Where Smart Money Went in 2025: Inside the Most Active Crypto VCs

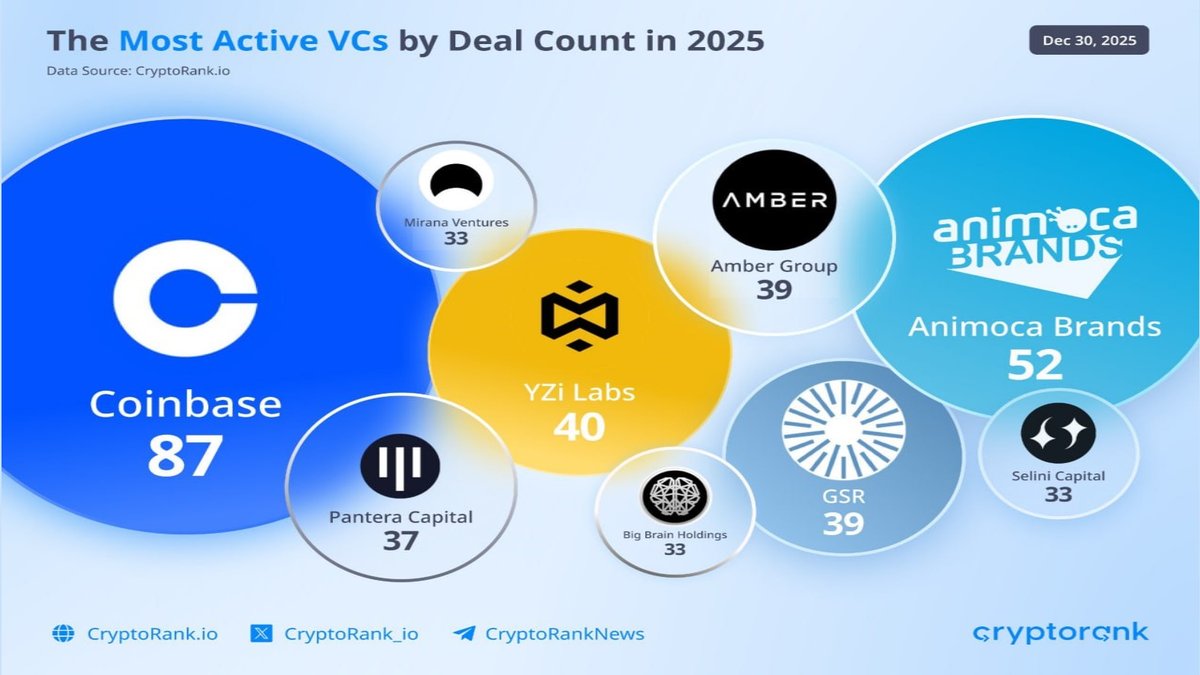

Funding data can look like a scoreboard, but behind each line of numbers is a view of how the industry sees its own future. In 2025, a small group of venture firms dominated crypto deal flow. According to CryptoRank and similar trackers, Coinbase Ventures led with 87 deals, followed by Animoca Brands with 52, and a cluster of highly active funds including YZi Labs (40), GSR (39), Amber Group (39), Pantera Capital (37), Selini Capital (33), Mirana Ventures (33) and Big Brain Holdings (33).

Those figures tell us more than who signed the most term sheets. They point to the parts of the crypto stack that investors still believe can create durable value after several turbulent cycles: infrastructure, real-world applications, market plumbing, and new computational paradigms such as AI-related networks. This article looks past the raw counts and examines what this concentration of activity really says about the state of crypto in 2025.

1. Reading the League Table: What Do the Deal Counts Really Signal?

The first temptation is to treat the ranking as a popularity contest: more deals equals more conviction. Reality is more nuanced. Each of the most active funds plays a slightly different role in the ecosystem, and their numbers reflect both strategy and positioning.

• Coinbase Ventures (87 deals) acts as a broad ecosystem investor. Its portfolio spans base-layer infrastructure, developer tools, DeFi, wallets, compliance tooling, and consumer applications. Many of its deals are early stage and relatively small in ticket size, designed to seed optionality across multiple verticals rather than concentrate risk.

• Animoca Brands (52 deals) is still strongly associated with gaming, metaverse and digital culture, but 2025 activity shows a tilt toward infrastructure for content and identity: gaming-focused chains, NFT tooling, and platforms that bridge Web2 game studios into on-chain economies.

• YZi Labs (40 deals) operates more like a thesis-driven lab, leaning into infrastructure, data, and experimental DeFi mechanisms. Its deal count suggests an appetite for backing complex, technical projects that may not be immediately visible to retail participants.

• GSR (39 deals) and Amber Group (39 deals) come from trading and liquidity backgrounds. Their investments often cluster around exchanges, derivatives venues, risk infrastructure, and tooling that deepens or stabilizes market structure.

• Pantera Capital (37 deals) continues its role as a multi-cycle macro fund, backing base layers, DeFi protocols, and emerging categories such as real-world assets (RWA) and programmable yield. Pantera tends to take larger, more concentrated positions than many seed-focused firms.

• Selini Capital, Mirana Ventures, and Big Brain Holdings (33 deals each) represent a mix of research-driven funds and ecosystem specialists. They often move faster into new narratives—rollups, restaking, modular infrastructure, and high-performance chains—while still maintaining a core of longer-term holdings.

In short, the numbers show two things at once: breadth (especially from platforms like Coinbase Ventures) and specialization (from funds with deep domain focus). The combination is one reason why capital deployment stayed active even through periods of muted token performance in 2025.

2. What 2025’s VC Heatmap Says About the Future of Crypto

Deal volume by itself does not tell you where value will ultimately accrue, but it does show where investors think it might. Looking across the portfolios of the most active funds, several themes stand out.

2.1 Infrastructure fatigue is over; infrastructure selection has begun

Early in past cycles, "infrastructure" often meant another general-purpose layer-1 chain or a similar version of a known pattern. In 2025, the picture is more selective. Funds are backing fewer new base layers and instead focusing on:

- Execution environments and rollups tailored to specific workloads (high-frequency trading, gaming, social, or data availability).

- Security and observability tooling that helps exchanges, funds and protocols monitor on-chain risk in real time.

- Data and indexing services that make it easier for developers and institutions to access reliable information without building their own data stacks.

This shift reflects the reality that not every new chain needs to be a general-purpose contender. The opportunity is increasingly in building the connective tissue that lets networks and applications coordinate safely and efficiently.

2.2 From "play-to-earn" to genuine digital economies

Animoca’s deal flow provides a clear lens into how the gaming and culture thesis has matured. Rather than backing purely speculative game tokens, 2025 allocations lean toward:

- Studios experimenting with longer life-cycle titles where in-game assets have utility beyond short-term speculation.

- Identity and reputation layers that help players carry progression, achievements, or perks across games.

- Creator infrastructure for modding, user-generated content and cross-platform item markets.

The takeaway is that "Web3 gaming" is less about attaching a token to a game and more about gradually weaving digital ownership and programmable incentives into the broader entertainment stack.

2.3 AI, data and crypto start to overlap

Even though the headline today is Bittensor ETF filings, the venture side of the AI–crypto intersection has been quietly busy all year. Funds such as Pantera, YZi, and others are backing:

- Decentralized compute marketplaces where idle hardware can be matched with model training or inference tasks.

- Data markets and curation layers that reward participants for contributing and validating high-quality datasets.

- Protocols that coordinate AI agents and allow them to hold balances, pay for resources, or interact with smart contracts.

The key here is not that every AI-related token will succeed, but that VCs are betting some of the coordination problems around compute and data can be addressed with open, tokenized mechanisms rather than closed platforms alone.

3. A Concentrated Funding Stack: Advantages and Risks

One of the most striking aspects of the 2025 funding landscape is how much activity is concentrated in a handful of repeat names. There are advantages to this pattern—but also important risks that founders and other investors should understand.

3.1 The upside: expertise, signaling and network effects

When a small group of experienced funds leads many rounds, several beneficial dynamics emerge:

- Due diligence standards improve. Teams are often vetted by partners who have seen multiple cycles and can benchmark metrics against a large internal dataset.

- Portfolio support becomes more systematic. Leading funds now operate like mini-platforms, offering BD introductions, token design feedback, and help with regulatory navigation.

- Signaling is clearer. For better or worse, a round led by a top-tier fund can still influence how exchanges, market makers, and other VCs perceive the project.

This is part of why many founders still actively court these firms despite increased competition for attention.

3.2 The downside: narrative concentration and crowding

However, concentrated funding also brings risks:

- Overcrowded narratives. When a theme catches on inside the venture community, multiple teams may be funded to pursue similar ideas, diluting both user attention and eventual fee pools.

- Correlated behavior. If leading funds adjust their theses or exit a sector at the same time, entire categories can see funding and liquidity dry up together.

- Access constraints. Smaller funds and independent investors may find it harder to participate on favorable terms in highly sought-after rounds.

For founders, this means that "who is on the cap table" matters, but so does avoiding crowded segments where differentiation is thin and timelines to adoption are long.

4. What This Means for Builders

For teams building in 2026 and beyond, the 2025 funding patterns offer several practical lessons.

4.1 Raise with a thesis, not just a token

The most active funds have seen countless pitch decks. What tends to resonate now is not a promise of rapid token appreciation, but a clearly articulated problem–solution fit supported by early evidence:

- Usage metrics or pilot customers, even at small scale.

- Thoughtful token design that avoids overwhelming the market with early supply.

- A roadmap that balances experimentation with realistic milestones.

In a world where capital is more selective, teams that can show they understand both their users and the broader market structure stand out.

4.2 Choose investors for alignment, not only brand

Having a prominent logo on the cap table can help, but the more important question is: What role will this investor actually play? The funds listed at the top of the 2025 rankings differ in how hands-on they are, how they think about governance, and how comfortable they are supporting multi-year build cycles.

Builders benefit from mapping those differences:

- Which funds have demonstrated patience through previous down cycles?

- Who has a track record of supporting protocol-level governance rather than merely seeking short-term liquidity events?

- Where do you see genuine thesis alignment rather than purely opportunistic interest?

The answers can be more important than the headline valuation at seed.

5. What This Means for Market Participants

For individuals and institutions following the market from the outside, VC activity is one signal among many. It does not guarantee success, but it can help inform how narratives might evolve.

• Funding often leads visible adoption by many months. A sector that sees heavy deal flow today may not have mainstream traction yet, but it is on the "watch list" of builders and allocators.

• Cross-portfolio patterns matter. When multiple leading funds back different teams in the same vertical—whether that is restaking, AI–crypto infrastructure, or tokenized finance—that segment likely reflects a shared belief that the problem space is important, even if timing is uncertain.

• Discipline still matters. Venture allocation is only one lens. On-chain usage, token design, governance quality and transparency remain essential dimensions to evaluate any given project.

In practice, using VC data responsibly means treating it as context, not as a shortcut. The fact that a well-known fund joined a round is not a substitute for understanding what the protocol actually does and how it intends to sustain itself.

6. A Snapshot, Not a Final Verdict

The ranking of 2025's most active crypto VCs is, ultimately, a snapshot. Some of the projects funded this year will quietly wind down. Others will pivot into shapes that look very different from their original whitepapers. A small number may grow into key pieces of the financial and data infrastructure of the next decade.

What we can say with more confidence is that venture capital in crypto has matured. The largest funds are no longer simply chasing the fastest-rising tokens; they are building portfolios around infrastructure, applications and services that could remain relevant across multiple macro regimes. They are also more willing to walk away from over-crowded narratives and to ask tougher questions about sustainability, governance and real demand.

For builders, that means the bar is higher but also clearer. For observers, it means that reading a funding table is less about who "won" the year and more about understanding how capital is trying to shape the industry’s long-term direction.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment, or legal advice. Digital assets and venture investments carry significant risk and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.