Wyoming’s FRNT Stable Token: When a Stablecoin Becomes Public Infrastructure

Most stablecoin headlines read the same: a new ticker, a new chain, and the same promise—one token equals one dollar. Wyoming’s Frontier Stable Token (FRNT) is different, not because the mechanics are novel, but because the issuer is. A U.S. state-backed public entity stepping into the “programmable dollar” arena changes the conversation from product innovation to institutional architecture.

That shift matters because stablecoins are quietly turning into the settlement layer for crypto markets, tokenized assets, and cross-border payments. When the settlement layer evolves, the rules of trust evolve too. Markets don’t trade morality; they trade enforceability, governance, and the credibility of the balance sheet behind the instrument. FRNT forces a more serious question: what happens when on-chain dollars start to look like public infrastructure rather than private fintech?

What FRNT Actually Is—and What It Isn’t

FRNT is best understood as a “public stable token” designed for transaction utility: fast settlement, transparent reserves, and predictable redemption mechanics. If a private stablecoin is like a payment app that happens to live on-chain, a public stable token aims to behave more like a digital public utility—boring by design, audited by necessity, and built to survive political cycles.

At the same time, it’s important to keep expectations disciplined. A stable token is not a growth story in the way altcoins often market themselves. It does not need narrative velocity. It needs operational reliability. If FRNT succeeds, the win won’t be “price goes up.” The win will be that people stop talking about it—because it works, quietly, every day.

• Reserve design: FRNT is described as fully backed by U.S. dollars and short-duration U.S. Treasuries held in trust for token holders. This matters because short-duration Treasuries are among the most liquid instruments in the world, but still require professional cash management when redemptions spike.

• Built-in buffer: A legislatively mandated target of 2% overcollateralization is a subtle but meaningful choice. It treats “stable” as a risk-management problem, not a marketing claim. The buffer is effectively a shock absorber against operational frictions, timing mismatches, or small valuation swings.

• Not a yield product: A state-issued stable token should be assumed to prioritize legal clarity and consumer protection over yield distribution. That’s a feature, not a bug. The moment a token begins to “sell yield,” it starts borrowing regulatory complexity.

The Hidden Design Choice: Multi-Chain From Day One

Most stablecoins expand chain-by-chain as demand proves itself. FRNT’s architecture signals the opposite: distribution is treated as a first-order design constraint. Launching across multiple networks is less about chasing users and more about acknowledging a reality—liquidity is already fragmented, and the most valuable stablecoin is the one that can move where commerce happens.

But multi-chain is never free. It replaces one big trust assumption (a single chain) with a network of smaller assumptions: bridge security, message integrity, supply accounting, and cross-chain operational playbooks. In other words, FRNT is making a conscious trade: broader reach in exchange for a more complex risk surface.

• Why it matters: If the same “public dollar” can circulate across major L2s and high-throughput L1s, it can become a standard settlement unit for tokenized treasuries, on-chain credit, and exchange collateral—without forcing the market to converge on one chain.

• What to watch: The real test is not deployment—it’s coherence. A multi-chain stable token must preserve a single source of truth about supply, redemption flows, and emergency controls. If the governance is unclear, fragmentation becomes a feature for attackers and a bug for users.

Why Solana + Kraken Is a Signal About the Intended User

Distribution choices reveal intent. Putting FRNT on Solana suggests that the design team is prioritizing low-fee, high-throughput environments where stablecoins behave like payments, not like speculative instruments. Solana’s user experience tends to reward speed and simplicity—two attributes that matter when you want a stable token to feel like “cash,” not like “crypto.”

Pair that with a plan to make FRNT available through a regulated exchange, and you start to see the shape of the strategy: reduce onboarding friction, reduce custody complexity, and let users interact with the token without needing to become blockchain engineers. That is how consumer payments scale—through invisible plumbing, not through ideology.

• On-ramp logic: Exchange distribution can standardize compliance, improve liquidity discovery, and make it easier for institutions to build internal controls. It also reduces the “where do I even get this token?” problem that kills many well-designed crypto products.

• Off-ramp logic: Visa-linked card rails (via partners) indicate a pragmatic view: a stable token becomes truly useful when it can exit on-chain and pay for real-world goods, bills, and services. That’s a payments thesis, not a DeFi-native thesis.

How FRNT Could Re-Price Risk in DeFi Without “Chasing Yield”

DeFi runs on collateral, and collateral runs on trust. A stablecoin’s most underrated function is not payments—it’s being the unit of account for risk. When a stable asset becomes more credible, the system can price leverage, borrowing costs, and liquidation risk more efficiently.

A public stable token could affect that pricing even if it never becomes the largest stablecoin by market cap. The reason is psychological and institutional: if risk committees are willing to treat a token as closer to “cash,” it can become acceptable collateral in places where private stablecoins face policy hurdles.

• Collateral quality: If FRNT’s reserve disclosures and attestations set a high bar, protocols and counterparties may begin to segment stablecoin collateral—charging different haircuts or interest rates depending on perceived credibility.

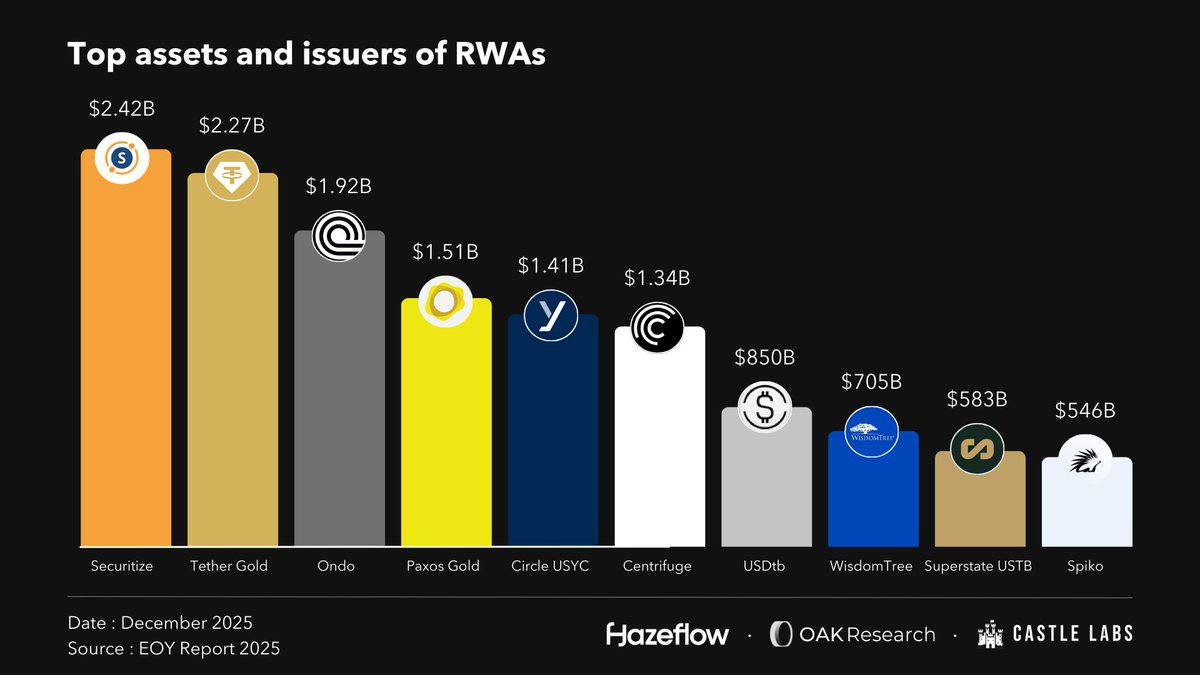

• Tokenized treasuries and RWA: RWA markets need a cash leg. A state-issued stable token could become a clean settlement asset for tokenized T-bills, on-chain credit facilities, or regulated marketplaces—especially if it remains “boring” and compliant.

• Market structure effect: Over time, this can shift incentives away from “stablecoin as a trade” and toward “stablecoin as infrastructure.” That’s how you move from crypto cycles to financial plumbing.

The Non-Obvious Risks: Sovereign Credibility Meets Smart-Contract Reality

Public backing can raise trust, but it does not erase technical risk. If anything, it can create a more fragile expectation: users may subconsciously assume a public issuer implies “no failure modes.” In blockchains, failure modes are always present—smart-contract bugs, chain halts, bridge exploits, key-management mistakes, and operational delays during periods of stress.

So the right framework is not “Is FRNT safe?” but “Where does FRNT concentrate risk, and how is that risk governed?” A public token lives at the intersection of law and code. When those domains disagree, the market learns quickly which one actually has the final say.

• Bridge and messaging risk: Multi-chain designs increase dependency on cross-chain messaging. That surface area deserves more scrutiny than the token branding. The strongest stablecoin architecture is the one that fails gracefully when a link breaks.

• Governance clarity: Emergency controls, redemption windows, and incident-response procedures matter as much as reserve ratios. A crisis is not where you want to discover who has authority to pause contracts or halt distribution.

• Political and legal noise: State initiatives can become political footballs. Even if reserves are sound, uncertainty around future policy can impact adoption. The market’s first reaction to policy risk is usually to demand a higher “credibility premium.”

What to Watch in 2026

Whether FRNT becomes “big” is less important than whether it becomes useful. Utility has measurable signals. The most honest metric is not social attention but transactional behavior: where the token circulates, how often it redeems, and whether it becomes embedded in payment and settlement workflows.

If 2024–2025 was about proving that stablecoins work, 2026 may be about determining who gets to issue the next generation of on-chain money. FRNT is an early test of a new model: public issuance, professional reserve management, and multi-chain distribution. That model can succeed even at modest scale, because its real product is precedent.

• Reserve transparency cadence: Watch how often attestations are published and how quickly discrepancies are addressed. Trust is built through repetition, not through one press release.

• Distribution milestones: Exchange availability and payment integrations will tell you if the token is becoming a tool for commerce rather than an artifact for headlines.

• DeFi integration quality: The healthiest pattern is slow, deliberate adoption by reputable protocols—especially those focused on payments, RWAs, and low-volatility credit. Fast adoption is not always good adoption.

Conclusion

Wyoming’s FRNT stable token is not interesting because it’s a stablecoin. It’s interesting because it treats stablecoins as civic infrastructure—something that should be transparent, resilient, and governed in the open. If private stablecoins were the “startup phase” of programmable money, FRNT is a sign that the “institutional phase” is beginning.

In the long run, the winners in digital finance are rarely the loudest products. They’re the standards everyone quietly relies on. FRNT’s real challenge is not adoption hype—it’s proving that public issuance can deliver the reliability the market has always demanded from money, while still capturing the speed and programmability that blockchains make possible.

Frequently Asked Questions

Is FRNT the same as a CBDC?

No. A CBDC is typically issued by a central bank and designed as a national monetary instrument. A state-issued stable token is a different governance layer: it’s a public entity initiative that aims to operate within existing dollar frameworks, not replace them.

Does 2% overcollateralization guarantee safety?

No buffer “guarantees” safety. Overcollateralization helps absorb small shocks and operational timing issues, but it does not eliminate smart-contract, custody, or governance risks. Think of it as a seatbelt, not a force field.

Why does the choice of chain matter if the token is “stable”?

Because user experience, fees, throughput, and ecosystem integrations differ across chains. A stable token becomes more useful when it can move cheaply and quickly where users already transact—especially for payments and settlement.

Could a public stable token compete with USDC or USDT?

It could compete on trust and transparency, even if it never matches their scale. The bigger impact may be indirect: raising the market’s expectations for reserve management and attestations, which pressures the entire category to professionalize.

What is the most important adoption signal to watch?

Not price. Watch circulation: transaction counts, merchant/payment integrations, credible on-chain use (RWAs, settlement, payroll-like flows), and consistent, timely reserve reporting.