When a Bitcoin Bull Turns Defensive: Reading Fundstrat’s 2026 Crypto Outlook

Few names are as closely associated with optimistic views on digital assets as Tom Lee. As Chair of Bitmine and co-founder and Head of Research at Fundstrat Global Advisors, he has spent years arguing that Bitcoin and Ethereum represent long-term breakthroughs in the global financial system. His public appearances often highlight ambitious price targets and structural tailwinds, especially around scarcity, institutional adoption and macro hedging.

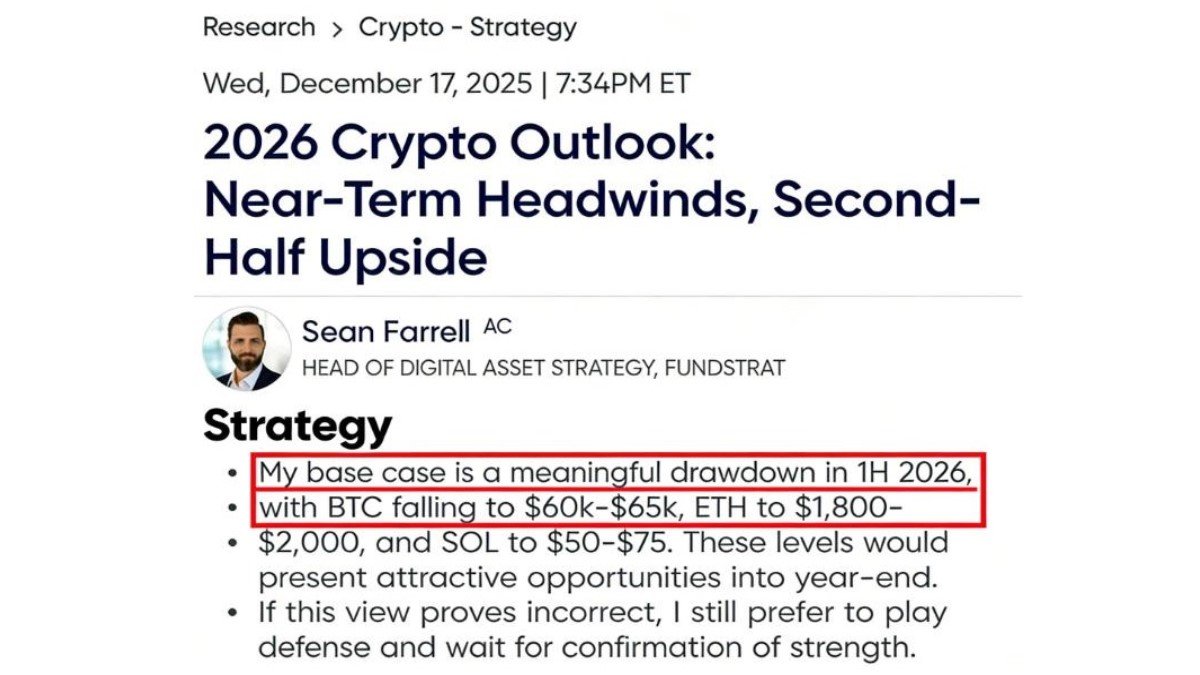

That is why Fundstrat’s Crypto Outlook 2026 has attracted so much attention. Despite Lee’s well-known enthusiasm, the detailed report prepared for the firm’s private clients, led by Sean Farrell, Head of Digital-Asset Strategy, paints a more cautious picture for the first half of 2026. It does not abandon the long-term bull case, but it suggests that the market may need to travel through a deeper consolidation before a sustainable advance can resume.

In the base scenario laid out by Farrell, the major assets retreat to levels that would meaningfully test investor conviction:

- Bitcoin (BTC) pulls back into the 60,000–65,000 USD zone.

- Ethereum (ETH) revisits the 1,800–2,000 USD area.

- Solana (SOL) declines toward 50–75 USD.

Paradoxically, these same levels are described as attractive long-term entry points. So how can a firm be both defensively positioned and structurally optimistic at the same time? To answer that, we need to unpack the logic behind the scenario, with a special focus on why Ethereum is treated particularly carefully.

1. Two Time Horizons, Two Messages

The first mistake many observers make is to assume that every public comment and every internal projection are aimed at the same time horizon. Tom Lee’s interviews typically focus on the multi-year narrative: Bitcoin as a store of value, Ethereum as a base layer for decentralized applications, and the broad idea that digital assets will capture an increasing share of global savings.

Farrell’s Crypto Outlook, by contrast, is written for clients who need to manage portfolios through the next few quarters. For them, the question is not only where Bitcoin or Ethereum might be in five years, but also how they could behave over the next six to twelve months, and how to size positions so that they can survive the journey.

That difference in purpose explains why the tone of the report can be more reserved without contradicting the long-term story. A strategist can believe strongly in the destination while still expecting a bumpy road between now and then.

2. What the Defensive Base Case Actually Says

Fundstrat’s base case does not assume a collapse of the digital-asset market or a permanent reversal of adoption trends. Instead, it sketches a scenario in which the current cycle takes a pause, driven by a combination of factors:

• Valuation stretch. After several years of appreciation, many large-cap tokens trade at levels that already reflect optimistic expectations for adoption, network activity and fee growth.

• Macro cross-currents. Real yields, central-bank policy and global risk appetite remain in flux. Even if the long-term environment is supportive, periodic waves of risk aversion can temporarily pressure growth-oriented assets, including crypto.

• Positioning and leverage. Derivatives markets show that speculative positioning tends to accumulate during strong rallies. Clearing this leverage often requires a sharper correction than most investors expect.

In that context, the target zones of 60–65k for BTC, 1.8–2k for ETH and 50–75 for SOL represent healthy retracements rather than catastrophe. They would unwind excess optimism, cool down derivatives markets and offer long-term capital a chance to enter at more reasonable valuations.

3. Why Ethereum Gets Special Scrutiny

One of the most striking aspects of the report is its extra caution toward Ethereum. That might seem at odds with Tom Lee’s ongoing public support for ETH, so it is worth understanding the rationale. Several overlapping considerations are at work.

3.1 Relative performance and narrative fatigue

In earlier cycles, Ethereum often led the broader smart-contract sector, benefiting from its first-mover advantage, developer base and role as the default platform for decentralized finance and non-fungible tokens. More recently, the landscape has become more competitive. High-throughput networks such as Solana, and a growing ecosystem of Ethereum Layer 2 solutions, have fragmented liquidity.

As a result, ETH has sometimes underperformed both Bitcoin and certain alternative Layer 1s during strong risk-on windows. When a core asset fails to deliver leadership during the growth phase of a cycle, strategists naturally ask whether the market is revising its expectations for future fee growth or market share.

3.2 Tokenomics and yield comparisons

Ethereum’s transition to proof of stake turned ETH into a yield-bearing asset. Staked ETH generates rewards funded by gas fees and protocol issuance. While this is structurally supportive, it also exposes ETH to comparison with traditional yield instruments. When global interest rates rise, investors can obtain relatively attractive yields from government and corporate bonds with lower perceived volatility.

In that environment, the incremental yield from staking ETH must be weighed against its price risk. If the staking reward is only modestly higher than available traditional yields, a cautious investor might decide to wait for a better entry price before increasing exposure.

3.3 Execution risk around upgrades and scaling

The Ethereum roadmap includes ongoing work on scaling, data availability and privacy. These upgrades are designed to improve user experience and keep Ethereum competitive as demand for block space grows. However, every major protocol change introduces some degree of execution risk, especially around how fees and revenues are shared between the base layer and Layer 2 networks.

Fundstrat’s defensive stance does not assume technical failure, but it recognizes that markets may periodically pause to reassess valuations as new architecture is rolled out. Waiting for confirmation that upgrades are functioning smoothly is a rational position for risk-aware capital.

4. Why a Pullback Can Still Be a Bullish Signal

At first glance, a forecast for BTC at 60–65k and ETH below 2k might sound negative. Yet for macro-oriented investors, such a scenario can actually be constructive. It implies that the market is moving from a late-stage euphoria toward a more balanced state in which long-term capital can accumulate positions without having to chase steep parabolic moves.

Consider how previous cycles have unfolded:

- Strong advances pull in momentum-driven flows and leverage.

- An external shock or simple exhaustion triggers a drawdown.

- Speculative positions are reduced or closed, while long-term holders continue to accumulate.

- Once supply from short-term participants is mostly absorbed, a new, more sustainable uptrend can begin.

Fundstrat’s base case fits neatly into this pattern. Farrell is effectively arguing that we are somewhere in the middle of the consolidation phase. Prices are still elevated relative to the last bear-market lows, but they may not yet reflect the kind of reset that invites the next wave of patient capital. From this perspective, a retreat toward the levels he highlights would not invalidate the structural story; it may be a precondition for the next phase of it.

5. How a Defensive Stance Can Be Implemented

What does it mean in practice to be "defensive" while believing that long-term value exists at lower levels? The report suggests several tactics that sophisticated investors often use, many of which are relevant for individual participants as well.

• Position sizing. Instead of being fully invested in volatile assets at all times, a defensive investor holds a mix of cash, stable instruments and core positions. This allows them to add exposure if a pullback occurs, without being forced to sell at unfavorable prices.

• Staggered entry points. Rather than picking a single price as an all-in level, accumulation can be spread across a range (for example, layering BTC purchases between 65k and 60k). This acknowledges uncertainty around exact bottoms while still taking advantage of discounted prices relative to previous highs.

• Focus on quality. During consolidations, portfolios are often tilted toward assets with the strongest fundamentals—liquidity, network effects, institutional acceptance and clear use cases—while trimming more speculative exposures.

• Trigger conditions. Some investors wait for specific signs of renewed strength, such as improving market breadth, rising spot volumes or stabilizing funding rates, before increasing risk.

Farrell’s message is less about precise price targets and more about sequencing: preserve capital while the market digests previous gains, prepare a plan for what to do if attractive levels are reached, and avoid mistaking short-term volatility for a verdict on the long-term thesis.

6. Reconciling Tom Lee’s Optimism with Fundstrat’s Caution

For many observers, the apparent gap between Tom Lee’s bullish public commentary and the cautious tone of the Crypto Outlook has been puzzling. In reality, they are two sides of the same framework.

Lee’s role as a high-profile market commentator is to explain the structural drivers that make him optimistic: limited supply for Bitcoin, network effects for Ethereum, the gradual integration of digital assets into mainstream finance, and the potential for new demand from exchange-traded products, institutional portfolios and payment applications.

Farrell’s role as a strategist is to ask, "Given those structural drivers, what is the most probable path over the next few quarters, and how should portfolios be positioned today?" In 2026, his answer is that the path may include a notable correction before the structural forces reassert themselves.

Seen that way, there is no contradiction. A long-term bull can welcome a scenario in which prices temporarily fall to levels that make future upside more compelling. The key is to be prepared mentally and financially for that journey instead of being surprised by volatility.

7. What Individual Investors Can Learn

Even if you are not a Fundstrat client, this episode offers several useful lessons for navigating the digital-asset market.

• Separate narrative from positioning. Inspiring long-term stories are not the same as day-to-day portfolio decisions. It is possible to believe in the long-term success of an ecosystem while waiting for better risk-reward conditions before increasing exposure.

• Build scenarios, not certainties. Farrell’s price ranges are not guarantees; they are reference points within a broader scenario. Serious investors work with ranges and probabilities rather than single numbers.

• Respect liquidity and psychology. During strong rallies, it is easy to forget that markets can move sharply in both directions, especially when leverage and speculative participation are high. A defensive stance is not pessimism—it is recognition of how quickly conditions can change.

• View pullbacks as potential opportunities, not just threats. The report explicitly frames lower prices as attractive long-term entry points, not as reasons to abandon the asset class. The challenge is having both the capital and the discipline to act when fear is elevated.

8. Looking Beyond 2026

Ultimately, Fundstrat’s Crypto Outlook 2026 reinforces a pattern that has repeated across previous cycles: the path of adoption is rarely a straight line. Bitcoin, Ethereum and Solana can all experience periods of rapid appreciation, followed by consolidations that feel uncomfortable but are necessary to reset expectations and allow the next chapter to begin.

Tom Lee’s public optimism and Sean Farrell’s defensive base case are part of the same story: a belief that digital assets will matter more in the global financial system over time, combined with a clear recognition that the market can temporarily move against that long-term direction. For investors willing to think in years rather than days, the challenge is less about predicting the exact low and more about designing a strategy that can survive—and even benefit from—the volatility along the way.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and can involve significant risk. Always conduct your own research and consult a qualified professional before making financial decisions.