U.S. GDP Jumps 4.3% in Q3: What Is Really Powering the Expansion?

The U.S. economy has once again surprised forecasters. Third-quarter gross domestic product (GDP) rose at an annualised pace of 4.3%, comfortably beating the already solid consensus estimate of 3.2%. At a time when many analysts expected higher interest rates and global uncertainty to cool activity, the data instead point to an economy still powered by robust household demand and healthy corporate earnings. President Trump quickly framed the figures as proof that his tariffs and tax framework are delivering a new 'golden age' for American growth, arguing that most economists underestimated the impact of his policies. To understand how much of this narrative is justified, we need to look beneath the headline number and examine the mechanics of this expansion.

Breaking down the 4.3% growth print

GDP is ultimately a sum of four broad components: consumption, investment, government spending and net exports. The current report shows a contribution from each, but the hero of the quarter is clearly the American consumer. Personal consumption expenditures rose 3.5%, a strong pace for a mature economy. That growth was relatively broad-based, with services such as travel, healthcare and entertainment leading the way, while goods spending remained firm rather than spectacular. In simple terms, households kept going out, kept buying and, at least for now, continued to behave as if they felt reasonably secure about their financial prospects.

Government spending added another layer of support. Federal outlays increased, reflecting both defence-related spending and the roll-out of programs linked to earlier legislation. State and local governments also contributed as they continued to invest in infrastructure and public services after several years of cautious budgeting. Together, the public sector acted as a stabiliser, ensuring that the economy did not lose momentum even as some interest-sensitive corners remained under pressure.

Net exports made a positive contribution as well. Exports increased while imports grew more slowly, helped in part by resilient overseas demand for U.S. manufactured goods, energy and services. Tariff policy can influence these flows at the margin by changing relative prices and shifting supply chains. However, it is important to remember that trade balances are also driven by global demand, exchange rates and domestic income growth. A strong domestic economy tends to pull in more imports; the fact that exports still managed to pull ahead suggests that U.S. producers remain highly competitive in key sectors.

Business investment, the segment that was supposed to be most vulnerable to higher borrowing costs, did soften but not as dramatically as feared. Capital expenditures on equipment and structures slowed, yet the decline was milder than earlier in the year and there were pockets of strength in technology, energy and manufacturing automation. Companies appear to be prioritising projects that increase productivity or reduce long-run costs, even while trimming less essential spending. In other words, investment has become more selective rather than collapsing outright.

One of the most encouraging lines in the report is corporate profitability. After several quarters of mixed results, pre-tax profits surged more than 4%. This indicates that firms were not only selling more goods and services but also managing to preserve or even expand their margins. Some of this reflects easing cost pressures as supply chains normalise and commodity prices stabilise. Some reflects the ability of businesses with strong brands or differentiated offerings to pass on higher costs without losing customers. From a macro perspective, robust profits provide fuel for continued hiring, wage growth and investment.

Why are households still spending so confidently?

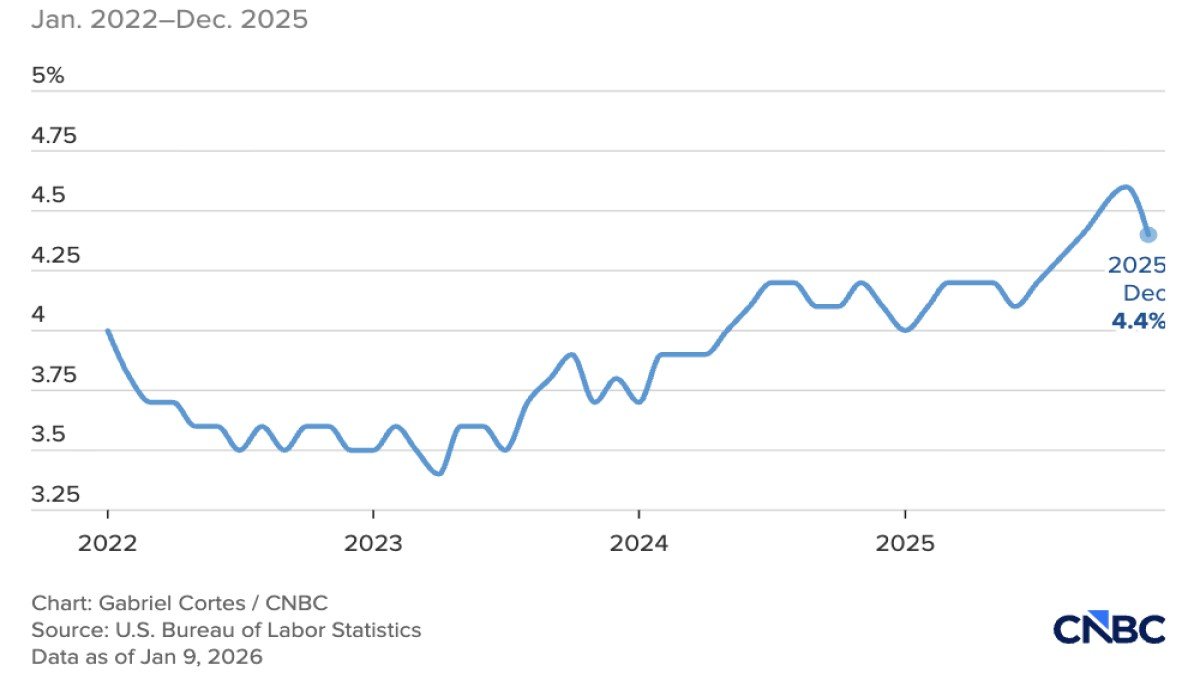

The resilience of consumer spending is arguably the most striking feature of the current expansion. Several factors are at work. The labour market has remained tight, with unemployment low by historical standards and job openings still elevated in many sectors. Even if wage growth has slowed from its post-pandemic peaks, real income gains have been supported by moderating inflation. For many households, paychecks are stretching a bit further than they did when price pressures were at their most intense.

Wealth effects also matter. Equity markets, while volatile, have generally trended higher over recent years, and home prices have held up better than many feared when interest rates began to climb. Households that saw their net worth increase are more willing to maintain consumption, even if they become slightly more cautious in big-ticket categories. At the same time, targeted tax measures and direct transfers—from child-related benefits to various rebates—have provided additional support to lower- and middle-income families, who tend to spend a higher share of any extra cash they receive.

There are, however, early signs of fatigue beneath the surface. Revolving credit balances have risen, and some households are relying more heavily on instalment plans or personal loans. Delinquency rates from a low base have edged higher. These trends do not automatically signal an imminent reversal, but they remind us that a consumption-led boom can be vulnerable if labour market conditions worsen or if credit becomes meaningfully tighter. For now, though, the data still show a consumer sector that is pulling the overall economy forward rather than holding it back.

The Trump administration’s explanation: tariffs, tax policy and a 'golden era'

President Trump has linked the strong GDP figures directly to his policy agenda. In his view, higher tariffs on imports, combined with a large package of tax reductions and targeted spending, have spurred business investment, supported manufacturing and put more money in workers’ pockets. He argues that many economists underestimated the positive effect of these measures and that the United States is entering a prolonged phase of elevated growth without a substantial inflation trade-off.

From a textbook macroeconomic standpoint, the picture is more nuanced. Tariffs can, in the short term, shift some demand towards domestically produced goods and reduce the trade deficit if they meaningfully cut import volumes. They can also raise government revenue that is then recycled into the economy through various programs. However, tariffs also tend to increase costs for domestic producers that rely on imported inputs, and they can invite retaliation from trading partners. The net effect depends on the structure of supply chains and the specific sectors affected; it is rarely purely positive or negative.

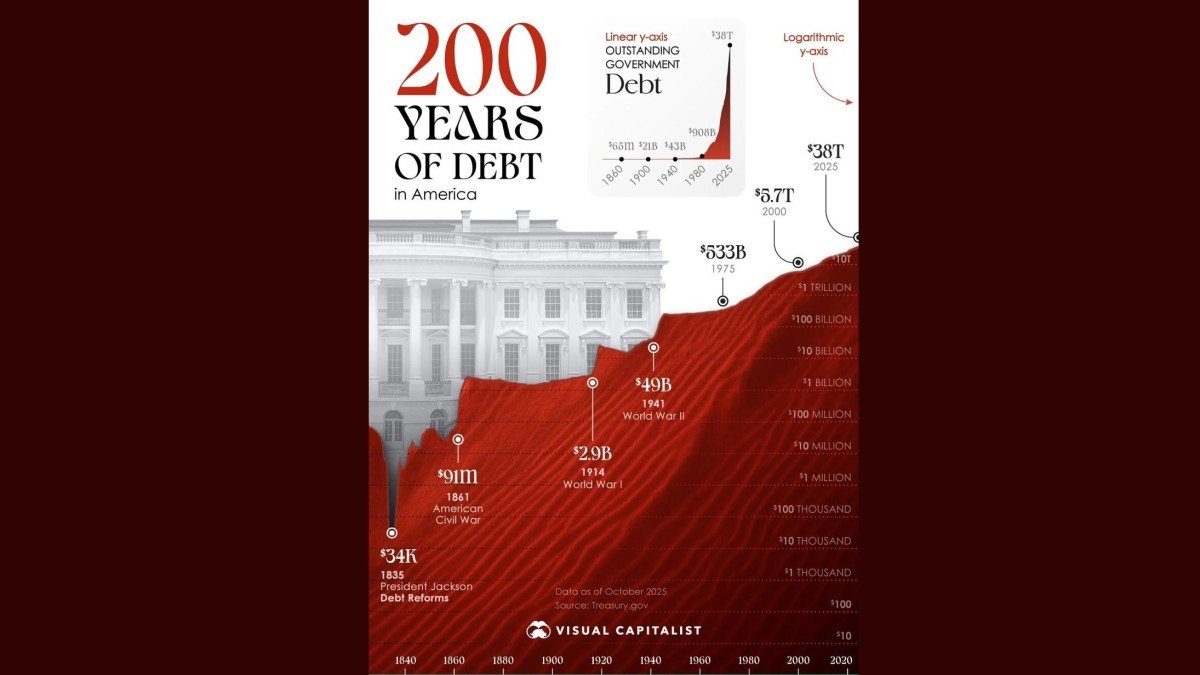

Tax and spending decisions arguably play a more significant role in the current momentum. Lower tax rates for households and businesses, combined with elevated federal outlays, amount to a sizeable fiscal impulse. In simple terms, the public sector is injecting more demand into the economy than it is withdrawing through taxation. That supports GDP and jobs in the short and medium term, exactly as the data currently show. The trade-off is that deficits and public debt continue to rise, setting up a different policy discussion for the next decade about how to finance long-term commitments without crowding out private investment.

Why were forecasters off by so much?

Many forecasts pegged Q3 growth around 3.2%, which would already have been a solid number. The fact that actual growth overshot by more than a percentage point has led to some introspection in the forecasting community. Three factors stand out.

First, analysts likely underestimated the durability of consumer spending. Models that placed significant weight on interest rates and accumulated savings assumed a sharper pullback as borrowing costs stayed high. Instead, the combination of wage gains, wealth effects and fiscal support kept demand stronger for longer. Second, productivity appears to be improving faster than expected in some sectors, especially those adopting automation, artificial intelligence and more efficient logistics. That allows the economy to produce more without proportionally increasing labour or capital inputs, boosting real GDP.

Third, the global environment has been somewhat less hostile than feared. While some regions are slowing, a full-blown external shock has not materialised. Energy prices, though still a source of uncertainty, have not surged to levels that would severely constrain household budgets. In that context, it is easier for domestic strength to shine through. Forecasting is inherently challenging, and periods of structural change—whether in technology, trade patterns or policy frameworks—tend to make traditional models less reliable.

Is the current pace of growth sustainable?

A 4.3% annualised growth rate is well above most estimates of the U.S. economy’s long-run potential, which typically sit in the 1.5–2.0% range. Growing faster than potential is not a problem in the short run; in fact, it can help reduce underemployment and pull more people into the workforce. The question is how long such a pace can be maintained without creating new imbalances.

One factor to watch is the composition of growth. An expansion driven largely by consumption and government spending may eventually run into constraints if income growth slows or fiscal space becomes tighter. For the boom to transition into a sustainable upswing, business investment in productivity-enhancing projects needs to accelerate and remain broad-based. The latest data show tentative progress in this direction, but not yet a decisive shift.

Another consideration is inflation. Strong demand is easier for the Federal Reserve to tolerate if price pressures remain contained. Should inflation re-accelerate meaningfully, policymakers would face a difficult balancing act: tighten policy further and risk cooling growth, or tolerate higher inflation in order to preserve employment gains. At present, the narrative of 'strong growth without runaway inflation' remains broadly intact, but it is far from guaranteed indefinitely.

Implications for the Federal Reserve and interest rates

A quarter of 4.3% growth complicates the Federal Reserve’s task. On one hand, the central bank can take comfort from evidence that the economy is not sliding into recession under the weight of past rate hikes. On the other hand, such a strong print may reduce the urgency of cutting rates, particularly if inflation does not fall decisively towards the 2% target. Markets that had been pricing aggressive easing may need to adjust towards a more gradual or data-dependent path.

For bond investors, this could mean persistently higher real yields and a steeper yield curve, as expectations of future rate cuts are pushed out. For equities, robust GDP and profits are supportive, but valuations must also reflect the higher discount rate environment. Sectors tied to domestic demand, infrastructure and productivity-enhancing technologies may continue to benefit from the current mix of policies, while more interest-rate-sensitive areas could experience ongoing volatility.

What does strong U.S. growth mean for crypto and digital assets?

Although the GDP report is primarily a macroeconomic story, it also has implications for digital asset markets. A resilient U.S. economy with firm interest rates can be a double-edged sword for crypto. Higher real yields on traditional assets such as Treasury securities make them more attractive as low-risk alternatives, which can divert some capital away from speculative segments of the market. At the same time, strong growth supports risk appetite in general, and a healthy corporate sector tends to experiment more with new technologies, including blockchain-based infrastructure.

From a narrative standpoint, the combination of fiscal expansion, growing public debt and medium-term inflation uncertainty continues to support the argument for scarce digital assets as a form of portfolio diversification. However, the short-term path of crypto prices is more likely to be driven by liquidity conditions, regulatory developments and product innovation than by a single GDP print. Investors in digital assets should therefore treat macro data as one input among many, rather than a direct trading signal.

How investors can read a blockbuster GDP report

For long-term investors, the key lesson from the latest GDP release is to look beyond the headline number and focus on composition, sustainability and policy implications. A growth rate of 4.3% tells us that the economy is currently running hot, but whether that is a reason to become more optimistic or more cautious depends on an individual’s time horizon and risk tolerance.

If one believes that productivity improvements, corporate earnings and prudent fiscal management will continue, then the data provide evidence that the U.S. remains a dynamic and adaptable economy, capable of delivering solid real returns over time. If, instead, one worries that the expansion is overly reliant on short-term fiscal stimulus and supportive credit conditions, the same data might be viewed as a late-cycle surge that eventually gives way to a slower phase.

Either way, anchoring expectations to a single quarter is rarely wise. More informative is the trend over several quarters, the evolution of inflation, the health of the labour market and the behaviour of business investment. The current report tilts the balance of evidence towards ongoing strength, but it does not remove the need for vigilance.

Conclusion: strong data, complex story

The third-quarter GDP figures showcase an American economy that remains remarkably energetic. Household spending is robust, corporate profits are climbing and both net exports and public outlays are providing additional lift. President Trump is unsurprisingly eager to claim this as a direct validation of his policy agenda, particularly his tariff strategy and tax reforms. Economic reality, however, is more complex than any single narrative. The data reflect a mix of structural strengths, cyclical forces and policy choices, some of which carry long-term costs even as they support short-term growth.

For observers and investors, the challenge is to appreciate the genuine achievements—strong employment, resilient demand, improved profitability—while also recognising the questions that remain about fiscal sustainability and the eventual impact of higher borrowing costs. In that sense, the latest GDP report is not the final verdict on the current policy mix, but a snapshot of a powerful expansion whose ultimate trajectory will depend on decisions still to come.

Disclaimer: This article is for educational and informational purposes only. It does not constitute financial, investment, tax or legal advice. Economic conditions and market prices can change rapidly. Always conduct your own research or consult a qualified professional before making financial decisions.