Vitalik’s Nod, zkSync’s ‘Atlas,’ and the Real Race for Ethereum’s Next 100 Million Users

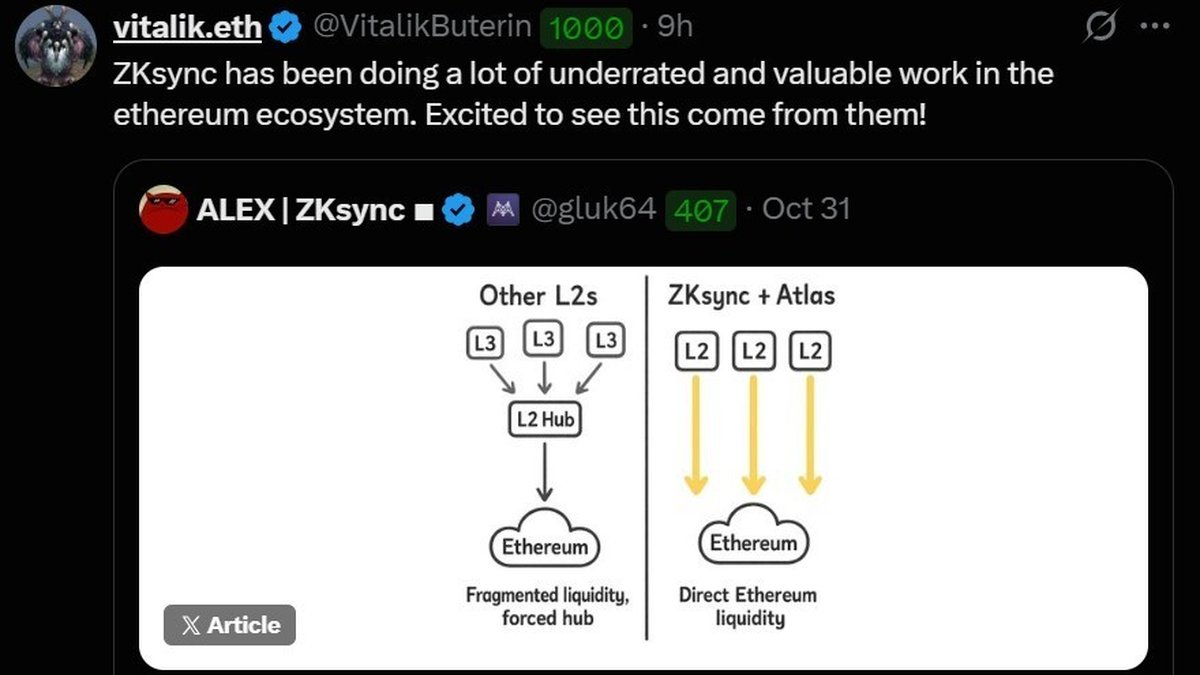

Ethereum’s scaling landscape never sleeps, but the last few days have been especially loud. Vitalik Buterin drew attention to a long essay by zkSync cofounder Alex Gluchowski, spotlighting work the team is doing that he considers underappreciated—and valuable for the broader Ethereum ecosystem. That public nod, in turn, focused market attention on zkSync’s newest milestone: Atlas, an upgrade described as a big jump in throughput and user experience. Independent coverage summarizing Vitalik’s post and the thrust of Gluchowski’s essay made the rounds in crypto media, and it has reframed the conversation from “which L2 is cheapest today?” to “which execution layer will compound advantages for years?”

In parallel, several trackers and news write-ups describe Atlas as introducing a higher-performance sequencer targeting 15,000+ transactions per second (TPS) with fast confirmation times (claims of about a second have circulated), and much lower user fees for common actions. Some outlets even cite higher theoretical benchmarks for native transfers under certain conditions. These are vendor-originated or secondary-source numbers and should be treated as directional rather than guarantees; still, they communicate intent: shrink latency, massively expand headroom, and reduce friction.

Why Vitalik’s Signal Matters (Beyond the Retweet)

Endorsements can be noisy in crypto, but context matters. When Ethereum’s creator elevates a technical roadmap from any L2 team, it does two things. First, it sets a research tone: builders (and funders) notice what problems are being celebrated. Second, it reminds the market that credible neutrality and long-term alignment with Ethereum’s values—open verification, rollup-centric scaling, and a path to decentralization—are as important as short-term gas price screenshots. Vitalik’s highlight explicitly framed zkSync’s work as something many observers undervalue but that is materially helpful to Ethereum’s future. That comment doesn’t crown a winner, but it raises the bar for the entire field.

For teams shipping L2s, the meta-message is clear: performance is necessary; verifiability and credible roadmaps are decisive. Without robust proof systems, transparent resolution logic for cross-chain messaging, and safeguards against sequencer capture, throughput alone doesn’t translate into durable adoption.

Atlas, in Plain English: What’s Being Promised

Atlas—per public write-ups—centers on a higher-throughput sequencer design aimed at reducing end-user wait times and enabling significantly more concurrent activity. Depending on the transaction class, reports cite targets starting at 15,000+ TPS, with faster final confirmations and materially cheaper fees. For routine transfers, some coverage suggests substantially higher theoretical ceilings under specific parameters. Again: these are early, vendor-guided targets, but the goal is unmistakable—push the UX toward web-like immediacy without compromising the core ZK properties.

Why a new sequencer matters: in rollups, the sequencer orders transactions and provides users a sense of liveness—the feeling that your click “took.” If you’ve ever waited on an L2 when activity spikes, you know how quickly patience decays. A faster, more predictable sequencer reduces that pain. Ideally, it should also plug into a roadmap that includes shared sequencing or decentralized sequencing so that no single operator becomes a chokepoint. Atlas speaks to the first half (speed). The second half (decentralization of sequencing and fair ordering) remains the harder, longer arc for every rollup team.

Zero-Knowledge Proofs Are the Feature, Not the Buzzword

zkSync’s north star has always been validity proofs—mathematical guarantees that state transitions are correct. That design choice matters for three reasons:

1. Security inheritance: In a zk rollup, the proof assures Ethereum L1 that a batch is valid. Users don’t have to wait a week for illegal deception windows to expire; they gain confidence from cryptography itself. Fast finality and high safety can coexist.

2. Future data strategies: As data availability (DA) costs dominate the bill, rollups will lean on data compression, blobs, and alternative DA layers without sacrificing safety. ZK proofs travel well across these trade-offs.

3. Composability prospects: In a world of many L2s and app-chains, cross-rollup messaging guarded by ZK proof systems is more composable and less trust-heavy than ad-hoc bridges.

Atlas’s value proposition—if delivered—slots into this philosophy: ZK at the core, UX improvements at the edge. That’s the right ordering.

What the Numbers Don’t Tell You

TPS is a seductive metric. It’s also a trap when divorced from state growth, DA costs, MEV policy, censorship resistance, and sequencer resilience. Here’s a grounded way to interpret the Atlas claims:

- Fast confirmations (≈1 second reports): good for perceived speed; the real win is predictable latency so swaps don’t feel lottery-like during volatility.

- High TPS ceilings: valuable for bursts (mints, on-chain games), but sustainable utility depends on whether fees stay low when blocks fill and whether bottlenecks simply move to the prover or DA layer.

- Fees “near zero” narratives: feasible when DA is cheap (e.g., blob markets are slack) and when transaction types are simple; multi-contract calls under congestion will still cost more. Treat averages and medians differently.

Bottom line: the Atlas story is promising, but real-world tests will come from peak-load weeks—airdrop seasons, hot memecoin cycles, and on-chain gaming surges—not from quiet weeks after an upgrade blog post.

How This Changes the L2 Competitive Board

The market now largely buckets Ethereum scaling into two philosophies: optimistic rollups (e.g., Arbitrum, Optimism) and zk rollups (e.g., zkSync, Scroll, Starknet, Polygon’s zk flavors). Optimistics have enjoyed earlier app liquidity and simpler developer onboarding, while ZK-centric teams argue for cryptographic finality and a better long-term economics story as DA evolves. Vitalik’s signal puts fresh wind behind the latter and challenges every team to prove they can deliver both performance and decentralization—not either/or.

Where could zkSync differentiate if Atlas lands?

- Consumer-grade UX: If sub-second confirmations become the norm and fee outliers remain rare, retail flows (payments, small swaps) become more viable on L2 without off-chain compromises.

- Enterprise & fintech pilots: A credible throughput story helps product teams inside exchanges, wallets, and payment firms green-light on-chain features previously parked for performance fears.

- Cross-rollup coordination: If zkSync pairs speed with robust proofs for messaging, builders gain confidence that composability across chains won’t be a bridge roulette.

What Builders Should Do Right Now

For developers eyeing an L2 home (or hedge), treat the current moment as a chance to run disciplined experiments:

1. Benchmark user flows, not micro-ops. Time the entire path—wallet connect, quote retrieval, signature, inclusion, confirmation, and UI update—under peak and off-peak traffic. TPS charts rarely capture this end-to-end lag.

2. Model DA sensitivity. If your app is chatty (lots of writes), stress your unit economics with different blob prices and calldata assumptions. The cheapest week of the quarter is not your steady state.

3. Probe the sequencer’s behavior. Measure variance and tail latency during known market events. Ask about fair ordering, censorship recourse, and decentralization timelines.

4. Budget for proof latency. A snappy UX with delayed finality can still be okay—if your contracts reflect it (e.g., optimistic UI with reconciliation states).

An Investor’s Lens: Pricing the Narrative Without Paying the Hype Tax

Investors love clean stories: “Vitalik praised it; throughput moon; fees vanish.” Reality is messier—and opportunity often lives in that mess. Here’s a framework for valuation thinking around zkSync-adjacent assets and the broader ZK cohort:

• Active addresses & retention: weekly active users are table stakes; retention cohorts and transactions per active are the alpha.

• Developer pipeline: count funded teams migrating or launching net-new on the chain. Hackathon spikes fade; grants that stick and seed rounds that ship are leading indicators.

• Share of on-chain economic activity: TVL alone is insufficient; examine DEX real volume, perps open interest, NFT secondary royalties, and payments routed through L2.

• Sequencer economics: Who captures it? Is there a path to decentralization of sequencing revenue? Are there credible plans for shared sequencing?

• Data availability spend: Track monthly DA costs and compression wins. A chain that scales users but drowns in DA fees will face rough unit economics if gas markets tighten.

Risks and Open Questions

It’s useful to separate two buckets of risk: product risk (can Atlas consistently deliver the advertised UX under pressure?) and governance risk (does the chain remain credibly neutral as it centralizes performance-critical components?). A few specifics to watch:

- Single-sequencer exposure: Even with backups, a central sequencer remains a failure domain—technical, economic, and political.

- MEV policy: If performance gains increase volume, MEV capture (and who benefits) will loom larger. Fair ordering or MEV rebate programs matter.

- Prover costs and latency: ZK proofs aren’t free. If throughput soars faster than prover efficiency, someone eats that delta—users, the protocol, or both.

- Cross-rollup complexity: As more chains interoperate, the attack surface expands. The best ZK proofs can’t rescue bad bridge design.

How to Tell Hype From Real Usage in the Next 90 Days

If you want a quick dashboard to validate Atlas’s impact, monitor:

- Median and 95th-percentile confirmation times during obvious stress windows (token unlocks, hot mints).

- Fee stability for multi-call transactions (AMM + router + verification) rather than simple transfers.

- Developer migration announcements with code shipping (contracts on mainnet, not just Medium posts).

- Organic retention of users without incentive programs or one-off airdrop quests.

A Quick Reality Check on Sources

Vitalik’s attention to Alex Gluchowski’s long post—and the claim that zkSync’s work is undervalued—was carried by crypto media, including Vietnamese-language coverage summarizing the exchange and its implications. Treat that as a reliable signal of interest, not an official standards document. On the performance front, several sites repeated Atlas targets (15,000+ TPS, ≈1-second confirmations, and much higher transfer ceilings under certain conditions). Those are promises or lab-style benchmarks; they’re not a guarantee of sustained mainnet behavior. Always pressure-test with your own flows.

Scenario Map: 12–18 Months

Bull Case

Atlas-level performance becomes durable; the sequencer decentralization path is credible; DA costs trend down via blobs and compression; a few flagship consumer apps (payments, social, gaming) hit product-market fit on zkSync. zkSync’s share of Ethereum L2 activity rises sustainably, and the chain becomes a default integration for wallets and fintechs targeting low-fee on-chain actions.

Base Case

Performance improves materially but clusters around certain flows; congestion edges still appear during mania weeks; progress on decentralizing critical components is incremental. zkSync grows, but the L2 market remains plural with Arbitrum/Optimism/Lite clients and other ZK teams (Starknet, Scroll, Polygon zkEVM flavors) retaining strongholds. Builders choose chains by audience, not ideology.

Bear Case

Headline numbers don’t translate to real-world UX gains under load; DA costs or prover bottlenecks offset fee savings; a visible outage or controversial resolution event dents trust. Competitors seize the narrative with shared sequencing or superior developer tooling. Users churn to the path of least resistance.

The Takeaway: What to Do With This Information

If you build: prototype on two chains and instrument the full user journey. Pick the chain where your unit economics and latency make sense, not the one with the loudest press cycle. Keep an eye on shared sequencing efforts and messaging standards; those will decide long-term composability more than one-off throughput wins.

If you invest: don’t price TPS; price retention and cost predictability. Focus on DA exposure, proof costs, and the availability of reliable liquidity at the app layer (DEX depth, perps, payments). Reaction rallies will come and go; sticky behavior will outlast them.

If you’re a user: greater speed is coming to Ethereum’s edge. That’s good news. But self-custody discipline, illegal deception scheme awareness, and fee sanity checks still matter. Fast confirmations won’t protect you from a bad signature.

Final Word

Vitalik’s signal and zkSync’s Atlas claims together mark a real moment for ZK rollups. The science is maturing; the product ambition is rising. Whether zkSync ultimately wins share from optimistic rollups or simply forces everyone to raise their game, the beneficiary is the same: the next wave of mainstream users who won’t tolerate clunky, costly experiences. If Atlas turns out to be more than a headline number—if it marks a consistent shift in daily UX—then we’ll look back on this period as one of those quiet turning points where Ethereum stopped being merely programmable, and started feeling instant.

Sources & Notes

- Media coverage of Vitalik’s highlight of Alex Gluchowski’s essay and the idea that zkSync’s work is undervalued within the Ethereum ecosystem.

- Reports on zkSync’s Atlas upgrade, including references to a higher-performance sequencer, 15,000+ TPS targets, ~1-second confirmations, and higher theoretical limits for native transfers under certain conditions. Treat these as vendor/secondary-source claims pending sustained production telemetry.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Performance figures and technical claims referenced from third-party sources are subject to change and should be independently verified in production conditions.