Pro-Crypto Leadership at the CFTC and the Next Wave of Institutional Crypto Adoption

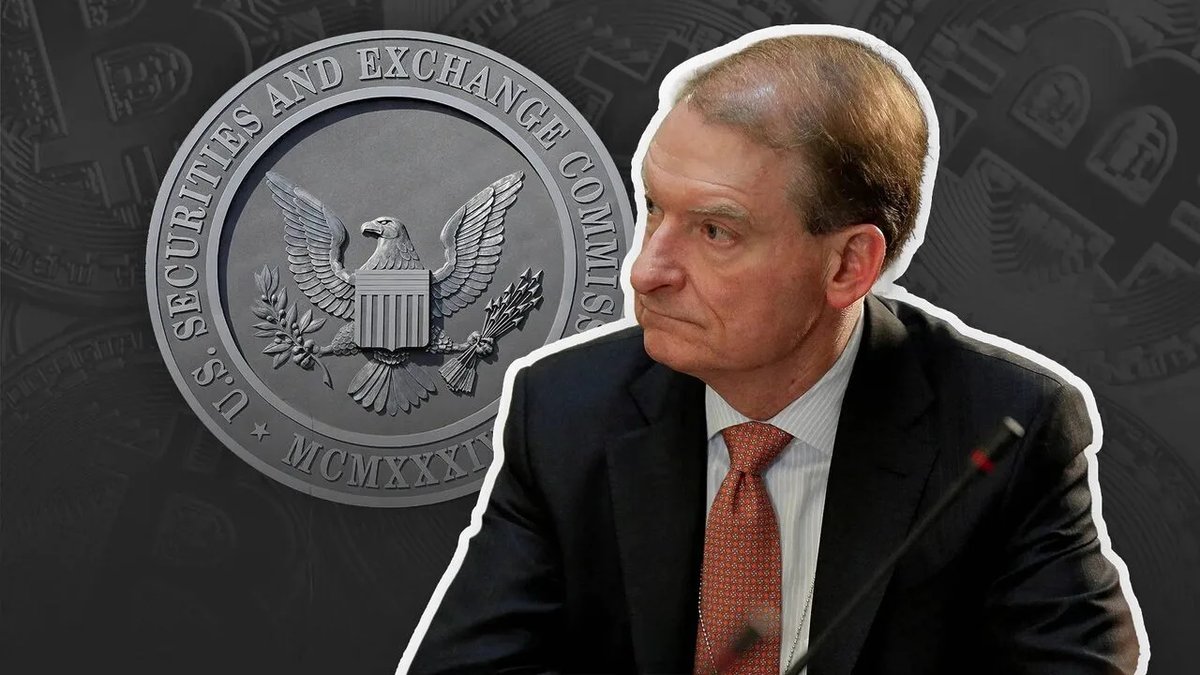

The past 24 hours have delivered a dense cluster of headlines that all orbit the same theme: digital assets are moving from the edges of finance into its centre, even as markets remain volatile and policy uncertainty lingers. At the regulatory core of that shift now stands Michael Selig, officially sworn in as the 16th Chair of the U.S. Commodity Futures Trading Commission (CFTC).

While Bitcoin trades around the 90,000 USD area and gold carves out yet another record near 4,450 USD per ounce, the structural changes may matter more than any single price print. A pro-innovation derivatives chief, the world’s largest asset managers openly describing Bitcoin as one of the year’s major investment themes, and a global banking giant evaluating institutional trading services all point in the same direction: the digital asset market is being wired into mainstream capital markets infrastructure.

Michael Selig Takes the Helm at the CFTC

Michael Selig’s swearing-in as CFTC Chair is more than a personnel change; it is a strong signal about how Washington intends to approach digital assets over the coming decade. Selig is not simply “friendly” to crypto – he has spent much of his professional career working on policy and legal frameworks for the sector. That background matters because the CFTC is the primary regulator for derivatives and commodity markets, and under most of the market-structure proposals in Congress it would oversee a large share of spot trading in Bitcoin and other non-security assets as well.

In his initial remarks, Selig emphasised that Congress is “poised” to send comprehensive market-structure legislation to the President’s desk. That may sound like standard Washington language, but it effectively tells institutional investors two things. First, the direction of travel is towards clear, federal rules, not fragmented state-level experiments. Second, the CFTC under his leadership intends to be an enabler of responsible innovation rather than a reluctant gatekeeper.

For derivatives markets, that could mean a more straightforward path for regulated futures, options and other risk-management tools built on digital assets. For trading platforms, it raises the prospect of a unified regime where registration, capital requirements and supervision are tailored to the realities of 24/7 global markets instead of forcing them into legacy moulds. It does not remove risk, but it makes the rules of the game easier to understand.

JPMorgan and the Quiet Normalisation of Institutional Trading

Against that regulatory backdrop, reports that JPMorgan is considering offering digital asset trading services to institutional clients take on new significance. JPMorgan oversees around 4 trillion USD in assets. Even a modest allocation from a fraction of that base would be meaningful for market depth and liquidity.

The fact that a bank of this size is exploring trading services – rather than merely research or custody – shows how far sentiment has moved since the early days when large institutions kept crypto at arm’s length. The calculus is changing from “Is this asset class legitimate?” to “How do we provide exposure in a way that fits our risk, compliance and capital frameworks?”

Combined with BlackRock’s public comments framing Bitcoin as one of the year’s most important investments, and with the continued growth of spot ETFs, the direction of travel is increasingly clear. Even after a choppy year for prices, institutional participation is expanding, not contracting. This does not guarantee higher prices in a straight line, but it does change the character of the market over time – fewer purely speculative flows, more long-horizon capital seeking structured, regulated access.

From Regulation to Corporate Treasuries: Trump Media and Beyond

The institutional story is no longer confined to banks and asset managers. Trump Media’s purchase of 451 BTC, worth over 40 million USD at current prices, underlines how corporate treasuries are experimenting with digital assets as part of broader brand and capital strategies.

At the same time, the political climate is evolving. The Trump administration has signalled support for comprehensive market-structure legislation, and the probability that the Supreme Court rules current tariff policies illegal – currently around 72% on prediction markets – adds another layer of macro uncertainty. Yet within that uncertainty, digital assets are increasingly seen as one of several tools companies can use to diversify their balance sheets and align themselves with innovation narratives.

Uniswap’s UNIfication: DeFi Learns to Speak the Language of Cash Flows

On the decentralised finance side, the most important development of the day is the UNIfication upgrade passed by the Uniswap DAO. For years, DeFi protocols have been valued largely on potential and network effects rather than clearly defined cash flows. UNIfication is a step towards changing that.

The upgrade does three things that matter for long-term observers:

- It activates protocol fees on Uniswap v2 and v3, creating a direct link between trading activity and value captured by the protocol.

- It establishes a buyback programme for UNI funded by those fees, aligning the token more closely with the performance of the underlying exchange.

- It authorises the burning of around 100 million UNI from the treasury, shrinking the outstanding supply from roughly 629 million to 529 million over time.

This combination of fee activation, buybacks and supply reduction pushes Uniswap further along the path from experimental protocol to something that resembles a digital-native financial marketplace with explicit, measurable economics. It also raises the bar for other projects that have talked about value accrual but avoided making difficult design choices.

Buybacks, Governance Tensions and the Maturing DeFi Playbook

Uniswap is not alone in refining its economic model. Aster DEX has launched the fifth stage of its buyback programme, pledging up to 80% of daily protocol fees to purchase its native token ASTER. Forty percent of those purchases are executed automatically, while the remaining 20–40% are deployed more flexibly depending on market conditions.

These mechanisms are not guarantees of success, but they show how DeFi is increasingly borrowing the language of corporate finance – capital returns, treasury management, and incentive alignment – while keeping its open, programmable nature.

The Aave DAO, meanwhile, is engaged in a more contentious but equally important discussion: whether to move control of key brand assets such as domains, social accounts and naming rights from Aave Labs to the DAO itself. Supporters argue that if a protocol is truly decentralised, its intellectual property should not sit in a single company’s hands. Critics worry about governance complexity, execution risk and the possibility of fragmented accountability.

However that vote resolves, it illustrates a broader trend. DeFi is moving from purely technical questions (Which chain? Which bridge? What yield?) toward institutional questions: Who controls the brand? How are trademarks handled? How do you coordinate thousands of tokenholders without slowing down innovation? These are exactly the kinds of questions legacy institutions grapple with – just expressed in a new, tokenised context.

Bitmine’s ETH Strategy: From Asset Exposure to Productive Treasury

Another notable development is on the balance sheet of Bitmine, which has acquired more Ether, bringing its holdings to roughly 4.066 million ETH. That represents around 3.37% of total ETH supply – a substantial position for a single corporate entity.

Bitmine’s strategy is not simply to hold ETH as a speculative position. The company has repeatedly emphasised that it views Ethereum as a productive asset, one that can be staked to secure the network, used as collateral for credit lines, or deployed in carefully curated DeFi strategies. For shareholders, the pitch is that a portion of the company’s value will be tied not only to the market price of ETH but also to the yield and optionality that comes from active management.

From a market-structure perspective, large pools of ETH locked up in long-term corporate or institutional hands contribute to a slow but persistent reduction in freely circulating supply. That does not guarantee any particular price outcome, but it changes how shocks propagate: when more supply is effectively “sticky”, short-term order-book imbalances can produce sharper moves in both directions.

Gold, Bitcoin and the Multi-Asset Macro Picture

While digital assets evolve, traditional stores of value are not standing still. Gold has surged to a new all-time high around 4,450 USD per ounce, and silver has pushed to record levels near 69 USD. The simultaneous strength of both precious metals and Bitcoin around 90,000 USD suggests that investors are seeking multiple hedges in the face of political, fiscal and technological uncertainty.

Part of this story is monetary. The Federal Reserve is expected to provide roughly 6.8 billion USD in short-term liquidity this week via repurchase operations, bringing the total over the past ten days to about 38 billion USD. These operations are best understood as routine balance-sheet management rather than full-scale quantitative easing, but they nevertheless highlight that funding markets remain sensitive and that central banks remain deeply embedded in the daily functioning of finance.

At the same time, forward-looking signals remain constructive. The CEO of Bank of America has argued that artificial intelligence could drive “strong” economic growth in 2026, while the Pentagon’s new partnership with Elon Musk’s xAI underscores how seriously governments are taking AI as a strategic capability. For digital assets, that matters in at least two ways: it creates sustained demand for advanced computing infrastructure – an area where several former mining companies are pivoting – and it reinforces the narrative that software-driven networks can become core national assets.

Regulation, Tax Clarity and the Stablecoin Layer

While Selig’s appointment at the CFTC grabs the headlines, the legislative branch is also nudging policy forward. Members of the U.S. House have floated a proposal to exempt small stablecoin payments under 200 USD from capital gains tax and to defer taxation on certain staking rewards. Paired with earlier efforts like the Digital Asset PARITY Act, this amounts to a gradual recognition that treating every tiny on-chain payment as a taxable event is neither practical nor fair.

If such measures become law, they could transform stablecoins from a specialised tool used primarily within trading platforms into a more widely accepted means of everyday payment and settlement. For merchants and consumers, the main benefits would be predictable tax treatment and reduced record-keeping burdens. For regulators, the trade-off is a cleaner line between speculative activity and routine payments.

In that sense, the combination of a crypto-literate CFTC chair and emerging tax clarity forms a more coherent policy stack: derivatives and trading platforms under Selig’s supervision, and day-to-day payments gradually brought into the mainstream tax code.

AI, Corporate Strategy and Market Sentiment

Outside pure finance, the intersection of technology and strategy continues to generate headlines. The Pentagon’s collaboration with xAI signals that advanced models are becoming part of national-level planning, not just consumer applications. Netflix, meanwhile, faces rising uncertainty around a potential deal with Warner Brothers, with prediction markets trimming the probability of completion from around 80% to 61%. These developments might seem far from Bitcoin, yet they contribute to the broader backdrop in which investors decide how to allocate capital between growth stories, defensive assets and digital networks.

In that environment, BlackRock’s statement that Bitcoin ranks among this year’s major investments serves as a kind of sentiment anchor. It tells portfolio managers that even if the asset remains volatile, it is now part of the serious conversation about portfolio construction – not an exotic outlier.

Short-Term Heat, Long-Term Discipline

In derivatives markets, the combination of Bitcoin near 90,000 USD and elevated open interest indicates that leveraged positioning is building up again. That can amplify both rallies and corrections. With CFTC leadership now clearly engaged, market participants should assume that oversight of derivatives venues and products will tighten, particularly where retail exposure and leverage are involved.

For long-term investors, the key is to distinguish between noise and structure. Day-to-day moves driven by funding rates or liquidations can dominate headlines, but the deeper story over the past 24 hours is about institutional and regulatory architecture falling into place: a pro-innovation CFTC chair, a global bank exploring trading services, DeFi protocols aligning tokens with cash flows, and corporate treasuries treating Bitcoin and Ether as strategic assets rather than curiosities.

24-Hour Market Recap

To summarise, here are the main developments that shaped crypto and macro sentiment over the last day:

• CFTC: Michael Selig, a long-standing supporter of responsible digital asset regulation, is sworn in as the 16th Chair, signalling a more constructive regulatory stance toward market-structure legislation.

• Institutional Banks: JPMorgan, which manages roughly 4 trillion USD in assets, is evaluating digital asset trading services for institutional clients, another step toward mainstream integration.

• DeFi Economics: Uniswap’s UNIfication upgrade passes, activating protocol fees, launching a UNI buyback funded by those fees and authorising the burn of 100 million UNI from the treasury; Aster DEX expands its own buyback programme.

• Governance: The Aave DAO debates transferring control of key brand assets from Aave Labs to the DAO, highlighting the growing importance of non-technical governance questions.

• Corporate Holdings: Bitmine increases its Ether position to about 4.066 million ETH (~3.37% of total supply), reinforcing its strategy of treating ETH as a core treasury asset.

• Macro & Commodities: Gold reaches a fresh all-time high near 4,450 USD, silver prints new records around 69 USD, and the Federal Reserve prepares additional short-term liquidity injections via repo operations.

• Politics & Policy: Lawmakers continue to discuss stablecoin tax exemptions for small transactions and deferred taxation for certain staking rewards, while market-structure legislation edges closer to the President’s desk.

• Technology & AI: The Pentagon partners with Elon Musk’s xAI to expand its artificial intelligence capabilities, and Bank of America’s CEO reiterates that AI could support strong economic growth in 2026.

Taken together, these threads tell the story of a market that is maturing in the background even as prices swing in the foreground. Regulatory architecture, institutional participation and protocol-level economics are all moving in a direction that treats digital assets less as a side experiment and more as embedded components of the global financial system.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and carry risk. Always conduct your own research and consider seeking advice from qualified professionals before making financial decisions.