From Stablecoins to Stable Yield: What BlackRock’s Tokenized Treasury Fund on BNB Chain Really Means

Crypto has spent a decade perfecting fast, programmable dollars in the form of stablecoins. In 2025, a new primitive quietly moved into pole position: tokenized yield-bearing dollars—shares of regulated U.S. Treasury funds that live on public chains. The flagship is BlackRock’s USD Institutional Digital Liquidity Fund, widely known as BUIDL. The latest step—carrying BUIDL onto BNB Chain and making it eligible as off-exchange collateral with Binance—deserves more than a cursory headline. It reframes how trading desks fund inventory, how venues manage margin, and how institutions think about on-chain cash.

This piece explains the mechanics and the consequences. We’ll show how a tokenized Treasury fund differs from a stablecoin, why off-exchange collateralization matters after a decade of custody scares, what could break in a crisis (bridges, admin keys, reconciliation), and how the shift to ‘stable yield’ will ripple through spreads, funding, and liquidity cycles. If you’re a trader, treasurer, or protocol designer, consider this your field manual.

The headline versus the substance

Two related developments sit behind the buzz. First, the fund’s tokenized shares are now natively supported on BNB Chain, integrating with a large liquidity universe already wired to that ecosystem. Second, Binance has added tokenized Treasury funds such as BUIDL to its off-exchange collateral framework—an arrangement where client assets remain with a third-party custodian or controlled environment (rather than the exchange’s wallet) while still backing trading limits. That combination—public-chain composability plus custodial segregation—has been the missing piece for institutions that want crypto liquidity without on-exchange asset risk.

BUIDL differs from a dollar stablecoin in one critical way: it is designed to track the net asset value of an underlying portfolio of short-duration U.S. government instruments and to distribute or accumulate yield according to the fund’s terms. In other words, it is digital cash with a coupon, not just digital cash. For treasurers who have watched idle margin decay in real terms for years, this is a structural upgrade.

Why BNB Chain matters—and why it doesn’t (yet) for retail

BNB Chain matters operationally because many crypto trading stacks—custodians, OTC desks, and internal treasury rails—already run there. A native BNB Chain representation of a tokenized Treasury fund reduces operational friction: you can pledge collateral, rebalance portfolios, and satisfy margin calls without hopping chains or touching custodial backwaters. For KYC’d entities that must coordinate with transfer agents and custodians, fewer hops mean fewer failure points.

However, access remains the gating factor. Tokenized Treasury funds are typically institution-only products with transfer restrictions. If you’re a retail wallet hoping to farm BUIDL in DeFi, temper expectations. The near-term impact sits squarely in the professional stack: market makers, funds, corporates, and qualified counterparties that can onboard to the fund and to the off-exchange settlement framework.

How off-exchange collateralization actually works

In a traditional prime-brokerage world, you can trade on one venue while your collateral sits with a bank under a tri-party agreement. The bank controls releases to the venue, the venue marks your positions to market, and the broker doesn’t commingle your assets. The crypto analog—now more mature after a bruising cycle of custody failures—keeps the client’s collateral in a segregated, controllable environment (bank, trust, or affiliated qualified custodian) while the exchange reads eligibility and exposure in real time.

Adding BUIDL to that framework changes the character of the collateral itself. Instead of dead cash or a zero-yield stable, your posted assets earn risk-free carry while they stand ready to cover losses. That reduces the opportunity cost of keeping fat buffers (less levering up to ‘make the cash work’ elsewhere), encourages conservative risk postures, and in the aggregate can dampen the whipsawing in perpetual funding and calendar spreads.

The market-structure impact you can actually model

• Funding and basis compression. If a meaningful share of posted margin earns 4–5% annualized carry, the equilibrium for futures basis tightens. Dealers can carry inventory with less urgency to monetize basis every hour, which often translates to shallower negative funding spikes during risk-off weekends and less froth in risk-on bursts.

• Inventory buffers and stress behavior. Yield on collateral makes it easier to justify larger inventory buffers. The more dealers can absorb flow without scrambling for borrow, the fewer cascade liquidations you see when headline risk hits.

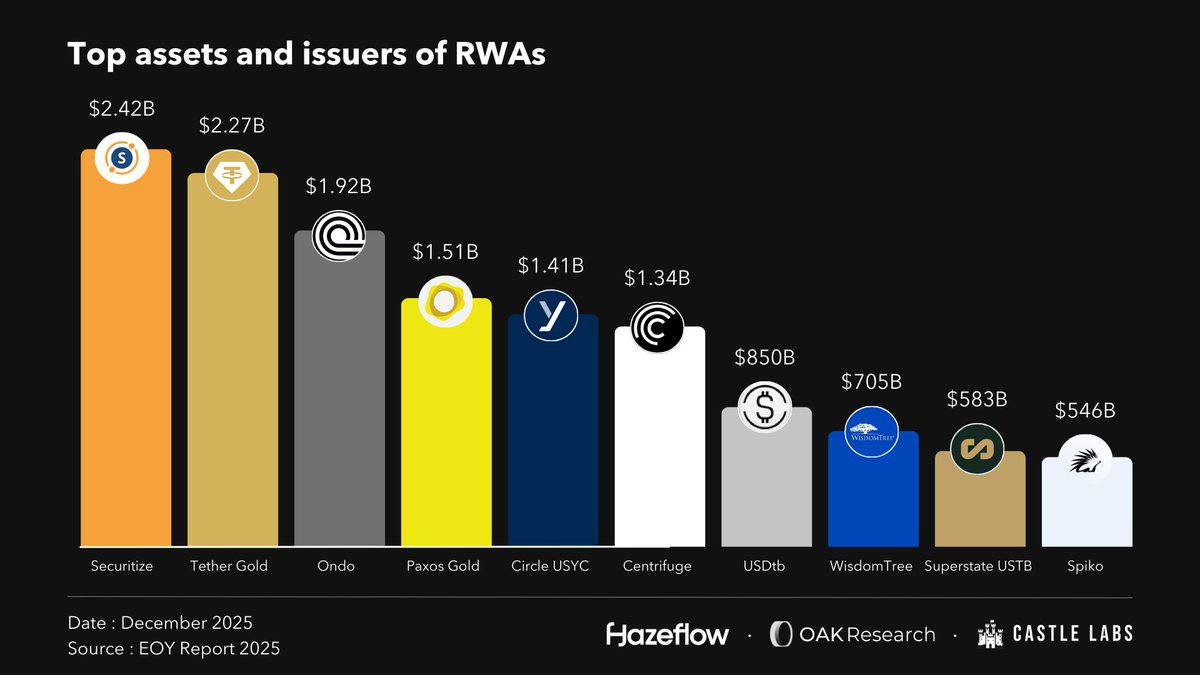

• Stablecoin substitution at the margin. For institutions, tokenized funds may displace stables as the preferred ‘digital cash’ in prime flows, especially if policy nudges raise the quality bar for stablecoin reserves. That won’t kill stablecoins—retail payments and permissionless DeFi still favor them—but it does split the cash leg into two tiers: permissionless zero-yield for ubiquity and permissioned yield-bearing for scale.

• Collateral quality tiers on-chain. If BUIDL becomes the Tier-1 reference, other tokenized funds will need crystal-clear disclosures, top-tier custody, and clean transfer-agent integrations to achieve similar haircuts across venues.

But don’t romanticize it: three new risks to price in

Moving a regulated fund share onto public rails doesn’t make risks disappear; it rearranges them. Treasurers should formalize three categories of risk with their venues and custodians:

1. Smart-contract and admin-key risk. Token contracts may be upgradable; admin keys may exist for emergency pauses or supply management. You need written policies from issuers and transfer agents describing who can do what, under what conditions, and how those actions are logged and verified.

2. Bridging/representation risk. If a share class is represented on multiple chains, what mechanism enforces 1:1 correspondence with the transfer-agent ledger? If a bridge pauses or security vulnerabilities occur, does collateral mobility pause with it? Your operating memo should include contingency settlement paths.

3. Reconciliation and legal finality. When positions move quickly and margin calls arrive, which book is controlling—the on-chain balance, the custodian statement, or the transfer-agent record? You want explicit priority rules and SLAs for each data feed, with playbooks for stale or contradictory states.

Why this isn’t just a Binance story

The larger arc here is the rise of on-chain Treasuries as collateral. In TradFi, U.S. bills are the world’s preferred collateral. Bringing that collateral type to public rails with institutional wrappers bridges two worlds without pretending they are the same. Different venues will compete to whitelist high-quality tokenized funds, pushing toward a de facto standard: lower haircuts and higher credit for instruments that look, feel, and settle like T-bill funds—not just IOUs for bank cash in omnibus accounts.

Issuers beyond BlackRock will follow, but the moat isn’t the brand; it’s the plumbing. Custody of the underlying, transfer-agent control, auditable on-chain representations, and operational readiness across multiple chains are what make an instrument collateral-grade. A slick token with a PDF ‘factsheet’ won’t cut it with risk committees.

BNB Chain composability: the good, the bad, the real

Composability is the tantalizing frontier. In theory, a BNB Chain representation lets KYC’d contracts do interesting things: automated collateral calls when VaR breaches, programmatic rebalancing between spot and perps, even intraday sweep accounts that toggle between trading venues and money-market yield. In practice, most of this will roll out behind compliance gates. Expect ‘institutional DeFi’ patterns: permissioned vaults, allow-listed contracts, and oracle schemes that verify transfer-agent states before funds flow.

The upside is efficiency. The downside is partial composability: public rails with gated doors. That’s a feature, not a bug, for institutions whose mandates require control and auditability. The retail DeFi dream of instantly rehypothecated, leverage-stacked MMFs is not the goal here—and shouldn’t be.

Macro context: why ‘stable yield’ matters now

In a world where front-end rates remain materially positive, the opportunity cost of zero-yield stables is no longer academic. For a market maker holding eight figures of margin across venues, that’s a real P&L line. Tokenized Treasury funds plug that leak. They also mesh with a broader institutional pivot: as crypto venues professionalize, the cash leg starts to resemble prime-brokerage cash—segregated, yield-bearing, and operationally monitored—rather than a pool of bearer tokens sloshing through hot wallets.

There’s also a subtle portfolio effect. When your base collateral earns risk-free carry, you can tolerate longer windows of low turnover without deteriorating economics. That tends to reduce pro-cyclical behavior at the margins: fewer forced unwinds during drawdowns and less over-reach for yield during lulls. It won’t eliminate boom-bust cycles—crypto’s reflexivity lives elsewhere—but it sands down some of the roughest edges.

What traders and treasurers should do next

• Model the haircut ladder. Ask each venue how it haircuts tokenized Treasury funds under normal and stressed conditions. A 1–3% haircut is common for high-grade funds in TradFi tri-party. Crypto venues may start wider and tighten with data. Your own risk engine should apply an internal buffer on top.

• Stress the plumbing, not just the price. Run drills for bridge stalls, custodian outages, and stale oracles. Define a recovery time objective (RTO) shorter than your fastest margin-call window. Pre-agree manual fallbacks (e.g., faxed or SWIFT confirmations from custodians) for settlement during on-chain incidents.

• Segment cash buckets. Keep a fast-settle bucket (still in stablecoins) on-exchange for micro-timing and a yield bucket (tokenized Treasuries) off-exchange to fund baseline limits. Rebalance on volatility spikes.

• Reprice basis and funding. If your cash now earns 4–5%, your breakeven on hedges and calendars shifts. Update playbooks for weekend gaps, quarter-end windows, and event risk.

• For protocols: If you explore integrations, build KYC-gated modules, explicit oracle checks against transfer-agent data, and kill-switches that unwind gracefully if representations desync from the registrar.

Common misconceptions, cleared up

“Isn’t this just a stablecoin with extra steps?” No. A stablecoin is an IOU that targets $1 par with reserves of varying quality. A tokenized Treasury fund is equity in a regulated vehicle invested in government securities. One aims for par stability; the other tracks NAV plus yield. The legal, operational, and risk profiles differ.

“Will this crowd out USDT/USDC?” Not for retail payments or permissionless DeFi. But for large KYC’d accounts, tokenized funds will increasingly become the default ‘parked cash’—especially if stablecoin oversight tightens and venues offer attractive haircuts to fund shares.

“Can we loop it for infinite yield?” If you can, you probably shouldn’t. Most institutional frameworks will forbid recursive rehypothecation and will gate lending against tokenized funds to conservative LTVs. The point is safety and efficiency, not leverage games.

What could go wrong (and how to hedge it)

• Policy whiplash. A tougher stance on tokenized funds on public chains could raise haircuts or cap usage. Hedge by maintaining dual readiness: a stablecoin playbook and a tokenized-fund playbook you can toggle between.

• Bridge or contract incidents. A high-profile security vulnerability freezing a representation would freeze collateral mobility. Keep a portion of limits backed by vanilla cash or high-quality stables to bridge acute episodes.

• Yield regime shifts. If front-end yields collapse, the relative advantage of tokenized funds narrows. You still retain transparency and custody benefits, but the cash-flow edge fades. Re-run your economics quarterly.

Competitive read-through: who benefits next

Expect a queue of venues (centralized and permissioned DeFi) to whitelist leading tokenized Treasury funds as eligible collateral. Issuers that can match BUIDL’s custody, disclosure, and operational polish will win listings; those that can natively live where liquidity sits (e.g., BNB Chain, major L2s) will win adoption. On the client side, market makers and basis funds get the first-order benefit; exchanges get a healthier collateral stack; and, indirectly, retail benefits from tighter spreads and fewer liquidation cascades.

Bottom line

This isn’t crypto discovering Treasuries—that happened last cycle. It’s the moment collateral, yield, and compliance finally meet at scale on public rails. By bringing a tokenized U.S. Treasury fund like BUIDL to BNB Chain and into an off-exchange collateral framework, the industry shifts from improvising with bearer dollars to deploying institutional cash infrastructure on-chain. The immediate payoff is capital efficiency for the largest players; the second-order impact is a more resilient market that prices risk on the right leg of the trade. For a space that still fetishizes leverage, that’s a quietly radical change—and it’s only getting started.