RWA 2026: Where Institutional Capital Actually Lands (and Why It’s Not Chasing Altcoin Narratives)

There’s a persistent myth that when “institutions arrive,” they will inevitably arrive with the same appetite as crypto’s most excited retail traders: hunting the next breakout token, the next narrative, the next 10x. In reality, institutions don’t enter new asset classes the way communities do. They enter the way operations teams do—by measuring settlement risk, legal risk, and the probability that a product can be scaled without making tomorrow’s headlines for the wrong reasons.

That’s why 2026 is shaping up to be less about “which altcoin wins” and more about which rails win. Real-World Assets (RWAs)—stablecoins, tokenized T-bills, private credit, and early versions of tokenized equities—are not a side quest. They are the route institutions take when they want crypto exposure that behaves like finance, not like folklore. This is not a moral statement about what crypto “should be.” It’s a description of how capital behaves when it has committees, auditors, and reputations to defend.

The quiet difference between “crypto adoption” and “crypto integration”

Adoption is when more people download an app. Integration is when an industry rewrites its workflow. That distinction matters because the RWA thesis is not powered by vibes—it’s powered by friction. Traditional finance has oceans of assets, but it still moves them through a maze of cut-off times, settlement windows, and counterparties that behave like toll booths. Tokenization isn’t magic; it’s a different logistics system.

In that lens, the headline number (often cited as RWAs jumping from a few billion dollars in 2022 to a few dozen billion by late 2025) matters less than the composition of what grew. Growth concentrated in places that look boring to a crypto-native—but irresistible to an institution: cash-like instruments, government debt, and credit structures that already exist off-chain and simply want better distribution and faster settlement.

Here’s the counterintuitive part: the “killer app” for RWAs is not a shiny new asset. It’s operational certainty. If a tokenized T-bill can be created, redeemed, audited, and custodied with clear rules, it becomes a building block. If a tokenized equity cannot, it becomes a political liability. Institutions are choosing building blocks.

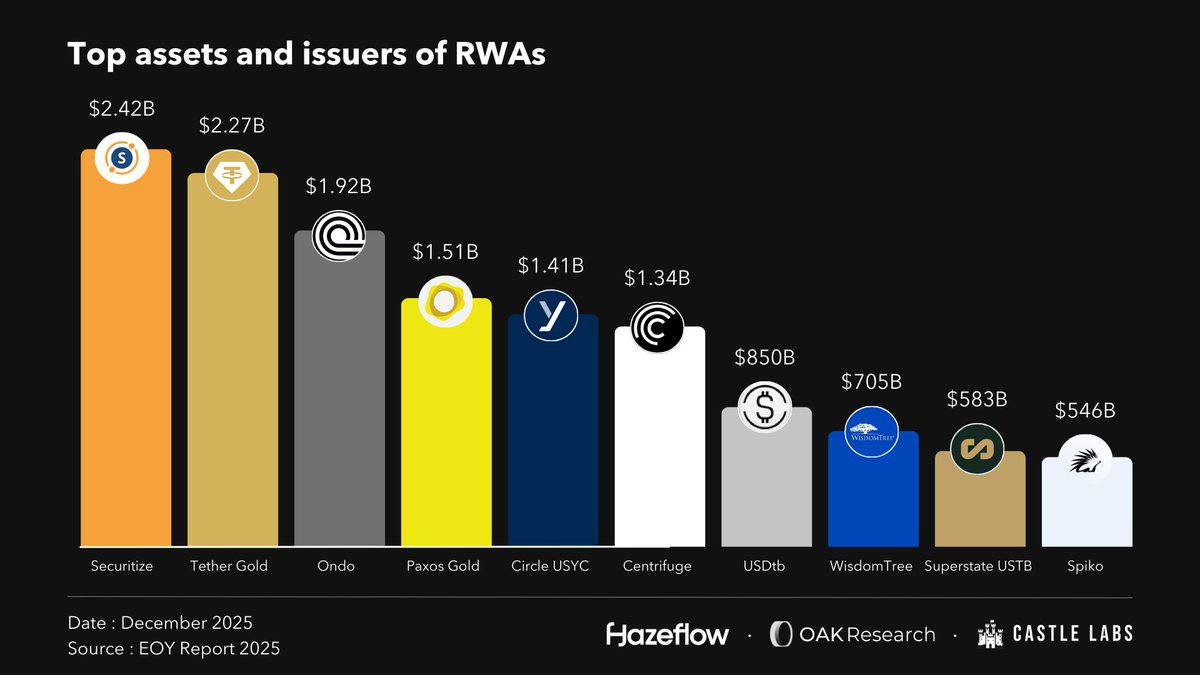

Reading the leaderboard: what the top issuers tell us about the real battle

The chart above is useful not because it crowns winners, but because it reveals what the market is paying for. You see infrastructure-native names (like Securitize and Centrifuge), “bridge” products that translate TradFi demand into on-chain form (like Ondo and Circle’s yield-bearing structures), and commodity-backed tokens that behave like digital receipts (like Tether Gold and Paxos Gold).

Notice what’s missing: an explosion of experimental tokenized everything. The dominance of these categories suggests that the real competition in 2026 is not who can mint the most tokens—it’s who can deliver three unglamorous promises at once: credible collateral, credible custody, and credible compliance.

To make that concrete, the leaders are winning on different axes:

• Distribution and trust. Products that look “ETF-adjacent” in behavior (simple exposure, defined redemption paths, clear disclosures) get adopted faster than products that require philosophical buy-in.

• Custody and control surfaces. Institutions don’t just want self-custody or third-party custody; they want the ability to choose a control model that matches policy. The moment a product can’t fit into an internal risk framework, it stalls.

• Redemption reality. On-chain yields are attractive. But what makes or breaks institutions is whether they can exit in size without becoming the market. Liquidity is a legal concept as much as a trading concept: “Can we unwind this without a governance drama?”

If you want a simple mental model: RWAs are competing to become the default collateral of on-chain finance. Whoever wins collateral wins downstream demand, because collateral gets rehypothecated (within rule sets) into lending, market-making, and settlement flows.

The four pillars that make RWAs an “institutional home base”

Most retail conversations about 2026 still treat RWAs as a niche—something for conservative investors who “don’t get crypto.” But institutions aren’t adopting RWAs because they fear crypto. They’re adopting RWAs because RWAs let them use crypto as infrastructure without adopting crypto’s cultural risk.

Four pillars are emerging as the real center of gravity:

1) Stablecoins: the settlement layer that doesn’t ask for permission

Stablecoins are the simplest RWA because they monetize a universal corporate need: moving dollars. Their adoption is less about ideology and more about throughput. A stablecoin is a programmable bank transfer with a global address format. That’s a product, not a narrative.

The 2026 implication is subtle: stablecoins are no longer just “on-ramps.” They become inventory—working capital that sits on-chain ready to be deployed. Once institutions hold stablecoins as inventory, the rest of DeFi starts looking like a capital market rather than a casino.

2) Tokenized Treasuries: yield that behaves like policy, not like hype

Tokenized T-bills are the bridge product that makes risk committees relax. They are familiar, regulated in their native habitat, and they offer yield that doesn’t require the institution to bet on a token’s popularity. For many allocators, this is the first time “on-chain” stops sounding like a tech experiment and starts sounding like a distribution channel.

Strategically, tokenized Treasuries also change how liquidity is held across crypto venues. Instead of holding idle stablecoins, institutions can hold yield-bearing collateral and still move fast when opportunities appear. That’s a powerful upgrade to cash management.

3) Private credit: the real economy wants cheaper capital, not better memes

Private credit is where RWAs stop being a finance toy and start becoming a macro story. Off-chain, private credit grew because it fills a gap between banks and public markets. On-chain, its promise is not “higher yield.” It’s cheaper distribution and faster settlement, with transparent servicing and potentially better monitoring.

But this is also where risk is most misunderstood. Private credit is not magically safer on-chain. Credit risk doesn’t disappear; it becomes more legible. The question becomes: do you trust the underwriting, the legal structure, and the enforcement? Institutions will participate only where those answers are boringly clear.

4) Tokenized equities: inevitable, but not immediate

Tokenized equities are the headline-grabber, yet they are the hardest pillar to scale quickly. Why? Because equities bring jurisdiction, market-hours rules, corporate actions, and the uncomfortable fact that “compliance” is not one standard—it is many. Institutions will engage here, but early adoption will likely favor synthetic or derivative-like structures and tightly controlled venues before broad public access.

The key insight for 2026: tokenized equities will grow when they stop trying to replace stock markets and start trying to interoperate with them. The winning products will feel less like rebellion and more like upgraded plumbing.

What 2026 institutions are really buying: optionality under rules

Institutional capital doesn’t pay for excitement; it pays for options. Not “call options” in the trading sense—options in the operational sense: the ability to deploy, hedge, and unwind under predefined rules. RWAs offer a rare combination of two things institutions crave: familiar risk and new efficiency.

This also explains why “RWA season” can look underwhelming to crypto natives. When stablecoin market share rises or tokenized T-bill supply expands, it doesn’t always pump a chart. But it changes the foundation. And foundations matter because they dictate who can participate without getting fired.

In plain terms, institutions are not chasing the next story. They are positioning for a world where on-chain settlement becomes normal, and they want exposure that survives three stress tests: regulatory scrutiny, accounting scrutiny, and liquidity scrutiny.

A practical framework for readers: how to think about RWA opportunity without turning it into a gamble

Retail participants often ask: “How do I benefit from the institutional wave?” The honest answer is: by focusing less on the loudest token and more on the pick-and-shovel layers. In 2026, the most durable opportunities typically attach to infrastructure that scales with usage rather than speculation.

Here are four questions that keep the analysis grounded:

• Where does compliance live? If compliance is an afterthought, the product may grow fast and then stall abruptly. If compliance is embedded, growth can be slower but steadier.

• What is the redemption path? Ask how a position becomes cash in a stress scenario. “There is liquidity” is not a plan; “there is a verified redemption mechanism” is a plan.

• Who bears the operational risk? Institutions care about where risk concentrates: custodian, issuer, smart contract, or governance. That’s where crises happen.

• Does adoption create second-order demand? The best rails create downstream usage: collateral for lending, margin for derivatives, settlement inventory for market-makers, or treasury tools for businesses.

None of this is investment advice. It’s a lens for avoiding the most common mistake of every cycle: confusing a narrative with a business model.

Conclusion

RWA 2026 is not a promise that tokenization will “replace TradFi.” It’s a signal that TradFi is already borrowing the parts of crypto that solve real operational pain. The market’s center of gravity is shifting toward assets that can survive institutional scrutiny: stablecoins that move money, tokenized Treasuries that manage liquidity, credit structures that finance businesses, and early tokenized equity experiments that prioritize compliance over chaos.

If you want the real headline, it’s this: institutions aren’t arriving to join crypto’s culture war. They’re arriving to build a settlement layer that works on weekends, clears faster, and can be audited. The capital that follows will be the kind that doesn’t chase the loudest chart—it builds the quietest infrastructure.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Digital assets and tokenized products carry risks, including market volatility, liquidity constraints, regulatory uncertainty, and operational/security risks. Always do your own research and consider seeking advice from qualified professionals.