Bitcoin Below $100,000: Why Whales Are Taking Profits, Not Running for the Exits

Bitcoin has finally lost its grip on the six-figure handle. After spending weeks battling around the $100,000 mark, the market has broken lower, with intraday lows in the mid-$90,000s and even brief spikes below that level on some venues. Headlines talk about crashes and liquidations. Social sentiment gauges sit in “extreme fear.”

Under the surface, however, the data tell a more nuanced story. On-chain analytics show that the investors doing most of the selling are not panicked newcomers, but long-term whales who have been in profit for years and are now locking in gains. Glassnode and other providers report a rapid decline in the supply held by long-term holders and a sharp negative turn in their net position change, exactly the pattern you see when older coins finally move to market for profit-taking rather than forced capitulation.

At the same time, spot Bitcoin ETFs—which were the heroes of the first phase of the bull run—have flipped from steady buyers to consistent net sellers. U.S. spot products saw an $869 million single-day outflow last week, the second-largest since launch, and an estimated $2.6 billion has left Bitcoin ETFs over just a few weeks. That means there is less fresh demand to absorb the coins whales are distributing.

In other words, the sell-off below $100,000 looks less like a stampede for the exits and more like what professionals call a “planned exit in a weak tape”: large, profitable holders taking chips off the table into a market where new money is hesitating.

1. What the On-Chain Picture Really Shows

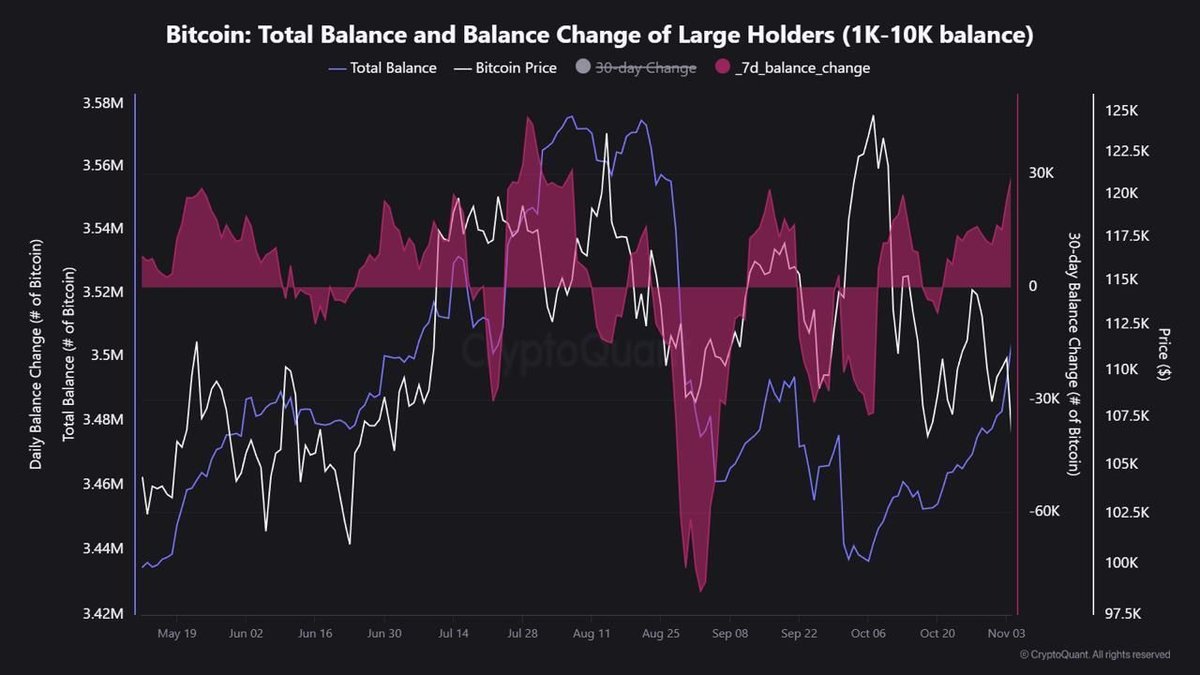

The simplest narrative for Bitcoin’s recent drop is “everyone is scared and dumping.” The actual chain data tell a different story.

Glassnode’s latest “Week On-Chain” reports show several clear trends:

• Long-term holder supply is falling quickly. Coins that have sat dormant for months or years are finally moving. This is exactly what you’d expect from investors who accumulated well below six figures and are now crystallising outsized gains.

• Net position change for long-term holders has turned sharply negative. Inflows to this cohort are smaller than outflows, meaning they are, on net, distributing to shorter-term holders or into the ETF and exchange ecosystem.

• There is no corresponding spike in young-coin destruction. Most of the coins being spent come from older vintages, not from panicked newcomers bailing out near breakeven.

KuCoin, CryptoSlate and other aggregators summarise the same pattern: Bitcoin’s break below the $100,000 area coincides with a wave of long-term profit-taking. This is very different behaviour from what we saw at deep bear-market lows in previous cycles, when short-term holders were dumping at a loss while long-term holders were largely inert or even adding.

In short: the hands selling right now are strong hands choosing to derisk, not weak hands being forced.

2. $100,000 as a Psychological Take-Profit Zone

Why does the selling cluster so clearly around $100,000?

Part of the answer is simple numerology. Round numbers have always mattered in markets. $20,000, $50,000, $100,000—these levels become mental anchors. Traders place take-profit orders around them, journalists use them as headlines, and social media memes grow up around “six-figure Bitcoin” as a status badge.

But there are also concrete economic reasons why $100,000 is significant in this cycle:

• Cost basis bands. On-chain cost-basis estimates show that many early ETF buyers and large whales accumulated substantial size in the $40,000–$60,000 region. Selling between $100,000 and $120,000 means locking in 2x–3x gains on very large positions.

• Portfolio concentration risk. As Bitcoin ripped to new highs above $120,000 in October, its weight in mixed portfolios exploded. For an institution mandated to keep any single asset below, say, 10% of NAV, trimming back around $100,000 is not greed—it’s compliance.

• Cycle memory. Participants who lived through 2017′s run to $20,000 and 2021′s blow-off toward $69,000 internalise those peaks as “it can go a lot higher than you think—but it can also round-trip later.” For them, ignoring a clean triple from their last bear-market buys at a psychologically charged level looks irresponsible.

That’s why many research notes now explicitly describe $100,000 as a take-profit magnet for experienced holders. Once price broke back below that line and stayed there for a few sessions, it activated a lot of “if we lose 6-figures, I’m trimming” rules across funds and family offices.

3. This Is Distribution, Not Capitulation

From a market-structure perspective, it’s crucial to distinguish between two very different phenomena:

- Capitulation: distressed or fearful selling at a loss, usually by newer entrants and over-leveraged traders.

- Distribution: planned profit-taking by long-term holders into demand from later buyers.

Recent data align much more closely with the second pattern.

Analytics from Glassnode and other on-chain firms show that the proportion of supply in profit has fallen, but not because those coins are suddenly underwater. Rather, they are being spent and re-classified into shorter-term cohorts as they move. Supply held by long-term holders has decreased, while short-term holder supply has ticked up—exactly what you’d expect if coins are migrating from OG wallets to new buyers, not from FOMO entrants into oblivion.

Derivatives markets tell a similar story. While there have been large liquidation clusters—some days seeing hundreds of millions of dollars in forced closures—funding rates are not stuck at deeply negative levels and open interest has not collapsed to zero. That suggests more of a controlled de-risking than a violent wipe-out of everyone at once.

In previous cycle tops, we saw a very different pattern: funding turning extreme, retail dominance surging, and then a ferocious cascade of liquidations where long-term holders either stood aside or, in some cases, added. Today, long-term holders are the ones selling, and they are doing so mostly into profit.

4. The Demand Problem: ETF Outflows and Thin New Money

If the supply side of this story is “whales are taking profit,” the demand side is “there isn’t enough fresh capital to catch all the coins they’re throwing at the market.”

Spot Bitcoin ETFs, which were the absorption engine on the way up, have become a source of net supply on the way down. Coindesk, Seeking Alpha and other fund-flow trackers report:

- A single-day outflow of roughly $869 million from U.S. spot Bitcoin ETFs last week—second only to one prior record day.

- Cumulative net outflows of about $2.6–2.7 billion over the last three weeks.

- A broader pattern of rotation within crypto ETFs: while BTC and ETH products see redemptions, vehicles tracking assets like SOL and XRP are recording modest inflows, suggesting investors are not leaving digital assets entirely, but they are reallocating away from Bitcoin at the margin.

At the same time, retail participation looks muted. Social volume has spiked around fear-laden keywords—“crash”, “death cross”, “ETF outflows”—but there is little evidence of a new wave of smaller buyers eagerly “buying the dip” the way we saw during 2020–2021. The Crypto Fear & Greed Index at 10 underlines a market that is emotionally exhausted and cautious.

Put simply: whales are supplying, but the buyer on the other side is increasingly thin. When that happens, even non-panicked profit-taking can look like a crash.

5. Macro Backdrop: Fading Fed Cut Hopes and Rising Micro Risk

None of this is happening in isolation. Macro is quietly leaning against crypto risk.

After spending much of the year speculating on a smooth sequence of Federal Reserve rate cuts, markets have had to re-price that optimism. Derivatives on Fed funds and commentary from Fed officials now point to a higher-for-longer stance, with December cuts looking less likely than they did even a month ago. A widely circulated research piece, “BTC Crashes Below $100K as Markets Price Out Fed Cut,” explicitly ties Bitcoin’s break of $100,000 to traders abandoning their dovish Fed assumptions.

Higher real yields and a firmer dollar challenge the narrative that “there is no alternative” to risk assets. When investors can earn 4–5% in short-dated Treasuries with minimal volatility, the hurdle rate for holding a 70-volatility asset like Bitcoin gets higher. That doesn’t kill the long-term case for BTC, but it reduces the urgency to pile in at six-figure prices.

On top of that, political noise—extended tariff disputes, the recent record-long U.S. government shutdown, and ongoing questions about fiscal discipline—keeps volatility elevated across risk markets. In that environment, any sign of fragility in crypto (like heavy ETF redemptions or a break of a big round number) can trigger a broader de-risking wave.

To summarise: whales are not dumping into a neutral macro environment. They are distributing into a backdrop where every marginal headwind matters more.

6. Whales Are Not All Alike: Profit-Takers vs Accumulators

One easy trap is to talk about “the whales” as if they were a single coordinated entity. They’re not.

Recent articles highlight at least two very different whale cohorts:

- Profit-taking long-term holders. On-chain data show older, profitable coins moving to exchanges and OTC desks. Glassnode describes this as long-term holders “accelerating their selling” and “booking profits” as BTC struggles to hold $100,000.

- Strategic accumulators. At the same time, whale-accumulation dashboards track addresses holding 1,000+ BTC adding over 300,000–375,000 BTC in the last month, even as price fell—a sign that some deep-pocketed players view the sell-off as an opportunity.

Michael Saylor sits squarely in the second camp. Through Strategy (formerly MicroStrategy), he has continued to add to corporate Bitcoin holdings even as the asset slid below $95,000, explicitly denying rumours of selling and reiterating that the firm is “buying quite a lot” at current levels. Bloomberg reports that Strategy has just executed an ~$835 million purchase, its largest since July, taking its stack to well over 600,000 BTC—more than 3% of circulating supply.

For market structure, this split matters. The same tape can simultaneously contain:

- Older whales who see $100,000+ as “mission accomplished” and are happy to derisk.

- Corporate and high-conviction whales who see $90,000–$100,000 as a long-term accumulation zone.

The net effect is still net selling in the short term, because profit-taker supply is hitting the market faster than accumulator demand. But the presence of aggressive buyers at lower levels is one reason why the market has, so far, avoided a full capitulation spiral.

7. Short-Term Pain, Long-Term Repricing

Putting all this together, where does it leave the outlook?

In the short term, the path of least resistance remains choppy to lower as long as two conditions hold:

- Long-term holder distribution remains elevated, with older coins still flowing out into the market.

- ETF flows remain negative or only mildly positive, meaning whales are effectively selling into a thinning bid.

That combination keeps Bitcoin vulnerable to further spikes below $95,000 and to stalling rallies that fail near the now-resistant $100,000 zone. Every test of six figures will invite more profit-taking from those who missed their first chance to trim.

In the medium to long term, the picture is less bleak than the current price action suggests:

• Profit-taking is finite. Once a critical mass of long-term holders has derisked to their target allocations, the marginal selling pressure from this cohort will naturally subside.

• Structurally, ETF infrastructure is still in place. The same pipes that are currently carrying outflows can, in a different macro regime, carry inflows again. The cumulative net inflow since ETF launch remains strongly positive despite recent redemptions.

• The presence of strategic accumulators like Strategy—and the broader cohort of whales that on-chain data shows are still adding—puts a soft floor under the market. These players are not trading quarter to quarter; they are framing Bitcoin as a multi-cycle treasury asset.

None of that guarantees that the local bottom is in. But it does suggest that what we are witnessing is a repricing of expectations after a euphoric run, not the end of the asset’s structural story.

8. How a Professional Should Read This Tape

For a professional news and analysis outlet, the key is to resist both extremes: the reflex to declare every drawdown a “crash,” and the equally dangerous reflex to dismiss all selling as “weak hands” to be faded.

The data right now support a more balanced conclusion:

- Yes, whales are selling—but mostly to realise profits after a historic run, not because they’ve lost faith.

- Yes, price is under pressure—but largely because ETF and spot demand have stepped back at the exact moment that long-term supply hit the market.

- Yes, macro is a headwind—but that cuts both ways: the same higher-for-longer regime that hurts Bitcoin today will look very different if growth slows further or fiscal stress pushes investors back toward non-sovereign stores of value.

The practical takeaway for sophisticated investors is not “sell everything” or “back up the truck.” It is to recognise that you are in the middle of a complex rotation:

- From early-cycle holders to mid-cycle buyers.

- From naive ETF euphoria to more discriminating institutional flows.

- From a clean, policy-driven bull narrative to a messier, macro-sensitive market.

In that environment, risk management, time horizon and sizing matter more than ever. Whales are not fleeing; they are reshaping the holder base. Whether that ultimately strengthens Bitcoin’s foundation or marks a cyclical top will depend less on the next 5% move and more on what happens when macro winds shift and ETF flows eventually flip again.

Conclusion: Planned Selling in an Unforgiving Market

Bitcoin’s slide below $100,000 has all the visual drama of a crash: sharp candles, red heatmaps, and headlines about billions evaporating. But a careful reading of on-chain data and fund flows paints a subtler picture.

What we are seeing is a cohort of long-term, profitable whales using a round-number milestone to take risk off the table—at the exact moment that ETF demand and retail enthusiasm have gone quiet. It is a textbook example of planned distribution into a demand vacuum, not a blind run for the exits.

That doesn’t make the drawdown less painful. But it does change how serious investors should respond. Rather than reacting to every move under $100,000 as if it were the start of a secular collapse, the more constructive question is: who is actually on each side of this trade, and what does that say about the next few years?

The answer, for now, is that some of the oldest hands in the market are cashing in, while a different class of whales—corporate treasuries, ETFs once the macro dust settles, and high-conviction funds—stand ready to define the next cost basis. Between those two poles lies the current volatility. Navigating it requires less faith in slogans and more respect for what the data are quietly telling us about how Bitcoin’s ownership is being rewritten, one block at a time.