$1.1 Trillion Evaporates: Has the Great 2025 Crypto Bull Story Just Broken?

At the start of 2025, it was hard to find a crypto investor who did not believe this would be a generational year. Donald Trump’s return to the White House on 20 January came with the most openly pro crypto rhetoric ever seen from a United States administration. A strategic Bitcoin reserve, a friendlier Securities and Exchange Commission (SEC), and a flood of new spot exchange traded funds (ETFs) all fed a single story: this time, the boom would be bigger, cleaner and more durable.

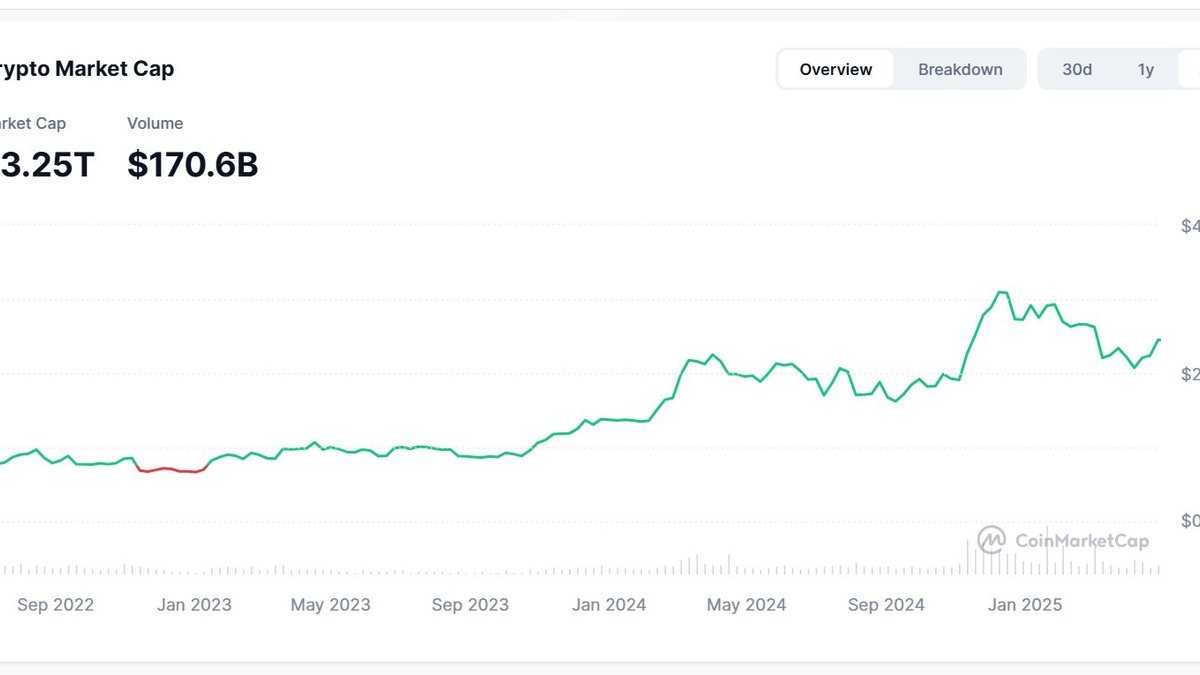

Fast forward to mid November and the mood could hardly be more different. In just 41 days, the total market capitalisation of digital assets has dropped by roughly 1.1 trillion dollars, according to data cited by major financial outlets. That decline has pushed the combined value of crypto about 10% below the levels seen during the record liquidation event around 10 October, despite what was supposed to be a friendlier regulatory and political backdrop. Meanwhile, the global market cap sits in the low three trillions, even after accounting for years of structural growth.

Bitcoin briefly fell to around 93,029 dollars over the weekend of 16 November, slipping underneath its opening level for the year, which CoinGecko data puts at roughly 93,507 dollars. It has since rebounded toward the mid 90,000s, but remains well below the all time high above 126,000 dollars set in early October. Ether, despite benefiting from booming on chain activity for much of the year, now shows a year to date decline of a little over 7% in dollar terms. Solana, one of the prior cycle’s darlings, is down around 25% year to date, with some sources estimating an even steeper slide depending on the reference date.

What happened to the promised “great victory year” for crypto? Did the narrative simply get ahead of reality, or have deeper structural assumptions been invalidated? As a professional research desk, our job is not to recycle shock headlines, but to deconstruct the moving parts: market structure, macro shocks and investor psychology.

1. The Numbers Behind the Pain: A 41 Day Reset

The figure that has captured headlines – 1.1 trillion dollars erased in 41 days – is not an exaggeration. Analysis of global market cap data shows that from early October’s peak to mid November, the market has surrendered roughly one quarter of its paper value. That translates into an average of about 27 billion dollars in capitalisation disappearing per day.

Crucially, this is not a collapse from an already depressed base. Only a month earlier, CoinGecko’s industry reports had highlighted how total crypto market cap had climbed back to around 4 trillion dollars by the end of the third quarter, after a series of rebounds from a messy first half. In other words, the drawdown has come from near record territory, not from the depths of a bear market.

Bitcoin sits at the centre of this repricing. After hitting an all time high near 126,000 dollars on 5 October – a move fuelled by ETF adoption and the new administration’s strategic reserve rhetoric – BTC’s fall to the 93,000 dollar region represents a drawdown of roughly 25%. That decline is steep but not unprecedented; the difference this time is that it has effectively erased the coin’s year to date gains, at least briefly, making 2025 look more like a giant round trip than a one way moonshot.

Altcoins have fared worse in relative terms. Weekly performance snapshots from mainstream financial media show Ether down around 12% in just one week and major altcoins such as XRP, BNB, Solana, Dogecoin and Cardano sliding more than 16% over the same period. Zooming out, independent datasets indicate that ETH is about 7% lower year to date, while SOL’s 2025 performance is roughly minus 25% to minus 30%, depending on the source. For investors who bought into the January hype, this is not a “slow grind higher” – it is a violent repricing of expectations.

2. The 2025 Grand Narrative: Policy Tailwinds and Overconfidence

To understand why the recent drawdown feels so jarring, we need to revisit the story that dominated the start of the year.

In the first quarter, CoinGecko’s market reports described how total crypto capitalisation surged to a local peak of roughly 3.8 trillion dollars on 18 January, just two days before Trump’s inauguration. The symbolism was hard to miss: markets were front running what they expected to be the friendliest United States administration for digital assets in history. Even after a sharp pullback in Q1, the second and third quarters saw a strong bounce, taking the market back to around 3.5 trillion and then 4 trillion dollars.

The optimism was not purely speculative. Within days of taking office, President Trump signed an executive order directing agencies to support the growth of the U.S. crypto industry and to treat blockchain infrastructure as a strategic sector. This was followed by a headline grabbing order creating a “strategic Bitcoin reserve”, instructing the government to retain BTC seized in law enforcement actions and explore budget neutral ways to accumulate more.

Regulators fell into line. By September, the SEC had approved a new set of listing standards that effectively opened the floodgates for a wide range of crypto spot ETFs beyond Bitcoin and Ether. In parallel, the Commission slowed or reversed several high profile enforcement actions, replacing ad hoc lawsuits with more explicit rulemaking.

Against that backdrop, it was easy – perhaps too easy – to believe that 2025 would be a straight line from policy support to price appreciation. The mental model many investors adopted was simple: if 2020–2021 could deliver a powerful bull run under an arguably hostile regulatory regime, then 2025 under a supportive administration had to be bigger.

Reality, as it tends to do, turned out to be more complicated.

3. The Double Macro Shock: Tariff Wars and a Record Shutdown

The first major blow to the “guaranteed bull year” thesis came not from crypto specific regulation, but from trade policy. Throughout 2025, the Trump administration’s aggressive tariff campaign against multiple trading partners – including fresh rounds of duties on Chinese and European imports – has kept global investors on edge. Business press coverage has repeatedly pointed out that this extended tariff battle has injected uncertainty into supply chains, corporate margins and inflation forecasts.

For digital assets, tariffs matter less through direct earnings channels and more through their impact on risk sentiment, the dollar and interest rate expectations. When trade tensions escalate, investors tend to move away from high beta assets and toward safe havens such as cash and short term Treasuries. Crypto, despite its long term “digital gold” narrative, still trades more like a risk asset in these episodes.

The second shock was even more direct: the longest government shutdown in United States history. Over a budget standoff that stretched 43 days and shut down large parts of the federal government, critical statistical agencies halted the collection and publication of economic data. Monthly employment and inflation numbers were delayed, backlog effects piled up, and economists struggled to update their models.

Crypto markets felt the pain in two ways. First, the absence of fresh data made it harder for the Federal Reserve to signal a clear path for rates, increasing uncertainty around the timing and number of future cuts. Without a steady feed of macro information, traders were forced to trade policy expectations on rumour and partial indicators. Second, the shutdown itself was read as a sign of rising political risk in the United States – something that tends to reduce global appetite for all but the safest assets, at least in the short term.

By mid November, some commentators were explicitly linking the drawdown in Bitcoin and the broader market to this combination of tariff conflict and fiscal paralysis, arguing that these macro headwinds had more than offset the earlier tailwinds from pro crypto policy.

4. Microstructure Matters: Liquidations, ETFs and the 10% Below “Liquidation Peak” Level

Macro explains why the direction of travel reversed; market structure explains why the move was so violent.

On the derivatives side, both perpetual futures and options markets had grown used to a one way grind higher. Funding rates remained positive for extended periods, signalling a bias toward leveraged long positioning. When Bitcoin started to roll over from its October highs, that positioning turned into dry tinder. Each leg lower triggered forced liquidations, pushing prices down further and prompting yet more margin calls.

According to several liquidation trackers and media summaries, individual days in this drawdown have seen hundreds of millions of dollars in leveraged long positions wiped out, with some intraday intervals clocking more than 100 million dollars in forced closures within an hour. The latest wave of selling has left the total crypto market cap not only below its recent high, but approximately 10% beneath the level reached during the October 10 liquidation spike – a remarkable reversal for a market that was supposed to be structurally stronger after ETF adoption.

Layered onto this is the behaviour of the very ETFs that were supposed to stabilise the market. While early 2025 saw strong inflows into spot Bitcoin products – with some estimates putting cumulative volumes above 1.4 trillion dollars by late October – the recent correction has produced one of the worst outflow days on record, with Bitcoin ETFs bleeding on the order of 800 to 900 million dollars in a single session.

This is not an indictment of the ETF model; it is a reminder that “institutional money” is not synonymous with “permanent capital”. Many ETF investors are just as pro cyclical as the retail cohort they replaced. When volatility spikes and macro uncertainty rises, they sell.

5. Altcoins: From “High Beta Play” to Structural Underperformers

The altcoin complex has experienced the drawdown in an even more acute way, and not just because high beta assets naturally move more.

By late October, Ether had already reached a record high near 4,950 dollars earlier in the year before retreating. At that point it was still up solidly year to date. As of mid November, reference data shows that ETH is now down around 7% since the start of 2025, with price sitting close to 3,100 dollars. The picture for Solana is starker: with prices in the 130–140 dollar range versus much higher levels earlier in 2025, Yahoo and other data providers estimate a year to date return of roughly minus 25% or worse.

In weekly performance terms, several major outlets have noted that Ether fell around 12% in just seven days, while a basket of large altcoins – from XRP and BNB to Dogecoin, Cardano and smaller DeFi names – dropped more than 16%. That is not the behaviour of a sector enjoying a healthy, diversified bull market; it is the behaviour of a leveraged, narrative driven trade being unwound.

Structurally, three forces are at work:

• Competition for risk capital. With legitimate spot ETFs now available for Bitcoin (and, in some jurisdictions, for Ether and other majors), many investors no longer need to move down the quality spectrum to express a bullish crypto view. That squeezes marginal demand for smaller tokens.

• Regulatory sorting. A clearer SEC rule book and new listing standards create winners and losers. Large cap tokens that can plausibly fit into an ETF or registered product universe may attract institutional interest over time; fringe assets may find themselves structurally sidelined.

• Tokenomics fatigue. Years of aggressive emission schedules and unlocks have left many projects with large overhangs. In a risk off environment, every scheduled unlock looks like a potential exit event, depressing valuations and liquidity.

Put differently, altcoins are no longer just a leveraged play on Bitcoin’s direction. They are being subjected to a more traditional kind of market discipline: survivorship based on relevance, cash flows and regulation.

6. The Psychology of a Broken Story: From “Guaranteed Victory” to “What If We Were Early?”

When a market gives back 1.1 trillion dollars of paper value in six weeks, the emotional shock is as important as the financial one.

At the start of the year, the common narrative had three pillars: a friendly White House, friendlier regulators and institutional access via ETFs. All three pillars are, in fact, still present. Trump’s administration has not reversed its pro crypto executive orders. The SEC has indeed moved toward a more transparent, listing based approach for spot products. ETF infrastructure is not going away.

What has changed is the realisation that these tailwinds do not inoculate the market against macro shocks, nor do they guarantee a straight line up. Tariff battles and a record shutdown have reminded investors that crypto trades inside a larger financial system where growth, inflation and policy mistakes still matter. That realisation has punctured the sense of inevitability that surrounded the “2025 super cycle” story.

From a behavioural finance perspective, this is a classic case of narrative overshoot. Investors anchored their expectations on an unusually favourable policy backdrop and extrapolated too far, underestimating both external risks and the possibility that much of the “good news” had already been priced in by the time Trump took office.

The good news, if there is any, is that the earlier narrative was not wholly delusional. Structural adoption is real. Spot ETFs exist. A strategic Bitcoin reserve is not a meme; it is written into policy. The question now is not whether those elements are real, but how long it will take for prices to reflect them again after the current macro storm passes.

7. Altseason Deferred: Why 2026 Looks More Plausible Than December

As December approaches, a more sober assessment is starting to take hold across professional desks: the odds of a classic, broad based “altseason” breaking out in the final weeks of 2025 are low.

Historically, altseasons have tended to coincide with three ingredients:

- Bitcoin consolidating after a strong run, rather than actively crashing.

- Macro conditions that are at least neutral, if not outright supportive, with clear central bank communication and no major political shocks.

- Fresh speculative capital entering the system, often via new retail cohorts or novel narratives.

Today, none of those boxes is fully ticked. Bitcoin is still finding its post liquidation footing. The Federal Reserve is navigating data gaps left by the shutdown, with markets unsure how many cuts, if any, will materialise in 2026. Tariff policy remains a wild card. And far from rushing in, many retail investors have just watched multi month gains disappear.

That does not mean altseason is cancelled; it means it is delayed. A more realistic timeline is 2026, for three reasons:

1. Macro visibility. By mid 2026, the economic data backlog from the shutdown will have been cleared, giving the Fed and markets a clearer view of inflation, employment and growth. That, in turn, will allow risk assets to trade off fundamentals rather than guesswork.

2. Regulatory clarity. The SEC’s new rules, along with any follow on legislation from Congress, should be more fully digested by then. Projects that can live within the regime will have adapted; those that cannot will be largely priced out.

3. Tokenomics repair. Many of the largest overhangs in altcoin unlock schedules are front loaded. By late 2026, a significant portion of those emissions will have been absorbed, making it easier for surviving projects to build sustainable markets.

In that environment, a more selective altseason – focused on high quality, revenue generating or systemically important projects – is plausible. What seems unlikely is a repeat of the 2017 or 2021 pattern where nearly every token with a ticker enjoyed a parabolic run.

8. How a Professional Desk Reads This Moment

For a professional news and analysis platform, the temptation in a 1.1 trillion dollar drawdown is to lean into drama. It is certainly an eye catching number. But the real value for readers lies in disentangling which parts of the story are cyclical noise and which are structural signals.

On the cyclical side, the message is straightforward: risk assets, including crypto, are repricing to a tougher macro backdrop dominated by trade conflict and political dysfunction. Leverage has amplified the move. ETF flows have turned from tailwind to headwind, at least temporarily. Sentiment has swung from overconfidence to fear.

On the structural side, very little has changed in the last 41 days. The same administration that championed a strategic Bitcoin reserve is still in place. The same SEC that opened the door for a broad ETF universe is still shaping the rule book. Developers are still shipping upgrades, rollups and new applications across chains. Stablecoin usage, on chain volumes and protocol revenues remain orders of magnitude higher than in prior cycles.

The art, for serious investors, is to respect both layers at once. That means acknowledging that the 2025 “guaranteed win” narrative has been decisively punctured, while also recognising that the long term adoption story is intact. It means protecting capital in the face of macro risk without losing sight of the assets and protocols that may emerge stronger on the other side.

Conclusion: A Broken Year, Not a Broken Asset Class

Roughly 1.1 trillion dollars of crypto market value has evaporated in 41 days. Bitcoin has briefly traded below its 2025 starting level. Ether and Solana are both in the red year to date. Two major macro shocks – an extended tariff war and the longest United States government shutdown in history – have turned what was supposed to be a textbook policy tailwind year into a painful reality check.

Yet the essence of the digital asset experiment remains unchanged. Blockchains still settle billions in value daily. Governments are, for the first time, openly treating Bitcoin and other assets as strategic reserves and regulated investment products, not curiosities. The ‘great victory year’ may have been postponed, and the idea of an automatic 2025 super cycle should probably be retired. But the longer arc of crypto’s integration into the financial system is still pointing in one direction.

For now, December 2025 looks more like a month for rebuilding risk frameworks than for chasing a late altseason. 2026 may offer a cleaner stage – clearer macro data, clearer rules and a less distorted token supply profile. Investors who survive this drawdown with capital and clarity intact will be the ones best positioned when that stage finally lights up.