Trump’s “Warrior Dividend” and the Promise of a Record Tax-Refund Season

In a nationally televised prime-time speech, President Donald Trump unveiled a new policy he calls the “warrior dividend”: a one-time payment of 1,776 USD to each active-duty member of the US armed forces. The payment, which the administration says will reach around 1.45 million service members before Christmas, carries an estimated price tag of roughly 2.5–2.6 billion USD.

In the same address, the president repeated his view that 2026 will deliver the largest tax-refund season in US history, pointing to recently enacted tax cuts, higher standard deductions and new credits. He framed these measures as part of a broader effort to help households cope with the lingering effects of elevated prices and to revive confidence in the US economy, while also arguing that he inherited a difficult environment from the previous administration.

Beyond the political theatre, these announcements raise important questions. What does the warrior dividend mean in the context of the defense budget and federal finances? How do large tax refunds interact with inflation, growth and long-term debt? And what should investors and citizens make of a policy mix that combines targeted transfers with broader tax reductions at a time when government borrowing is already high?

This article takes an educational look at the mechanics, potential benefits and trade-offs behind the warrior dividend and the promised refund wave, with a focus on how they fit into the bigger macro-fiscal picture.

1. The Warrior Dividend: Symbolism Meets Fiscal Arithmetic

At first glance, a 2.5–2.6 billion USD program is modest when set against a defense budget that exceeds 800 billion USD per year. Yet, the warrior dividend is significant in three ways: as an income boost for individual service members, as a signal of political priorities, and as one more example of targeted fiscal transfers in a period of economic uncertainty.

1.1 What the payment means for service members

For an enlisted soldier, sailor, airman or marine, a 1,776 USD payment is not life-changing, but it is meaningful. Many junior enlisted personnel earn basic pay in the low-to-mid tens of thousands of dollars per year, often supporting families and juggling housing, childcare and debt obligations.

Depending on tax treatment and local living costs, the warrior dividend could help:

- Reduce high-interest consumer debt or credit-card balances.

- Cover seasonal expenses such as travel and holiday spending without new borrowing.

- Build or replenish an emergency-savings buffer, which is often thin for younger households.

From a behavioural perspective, one-off payments can also have an outsized emotional impact. The specific amount, 1,776 USD, is clearly chosen for its symbolism rather than round-number simplicity, linking the initiative to US independence and national identity. That symbolism is likely intentional: the administration is emphasising not just material support but public recognition of military service.

1.2 How large is it in budget terms?

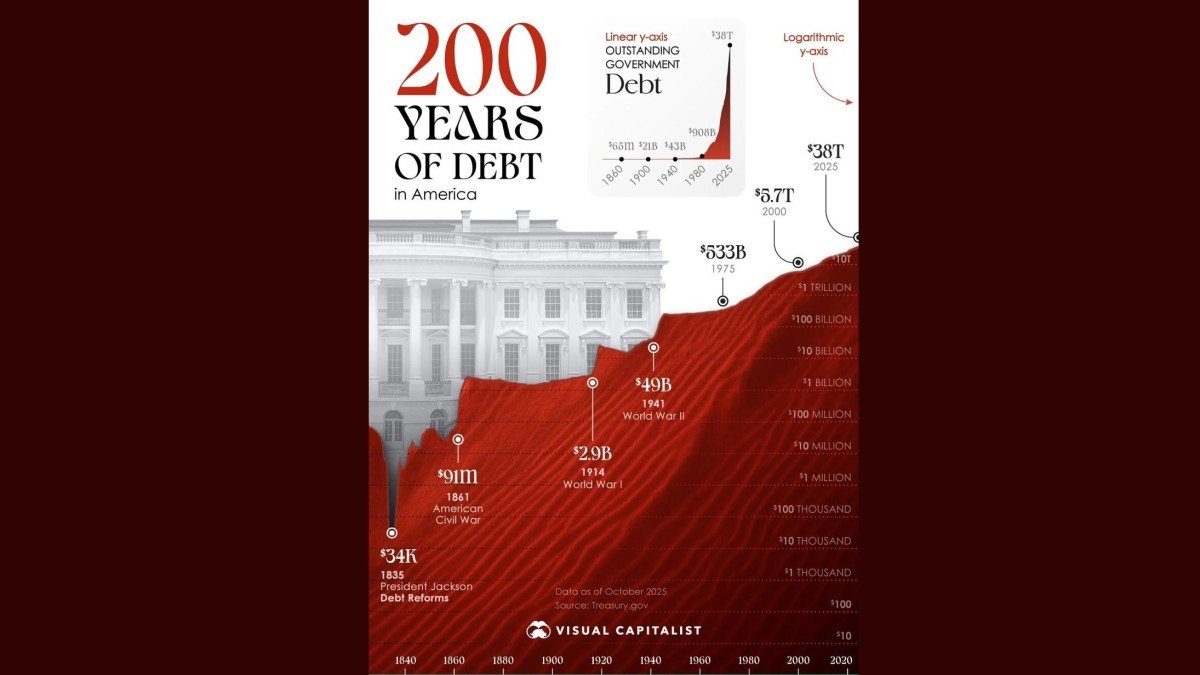

Around 2.5–2.6 billion USD is small in the context of total federal spending, which is measured in the trillions, but the timing still matters. The United States is already running sizeable budget deficits, and the debt stock has surpassed 38 trillion USD. Any new program must therefore be understood as part of a larger pattern: fiscal policy remains firmly in a supportive, rather than restrictive, stance.

If the warrior dividend is financed within the existing defense allocation, the immediate impact on borrowing could be muted, but other priorities might need to be deferred. If it is funded through additional borrowing, it adds incrementally to the deficit, though the scale is not large enough on its own to shift debt trajectories.

More important is the precedent. Once governments begin using targeted transfers as tools for economic management and political signalling, expectations can form around future payments to specific groups. Over time, those expectations influence both household behaviour and budget planning.

1.3 Short-term demand versus long-term sustainability

In macroeconomic terms, the warrior dividend functions as a small, highly targeted stimulus. Most recipients are likely to spend a significant share of the payment, supporting demand in local economies near bases and in the broader retail sector. The effect will be diffuse but directionally positive for consumption in the near term.

The longer-term question is sustainability. A one-off payment has limited permanent impact on the fiscal position, but it adds to a pattern in which new commitments — tax cuts, refunds, targeted transfers — outpace offsetting measures such as reduced spending elsewhere or higher revenues in other areas. That pattern matters when investors assess the trajectory of US debt and the potential future path of interest rates.

2. The Promise of a Record Tax-Refund Season

The second major theme of the speech was the claim that 2026 will bring the largest tax-refund season in US history. This expectation stems from recently enacted legislation that lowers rates, adjusts brackets and increases certain credits and deductions. The mechanics of refunds, however, are often misunderstood.

2.1 What a tax refund really is

A refund is not free money from the government; it is the difference between what taxpayers owed and what was withheld from paycheques or paid in estimated instalments. A larger average refund typically means that:

- Taxpayers had more withheld than necessary under the new rules, or

- Credits and deductions were expanded relative to provisional withholding tables.

From a household’s point of view, a refund can feel like a bonus, even though it usually represents a return of one’s own money. Behaviourally, lump-sum payments arriving in spring can temporarily boost spending on durable goods, travel or debt repayment.

2.2 Why 2026 could stand out

Several features of the new fiscal package help explain the forecast of an unusually large refund season:

- Lower marginal rates and higher thresholds mean that many workers will ultimately owe less than implied by existing withholding schedules, at least in the initial year before they adjust allowances.

- Enhanced child and family benefits increase refundable credits for eligible households, directly boosting refund amounts.

- Expanded standard deductions reduce taxable income for many filers, which again can lead to over-withholding if employers do not immediately recalibrate.

Treasury officials have already suggested that households could see 1,000–2,000 USD in additional refunds on average, depending on income and family structure. For some families, that is equivalent to a 13th paycheque arriving all at once.

2.3 Short-term economic impact

From a macro perspective, a record refund season acts like a temporary, broad-based cash injection into the economy. Historical evidence suggests that households use such windfalls in three main ways:

- Consumption: Upgrading household items, booking holidays or catching up on deferred purchases.

- Savings: Placing funds into bank accounts, investment products or retirement plans.

- Debt reduction: Paying down credit cards, auto loans or other obligations.

The balance among these uses will determine the short-run effect on growth. If most of the money is spent, the stimulus to consumption could be visible in retail sales data. If a large share goes to debt reduction and savings, the impact on measured activity might be smaller, but household balance sheets would improve.

Either way, it is important to recognise that refunds are front-loaded benefits. They can support activity in the year they arrive, but they do not by themselves change the long-term growth potential of the economy unless accompanied by structural reforms, productivity gains or sustained investment.

3. Inflation, Cost of Living and Policy Trade-offs

One of the motivations for both the warrior dividend and the broader tax package is concern about the cost of living. Even as headline inflation has eased from its peak, many households still feel pressure from elevated prices for housing, food, energy and healthcare.

Here the policy trade-off becomes clearer:

- On the one hand, targeted transfers and tax cuts cushion households against higher prices, making it easier to cope without sharply reducing consumption.

- On the other hand, additional fiscal stimulus can keep demand robust at a time when the central bank is trying to bring inflation sustainably back toward its target.

If the economy were already in a deep recession, such measures would be straightforwardly counter-cyclical. In the current environment, where growth has slowed but remains positive, the balance is more delicate. The Federal Reserve will need to consider how an influx of refunds and transfers interacts with its own decisions on interest rates.

President Trump has argued that the central bank should adopt a more accommodative stance and that lower rates will help households and businesses manage debt and invest. Some policymakers and analysts, however, caution that loosening both fiscal and monetary policy simultaneously could reignite price pressures if underlying supply constraints persist.

4. Debt Dynamics: Generosity Today, Obligations Tomorrow

Any assessment of new spending and tax reductions must grapple with the state of US public finances. The federal debt continues to climb, reflecting years of deficits driven by demographic costs, discretionary programs and periodic stimulus measures.

Adding a 2.5–2.6 billion USD warrior dividend and larger refunds will not transform that picture on their own, but they are part of a broader pattern of policy choices that prioritise near-term support. The key questions for long-term sustainability are:

- Will economic growth accelerate enough, on a lasting basis, to stabilise the debt-to-GDP ratio despite higher primary deficits?

- Will future Congresses offset current tax reductions with spending restraint or revenue measures elsewhere?

- How will investors in Treasury securities respond if they perceive that the fiscal path is becoming less predictable?

For now, global demand for US government debt remains strong, supported by the dollar’s reserve-currency role and the depth of US capital markets. That allows substantial deficits to be financed at interest rates that, while higher than a few years ago, are still manageable by historical standards. Nevertheless, the more policy leans on borrowing to deliver relief and stimulus, the narrower the margin for error becomes if conditions change.

5. Political Framing: “Inheriting a Mess” and Rebuilding Confidence

In his speech, President Trump also reiterated that he had “inherited a mess” from the prior administration, citing concerns over the border, foreign policy and economic management. From an analytical perspective, this framing serves several purposes:

- It positions current policies as corrective rather than purely expansionary.

- It attempts to shift responsibility for existing weaknesses in the economy or public finances to predecessors.

- It links tangible measures such as the warrior dividend and refunds to a broader narrative of restoration and renewal.

For citizens and investors, the key is to distinguish between rhetoric and measurable outcomes. Regardless of which administration is in power, indicators such as inflation, unemployment, real wage growth, productivity and debt sustainability provide more objective gauges of progress than political language.

The coming years will test whether the combination of direct transfers, tax reductions and regulatory changes can deliver on promises of stronger, more inclusive growth without undermining financial stability.

6. What This Means for Households, Markets and Builders

Looking ahead, several practical takeaways emerge from the warrior dividend and the prospective record tax-refund season:

• Households should treat both payments and refunds as part of a broader financial plan rather than as windfalls. Using a portion to improve emergency savings and reduce high-interest debt can increase resilience if the economy slows.

• Businesses, especially in consumer-facing sectors, may see a temporary boost in demand as funds are spent. Planning inventory, staffing and marketing around the timing of refunds can help capture this uplift without overextending.

• Investors need to weigh the supportive impact of fiscal measures on near-term growth against the implications for long-term debt and potential interest-rate paths. For fixed-income markets, the path of issuance and the central bank’s response will remain crucial.

• Digital-asset participants often watch fiscal developments closely, since expansive policy and rising debt are sometimes cited as structural reasons for interest in scarce or programmable assets. However, short-term price movements in assets like Bitcoin depend on many factors beyond any single policy announcement.

7. Conclusion: Between Generosity and Responsibility

The warrior dividend and the promise of a historic tax-refund season encapsulate a broader theme in contemporary US policy: the desire to provide visible, immediate support to key constituencies while managing a complex mix of inflation concerns, growth aspirations and high public debt.

For service members, a 1,776 USD payment is a tangible acknowledgment of contribution and sacrifice. For households anticipating refunds, the prospect of extra cash in early 2026 offers some relief from persistent cost-of-living pressures. For the macro economy, these steps add modest but non-trivial stimulus at a sensitive moment in the cycle.

Ultimately, the success of this approach will depend on factors that extend beyond any single announcement: the trajectory of productivity, the health of the labour market, the credibility of monetary policy and the willingness of future policymakers to balance generosity with long-term responsibility. Observers who focus not only on the size of the checks but also on the structure of the broader fiscal framework will be best positioned to understand what these policies mean for growth, stability and opportunity in the years ahead.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Economic conditions and policies can change rapidly. Readers should conduct their own research and consult qualified professionals before making financial or policy-related decisions.