Turning Bitcoin Miners Into Radiators: Inside America’s Experiment With Crypto-Powered Home Heating

Few technologies are as polarising as Bitcoin mining. To critics, it is an electricity-hungry lottery that wastes energy on abstract math problems. To miners, it is a security backbone for a decentralised monetary system. This winter in the United States, a third narrative is taking shape: Bitcoin mining rigs quietly doubling as household heaters.

Across colder states, a niche but fast-growing group of homeowners and small businesses are experimenting with devices that look like designer space heaters but contain specialised Bitcoin mining chips inside. Instead of letting the heat from those chips blow uselessly into a warehouse, these machines push it into living rooms, garages, shops and even hot-water tanks. In return, users receive a trickle of Bitcoin over time—small in absolute terms, but psychologically powerful in an era of rising energy bills.

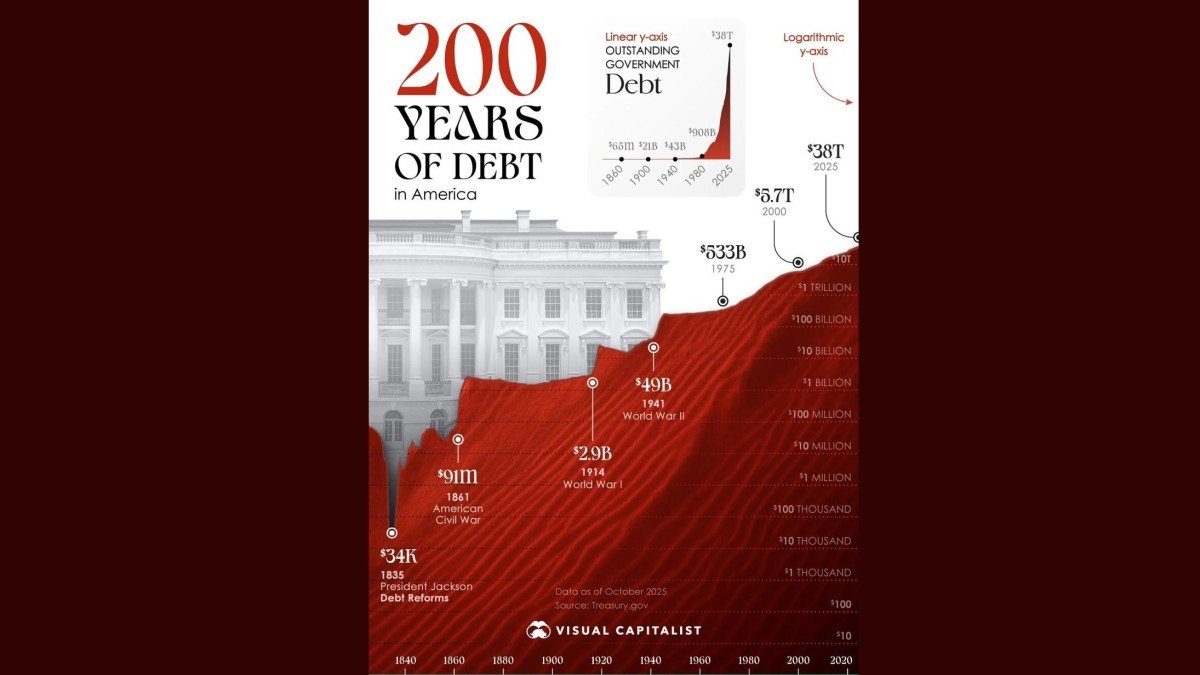

On paper, the physics are simple. Almost all the power a Bitcoin miner consumes ends up as heat. Research by digital asset analysts estimates that the global network now dissipates around 100 terawatt-hours of heat per year, enough to cover the space-heating needs of an entire Nordic country if it were all captured and reused. In practice, most of that energy is still vented into the atmosphere. The current wave of “mining heaters” and heat-recovery pilots is an attempt to turn that waste into a feature rather than a bug.

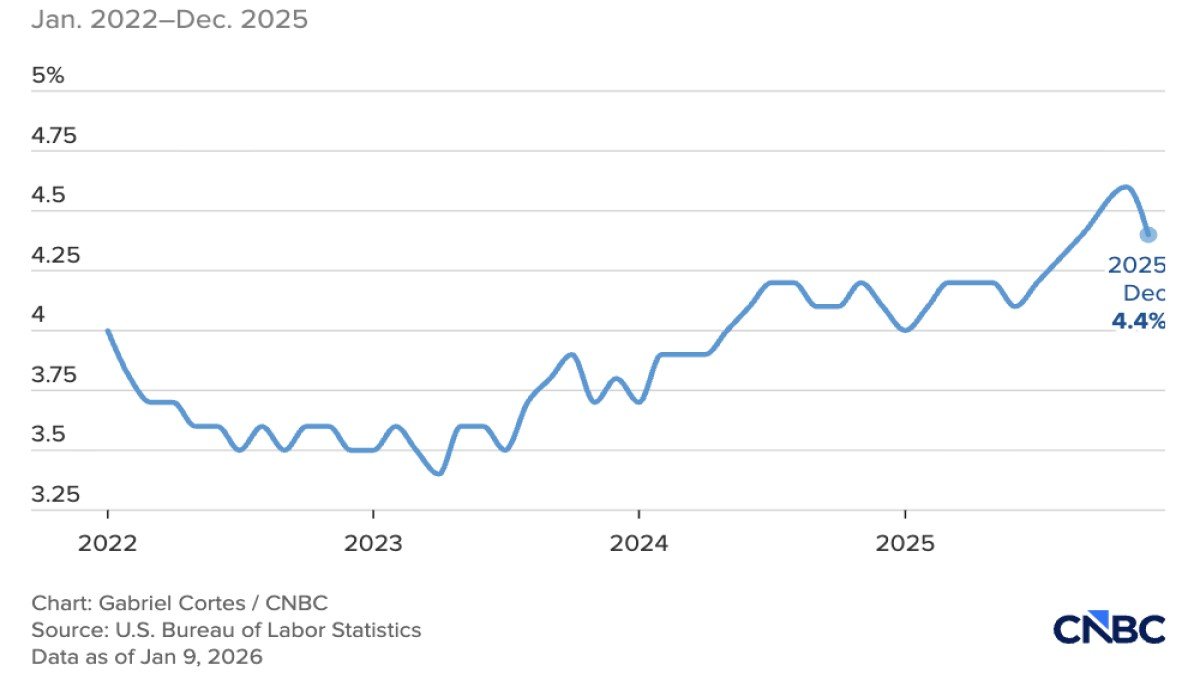

At the same time, American households are facing another winter of uncomfortable energy costs. Official forecasts suggest that typical heating expenses for gas and electric customers will rise again this season, driven by higher retail power prices and weather that is colder than last year in many regions. That squeeze is happening despite President Donald Trump’s campaign promise to deliver “the lowest-cost energy on Earth” and a flurry of executive orders aimed at boosting domestic fossil fuel and nuclear production.

It is in this environment that Bitcoin-powered heating has gone from a YouTube curiosity to something appearing in mainstream business coverage. The key question is not whether it works—electrically, a mining rig and a resistive space heater are cousins. The question is whether it is economically and environmentally sensible, and at what scale.

1. From data centre waste heat to living-room product

The idea of using computing waste heat is not new. Data centres have been piping hot exhaust into district heating networks, swimming pools and greenhouses for years. Bitcoin miners, which operate 24/7 and concentrate lots of power in small footprints, are especially well suited to heat recovery.

What is different in late 2025 is that this concept has been packaged into consumer-grade products. Devices such as Heatbit’s Trio and Maxi units, marketed as “Bitcoin heaters”, promise a familiar experience: plug the device into a regular socket, open an app, and watch your balance of sats slowly climb while the room gets warm. These appliances typically draw around 1–1.5 kilowatts of power—similar to a strong space heater—and claim to offer a partial “cashback” on heating costs in the form of mined Bitcoin.

At the same time, small companies are piloting more industrial applications. In Idaho, Softwarm has installed Bitcoin miners in car washes and industrial facilities, routing the heat into water tanks and wash bays. For some clients, the crypto-heated systems reportedly offset hundreds of dollars a month in gas or electric heating costs while stacking BTC on the side.

Technically, there is nothing magical here. A miner is effectively an electric radiator that happens to produce hashes as a by-product. The creative step is to locate that radiator where heat is actually useful, rather than in a remote warehouse where cooling it is an unwanted cost.

2. The physics: perfect conversion, imperfect economics

From a pure energy perspective, proof-of-work mining is straightforward: every joule of electricity consumed by an ASIC eventually becomes heat. That is why miners need so many fans and elaborate cooling. For a homeowner trying to stay warm in January, this is good news: 1 kilowatt of power running through a mining heater produces essentially the same amount of usable heat as 1 kilowatt running through a conventional resistive heater.

However, residential electricity in the United States is expensive by global mining standards. Industrial-scale Bitcoin operations usually chase the absolute lowest-cost power they can find: stranded natural gas, surplus hydro, or bulk utility contracts at a few cents per kilowatt-hour. Households, by contrast, routinely pay two to three times that rate, and in some states even more. When you add in the fact that modern mining difficulty is brutal, many academics and energy analysts argue that home mining “does not pencil out” if your only goal is to generate Bitcoin.

That critique is fair if you treat the miner purely as a financial instrument. But the homeowners now buying heater-miners are not starting from zero power consumption. They already need to heat their spaces. The economic comparison is therefore not between “no heater” and “mining heater”, but between:

- Paying the utility for 100% of your heating energy and getting no additional output, versus

- Paying the utility for the same heating energy and receiving a variable Bitcoin rebate on top.

Viewed that way, the miner is a heater that potentially refunds a portion of your bill, rather than a speculative mining investment. If the device returns 20–30% of your annual electricity spend in BTC during a cold season, that is non-trivial for some households, especially those already interested in accumulating Bitcoin. If difficulty, price or uptime move against you, the worst case is that you are left with an expensive but still functional space heater.

That does not mean the economics are universally attractive. In regions with high electricity tariffs, any extra complexity may not be worth the marginal return. And heat pumps, which can deliver two to four units of heat for each unit of electricity by moving thermal energy rather than creating it, remain a far more efficient mainstay for whole-home heating. Bitcoin heaters sit in a niche: technically elegant, emotionally appealing to crypto enthusiasts, but unlikely to replace core HVAC systems at scale.

3. Policy backdrop: cheap energy promises, expensive reality

The timing of this mining-as-heating trend is not accidental. Trump’s second term has been defined by an aggressive “energy dominance” agenda: revoking climate regulations, fast-tracking fossil and nuclear projects, and pledging to cut power prices in half. Yet multiple independent analyses now show that average U.S. electricity bills have risen since early 2025, not fallen, driven by a combination of delayed clean energy projects, tariffs on imported equipment, and surging demand from AI data centres.

That gap between rhetoric and reality is acutely felt in winter. For middle-income households already squeezed by housing costs and inflation, an extra few hundred dollars per season on heating is significant. Against that backdrop, the idea that a heater can “pay you back” in Bitcoin is understandably seductive, even if the payback is slow and uncertain.

It also fits a broader cultural pattern in American energy policy: when federal solutions feel distant or politicised, individuals and small businesses search for security incidents. Rooftop solar was once a fringe hobby; then it became a mainstream response to high power prices and grid reliability fears. Bitcoin-heated car washes and living rooms are a weirder security incident, but they spring from similar instincts: if the system cannot deliver the deal you were promised, maybe technology can.

4. Beyond the hype: what the data actually says

Headline stories about “heating your house for free with Bitcoin” are easy to mock, and sometimes they deserve it. Mining hardware is capital-intensive; it depreciates quickly; and rewards are volatile. But dismissing the entire concept as a gimmick misses two important points revealed by current data and pilot projects.

First, the scale of available heat is genuinely enormous. Estimates around 100 TWh of annual heat output from global mining are not marketing spin; they are a direct consequence of network-wide power consumption. Even if only a slice of that energy is captured and re-used, the potential for district heating, process heat in industry, or greenhouse agriculture is real. We already see examples in Canada and Europe where municipal networks are fed by mining or data-centre waste heat.

Second, the pilot economics look most promising where heat has clear commercial value. Softwarm’s work in Idaho is instructive: a car wash that needed to keep bays warm in sub-zero temperatures was already spending about $25 a day to heat a water system. By substituting or supplementing that with mining heat, the business can both maintain service quality and accumulate Bitcoin on its balance sheet. For an industrial concrete company heating large water tanks, recouping up to four figures a month in energy costs through mining-based heat recovery is not trivial.

In those settings, the miner is not a speculative speculative position; it is a specialised electric boiler whose waste product happens to be a liquid asset. The underlying energy is still paid for, and it still has a carbon footprint depending on the source. But the financial stack on top of that energy is more interesting than with a vanilla resistance heater.

5. Environmental and grid implications

No discussion of Bitcoin mining can avoid the climate and grid questions. Does heating homes with mining rigs make the system greener, or does it simply provide rhetorical cover for more electricity consumption?

The honest answer is: it depends on context. If a household in a coal-heavy grid replaces a standard electric heater with a mining heater, their direct emissions are nearly identical. The extra Bitcoin is purely financial; the climate impact is unchanged. In that scenario, heat pumps or improved insulation would do far more for decarbonisation.

The picture changes when mining heat is coupled with otherwise curtailed or stranded power. In regions with abundant hydro, wind or nuclear generating more off-peak energy than the grid can absorb, using that surplus to both secure the Bitcoin network and heat water or air can make sense. It can improve plant economics, justify renewable overbuild, or reduce flaring of natural gas that would otherwise be burned off without any productive use.

Critically, using miners as controllable heaters introduces a new form of demand response. Unlike a conventional resistance heater, a mining heater generates a tradeable digital asset. When power prices spike, a smart controller could throttle or shut off mining while leaving critical heating serviced by a conventional system. When prices are low, the unit can run at full capacity, effectively converting cheap electricity into both warmth and Bitcoin. In aggregate, millions of such flexible loads could help smooth demand peaks—though we are still a long way from that scale.

6. From garages to grids: where this could realistically go

So is this winter’s Bitcoin-heating trend a quirky footnote, or the start of a meaningful shift in how we think about digital infrastructure and energy?

Our view is that the household mining heater will remain a niche product for enthusiasts, high-conviction Bitcoiners and early adopters in regions with favourable electricity prices. It sits where lifestyle gadget, ideological statement and financial experiment overlap. For that audience, the blend of warmth, sats and conversation value is compelling enough to overcome the downsides.

The more interesting frontier lies in integrated systems:

- Water heaters, boilers and thermal stores with embedded ASICs and heat exchangers, designed from the ground up for heat recovery rather than retrofitted rigs.

- Commercial and multi-residential buildings where mining-based heating complements heat pumps, providing a controllable baseload while pumps handle efficiency-optimised temperature lifts.

- Industrial processes and district energy networks that use mining loads to monetise surplus electricity, with heat reuse as a co-benefit rather than the primary justification.

Engineers are already experimenting with liquid-cooled “digital boilers” where miners are immersed in dielectric fluids, and the warmed coolant feeds directly into hot-water circuits. Academic work suggests that with careful design, these systems can approach data-centre-grade efficiency while delivering high-grade heat suitable for building services.

Regulation will also play a role. As local authorities grapple with both decarbonisation targets and the sudden load growth from AI and crypto, they may favour projects that visibly recycle heat and use low-carbon power sources. Mining operations that can show they are helping to heat homes, spas or greenhouses with clean energy stand a better chance in public consultations than those presenting as pure financial arbitrage.

7. What this tells us about Bitcoin’s evolution

There is a deeper story under the memes about “heaters that print money”. For much of its life, Bitcoin has been treated as a purely financial object: a price on a chart, a speculative trade, a hedge or a risk asset depending on the macro regime. Mining was something that happened far away, in anonymous warehouses filled with noise and dust.

The emergence of consumer-facing mining heaters and visible heat-reuse projects pulls the infrastructure layer into everyday life. When your living room is warm because a machine in the corner is both securing a global network and dripping sats into an app, Bitcoin stops being just a line in a portfolio. It becomes a tangible part of the energy system in your house.

That doesn’t make it a silver bullet for rising bills or climate change. But it does illustrate a broader pattern: as digital and physical infrastructure intertwine, the sharp boundary between “financial asset” and “energy appliance” starts to blur. We saw similar blending with rooftop solar financing, home batteries and electric vehicles doubling as grid resources. Bitcoin heaters may be the latest, strangest entry in that list.

Conclusion: warm rooms, cool heads

The fact that Americans are experimenting with Bitcoin-powered heating this winter does not mean everyone should rush out to replace their radiators with ASICs. The economics are highly context-dependent, the environmental benefits are nuanced, and many of the loudest marketing claims will not survive a simple spreadsheet check.

But this trend is still worth taking seriously. It forces us to ask more sophisticated questions about how we value energy, how we design digital infrastructure, and how policy promises around “cheap power” translate into real households’ decisions. It also highlights the creativity of individuals and entrepreneurs who look at an industry’s biggest criticism—wasted heat—and ask whether it can be turned into a feature.

For a professional news and analysis outlet, the opportunity is not to cheerlead or sneer, but to track the hard data: real-world savings, lifecycle emissions, hardware reliability, grid impacts and regulatory responses. As those numbers come in, we will learn whether Bitcoin heaters remain an intriguing winter curiosity, or grow into a small but meaningful chapter in the story of how crypto and energy systems converge.

This article is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Bitcoin mining and home heating both involve significant costs and risks. Always conduct your own research and consult qualified professionals before making financial or energy-related decisions.