closer to a traditional boom and bust. If the warning signs described earlier emerge strongly and in combination, markets could decide that expectations were too optimistic and reprice AI linked assets quickly.

Even in that case, the underlying infrastructure and capabilities would not vanish. They would instead be repriced and potentially reallocated. Historically, some of the most important technologies of previous eras went through such cycles before maturing.

7. Staying Grounded: A Framework for Investors and Builders

Whether one is optimistic or cautious about AI, it is useful to have a structured way to think about the space.

7.1 For investors

Investors can benefit from asking a few disciplined questions:

- Where does the revenue come from? Is it primarily from end users and enterprises, or mostly from other AI companies within the stack?

- How sensitive is the business to changes in chip prices and infrastructure costs? Are there clear paths to improve margins over time?

- Is spending on hardware and data centers matched by long term contracts and proven use cases?

- How diversified is the customer base? Does the company depend on a small number of large clients or have broad adoption?

Thinking in these terms shifts the focus from abstract excitement about AI to concrete questions about resilience and cash flow.

7.2 For builders and operators

Teams building AI products and platforms face their own version of these trade offs. Helpful questions include:

- Are we scaling infrastructure at a pace that is justified by adoption, or mainly out of fear of missing out?

- Which use cases show clear, repeatable value for customers, and which are still exploratory?

- How can we design our systems so that capacity can be reused or redeployed if demand shifts?

- Are we communicating transparently with users and stakeholders about both the potential and the limitations of current AI technology?

Making deliberate choices on these fronts can help companies navigate whatever combination of growth and volatility lies ahead.

8. Conclusion: Between Hype and History

So, are AI companies a bubble? The honest answer is that the sector contains elements of both genuine transformation and classic cycle dynamics. There is little doubt that AI will remain a core technology for decades. There is also little doubt that some of today's spending and valuations will, in hindsight, look excessive.

Recognizing this duality is more useful than choosing a simple label. It allows observers to appreciate the real progress in models and applications, while also watching for signs that the financial side of the story is running too far ahead of what customers and economies can support.

If the coming years bring a period of adjustment, that will not invalidate AI as a field. Instead, it will likely mark a transition from an era defined by rapid capacity buildout and narrative momentum to one defined by careful execution, disciplined capital allocation, and measurable value creation.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment, or legal advice. Markets involving artificial intelligence, technology, and digital infrastructure can be volatile and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.