95% Mined, 100+ Years to Go: What Bitcoin’s New Scarcity Era Really Means

Bitcoin has entered a new phase of its life: the vast majority of coins that will ever exist are already out in the wild.

As of mid-November 2025, on-chain data shows that more than 19.95 million BTC have been mined, crossing the symbolic line of 95% of the 21 million cap. That leaves roughly 1.05 million BTC still to be created over the next century-plus, with the very last satoshi expected sometime around the year 2140.

At the same time, the most recent halving in April 2024 cut the block subsidy from 6.25 BTC to 3.125 BTC per block. Annualised supply growth for Bitcoin has now dropped to well under 1% and will keep falling every four years from here. For the first time, Bitcoin’s issuance looks more like a shrinking, predictable drip than a meaningful source of new supply.

This combination of “95% already here” and “100+ years still to go” can sound paradoxical. But it is exactly what Satoshi Nakamoto’s code was designed to produce: an asset whose scarcity is hard-coded, predictable and slowly tightening. The question today is not whether Bitcoin is scarce—that debate is largely over—but what this new scarcity era means for price dynamics, security, and the asset’s role in portfolios.

1. The 95% milestone in plain numbers

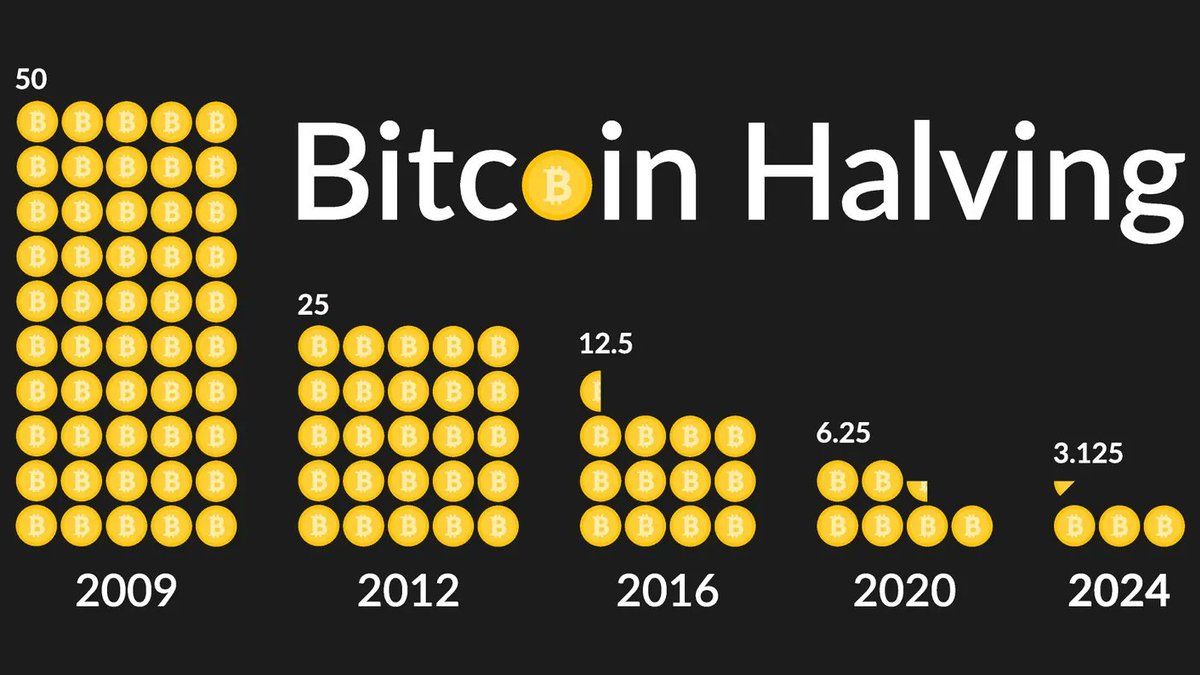

Bitcoin’s supply schedule is simple in theory. The protocol’s rules cap total issuance at 21,000,000 BTC, released as block rewards to miners who add new blocks to the chain. Roughly every four years, the reward for each block is cut in half in an event known as the halving.

After the halving that took place around April 19–20, 2024, the reward dropped to 3.125 BTC per block. With an average of about 144 blocks mined per day, that works out to roughly 450 new BTC per day and around 160,000 BTC per year. Against a circulating supply near 20 million, that annual issuance equates to well under 1% supply growth.

Crossing the 95% line in November 2025 means that:

- Roughly 19.95 million BTC have been mined out of the 21 million cap.

- Only around 1.05 million BTC are left to issue over all future decades.

- New coins are arriving at a slowing pace, while the absolute base of existing coins is effectively fixed.

That is the mechanical picture. The more interesting story is how this supply math reshapes Bitcoin’s economics and narrative.

2. How the halving turns inflation into a rounding error

In its early years, Bitcoin’s issuance was high and highly visible. Block rewards started at 50 BTC, then dropped to 25, 12.5 and 6.25 BTC in successive halvings. Each time, the number of new coins entering circulation fell by half. In percentage terms, Bitcoin’s annualised “inflation rate” has stepped down from double digits to single digits to something that now looks closer to the behaviour of a mature commodity.

After the 2020 halving, annual supply growth was already hovering around half a percent to one percent of circulating supply. The 2024 halving pushed that lower again. With roughly 160,000 new BTC per year against nearly 20 million outstanding, Bitcoin’s new issuance is now a fraction of a percent annually and trending toward zero.

Economically, that matters in three ways:

• Issuance dilution is minimal. Holders are no longer being meaningfully diluted by newly minted coins, especially compared with fiat currencies whose supply expands by several percent per year or more.

• New supply shocks are mostly behind us. In the early halving cycles, each reward cut sharply reduced the amount of BTC miners sold to cover costs. Now, the difference between pre- and post-halving issuance is smaller in dollar terms relative to overall market liquidity.

• Fees must eventually carry more of the load. As block subsidies shrink toward zero, miner revenue will depend increasingly on transaction fees, raising complex questions about long-run network security.

In other words, Bitcoin has effectively transitioned from being an asset with substantial ongoing issuance to one where new coins are a slow trickle. That places it in a very small club of assets whose long-term supply path is not just limited, but algorithmically disinflationary.

3. Scarcity as a feature, not a marketing slogan

Scarcity has always been central to the Bitcoin story. What changes at the 95% mark is not the existence of scarcity, but the way markets can quantify it.

Consider a few key metrics:

• Stock vs. flow. The existing “stock” of Bitcoin is now roughly twenty times larger than the annual “flow” of new issuance. That ratio will only grow as halvings continue. For comparison, gold’s stock-to-flow ratio is high but not fixed; new discoveries and mining investment can respond to price. Bitcoin’s long-run flow is predetermined.

• Effective supply vs. theoretical supply. Research on lost coins suggests that a non-trivial share of BTC is permanently inaccessible: early wallets with missing keys, dust amounts, and long-dormant holdings. Some analyses now argue that annual losses could already be comparable to, or even exceed, new issuance in the coming cycles. If that is true, Bitcoin’s effective float may already be shrinking in net terms.

• Time horizon. The remaining 5% will be distributed over more than a century. Every halving extends the tail of issuance further into the future, compressing current inflows but lengthening the period over which miners receive subsidies.

This is why many analysts describe Bitcoin as evolving into a “digital hard asset”. It is not just capped; it is increasingly indifferent to short-term political decisions, production shocks or monetary-policy cycles. Any change to the 21 million limit would require a social and technical consensus so overwhelming that it is better treated as a theoretical edge case than a realistic scenario.

For portfolio construction, that makes Bitcoin conceptually closer to scarce real assets like gold or high-quality real estate than to typical financial claims whose supply can be expanded by decree.

4. Why this milestone is not automatically a price rocket

At this point, a fair objection arises: if 95% of the supply being mined is such a big deal, why did Bitcoin sell off sharply right as the milestone was reached?

There are three important reasons why “scarcity” does not equal “straight up only” in the short term:

• The issuance path is not new information. Bitcoin’s halving schedule and supply cap have been publicly known since the genesis block. The fact that we would cross 95% around this time has been predictable for years. Markets are forward-looking; anything fully anticipated is, at least in theory, partly priced in.

• Demand is the moving target. Scarcity only supports higher prices if demand is stable or growing. In 2025, Bitcoin is trading in a complex macro environment: shifting expectations about interest rates, ETF flows that swing from positive to negative, and risk appetite that can flip in a day.

• Leverage and positioning still dominate short-term moves. When markets are crowded on one side – for example, with large leveraged long positions built near all-time highs – even a modest negative catalyst can trigger liquidations and sharp drawdowns, regardless of long-run supply math.

The key insight is that Bitcoin’s scarcity is a slow-moving structural force. It sets the boundary conditions for price over years and decades, not hours and days. Over very long horizons, a shrinking growth in supply makes it easier for even modest increases in demand to support higher equilibrium prices. Over short horizons, liquidity and positioning still rule.

5. Security budget and the long tail of the next 100 years

As Bitcoin’s issuance falls, one question looms larger: how will the network remain secure when block rewards become tiny?

Today, miners earn two revenue streams:

- The block subsidy (newly issued BTC per block).

- Transaction fees paid by users who want their transactions included.

Right now, the subsidy still dominates over fees on most days. But every halving cuts that subsidy in half. If Bitcoin is still widely used decades from now, fees will need to cover a growing share of the security budget – the economic incentive for miners to keep expending energy to protect the chain.

There are several competing views on this:

• Optimistic view. As Bitcoin’s role as a settlement layer deepens, users will be willing to pay higher fees for high-value finality. Layer 2 solutions and batched transactions will push small payments off-chain, leaving the base layer for large, fee-tolerant flows.

• Cautious view. If demand for block space does not rise enough, or if users migrate to alternative chains, the fee market may be too thin to support today’s level of hash power. That could, in theory, make certain attacks cheaper.

• Hybrid view. The security budget will be a combination of modest but sufficient fees, a smaller but more efficient mining industry, and possibly complementary mechanisms (for example, drivechains or merged mining) that share security costs across multiple layers.

The 95% milestone does not answer these questions, but it makes them less abstract. We are no longer talking about what happens “someday.” We are already in an era where the subsidy is small enough that mining economics are sensitive to price, fee spikes and energy costs in ways they were not in 2013 or 2017.

6. Bitcoin’s evolving role as a portfolio diversifier

One reason institutional interest in Bitcoin has grown is precisely this predictable scarcity. As traditional portfolios face the twin pressures of high debt loads and uncertain inflation dynamics, assets that are hard to dilute look increasingly attractive as long-term hedges.

From a professional allocator’s perspective, the case for Bitcoin as a diversifier rests on several pillars:

• Supply certainty. No other major macro asset offers the same combination of global liquidity and mathematically fixed long-run supply. Even gold’s supply can respond, at the margin, to price through increased mining.

• Different risk drivers. Bitcoin is clearly sensitive to liquidity and risk sentiment, but its long-run value drivers – adoption curves, regulatory frameworks, technological progress – are not identical to those of equities or bonds.

• Optionality. A small allocation can, in favourable scenarios, have outsized payoff if Bitcoin evolves into a recognised global reserve asset or collateral layer. If it fails, the limited position size caps the damage.

At the same time, the 2022–2025 period has reminded investors that Bitcoin is not a simple inflation hedge. It has traded both with and against the dollar, sometimes moving more like a tech stock, sometimes like a high-beta commodity. Scarcity does not immunise it from drawdowns; it sets the stage for asymmetric long-run payoffs if adoption persists.

The move into the “final 5% issuance era” reinforces Bitcoin’s suitability as a strategic allocation for investors who can tolerate volatility. There will be other narratives – AI, real-world assets, DeFi – but none of them change the underlying fact that the available pool of BTC is now mostly fixed.

7. Narrative shifts: from mining boom to stewardship

In Bitcoin’s first decade, the story was about creation: new coins, new miners, new halvings, new all-time highs. As we cross 95% of supply issued, the story quietly shifts toward stewardship of an almost-complete asset base.

Several subtle narrative changes follow from this:

• Less focus on issuance, more on distribution. The key question is no longer how many coins are left to mine, but who holds them and under what conditions. Are coins concentrated with a few early whales, or progressively moving into ETFs, corporations and ordinary savers?

• Greater attention to lost coins and dormant supply. If the effective float is, say, 16–17 million rather than the full 19.95 million, scarcity is even tighter than the headline suggests. Assessing that “invisible burn” becomes an important part of valuation work.

• Longer feedback loops. With issuance tiny, most changes in circulating supply now come from behaviour: long-term holders deciding to sell, institutions rebalancing, or new holder cohorts emerging in different regions.

For the industry, this demands a more mature approach. Miners must think less like short-run arbitrageurs and more like infrastructure providers. Investors must think less in terms of “next halving pump” and more in terms of multi-cycle positioning. Researchers must pay more attention to fee markets, security economics and second-layer ecosystems.

Conclusion: entering Bitcoin’s age of mature scarcity

Crossing the 95% mined threshold is not a magic event that guarantees a straight-line bull market. It is, however, a clear marker that Bitcoin has moved into a new age: one in which almost all of the supply exists, and almost none of it is left to be created.

Over the next 100 years, the remaining 5% will arrive in ever-smaller increments. Halvings will continue to cut issuance, fees will matter more, and the security model will need to evolve alongside user behaviour. But the broad arc is set. There will never be more than 21 million BTC, and we are already very close to that ceiling.

For a professional news and analysis outlet, the real value of this milestone is not to rehash the mantra that Bitcoin is scarce. It is to dig into the second-order consequences: how reduced issuance alters miner economics, how effective supply shrinks as coins are lost or locked, how institutional adoption interacts with a slowly tightening float, and how the protocol’s security incentives adapt to a world where inflation is close to zero.

Investors who understand those dynamics will be better equipped to treat Bitcoin not as a meme with a price chart, but as a long-lived monetary network whose rules are now colliding, in real time, with the messy realities of global macro and market structure.

This article is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and may be unsuitable for many investors. Always conduct your own research and consider consulting a qualified professional before making financial decisions.