Japan’s Crypto Tax Cut: Can a Sleeping Retail Giant Finally Wake Up?

Japan has long been described as a sleeping giant in the world of digital assets. It has a large and affluent population, a culture of disciplined saving, and a highly regulated financial system. Yet, despite these ingredients, crypto activity in Japan has often lagged behind other hubs such as the United States, Korea or parts of Europe.

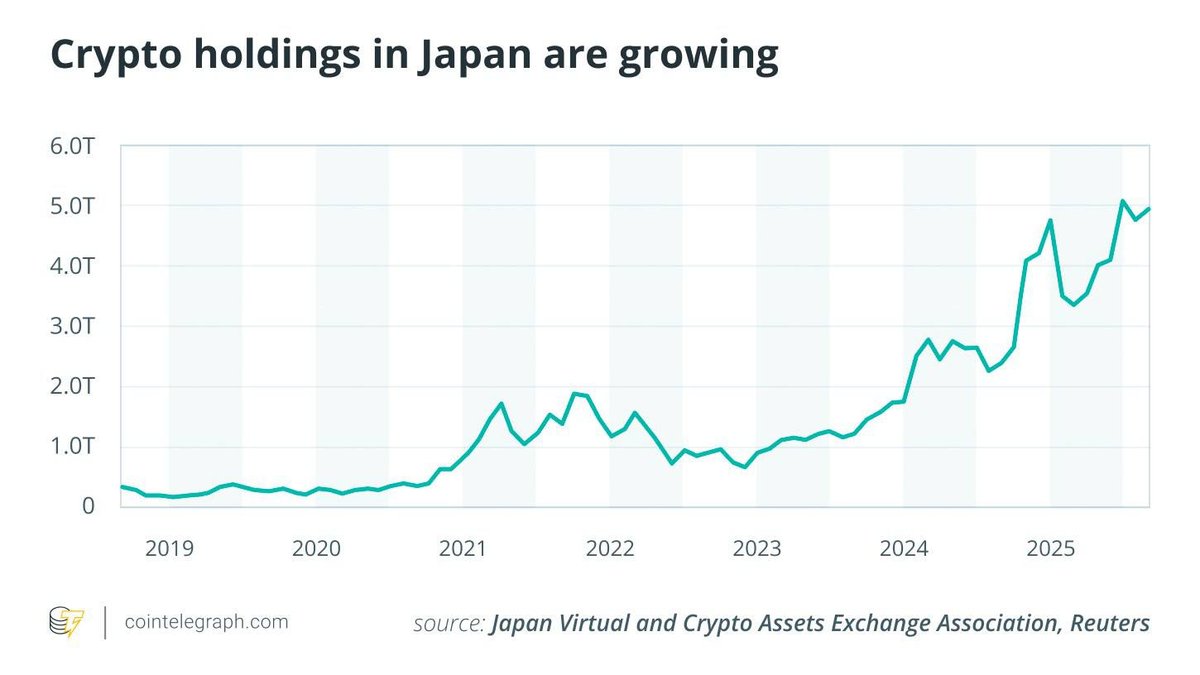

The chart of crypto holdings in Japan tells a more nuanced story. From almost negligible levels in 2019, total on-exchange holdings have steadily climbed to around 5 trillion yen in 2025. Adoption is happening, but it has been gradual rather than explosive. One of the main reasons is simple: taxes.

Today, Japan is preparing to change that. The government is moving toward a reform that would cut tax on digital-asset gains from a maximum of 55% to roughly 20%, treating them more like traditional financial investments. If implemented as expected, this shift could reshape incentives for households, platforms and global businesses looking at Japan as a long term market.

This article examines why the existing framework held back retail participation, what the new regime could unlock, and how corporate and regulatory trends are quietly aligning behind a more mature crypto ecosystem in Japan.

1. Why the Old Tax Regime Kept Many Retail Investors on the Sidelines

Under the current rules, most individual crypto investors in Japan see their gains treated as “miscellaneous income”. That categorisation matters, because it throws crypto into the same bucket as side jobs or one off income, rather than long term investment. The practical consequences have been painful for active traders and long term holders alike:

• High marginal rates: Gains could be taxed at a combined national and local rate of up to 55%, depending on total income. For many salaried workers, this meant that a successful crypto investment could push them into the top bracket.

• Limited offsetting of losses: Losses from digital assets could not easily be offset against other kinds of investment income, making risk management through diversification less effective.

• Complex reporting: Frequent traders needed detailed records of every transaction to calculate taxable gains in yen, a friction that discouraged many from moving beyond small experimental allocations.

These rules sent a clear, if unintended, message: crypto was not yet being treated as a mainstream asset class. For a society that values regulatory clarity and stability, the result was predictable. Many households preferred to keep the bulk of their savings in bank deposits, investment trusts or domestic equities rather than deal with high rates and administrative complexity.

At the same time, the tax environment reduced incentives for foreign exchanges and service providers to prioritise Japan. Building a local presence or securing a licence was costly, yet the potential retail revenue pool looked capped by after tax returns. The country’s strict licensing framework improved consumer protection, but the combination of heavy tax and conservative risk rules limited experimentation.

2. The New 20% Regime: Bringing Crypto Closer to Traditional Finance

The proposed reform changes the tone. By moving digital assets onto a flat 20% tax regime similar to that applied to many financial instruments, Japan would send a signal that crypto is no longer an outlier but part of the broader investment universe.

In practice, the new framework is expected to introduce three important shifts for individual investors:

• Predictable after tax outcomes: A flat rate allows households to estimate potential liabilities more easily, making it simpler to plan long term allocations instead of worrying that success will push them into punitive brackets.

• Closer alignment with stocks and funds: When digital assets are taxed similarly to equities or mutual funds, they can be evaluated side by side in a portfolio rather than being treated as a special case.

• Room for product innovation: Lower and clearer taxation opens the door for products such as crypto based exchange traded funds, structured products and retirement oriented solutions that need predictable tax treatment to attract mainstream savers.

The most important effect, however, may be psychological. For years, Japanese retail investors who were curious about crypto often heard a simple warning from friends, accountants or financial media: “Be careful, the taxes are heavy.” Moving to a more familiar framework reduces that barrier and reframes the conversation from tax avoidance to responsible portfolio construction.

3. A Sleeping Giant: Why Japan Matters So Much for Global Crypto

Calling Japan a sleeping giant is not just rhetoric. Several structural features make its eventual participation especially important for the digital asset economy:

• High household savings: Japanese households collectively hold hundreds of trillions of yen in cash and deposits. Even a small reallocation from bank accounts into digital assets could represent meaningful inflows.

• Tech savvy population: From mobile payments to gaming, Japanese consumers are comfortable with digital experiences, yet they expect reliability and strong consumer protection.

• Global corporate footprint: Financial groups such as SBI and Nomura and technology and entertainment brands like Sony and Sega have worldwide reach. When they launch digital asset initiatives, those products and standards can travel.

Until now, strict rules and high tax have meant that much of this potential energy remained stored rather than released. The chart of holdings growing steadily from 2019 to 2025 shows that the story is not one of stagnation, but it does suggest that adoption has been slower than what the country’s economic size might imply.

Lower tax alone will not transform all of this overnight. But it removes one of the most visible brakes on participation at the very moment when local institutions are building infrastructure that can translate interest into sustainable products.

4. Corporate Japan Is Already Laying the Rails

While tax policy dominated headlines, large Japanese companies quietly spent the past few years experimenting with digital asset infrastructure. Several trends stand out:

• Bank backed stablecoins and tokenized deposits: Groups like SBI have worked on yen denominated stablecoins backed by bank deposits, targeted at cross border payments and on-chain settlement. These products aim to blend the transparency of public ledgers with the familiarity of existing banking relationships.

• Tokenization of real world assets: Securities firms and asset managers have explored tokenized bonds, funds and real estate units, allowing investors to buy fractional interests with lower minimums and potentially faster settlement.

• Entertainment and IP driven projects: Gaming and media companies including Sony and Sega have experimented with digital collectibles and fan engagement tools that sit on public chains but are deeply tied to well known brands.

For these initiatives, clarity on investor taxation is not a minor detail; it is central to product design. A fan who buys a digital collectible linked to a famous franchise will care less about tax rates, but a household considering a tokenized fund or yield bearing stablecoin will immediately ask how returns are taxed.

By aligning the tax treatment of these instruments with traditional securities, Japan not only supports retail adoption but also gives corporate innovators a consistent rulebook. This can accelerate the transition from small pilot projects to scaled offerings.

5. How Retail Behaviour Could Change in a Lower Tax World

What, concretely, might change for individual investors once the new regime is in place?

5.1 From opportunistic trading to strategic allocation

High marginal tax rates tend to push behaviour toward either very short term trading or complete avoidance. Some investors treat crypto as a one off opportunity and then step away to avoid complex reporting. Others ignore the space entirely. A lower, flat rate creates room for regular, incremental investing, such as monthly purchases of Bitcoin or diversified baskets through regulated exchanges.

Such strategies align more naturally with Japan’s culture of disciplined saving. Rather than trying to time large moves, households can allocate a small portion of income to digital assets the same way they contribute to investment trusts or retirement accounts.

5.2 Opportunities for regulated ETFs and trusts

Tax parity with traditional products also improves the case for exchange traded funds and publicly offered trusts tied to digital assets. These vehicles can package Bitcoin or baskets of tokens inside a wrapper that trades on regulated exchanges, with professional custody and plain language documentation.

For conservative savers, such structures may feel more comfortable than directly managing wallets or navigating online platforms. If the tax treatment of these funds matches that of other securities, they can sit naturally inside existing brokerage accounts, side by side with domestic and international equities.

5.3 Regional competition and capital flows

Finally, there is a competitive angle. Neighbouring jurisdictions like Singapore and Hong Kong have actively courted digital asset businesses with tailored rules. A more supportive tax regime helps ensure that Japanese capital is not forced offshore solely for tax reasons. Instead, investors can access a range of products through domestic channels that are integrated with local consumer protection and reporting standards.

6. The Importance of Clear, Stable Rules Beyond Tax

While the tax cut is a significant step, it is not a standalone solution. For a sustainable expansion of Japan’s crypto market, it needs to sit alongside clear conduct rules, robust supervision and investor education.

In recent years, Japanese regulators have already moved in this direction by:

- Requiring exchanges to hold customer assets separately from company funds and to maintain strong capital buffers.

- Setting detailed rules for listing new assets, marketing high risk products and managing conflicts of interest.

- Encouraging self regulatory organisations to develop industry standards for security, disclosure and incident response.

These measures may make it slower for new tokens or experimental products to launch in Japan, but they also help build the trust that conservative savers demand. When the tax regime becomes more welcoming at the same time that guardrails are in place, the result can be a measured but durable form of adoption rather than a short lived boom.

7. What the Rising Holdings Chart Is Really Telling Us

Returning to the chart of crypto holdings in Japan, the line from 2019 to 2025 is revealing. It starts near zero, rises sharply around the global bull market of 2021, then moves sideways with bouts of volatility before climbing again to new highs above 5 trillion yen.

Two interpretations stand out:

- Resilience despite headwinds: Even with high taxes and strict rules, Japanese investors continued to accumulate digital assets over time. This suggests a base level of interest that is not purely driven by speculative waves.

- Room for acceleration: If holdings could reach these levels under an unfavourable regime, a more balanced tax framework and better product offerings could support a faster pace of growth without necessarily increasing risk.

In other words, the “sleeping giant” may already be half awake. The policy change does not start the story; it changes its slope.

8. Risks and Responsible Expectations

It is important, however, to keep expectations grounded. A lower tax rate does not guarantee a straight line upward for prices or adoption. Several risks remain:

• Market volatility: Digital assets remain highly volatile. Retail participants who enter the market solely because taxes are lower could still face large swings in portfolio value.

• Complexity of products: New products such as yield bearing stablecoins, tokenized loans or leveraged instruments may be difficult for non professional investors to fully understand. Clear disclosure and suitability checks remain essential.

• Policy reversals: While the current trajectory is supportive, future governments could revisit rules if market developments create concerns. Long term planning should account for this possibility.

For these reasons, the most constructive way to view Japan’s tax reform is not as an invitation to chase short term gains, but as a foundation for gradual integration of digital assets into diversified portfolios. Education around risk, time horizons and basic financial planning will be as important as the tax code itself.

9. Global Implications: A Template for Other Mature Economies?

Japan’s move may also have significance beyond its borders. Other advanced economies face similar questions: how to tax digital assets in a way that preserves revenue, protects consumers and still allows innovation. By shifting from a highly punitive framework toward one that mirrors traditional securities, Japan offers a possible template.

If the reform succeeds in expanding participation without creating systemic issues, it could encourage other regulators to consider similar steps. Conversely, if the change led to excessive speculation or consumer harm, it would reinforce more restrictive approaches elsewhere. In that sense, the success of Japan’s policy experiment will be watched closely by policymakers around the world.

10. Key Takeaways for Investors and Builders

For those active in digital assets — whether as investors, builders or observers — several lessons emerge from Japan’s tax shift:

• Tax policy shapes who participates. High marginal rates limited Japan’s retail activity for years, even as interest quietly built. Aligning tax treatment with traditional assets can unlock participation without changing the underlying technology.

• Regulation and innovation can coexist. Japan’s conservative approach did not prevent large groups like SBI, Sony, Sega and Nomura from building in the space. Instead, it nudged them toward products that emphasise compliance, transparency and integration with existing finance.

• Charts tell only part of the story. The rise of holdings from near zero to trillions of yen shows adoption, but the pace has been shaped by rules, not just by sentiment or technology trends.

As the new tax regime takes shape, Japan may finally move from being a sleeping giant to a fully engaged participant in the digital asset economy. The process will likely be cautious rather than explosive — in line with the country’s wider approach to innovation. For long term observers, that might be precisely what makes this next phase so interesting.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and involve risk. Readers should conduct their own research and consult qualified professionals before making financial decisions or interpreting tax rules for their specific situation.