From ETF Wave to Payroll Wave: How $9.3 Trillion in 401(k)s Could Become Bitcoin’s Next Structural Bid

Spot Bitcoin ETFs were supposed to be the “big unlock” for institutional money. In practice, they have delivered: by late 2025, U.S. spot Bitcoin ETFs collectively manage well over $100 billion in assets and hold around 1.3 million BTC, with net inflows north of $60 billion since launch. But a newer, potentially deeper pool of capital is now in play—one that does not trade intraday, does not respond to every headline, and is funded automatically from paychecks.

That pool is the U.S. 401(k) retirement system. As of the second quarter of 2025, Americans held roughly $9.3 trillion inside 401(k) plans alone, within about $13 trillion in total employer-based defined-contribution (DC) plans. Those balances sit at the intersection of tax policy, corporate HR decisions and ordinary households’ financial futures, making them one of the most conservative corners of the investment universe.

They are now, at least in principle, open to Bitcoin.

On 7 August 2025, President Donald Trump signed an executive order titled “Democratizing Access to Alternative Assets for 401(k) Investors”. The order directs the Department of Labor (DOL) and the Securities and Exchange Commission (SEC) to revise their rules so that 401(k) and similar DC plans can include a broader range of “alternative” investments—explicitly including digital assets and cryptocurrencies—without plan sponsors feeling they are stepping into regulatory minefields.

Policy analysts have rightly focused on the risks: higher fees, complexity, suitability concerns. But there is also a structural story emerging for Bitcoin. Even a small allocation in a massive, slowly compounding system, implemented through automatic contributions, can become a persistent bid that looks very different from ETF flows or hedge-fund trades.

This article unpacks what the executive order actually does, how the 401(k) machine works, what a 0.5% Bitcoin allocation would mean in numbers, and why this next phase of adoption is less about fireworks and more about slow, relentless accumulation.

1. What Trump’s August 2025 order actually changed

Before 2025, the DOL’s stance toward crypto in retirement plans was, at best, skeptical. A 2022 compliance release effectively told plan fiduciaries to exercise “extreme care” before adding cryptocurrency options to 401(k) menus, a phrase that many lawyers read as a bright-yellow warning sign. Few large employers were willing to be first.

Trump’s August 7 executive order flipped the tone. It instructs the DOL and SEC to expand access to alternative assets in DC plans, specifically naming digital assets alongside private equity, private credit and real estate. The order does not force any employer to add Bitcoin or other crypto options, nor does it override fiduciary duties under ERISA. Instead, it does three important things:

• Removes the presumption of hostility. By telling regulators to move away from the “extreme caution” framing and toward a risk-based, neutral approach, it gives 401(k) providers political cover to explore digital assets without feeling they are defying Washington.

• Signals a long-term policy direction. Executive orders can be challenged or rolled back, but they shape agency priorities. DOL and SEC staff are now explicitly tasked with building a framework in which crypto exposure in 401(k)s is possible rather than presumptively reckless.

• Invites product innovation. Recordkeepers, asset managers and custodians now have a clear commercial incentive to design compliant, wrapped crypto strategies—collective investment trusts, separate accounts, target-date sleeves—that fiduciaries can plausibly defend.

In parallel, the DOL has already rescinded its earlier crypto-specific warning, and lawmakers are pressuring regulators from both sides: some urging tighter safeguards, others accusing the old regime of paternalism. The result is not a free-for-all. It is a controlled opening, with plenty of friction still ahead but a fundamentally different starting point from just a year ago.

2. The 401(k) system: big, slow, and relentlessly automatic

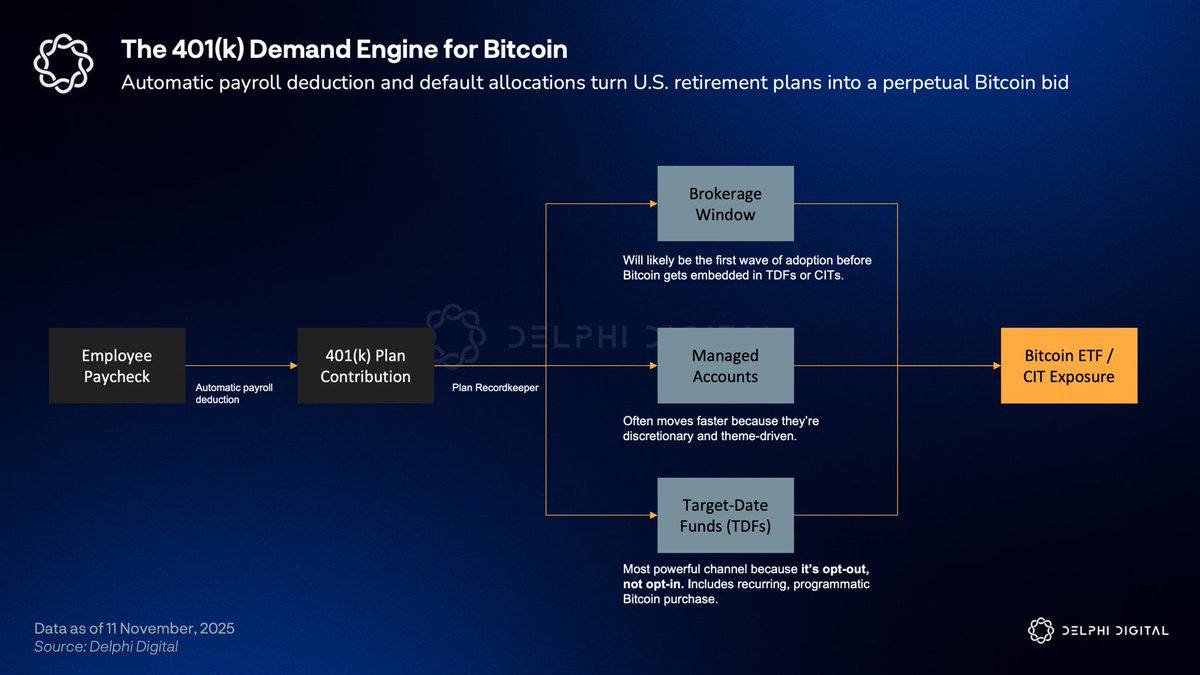

To grasp the potential impact on Bitcoin, you have to understand the mechanics of 401(k)s. Unlike ETFs, which react in real time to flows from traders and wealth managers, 401(k) plans are powered by three slow-moving engines:

• Automatic enrollment and payroll deferrals. Many employers automatically enroll new hires into a default investment option, often a target-date fund, with contributions deducted from every paycheck. Participation is the default, not the exception.

• Employer matching. Companies frequently match a portion of employee contributions, effectively amplifying the size of regular inflows regardless of day-to-day market sentiment.

• Long holding periods. Money inside 401(k)s is locked up by design until retirement age, barring hardship withdrawals or loans. This creates a structural bias toward buy-and-hold behaviour and reduces the frequency of panic selling.

As of mid-2025, data from the Investment Company Institute and other industry trackers put total 401(k) assets around $9.3 trillion, within a broader U.S. retirement system nearing $46–50 trillion when IRAs, public pensions and annuities are included. Annual contributions to 401(k)s are measured in the hundreds of billions of dollars, with a significant portion coming from automatic deferrals and matches rather than active investment decisions.

In that context, a small allocation percentage actually matters. The question is not whether every participant suddenly chooses Bitcoin; it is whether plan menus, target-date funds or managed accounts gradually integrate a crypto sleeve that quietly captures a fraction of the system’s inflows.

3. The 0.5% scenario: turning percentages into dollars

Consider a stylised scenario in which, over the next several years, 401(k) plans evolve toward a world where a 0.5% average allocation to Bitcoin is achieved across the system. That does not mean every participant holds BTC directly; it could be achieved through vehicles such as:

- A small Bitcoin allocation inside a diversified digital assets fund made available on plan menus.

- Crypto sleeves within managed accounts used by higher-income participants.

- Optional “innovation” funds that attract a minority of participants but still gather significant assets.

If we start from today’s baseline of $9.3 trillion in 401(k) assets and assume nominal growth in line with recent history—say 7–8% per year from contributions and market performance—total 401(k) balances could plausibly be in the low-to-mid teens of trillions of dollars by 2032. Under an 8% growth path, a simple compound projection yields something on the order of $15–16 trillion in 401(k) assets by that date.

Half a percent of $15.8 trillion is roughly $79 billion. That figure is not a forecast; it is an order-of-magnitude estimate for what a modest, system-wide Bitcoin tilt might mean in dollar terms if the regulatory and product plumbing is in place.

How does that compare to existing channels?

- U.S. spot Bitcoin ETFs currently manage about $120–125 billion across all issuers, depending on price swings and flows, after attracting roughly $60+ billion in net inflows since their 2024 launch.

- A $79 billion 401(k)-driven allocation, gradually achieved over several years, would therefore be meaningful even relative to the ETF wave. It may no longer be “almost double” current ETF assets as those funds have grown rapidly, but it would still rival or exceed the cumulative net inflows into spot ETFs to date.

The more interesting point is not the headline number; it is the shape of the flow. ETF demand tends to come in pulses around news, narratives and tactical asset allocation decisions. 401(k) flows, by contrast, are akin to a drip irrigation system: small, frequent, predictable, and heavily anchored in behaviour (saving for retirement) rather than short-term market views.

4. From theory to implementation: who actually chooses Bitcoin?

Even with friendlier regulation, Bitcoin does not magically appear in workers’ retirement accounts. There are multiple gatekeepers and design choices between the White House and a line worker’s pay stub:

• Plan sponsors. Employers decide which investment options to include in their 401(k) menus. Their primary concern is fiduciary risk: can they defend each option as prudent for an unsophisticated participant base?

• Recordkeepers and asset managers. These firms handle the plumbing and often design the default investment options (target-date funds). They will only roll out crypto-linked products once they are comfortable with custody, pricing, compliance and demand.

• Participants themselves. Many workers never change the default allocation set at enrollment. For Bitcoin to feature meaningfully at the system level, either default options must incorporate it in tiny doses, or opt-in alternatives must attract a non-trivial share of contributions.

Given that chain of decisions, rapid, broad-based adoption is unlikely. Early implementations are more likely to appear as:

- Self-directed brokerage windows where sophisticated participants can buy crypto-linked ETFs within their 401(k), much as some plans already allow purchases of individual stocks.

- Specialty alternative asset funds that blend private equity, infrastructure and digital assets into a single, diversified sleeve capped at a small percentage of the overall portfolio.

- Managed accounts for high-balance participants where advisors can recommend a small Bitcoin allocation as part of a broader risk-managed strategy.

In other words, the 0.5% scenario is not a near-term baseline. It is an end-state that could emerge over several years if product builders, fiduciaries and regulators converge on a common view: that a small Bitcoin allocation can be defended as prudent for at least some segments of the retirement saver population.

5. How 401(k) Bitcoin flows differ from ETF flows

From Bitcoin’s perspective, dollars are not all created equal. The impact of a $10 billion inflow depends on who is buying, with what horizon and through which wrapper.

ETF flows are tactical and market-driven. Wealth managers, hedge funds and retail traders can move in and out of spot ETFs on short notice. Inflows surge around price breakouts, narratives and macro events; outflows accelerate during drawdowns or when risk-budget models flash red. ETF flows are easier to hedge and to reverse.

401(k) flows are behavioural and policy-driven. Contributions are deducted from paychecks on a schedule, often monthly or bi-weekly, regardless of whether Bitcoin is rallying or crashing. Participants might glance at their balances a few times a year. Plan changes are slow, require committee approval and take months to implement. Once an allocation is embedded in a default or model, inertia tends to dominate.

That contrast could have several effects on Bitcoin’s market structure if 401(k) adoption reaches critical mass:

• More persistent base demand. Automatic contributions would create a steady stream of small BTC purchases, especially if implemented via dollar-cost-averaging inside diversified funds.

• Different seller profile. Retirement savers are more likely to rebalance gradually or take distributions at retirement age than to trade around short-term price moves, potentially reducing the share of highly reactive supply.

• Interaction with miner supply. As block subsidies continue to halve, a structural bid from retirement contributions could absorb a larger share of net new issuance and secondary supply from traders, subtly shifting the balance of marginal price-setting power.

None of this removes Bitcoin’s volatility. But it changes the composition of its holder base in ways that could matter over a full cycle, especially if ETF and 401(k) flows end up reinforcing rather than substituting for each other.

6. Risks and criticisms: higher yield, higher responsibility

Not everyone is cheering the August order. Critics in Congress and the policy community have warned that opening 401(k)s to crypto and other complex alternatives could expose ordinary savers to risks they do not fully understand.

The concerns fall into several buckets:

• Suitability. Bitcoin’s drawdowns of 50–80% in prior cycles are not hypothetical. Asked to choose between a “high-growth digital asset fund” and a conservative balanced fund, many unsophisticated investors may gravitate to the former without grasping that losses could be severe and long-lived.

• Fees and opacity. Alternative asset sleeves often come with higher fees than traditional index funds. If those fees are layered on top of crypto custody and trading costs, the long-run drag on returns could offset much of the diversification benefit.

• Fiduciary liability. Plan sponsors are still bound by ERISA’s duty of prudence. Plaintiffs’ lawyers are already signalling that, if Bitcoin allocations blow up in a downturn, they will argue that fiduciaries failed to protect participants. That threat alone may keep many large employers on the sidelines.

• Regulatory whiplash. Executive orders are more fragile than statutes. A future administration could tighten the rules again, creating uncertainty for product manufacturers and plans midway through adoption.

From a professional analysis perspective, these criticisms are not reasons to dismiss the 401(k) opportunity, but they are reasons to be cautious about extrapolating headlines into guaranteed flows. The adoption curve is likely to be S-shaped: slow early experimentation, then a steeper growth phase if initial products perform and legal challenges are navigated, followed by a plateau as risk budgets are filled.

7. Strategic implications for Bitcoin’s maturation

If 401(k) allocations to Bitcoin do materialise over the next decade, even at low single-digit percentages, they will say as much about Bitcoin’s social status as about its price.

For years, the story has been one of sequential legitimisation:

- First, high-net-worth individuals and crypto-native funds.

- Then, corporates experimenting with treasury allocations and public companies like MicroStrategy embracing BTC as a balance-sheet asset.

- Then, spot ETFs giving wealth managers and retail investors a regulated wrapper.

- Now, potentially, tax-advantaged retirement accounts in which ordinary workers dollar-cost-average into Bitcoin without ever touching an exchange.

Each step has moved Bitcoin further from the fringes and closer to the center of mainstream financial infrastructure. The 401(k) channel, if it grows, would complete that arc: Bitcoin would sit next to index funds and target-date strategies in the place where Americans keep their longest-term savings.

That has implications beyond flows:

• Regulatory expectations. Once retirees hold Bitcoin exposure in their 401(k)s, political tolerance for outright bans or ultra-aggressive regulation shrinks. Policymakers who move against Bitcoin would be acting directly against constituents’ retirement accounts.

• Correlation dynamics. As BTC becomes embedded in diversified multi-asset portfolios, its price behaviour may be increasingly influenced by standard risk-on/risk-off flows, rebalancing cycles and macro shocks, not just crypto-native events.

• Competition with other digital assets. If Bitcoin becomes the default “digital asset” in retirement menus, other tokens may find it harder to win shelf space, reinforcing Bitcoin’s status as the flagship store-of-value asset in the space.

Conclusion: big numbers, slow clocks

The idea that the $9.3 trillion 401(k) system could become “the next ETF” for Bitcoin is seductive, and the math behind attention-grabbing numbers like $79 billion in potential flows is real enough in a stylised scenario. But the clocks are different.

ETF adoption happens on trading screens, in quarters. 401(k) adoption happens in committee meetings, in product roadmaps and in HR policy documents, over years. For Bitcoin, that is precisely what makes the opportunity interesting. Capital that moves slowly, funded automatically from salaries and matched by employers, is capital that, once committed, tends to stick around.

Trump’s August 2025 executive order does not guarantee any of this. It simply removes a major regulatory obstacle and invites the market to experiment. Over the next five to seven years, the real story will be written not in press releases but in plan menus, target-date fund prospectuses and the small allocation decisions of millions of ordinary savers who may never think of themselves as “buying Bitcoin” at all.

For professional observers, the task now is to watch that slow-motion process with the same care once reserved for ETF approval headlines: tracking product launches, DOL guidance, litigation outcomes and, above all, the actual allocation percentages that emerge in the data. Only then will we know whether the retirement system truly becomes Bitcoin’s next structural bid, or whether the promise of a payroll-powered bull market remains just that—a promise.

This article is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets and retirement products involve significant risk and may be unsuitable for many investors. Always conduct your own research and consider consulting a qualified professional before making financial decisions.