Alibaba + JPMorgan: Why Tokenized Deposits Matter More Than Another "Big Company Enters Crypto" Headline

At first glance, the headline sounds familiar: a tech giant "enters crypto" and markets light up with speculation. But what Alibaba.com is doing with JPMorgan is fundamentally different from a typical corporate token experiment or a marketing partnership with a popular exchange.

Alibaba’s global B2B marketplace is preparing to route part of its cross-border payment flows through tokenized bank deposits — digital representations of U.S. dollar and euro balances issued by JPMorgan and moved on blockchain rails. The goal is not to speculate on volatile coins, but to make a very old process, cross-border trade settlement, faster, cheaper and more programmable.

This is not a new speculative asset for retail traders. It is bank money in digital form, backed 1:1 by commercial bank deposits and governed by the same regulatory perimeter that already applies to JPMorgan’s balance sheet. For the crypto industry, that distinction matters: it signals the emergence of a parallel track where large enterprises adopt blockchain not to launch their own coins, but to upgrade the plumbing of global finance.

1. What Alibaba and JPMorgan Actually Announced

According to recent disclosures and reporting, Alibaba’s B2B platform will use tokenized deposits representing U.S. dollars and euros, issued by JPMorgan, to streamline international payments between buyers and sellers on Alibaba.com. Instead of funds being routed through multiple correspondent banks, a digital claim on dollars or euros will move directly over JPMorgan’s blockchain infrastructure. Settlement shifts from days to seconds, and from banking hours to 24/7 availability.

The underlying rails are part of JPMorgan’s expanding tokenization stack, which includes:

- Kinexys Digital Payments – the bank’s blockchain network for institutional money movement.

- JPM Coin / JPMD – a family of deposit tokens that represent on-balance-sheet bank deposits and can move on-chain with near-instant settlement.

Alibaba.com will tap into this stack to let a buyer in, say, the United States send a tokenized dollar deposit directly to a supplier in another country, while both sides remain inside the formal banking system. The tokens are not issued by a start-up stablecoin issuer backed by treasuries; they are claims on cash sitting at JPMorgan, reflected on the bank’s books.

To avoid confusion: this is not (at least for now) Alibaba launching its own stablecoin, nor is it rolling out a tradable token for retail speculation. The initiative is tightly focused on B2B trade settlement and uses bank-issued instruments designed to fit within existing banking regulation.

2. Tokenized Deposits 101: Bank Money on a Blockchain

To understand why this matters, it helps to be precise about what tokenized deposits are — and what they are not.

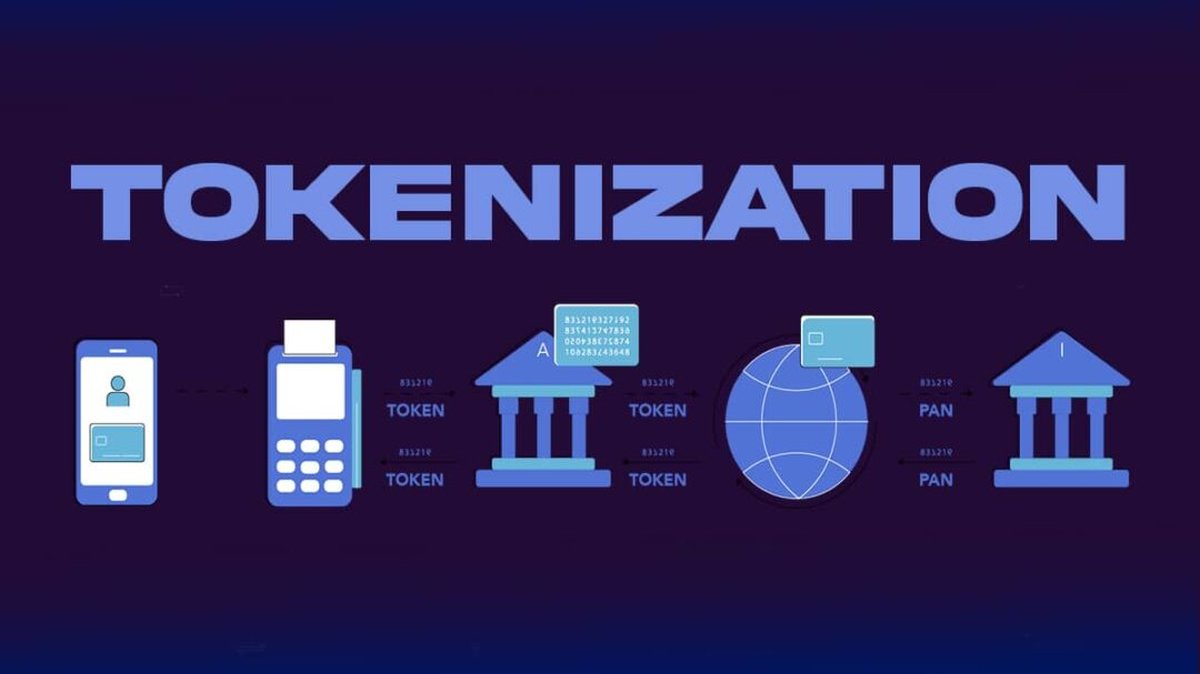

A tokenized deposit is, conceptually, simple: it is a digital token on a blockchain that represents a direct claim on a deposit at a commercial bank. The bank records the customer’s balance on its balance sheet as usual, but also issues a corresponding token in a permissioned or public ledger. That token can then be transferred, pledged as collateral or embedded in smart contracts while still being fully anchored in the bank’s legal and regulatory framework.

This differs in key ways from traditional stablecoins:

• Issuer type. Stablecoins like USDT or USDC are typically issued by non-bank entities whose reserves are held in a mix of cash and short-term securities. Deposit tokens are issued directly by a regulated bank.

• Balance sheet treatment. A deposit token corresponds to a liability on the bank’s own balance sheet, much like a regular corporate deposit. That means it falls under banking supervision, capital rules and, in some jurisdictions, deposit insurance frameworks.

• Risk profile. With stablecoins, holders take issuer and reserve risk: if the reserves are mismanaged or impaired, the peg can break. With deposit tokens, holders are exposed to standard bank credit risk — but not to a separate reserve portfolio.

• Compliance. Deposit-token systems are typically designed with KYC / AML controls and clear onboarding requirements for participants, making them easier to integrate into existing regulatory regimes.

In other words, tokenized deposits are less “wild-west crypto” and more “old-world bank money, new transport layer.” JPMorgan has been explicit about this positioning: deposit tokens, in its view, are the natural on-chain representation of commercial bank money, positioned alongside (not in opposition to) stablecoins and central bank digital currencies (CBDCs).

3. The Pain Point: Cross-Border B2B Payments Are Still Stuck in the 20th Century

Alibaba’s motivation is straightforward. Its core marketplace connects millions of buyers and suppliers across borders. Yet the payment rails many of those transactions rely on are legacy systems: correspondent banking networks, SWIFT messages, manual reconciliations and settlement time measured in days.

Consider a typical transaction today:

- A buyer in the U.S. sends a USD wire transfer to a supplier’s bank in another region.

- The funds hop through one or more correspondent banks, each taking a fee and introducing potential delays.

- Time zones and cut-off times mean a payment initiated on Friday evening might not settle until Monday or Tuesday.

- Reconciliation requires emails, spreadsheets and often manual confirmation that the funds have arrived and are correctly allocated to a purchase order.

The result: cash is trapped in transit, small and medium suppliers often wait days to see funds, and the risk of errors or disputes is non-trivial. For a platform the size of Alibaba’s global B2B marketplace, those friction points translate directly into working-capital strain across its ecosystem.

By moving to tokenized deposits, Alibaba.com is effectively saying: instead of asking banks to update ledgers asynchronously via messaging protocols, let’s move the money itself as a token on a shared ledger that both sides can see in (almost) real time.

In practice, this could mean:

- Settlement windows compressing from 48–72 hours to seconds or minutes.

- Lower aggregate fees as intermediaries are reduced and FX spreads become more transparent.

- Automated reconciliation, where the payment token is tied directly to a purchase order or invoice ID on-chain.

- New payment logic, such as conditional release of funds based on shipping or customs data, enforced by smart contracts rather than email chains.

For large corporates, these may sound like incremental upgrades. For smaller exporters who live and die by cash-flow timing, such changes can be transformative.

4. Why Deposit Tokens Instead of Stablecoins?

From a purely technical perspective, one could imagine Alibaba simply integrating USDC-style stablecoins and letting buyers pay suppliers in those tokens. So why go through the extra complexity of bank-issued deposit tokens?

Several reasons stand out:

• Regulatory comfort. In China and many other jurisdictions, privately issued dollar stablecoins are politically and legally sensitive. They sit outside the direct control of domestic regulators and central banks. A deposit token issued by JPMorgan, under bank regulation, is easier to position as a modernised bank product rather than a parallel monetary system.

• Balance sheet integration. For large buyers and suppliers that already maintain accounts with global banks, holding a deposit token can be economically equivalent to holding a regular cash balance — just one that can move faster and interact with smart contracts.

• Risk and reporting. Corporate treasurers understand how to account for deposits at a global bank. Accounting for a third-party stablecoin is less straightforward and may raise questions about fair value, custody and regulatory treatment.

• Strategic alignment. For JPMorgan, deposit tokens are a way to keep client money inside the banking perimeter while offering many of the speed and programmability benefits that made stablecoins attractive in the first place.

In that sense, the Alibaba–JPMorgan partnership can be read as a blueprint for how large enterprises may adopt blockchain-based money without embracing the full risk and openness of public stablecoin ecosystems.

5. Inside JPMorgan’s Playbook: Kinexys, JPM Coin and JPMD

Alibaba’s decision also validates a speculative position JPMorgan has been making for years: that tokenized bank money will become a core part of institutional payments.

Through its Kinexys Digital Payments division, JPMorgan has already been running a private blockchain network that moves dollar, euro and sterling balances for large clients. That network has processed billions of dollars of value daily, albeit still small compared with the bank’s total payment flows. More recently, JPMorgan has begun rolling out its JPM Coin / JPMD deposit tokens more broadly, including on public infrastructure such as Coinbase’s Base network for institutional clients.

The philosophy is consistent:

- Represent deposits as tokens.

- Let those tokens move over programmable, near-instant settlement rails.

- Keep issuance and redemption tightly coupled to the bank’s existing control framework.

Alibaba.com plugging into this stack for its cross-border B2B marketplace does two important things for JPMorgan:

- It provides a real-economy use case anchored in trade, not just in crypto markets or interbank experimentation.

- It showcases deposit tokens as a credible alternative to stablecoins for very large, compliance-sensitive platforms.

For the broader industry, this is a signal that "on-chain money" is no longer exclusively the domain of fintech start-ups and DeFi protocols. Global banks are not only experimenting; they are putting their rails under the daily transactions of one of the world’s largest e-commerce ecosystems.

6. Is Alibaba “Entering Crypto” — or Just Upgrading the Rails?

It’s tempting to package this story as "Alibaba joins the crypto revolution." The reality is both more boring and more consequential.

Alibaba is not suddenly becoming a crypto exchange, nor is it encouraging its merchants to speculate on volatile tokens. Instead, it is doing something that any serious financial analyst should recognise as strategic risk management:

- Reducing settlement risk and delays in its core marketplace.

- Building payments infrastructure that can operate 24/7, independent of traditional banking cut-off times.

- Testing a model of digital money that is likely to be compatible with future regulatory developments around tokenization and digital assets.

This is classic infrastructure modernisation, not crypto marketing. Yet precisely because it is infrastructure, it has the potential to reshape how value moves through Alibaba’s ecosystem in ways that are much stickier than any one token launch.

For the crypto-native world, the message is also subtle. The partnership validates the idea that blockchains are useful as settlement layers. But it also reinforces a competing narrative: that much of the value may accrue to regulated, permissioned implementations controlled by large banks and platforms, rather than to fully open, permissionless protocols.

7. What This Means for Stablecoins, DeFi and the Broader Crypto Stack

Does a world of Alibaba-sized platforms using bank-issued deposit tokens spell doom for stablecoins and DeFi? Not necessarily — but it does change the map.

On one side, deposit tokens introduce a powerful competitor to stablecoins in the institutional payments niche. For cross-border trade between large, KYC’d entities who already bank with global institutions, the convenience of deposit tokens may outweigh the benefits of permissionless stablecoins.

On the other side, stablecoins and DeFi still offer attributes that bank-issued tokens, by design, do not:

- Global accessibility. A wallet and an internet connection are enough to hold and use major stablecoins. Deposit tokens will likely remain restricted to vetted institutional and corporate users.

- Composability with open finance. Stablecoins plug directly into DeFi protocols, on-chain lending markets and permissionless exchanges. Deposit tokens may be limited to whitelisted venues and use cases.

- Diversified issuer base. The stablecoin market supports multiple issuers and structures. Deposit tokens, at least initially, concentrate issuer risk in a handful of very large banks.

Rather than one model replacing the other, a more realistic outcome is a multi-rail future: deposit tokens for bank-domain transactions like B2B trade and large institutional flows, stablecoins for open-ecosystem use cases and DeFi, and CBDCs for central-bank-level experiments in digital cash.

From that perspective, Alibaba’s move is less an existential threat to crypto and more a signal that the "blockchain settlement layer" idea is mature enough to be embedded in mainstream finance — even if the first wave takes a form that feels more bank-like than DeFi-native.

8. Open Questions and Risks

As with any major shift in financial infrastructure, there are risks and unresolved questions.

• Interoperability. What happens when multiple banks issue their own deposit tokens on different networks? Will Alibaba need to integrate half a dozen bank-specific rails, or will standards emerge to bridge them?

• Concentration risk. Relying heavily on one bank’s token infrastructure increases dependency on that institution’s technology stack, risk management and regulatory fortunes.

• Regulatory evolution. Lawmakers are still digesting stablecoins, CBDCs and tokenized securities. Deposit tokens add another element. Their ultimate treatment in capital rules, resolution planning and cross-border supervision is still being worked out.

• Access. For now, these systems are geared toward institutional users. Whether and how the benefits trickle down to smaller merchants that don’t have direct relationships with global banks is an open question.

There’s also a bigger philosophical issue: if the most successful on-chain money rails end up being closed, bank-controlled networks, what does that mean for the original promise of public, permissionless crypto? The Alibaba–JPMorgan deal doesn’t answer that, but it does sharpen the contrast between two visions of blockchain’s future.

Conclusion: Less Hype, More Plumbing — and That’s Exactly Why It Matters

The instinctive reaction to "Alibaba enters crypto" is to look for a ticker. But the real story here is plumbing, not price. Alibaba.com is aligning its global B2B marketplace with JPMorgan’s tokenized deposit infrastructure to solve a decades-old problem in cross-border trade: slow, fragmented, expensive money movement.

In doing so, it validates three ideas at once:

- That blockchains can add tangible value to mainstream finance, not just speculative trading.

- That regulated banks intend to be major issuers of on-chain money, not bystanders watching stablecoins eat their lunch.

- That the next phase of "crypto adoption" may look less like new coins and more like existing money quietly changing the rails it runs on.

For traders, this announcement will not move a chart on its own. But for anyone thinking seriously about the long-term architecture of digital finance, the signal is loud: when an e-commerce giant and one of the world’s largest banks converge on tokenized deposits as the right tool for global trade, we are no longer talking about experiments on the fringe. We are watching the early stages of a new, hybrid monetary layer take shape — one foot in banking regulation, the other on-chain.

That may not make for catchy memes. But in the long run, it is exactly this kind of boring, structural change that rewires how money and goods move around the world.