SoftBank’s $40 Billion Bet on OpenAI: When AI Infrastructure Becomes a Strategic Asset Class

SoftBank has never been shy about making bold, headline-grabbing bets. But its completed $40 billion commitment to OpenAI marks a new chapter even by its own standards. Rather than simply buying shares in a high-growth tech company, SoftBank is effectively helping to finance an entire layer of AI infrastructure: data centers, advanced chips, and long-term compute capacity that will power large models for years to come.

According to recent disclosures, SoftBank has now wired the remaining portion of its multiyear commitment, bringing its total exposure to OpenAI to over $40 billion and giving it a stake of more than 10% at a pre-money valuation of roughly $260 billion. Part of this capital is earmarked for equity. A substantial portion, however, is tied to long-term infrastructure spending: AI data centers, the Stargate project with Oracle, and massive chip procurement from Nvidia, AMD, and Broadcom.

The move comes after SoftBank exited its direct stake in Nvidia and repositioned itself from being a shareholder in a single chip manufacturer to becoming one of the major financial backers of the broader AI stack. OpenAI, with ChatGPT and its enterprise offerings, sits at the application and model layer; the capital that SoftBank is providing ultimately flows down to silicon, data centers, and the energy footprint required to sustain them.

This article unpacks what this means on several levels: for SoftBank’s strategy, for OpenAI’s growth trajectory, for the global race to build AI capacity, and for investors trying to understand how AI infrastructure is turning into a new kind of strategic asset class.

1. From Nvidia Shareholder to AI Ecosystem Architect

For years, SoftBank’s exposure to AI was largely indirect: it held a sizable position in Nvidia, one of the primary suppliers of GPUs used to train and run large models. That was a highly profitable trade, but it was still exposure to a single vendor, not a structured bet on the entire AI production pipeline.

By selling its Nvidia position and pivoting into OpenAI, SoftBank is making a different statement:

- Instead of only backing the chip supplier, it wants to be close to the model provider that sits directly in front of enterprise demand.

- Instead of passively enjoying multiple expansion, it aims to shape the AI infrastructure buildout by financing compute, storage, and data center capacity tied to OpenAI’s growth.

- Instead of having a single exposure line on the balance sheet, it is effectively acquiring an ecosystem position: model equity, infrastructure commitments, and optionality on future services built on top.

In that sense, the $40 billion package is not just a venture bet. It is part of a broader strategy in which AI infrastructure itself becomes an investable macro theme, similar to how oil & gas or telecom infrastructure once anchored previous eras of global growth.

2. What the $40 Billion Actually Funds

The headline number is large, but it is important to distinguish between different components. Not all of the $40 billion is simple equity capital.

2.1 Equity in a foundational AI company

A meaningful slice of SoftBank’s commitment buys a direct stake in OpenAI at a valuation in the hundreds of billions of dollars. This gives SoftBank:

- Exposure to future product revenue from ChatGPT, API usage, and enterprise offerings.

- Optionality on new lines of business that may emerge around agents, productivity tools, and vertical applications.

- A strategic seat at the table as OpenAI prepares for a potential future IPO and navigates regulation, competition, and partnership deals.

However, a large portion of the committed capital is not simply sitting on OpenAI’s balance sheet as cash. It is earmarked for long-term infrastructure contracts.

2.2 Multi-year infrastructure and chip commitments

OpenAI has committed more than a trillion dollars in long-term spending toward AI infrastructure over the coming years, spread across data centers, power, networking, and advanced chips from multiple vendors. SoftBank’s capital is an important enabler of that plan.

In practice, this means that:

- OpenAI can sign multi-year capacity agreements for GPUs and custom accelerators, giving chip vendors visibility on future demand.

- It can co-finance or pre-pay for hyperscale data center capacity, including the Stargate project with Oracle, which aims to create purpose-built AI data centers.

- It can negotiate better terms and priority access by providing upfront financial commitments in a market where high-end chips and power are still constrained.

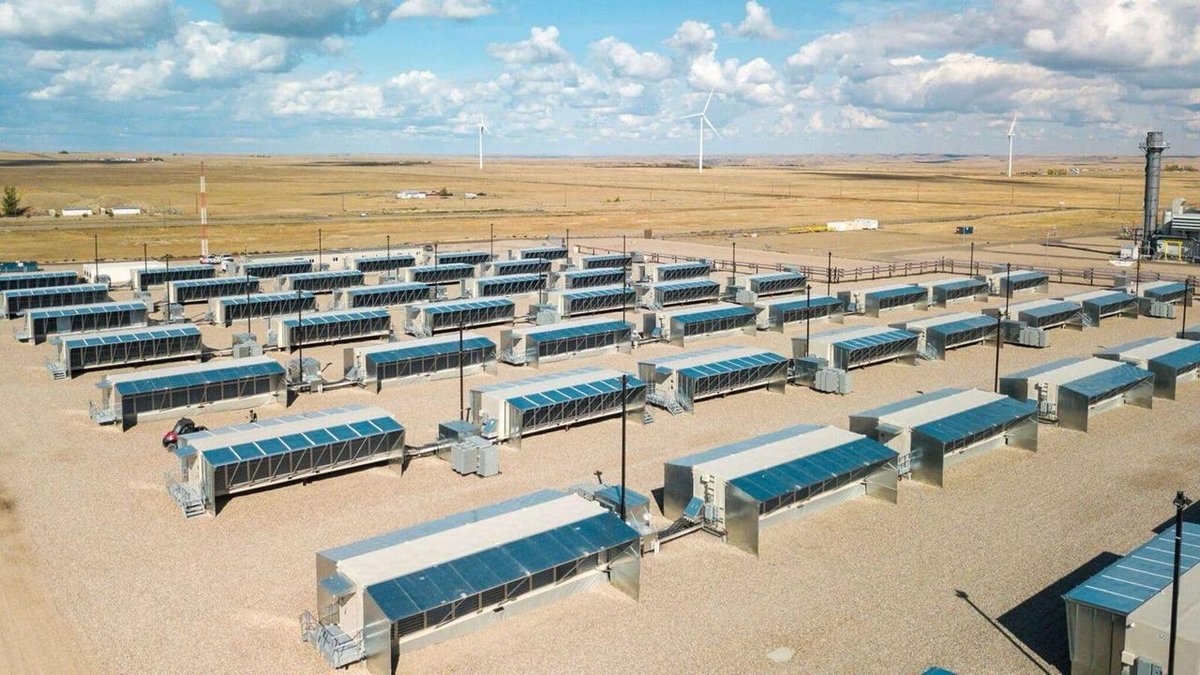

From an educational perspective, this highlights a key point: modern AI is extremely capital intensive. Training and serving frontier models is not just a software problem; it is a large-scale infrastructure problem that looks, in financial terms, closer to building a new power plant or telecom network than launching a traditional software application.

3. Why AI Infrastructure Is Becoming a Strategic Asset Class

SoftBank’s move reflects a broader shift: hardware and infrastructure behind AI are increasingly being treated as strategic national and corporate assets, not just ordinary capital expenditure.

3.1 Compute as a form of economic power

In earlier eras, nations and large corporations competed over energy, shipping routes, or rare materials. In the AI era, a new dimension is emerging: access to compute and the ability to train large models at scale. The more compute a company or country controls, the more advanced models it can build, and the more applications it can support.

This helps explain why:

- Cloud providers are racing to announce ever-larger AI clusters.

- Chip manufacturers are booked out years in advance for their most advanced products.

- Investors like SoftBank are willing to commit tens of billions of dollars to secure early and deep access to this capacity.

AI infrastructure is no longer a backstage cost line. It is increasingly viewed as a strategic reserve, similar in importance to energy infrastructure in previous decades.

3.2 Data centers as the new industrial real estate

Data centers used to be a niche segment of real-estate and infrastructure investing. With AI, that picture is changing. AI data centers have:

- Higher power density and more complex cooling requirements than traditional facilities.

- Longer-term contracts tied to model training roadmaps and enterprise AI adoption, rather than generic cloud workloads.

- Closer links to national energy policy, as they require stable and increasingly low-carbon power sources to scale.

By channeling capital into OpenAI’s infrastructure plans and related projects such as DigitalBridge, SoftBank is effectively treating data centers as long-duration infrastructure assets with AI as their primary tenant.

4. Strategic Logic: What SoftBank Gains Beyond Financial Upside

SoftBank’s decision can be read on multiple layers. At the pure investment level, a meaningful equity stake in a leading AI company is an attractive proposition if one believes that AI will capture a large share of future software and services revenue. But the logic extends beyond that.

4.1 Influence at the model layer

By becoming a major shareholder, SoftBank secures a position of influence in one of the most important AI research and deployment organizations in the world. This can matter for:

- Strategic partnerships between OpenAI and SoftBank portfolio companies.

- Regional expansion, especially in markets where SoftBank already has deep telecom and digital infrastructure footprints.

- Shaping the discussion around AI safety, regulation, and industry standards.

4.2 A platform for future AI investments

OpenAI is not just a product company; it is also a platform on top of which many other businesses are likely to build. By aligning closely with OpenAI, SoftBank can:

- Identify promising application-layer startups early, especially those leveraging OpenAI’s models in finance, healthcare, enterprise software, or consumer experiences.

- Support the creation of AI-native companies in its existing portfolio by providing them with preferential access to infrastructure and expertise.

- Position itself as a bridge between capital, infrastructure, and applications, rather than just a financial sponsor.

4.3 Optionality on a future IPO

OpenAI’s plans include the possibility of going public in the coming years. If that happens, SoftBank’s early, large-scale investment could translate into significant realized gains. But even if timelines shift, the combination of equity upside and access to AI infrastructure can still be valuable as SoftBank refashions itself around an AI-centric thesis.

5. Risks and Open Questions

Large-scale commitments like this are never risk-free. Several uncertainties surround both the AI sector in general and this deal in particular.

5.1 Execution risk in an ultra-competitive AI market

OpenAI operates in a landscape filled with technically strong and well-funded competitors, including major cloud providers and other research labs. Maintaining a durable lead requires:

- Continuous improvements in model quality and reliability.

- Careful management of infrastructure costs, especially as models become larger.

- Ongoing trust from regulators, enterprise clients, and end users.

If the economics of AI services compress or if competition intensifies faster than expected, the return on such a large capital base might be lower than current projections assume.

5.2 Capital intensity and payback periods

Training frontier models consumes enormous amounts of capital upfront, while revenue and earnings arrive over time as those models are integrated into products and services. That creates a timing gap between cash outflows and cash inflows.

From a financial perspective, SoftBank is taking on exposure to long-duration infrastructure that must be matched by equally long-lived and robust revenue streams. If enterprise adoption slows, or if pricing pressure reduces margins, the payback period lengthens.

5.3 Policy and regulatory uncertainty

AI policy is evolving quickly. Requirements around data governance, model transparency, safety, and liability may change. This can influence both the pace of deployment and the cost structure of running large models. For an investor backing AI at scale, regulation becomes a core part of the risk profile, not just a footnote.

6. What This Signals to Markets and Builders

Even with these risks, SoftBank’s commitment sends a powerful signal: large investors increasingly view AI infrastructure as a central pillar of future economic growth, not a niche technology trend.

6.1 For public and private market investors

For investors, the key takeaway is that AI is pushing capital markets into a new configuration:

- Chips, data centers, and energy are increasingly treated as core enablers of future productivity.

- Large, long-duration contracts between model providers and infrastructure vendors are becoming a new fixed-income-like stream, even if they are not framed that way formally.

- Exposure to AI can come from multiple layers: semiconductors, cloud, model providers, and application companies. The SoftBank–OpenAI deal emphasizes the importance of understanding how these layers interact, rather than viewing them in isolation.

6.2 For founders and builders

For founders building in AI or adjacent fields, this development underlines two points:

- Infrastructure is not abstract. Model quality, latency, reliability, and cost all depend on concrete infrastructure choices. The better founders understand the economics of compute and data centers, the more intelligently they can design products and business models.

- Partnerships matter. As AI infrastructure consolidates around a few large providers, being strategically aligned with one or more of them can make a meaningful difference in terms of pricing, support, and distribution.

In other words, the AI landscape is becoming more like a multi-layered industrial ecosystem and less like a purely open, horizontal software field.

7. A Turning Point in How Capital Sees AI

SoftBank’s completed $40 billion commitment to OpenAI is more than a large number on a headline. It marks a shift in how major institutions think about AI:

- Not only as a category of applications or productivity tools.

- Not only as a promising segment of the software industry.

- But as a new layer of critical infrastructure that underpins future economic activity, much like railroads, power grids, and telecommunications did in earlier eras.

Seen through that lens, the deal is part of a broader realignment. Capital is moving toward assets that combine computational capacity, reliable energy, and scalable data center architectures. OpenAI stands at the tip of that spear on the model side; SoftBank is choosing to stand behind it as a financial architect of the hardware and infrastructure that make it all possible.

For observers trying to make sense of where AI is heading, the key is not to fixate on the exact dollar figure, but to recognize what those dollars are buying: long-term control over compute and infrastructure in a world where those resources are becoming central to both economic competitiveness and national strategy.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment, or legal advice. Artificial intelligence and digital asset markets involve significant uncertainty and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.