Deep Red Week or Deep Value? Why Long-Term Crypto Investors See This Dip as an Entry Point

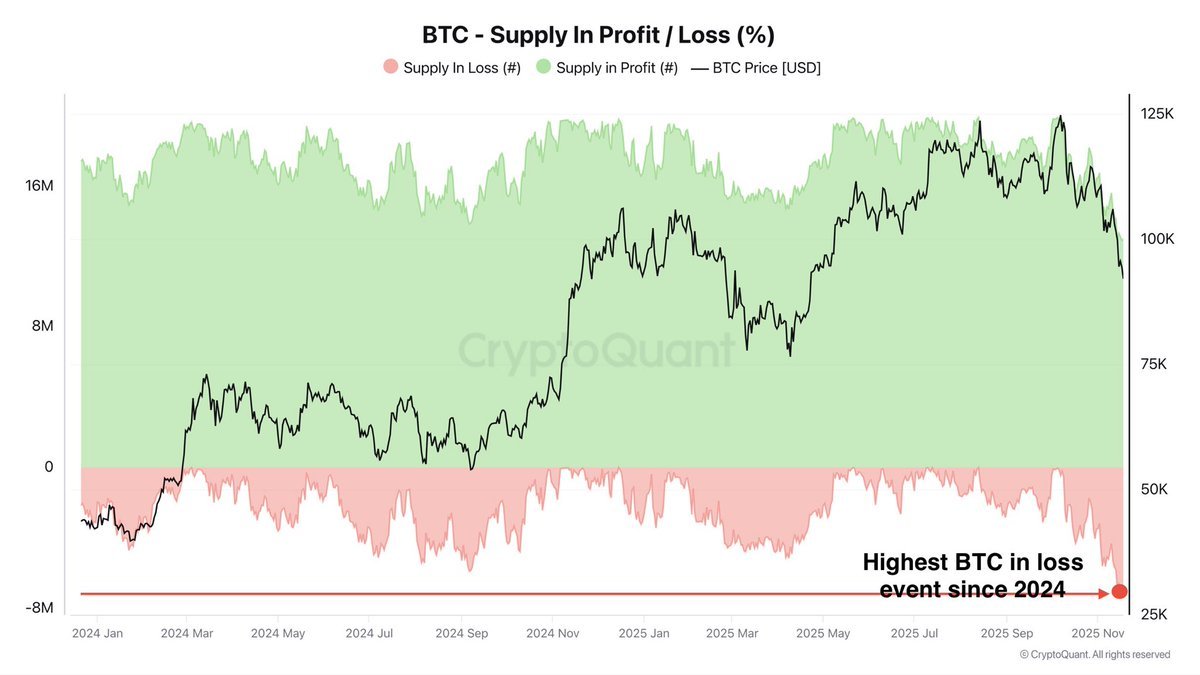

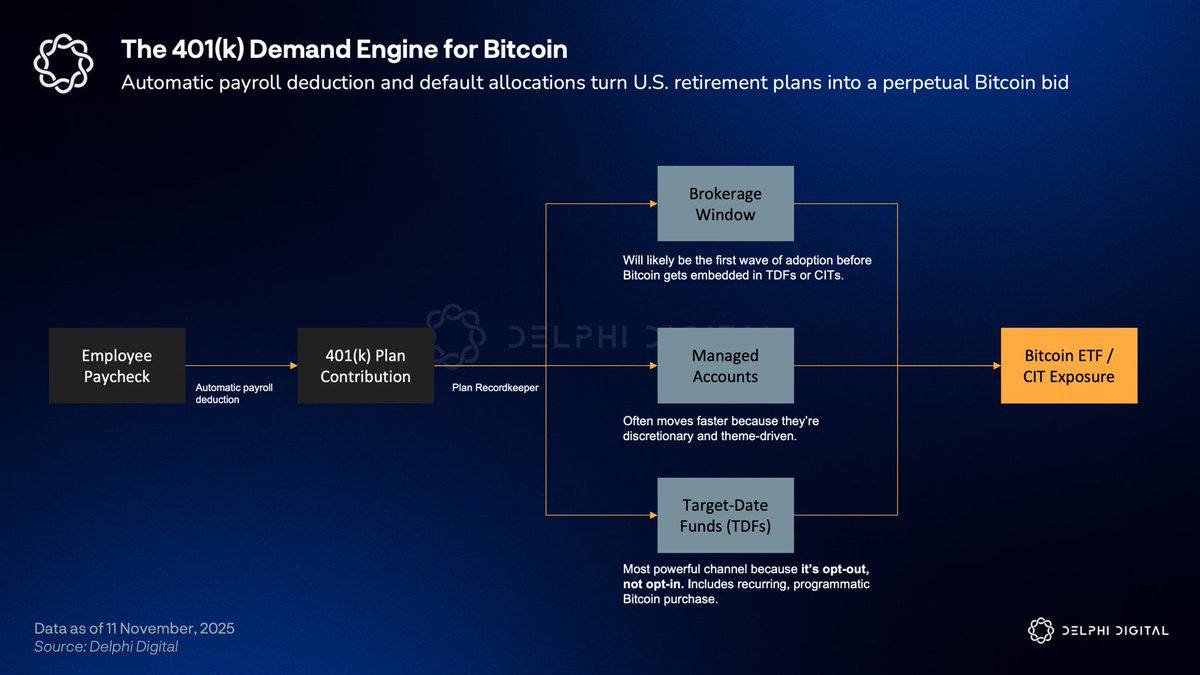

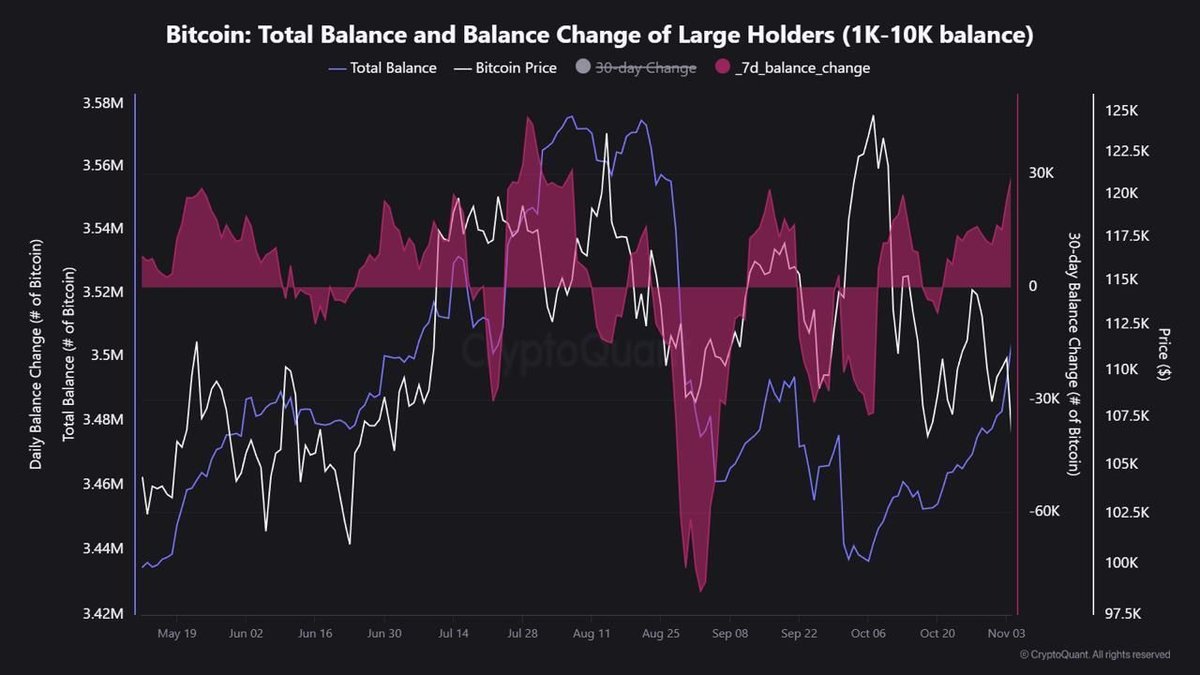

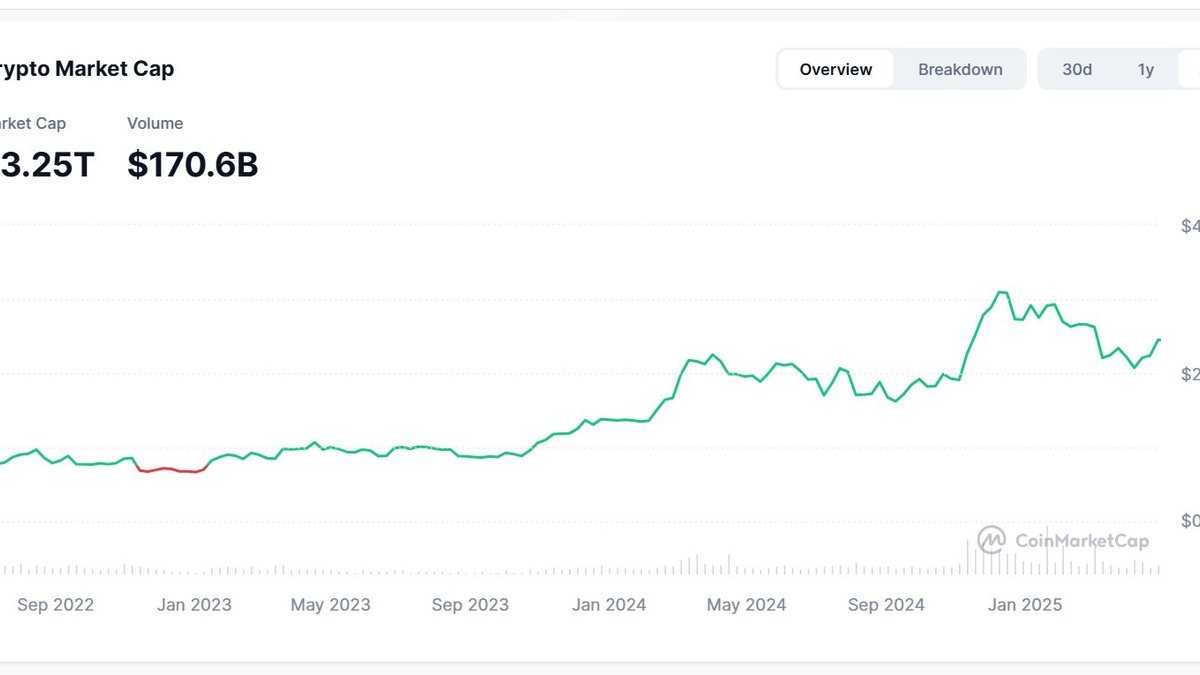

After one of the harshest red weeks of the year, retail sentiment is bleak. Yet large funds are quietly moving tens of thousands of BTC and ETH off exchanges via OTC deals and custodians. ETF flows scream ‘exit’, but spot prices are holding better than the headlines suggest. This is precisely the kind of dislocation that long-term crypto investors wait for.

Read more →