A Cooler Jobs Market, Not a Crisis: What 4.4% Unemployment and 50K Payrolls Actually Signal

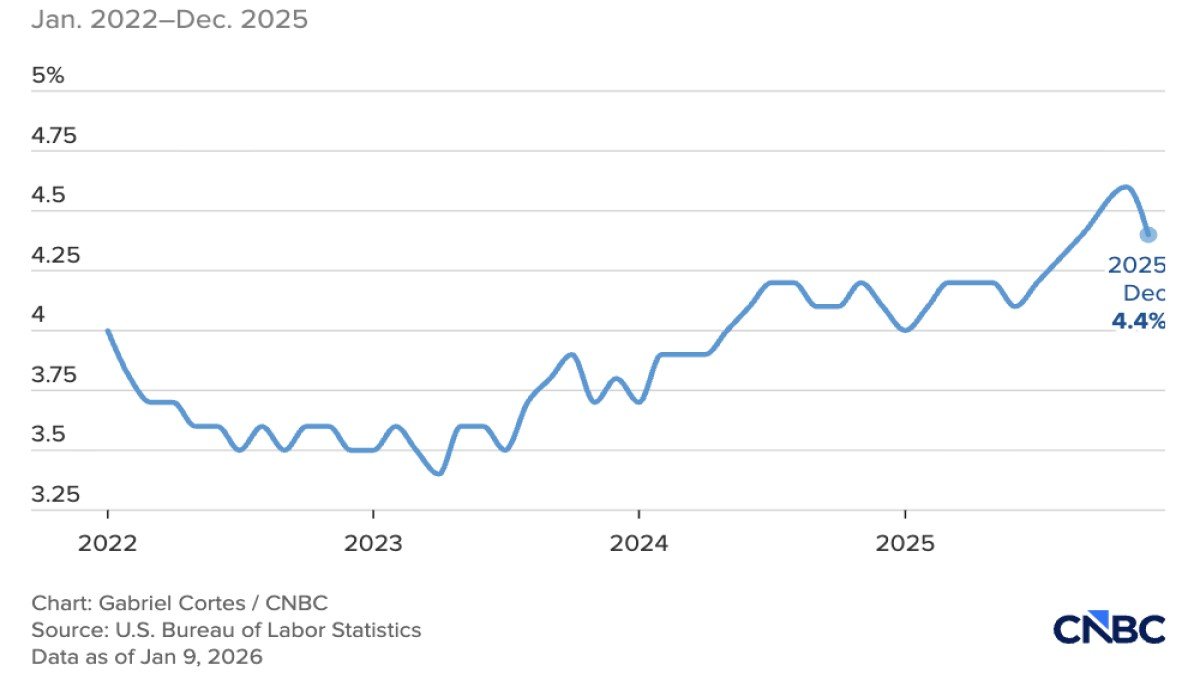

The US labor market ended 2025 with a headline that reads like a paradox. Nonfarm payrolls grew by about 50,000 in December—below expectations—yet the unemployment rate slipped to 4.4% (from 4.6%). Add an average hourly earnings increase of $0.12, roughly +0.3% on the month, and you get the kind of mixed dataset that fuels two opposite narratives at once: “the economy is weakening” and “the economy is still tight.”

Both narratives are incomplete. The more useful interpretation is that the labor market is not collapsing—it is recalibrating. The era of broad-based “we’ll hire anyone who can start Monday” demand is fading. In its place is a market that is more selective: still hiring in specific service segments where demand is sticky, while reducing headcount in sectors exposed to price sensitivity, automation, and inventory cycles. In that environment, the unemployment rate can fall even when payroll growth slows, and wages can rise even as confidence cools.

Why unemployment can fall when job growth disappoints

The unemployment rate and payroll growth come from different surveys and can move in different directions without either being “wrong.” Payrolls count jobs on company books; unemployment counts people actively looking for work who do not have one. When these two diverge, the key question becomes: what changed in the flow of people—into jobs, out of jobs, and in or out of the labor force?

A lower unemployment rate alongside modest job creation often points to one of three mechanics: fewer layoffs, fewer people entering the labor force, or faster matching for a subset of seekers. In late-cycle labor markets, layoffs can remain low (companies don’t want to lose trained staff), while hiring slows because firms are unsure about demand. This produces a “quiet” slowdown: fewer openings, slower re-hiring, but not a dramatic surge in unemployment.

• Layoffs staying contained can push unemployment down even if new hiring is limited, because fewer people are being displaced.

• Labor-force participation shifts matter: if some workers pause job searches, they are not counted as unemployed.

• Matching becomes uneven: certain roles fill quickly (health, care services), while others stall (retail, some back-office roles).

The composition tells you more than the total

December’s job gains were concentrated in service categories such as food services and bars (+27K), as well as healthcare and social assistance, while retail shed roughly 25K jobs. This isn’t random; it reflects how US consumption has evolved after years of inflation and rate hikes. Households can delay buying discretionary goods, but they still eat out, they still seek healthcare, and they still rely on care services—especially as demographics and chronic conditions keep demand structurally firm.

Retail job losses also fit a broader pattern: goods demand is more sensitive to interest rates and real disposable income, and it is increasingly shaped by logistics efficiency and automation. A retailer can cut staff hours, consolidate locations, and lean on fulfillment networks faster than a hospital can “automate away” patient care. So the labor market is splitting into two speeds: human-intensive services that remain hiring-resilient, and margin-sensitive goods sectors that cut first.

• Food services hiring often signals “experience demand” is still alive—even if consumers trade down on big purchases.

• Healthcare and social support are driven by long-run needs, making them less cyclical than retail.

• Retail losses can indicate tighter household budgets, inventory normalization, and ongoing productivity upgrades.

Wages up +0.3%: cooling, but not yet “easy”

A +0.3% monthly wage increase looks modest, but it is not trivial. Annualized, it implies a pace that can still feel “warm” relative to an inflation target—especially if productivity growth is not strong enough to absorb it. Wage growth is also noisy: it can rise because firms are paying more, or because the mix of jobs shifts toward higher-paying roles (composition effects). In a month where retail jobs decline and healthcare jobs grow, average wages can be lifted by the mix alone.

Here is the deeper point: a cooling labor market doesn’t automatically mean wage pressure disappears. When firms expect uncertainty, they often freeze hiring before they cut pay. They retain key employees, avoid layoffs where possible, and compete for scarce specialized skills. That produces a “sticky wage” dynamic—slower hiring, but wages that drift upward because the remaining hiring is for roles that are harder to fill.

• Composition effects can push average wages up when lower-wage sectors shrink.

• Labor hoarding keeps wage growth firmer: companies prefer slower hiring to disruptive layoffs.

• Skill premiums grow when firms hire fewer people but demand higher capability per hire.

What this mix implies for rates and policy

From a policy perspective, this report is “cooler” than a strong payrolls print, but not “cold” enough to declare victory. The Fed cares about whether the labor market is rebalancing without breaking—and whether wage growth is consistent with stable inflation. A slowdown in payroll gains reduces the risk of overheating, but a low unemployment rate and steady wage gains keep services inflation concerns alive.

There is also a timing nuance. Monetary policy works with lags, and labor markets tend to turn late. The Fed’s challenge is avoiding an overreaction to a single month. If hiring slows while unemployment stays contained, policymakers may interpret that as the desired outcome: demand moderates, but job losses do not cascade. However, if payroll weakness persists and unemployment begins to rise later, policy can shift quickly from “fine-tuning” to “support.”

• Soft-landing read: hiring slows, layoffs remain low, wage growth gradually cools.

• Stall-speed risk: hiring slows too much, re-employment becomes harder, unemployment rises with a lag.

• Re-acceleration risk: services demand stays strong, wages stay firm, inflation eases too slowly.

The real test: not “jobs,” but mobility

The most underappreciated labor-market variable is mobility—how easily a worker can move from one job to the next. A market can look stable on the surface (low unemployment) while becoming less forgiving underneath (longer job searches, fewer openings, reduced hours). When firms “hire less and fire less,” it sounds benign, but it can be frustrating for anyone trying to re-enter employment or upgrade roles.

That is why future reports will matter more than this single print. If the economy is genuinely landing softly, you should see a gradual cooling in wage growth, stable participation, and a labor market that still offers credible pathways for displaced workers. If, instead, mobility is deteriorating, unemployment can rise later even if it looks calm now.

• Watch hours worked and part-time for economic reasons for early stress signals.

• Watch job openings and quits to measure confidence and bargaining power.

• Watch revisions: payroll data is often reshaped after the first release.

Conclusion

December’s jobs report is best read as a transition, not a turning point. Payroll growth is slowing, but unemployment is still low—suggesting the US is moving from an overheated hiring cycle to a more selective one. The sector split matters: food services and care-oriented work remain resilient, while retail shows the strain of tighter budgets and productivity pressure. Meanwhile, wages are cooling but not yet “dead,” partly because the labor market is increasingly paying for skill, not just attendance.

If you want a single takeaway, it’s this: the labor market is not sending a recession siren—it’s sending a calibration signal. The next chapter will be decided by whether mobility holds up. A soft landing is plausible when layoffs stay contained and wage growth slowly normalizes. But if hiring stays this weak for too long, the calm headline can change with a lag. The story is less about one month’s number and more about whether the labor market remains a moving escalator—or becomes a waiting room.