Solana and Aptos Start Quietly Preparing for a Post-Quantum Future

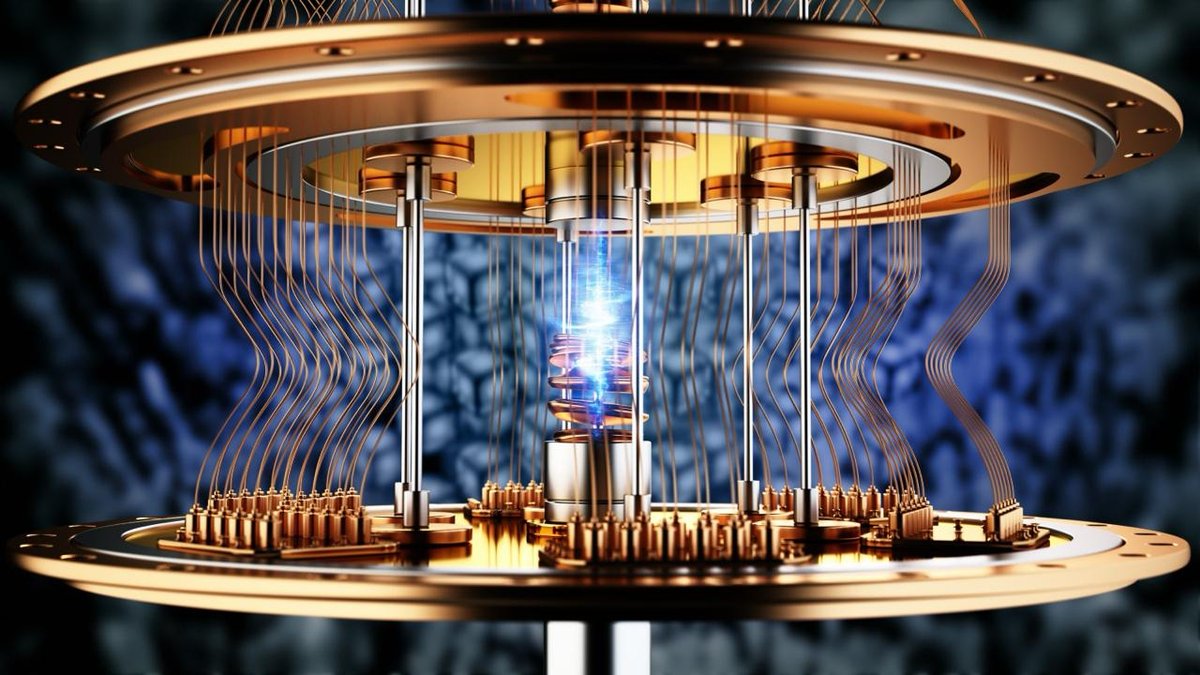

The phrase “quantum risk” has hovered around the blockchain industry for years, often used more as a buzzword than as a concrete engineering problem. The core idea is simple: if future quantum computers become powerful enough, they could undermine the cryptographic assumptions that secure today’s networks. Most public chains rely on elliptic curve digital signatures; quantum algorithms, in theory, could weaken those schemes.

For a long time this sounded like science fiction. But as research into quantum hardware and post-quantum cryptography accelerates, some of the largest blockchain ecosystems have decided that waiting for certainty is not an option. Two of the most active examples are Solana and Aptos, which have begun rolling out concrete initiatives aimed at making their networks more resilient in a world where quantum machines are part of the threat model.

Solana is collaborating with security firm Project Eleven on a testnet that uses quantum-resistant signatures to secure transactions, while Aptos is proposing an optional post-quantum key system for users who want stronger protection without forcing a disruptive transition on the entire network. Together, these approaches offer an early glimpse of how blockchains may evolve from “quantum-aware” to “quantum-ready” over the coming decade.

1. Why Quantum Computing Matters for Blockchains

To understand why these projects matter, it is worth revisiting how blockchains secure ownership. When you hold coins or tokens, what you actually control is a private key that can generate digital signatures. The network validates those signatures using a corresponding public key. As long as the private key stays secret, funds cannot be moved without your approval.

Most major networks, including Bitcoin, Ethereum, Solana and Aptos, rely on elliptic curve cryptography (ECC) for this process. Classical computers find it extremely difficult to derive a private key from a public key within any reasonable time frame. Quantum algorithms, however, such as Shor’s algorithm, could theoretically perform this task far more efficiently once hardware becomes sufficiently advanced.

We are not there yet. Current quantum machines are noisy, limited and far from being able to break well-implemented public-key schemes on a live blockchain. But there is a second risk that motivates early preparation: “store now, decrypt later.” An adversary could record encrypted or signed data today and wait until quantum hardware is strong enough to attack it. For long-lived systems like blockchains, where data is meant to be permanent, the relevant security horizon is measured in decades, not months.

This is why researchers and standards bodies have been developing post-quantum cryptography—new signature and encryption schemes designed to remain secure even in the presence of powerful quantum computers. Lattice-based schemes, hash-based signatures and other constructions are leading candidates. The challenge for blockchains is how to incorporate these methods without sacrificing performance, decentralization or compatibility with existing wallets and smart contracts.

2. Solana’s Project Eleven Testnet: Quantum-Resistant by Design

Solana’s collaboration with security firm Project Eleven is one of the first visible experiments aimed at answering that question. The two teams are deploying a dedicated testnet that uses quantum-resistant signatures for transactions. The goal is to test whether advanced cryptographic schemes can be integrated into a high-throughput, low-latency environment without undermining the chain’s core performance profile.

The experiment focuses on several key dimensions:

• Signature size and bandwidth. Many post-quantum signature schemes produce larger keys and signatures than ECC. On a chain that processes thousands of transactions per second, even modest size increases can translate into substantial bandwidth and storage costs. The testnet allows engineers to measure this overhead in realistic conditions.

• Verification speed. Validators must be able to verify signatures quickly enough to keep blocks flowing. The testnet evaluates how post-quantum algorithms behave under real-world load and whether specialized hardware or code paths are needed.

• Integration with existing tooling. Wallets, SDKs and infrastructure have been built around current signature formats. The testnet is a sandbox for exploring how to expose post-quantum options to users without fragmenting the ecosystem.

Importantly, these experiments happen off to the side of the main network. Solana is not rewriting its core consensus rules overnight. Instead, it is taking the more measured route of building, testing and iterating in an environment where mistakes are educational rather than catastrophic. That posture reflects a broader reality: quantum security is a marathon, not a sprint.

3. Aptos’s Opt-In Strategy: Post-Quantum as a User Choice

While Solana explores system-level changes on a testnet, Aptos is pushing a complementary idea: make post-quantum signatures an optional feature for users who need stronger guarantees, while keeping the existing signature system intact for most everyday activity.

Under this proposal, the protocol would support additional signature types that are designed to be resilient against quantum attacks. Users who manage large balances, sensitive business workflows or long-term holdings could opt to generate post-quantum keys alongside their existing keys. Transactions from those addresses would use the new scheme, while the rest of the network would continue operating with conventional signatures.

This approach has several appealing properties:

- Gradual migration. There is no all-or-nothing cutoff date. Users can move to quantum-resistant keys at their own pace, and infrastructure providers can support both systems in parallel.

- Risk-based security. Not every wallet needs the same level of protection. Optional signatures allow high-value or long-horizon users to upgrade first, where the cost-benefit trade-off is most favourable.

- Backward compatibility. Existing smart contracts and tools do not need to be rewritten overnight. The network can gain post-quantum capabilities without disrupting current usage.

The downside is complexity. Users must understand which key type they are using, how to back it up and how it interacts with different applications. For that reason, the long-term success of this model depends heavily on wallet design and education. If done well, however, it offers a practical path from theoretical security discussions to concrete user choices.

4. The Engineering Challenges of Going Post-Quantum

Both Solana and Aptos are encountering the same set of engineering questions that any chain will face when it tries to become quantum-resistant:

• Key migration. How can users replace or supplement their existing keys without exposing themselves during the transition? Simple “send everything to a new address” workflows can work, but they require careful planning, especially for long-lived multi-signature arrangements or institutional accounts.

• Hardware and performance. Some post-quantum schemes are computationally heavy. Validators and nodes may need optimized implementations or dedicated hardware to maintain current throughput and latency.

• Standards and interoperability. Different chains might select different algorithms. Without coordination, a wallet that supports one post-quantum scheme on one chain may not automatically work on another, complicating cross-chain activity.

• Regulatory clarity. As financial regulators develop rules around digital assets, they may eventually weigh in on which cryptographic standards are appropriate for critical infrastructure. Early experimentation helps networks be ready for that conversation.

These challenges are not insurmountable, but they reinforce why preparation must begin long before quantum machines pose an immediate threat. Re-keying an entire global financial network is not something that can be done in a few months under pressure.

5. How Real Is the Quantum Threat Today?

The natural follow-up question is whether users should be worried right now. The short answer is: quantum computers capable of undermining well-designed blockchains are still a long way off. Estimates vary widely, but most experts believe that reaching the necessary scale and stability will take many years of sustained research and investment.

However, the absence of an immediate threat does not mean the problem can be ignored. Data recorded on a blockchain in 2025 may still need to remain secure in 2045 and beyond. Long-term institutional holdings, tokenized financial instruments and historical records are especially sensitive to this “long shelf life” risk.

From that perspective, the initiatives by Solana and Aptos are less about reacting to a current emergency and more about building institutional credibility. They signal to developers, enterprises and regulators that these networks take long-term security seriously and are willing to invest engineering resources in future-proofing their infrastructure.

6. What This Means for Users and Builders Today

For most everyday users, the immediate impact of these quantum-security projects will be minimal. You are not required to change your wallet, migrate your coins or learn a new set of cryptographic terms overnight. But there are several practical lessons worth noting:

• Key hygiene still matters. Regardless of future quantum risks, using strong passphrases, hardware wallets and secure backups remains the most important line of defence.

• Pay attention to long-term holdings. If you manage assets that are intended to remain untouched for many years, it may eventually make sense to explore post-quantum key options as they become available and battle-tested.

• Infrastructure choices signal priorities. When a network invests in quantum-resistant research, it often reflects a broader culture of risk management and security awareness, which can be a useful qualitative factor when evaluating where to build applications.

• Regulatory and enterprise adoption may lean toward quantum-ready chains. Large institutions and governments tend to think in decade-long time frames. Networks that can demonstrate credible quantum-resilience roadmaps may become more attractive as platforms for tokenized securities, payments and data.

7. A Preview of the Next Security Frontier

Viewed from a distance, the quantum story is not only about protecting existing coins. It is also a preview of how blockchains evolve when confronted with new scientific realities. In the early days, security was primarily about resisting conventional cyber risks and ensuring that consensus could withstand network faults. Over time, the threat model expanded to include sophisticated financial attacks, economic incentives and cross-chain vulnerabilities.

Quantum computing adds another layer to that model: the possibility that some of the mathematical assumptions underlying today’s signatures might not hold forever. Solana’s Project Eleven testnet and Aptos’s optional post-quantum keys illustrate a responsible response to that possibility. They are not alarmist moves; they are early prototypes of how a mature digital-asset ecosystem adapts to long-run uncertainty.

For now, the everyday user does not need to change behaviour because of these experiments. But the fact that major networks are engaging with the problem is itself a valuable signal. It shows that the industry is moving beyond short-term price charts and beginning to treat blockchains as long-lived public infrastructure that must remain secure in technological environments we can barely imagine today.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and involve risk. Always conduct your own research and consult a qualified professional before making financial decisions.