No Buffer Left: The Fed’s Empty Reverse Repo Facility and What It Means for Markets and Crypto

For most of the last three years, an obscure line item on the Federal Reserve’s balance sheet quietly absorbed trillions of dollars in cash: the overnight reverse repurchase agreement facility, usually shortened to RRP. At its peak in 2023, money market funds and other institutions parked more than $2 trillion there each night, earning a risk-free return while the Fed used the program as a tool to tighten financial conditions without directly straining the banking system.

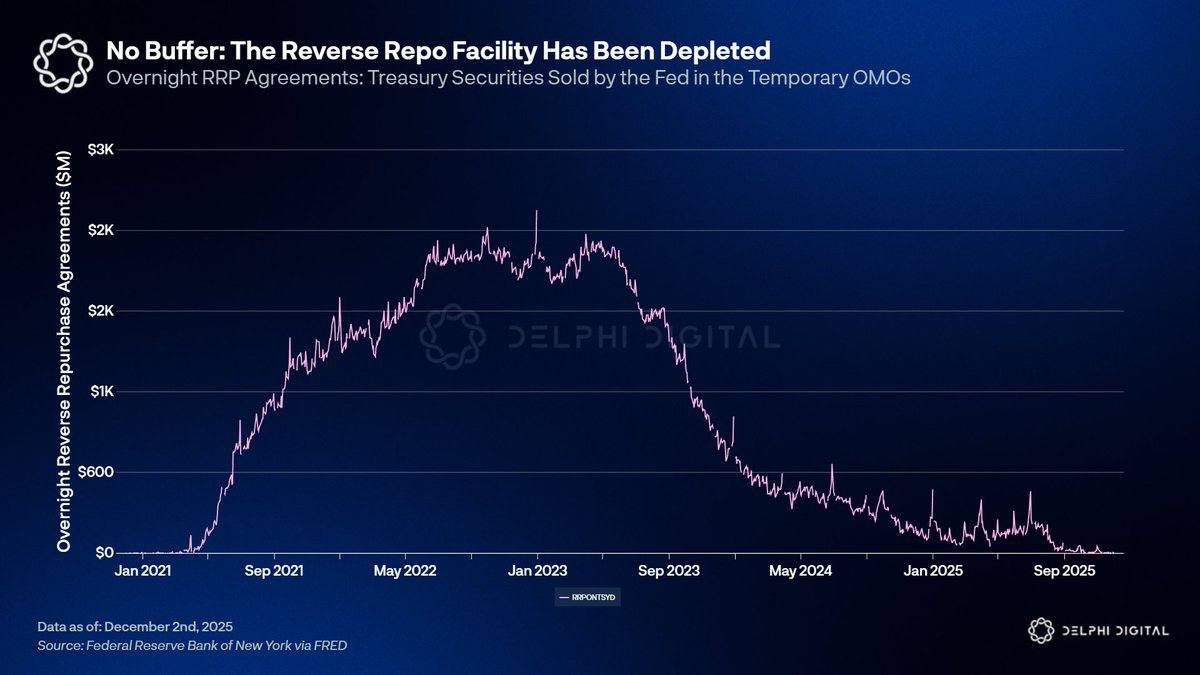

That era is over. As the chart from Delphi Digital highlights, the RRP balance has collapsed from its towering peak to almost zero by late 2025. The buffer is spent. Liquidity that once flowed in a loop between money funds and the Fed has now migrated into Treasury bills, bank deposits and other assets. With quantitative tightening (QT) officially halted and the Treasury General Account (TGA) set to decline, we are entering a very different macro environment from the one that dominated 2022–2024.

This shift matters not only for bonds and money markets but also for risk assets, including digital currencies. When the Fed moves from draining liquidity to adding it, the background conditions for valuation and risk appetite change in subtle but powerful ways.

1. What the Reverse Repo Facility Actually Is

To understand why the depletion of the RRP facility is important, it helps to review how it works. In simple terms, the RRP is a mechanism that allows certain financial institutions—primarily money market funds—to lend cash to the Fed overnight in exchange for Treasury securities as collateral. The Fed pays these lenders a fixed interest rate, and the next day the transaction unwinds.

From the Fed’s perspective, using the RRP facility achieves two goals:

- Draining excess cash. When the financial system is awash with liquidity, the Fed can absorb some of that cash via RRP agreements, reducing pressure on other short-term rates and helping keep its policy rate in the desired range.

- Providing a floor under money-market yields. Because money market funds can always lend to the Fed at the RRP rate, private borrowers must offer at least as much to attract cash. This gives the Fed stronger control over short-term funding conditions.

During and after the pandemic, a combination of large-scale asset purchases and fiscal support left the system with more cash than banks could comfortably absorb. Money funds rotated huge sums into the RRP facility, pushing the balance toward multi-trillion-dollar levels. That cash represented a kind of parking lot for liquidity—a pool of funds that could later be redirected into Treasuries, bank reserves or other assets as conditions changed.

2. How RRP Became a Hidden Liquidity Buffer

When the Fed began shrinking its bond holdings through QT and the Treasury ramped up issuance to rebuild the TGA, many analysts worried that bank reserves would be drained too quickly. Falling reserves can strain the plumbing of the financial system, as seen during the funding stress of September 2019.

Instead, much of the adjustment was absorbed by the RRP facility. As the Treasury issued more short-dated bills at attractive yields, money funds shifted cash out of RRP and into those securities. In effect, the government was able to borrow from investors who had previously been lending to the Fed, without forcing banks to give up additional reserves.

This is why researchers began to talk about the RRP balance as a liquidity buffer. As long as there was still plenty of cash parked at the Fed, the Treasury could issue debt and the Fed could allow its assets to run off, all while keeping bank reserves above the rough comfort zone needed for smooth functioning of money markets.

3. The Chart: From Trillions to Almost Nothing

The Delphi Digital chart captures this whole story in a single line. From early 2021 through mid-2023, the RRP balance climbed steadily from zero to more than $2 trillion, reflecting the flood of post-pandemic liquidity. Then, beginning in the second half of 2023, the line rolled over and headed downhill.

Several forces drove that decline:

- Higher yields on Treasury bills. As the Fed raised rates, short-term government debt became more attractive relative to the RRP rate. Money funds rotated into bills, financing the Treasury directly.

- Ongoing QT. The Fed allowed significant amounts of Treasuries and mortgage-backed securities to run off its balance sheet, which influenced how reserves and RRP balances adjusted.

- Shifts in demand for safe assets. As market volatility ebbed and credit spreads normalised, some investors moved cash out of ultra-short vehicles into longer-duration assets.

By late 2025, the RRP facility was essentially empty. The buffer that once sat between policy decisions and bank reserves no longer exists. From here on, new Treasury issuance or TGA rebuilding is far more likely to translate directly into changes in reserves.

4. Why the End of the Buffer Forces a Choice

With the RRP facility depleted, the system stands at an important crossroads. The Fed and Treasury now face a binary choice whenever they need to fund large deficits or adjust the TGA:

- Allow bank reserves to fall further. If new Treasuries are bought primarily with existing deposits, reserves at the Fed decline. At some point, they could approach the minimum level at which money markets remain stable.

- Expand the Fed’s balance sheet to maintain or increase reserves. This could involve slowing or reversing QT, purchasing assets, or using tools such as repo operations to add reserves directly.

In the past, the RRP facility allowed policymakers to avoid this trade-off; they could draw on parked cash without immediately affecting reserves. That margin of safety is gone. Going forward, the link between government funding needs and bank balance sheets becomes much tighter.

5. Lessons From the 2019 Repo Stress

Why does the level of reserves matter so much? The answer lies in the episode of September 2019, when overnight funding rates suddenly spiked as demand for cash outstripped available supply. At that time, the Fed had already reduced its balance sheet significantly, and reserves had drifted down to levels that turned out to be less comfortable than anticipated.

To stabilise markets, the Fed had to step in with large repo operations and eventually resume net asset purchases. The message was clear: there is a practical lower bound on reserves, even if it is difficult to pinpoint in advance. Letting reserves fall too close to that boundary risks sudden funding stress.

That experience is one reason many analysts, including those at Delphi Digital, believe that if faced with the choice between renewed funding tension and balance-sheet expansion, the Fed will ultimately choose the latter. Financial stability is a core priority, and the costs of brief targeted liquidity support are often viewed as preferable to the risk of a disruptive spike in short-term rates.

6. From Net Drain to Net Injection?

For nearly two years, the macro narrative has revolved around liquidity drain. QT reduced the Fed’s holdings of Treasuries and mortgages; the Treasury rebuilt its cash balance after debt-ceiling episodes; and the RRP facility steadily emptied as cash moved elsewhere. For risk assets, that backdrop acted like a persistent headwind.

The environment now looks very different:

- QT has officially ended. The Fed is no longer shrinking its asset portfolio, removing a major source of mechanical liquidity withdrawal.

- The TGA is expected to decline. When the Treasury spends down its cash balance at the Fed, reserves in the banking system rise, all else equal.

- The RRP buffer is gone. With no more parked cash to drain, any liquidity injected through TGA drawdown or Fed operations flows straight into reserves.

Put together, these elements suggest that marginal liquidity is turning net positive for the first time since early 2022. That does not mean the Fed is launching a full-scale asset-purchase program, but the direction of change has shifted. Instead of squeezing the system, policy is gradually allowing more cash to accumulate in bank reserves and money markets.

7. Why Liquidity Matters for Risk Assets and Crypto

Global liquidity is not a perfect predictor of asset prices, but the relationship is hard to ignore. When central banks add reserves and funding conditions ease, investors often feel more comfortable taking risk. Valuations for equities, credit and digital assets tend to expand during these phases, while liquidity drains have historically coincided with more cautious behaviour.

For digital currencies specifically, the link operates through several channels:

• Portfolio allocation. When yields on cash and short-term bonds fall or stabilise, diversified investors may allocate a small share of capital to alternative assets such as Bitcoin or ether, especially if they view them as long-term diversifiers.

• Derivative and funding conditions. Easier dollar liquidity often shows up as lower funding costs for market-making and hedging, which can support deeper order books and tighter spreads.

• Stablecoin usage. Many stablecoins are backed by US Treasuries and dollar deposits. A friendly rate and liquidity environment improves the economics of issuing and holding these instruments, which in turn supports on-chain activity.

None of this guarantees a straight line up for prices. Macro shocks, regulatory developments or project-specific setbacks can easily overwhelm the effect of gradual changes in liquidity. Still, when one of the main macro headwinds of the past two years—persistent central-bank drainage—begins to fade, it is reasonable to say that the background environment for digital assets is becoming less hostile.

8. A Fading Source of Selling Pressure

Another way to frame the RRP story is through the lens of who has been selling what to whom. During the tightening phase, the combination of QT and large Treasury issuance effectively required private investors to absorb more government bonds. Some of that absorption came from RRP balances, but as those balances fell, investors also reallocated from other assets.

For multi-asset portfolios, this often meant trimming risk positions to make room for safe bonds with attractive yields. Digital currencies, as one of the more volatile segments of the market, can be particularly sensitive to that kind of top-down allocation shift.

As the need for incremental absorption declines—because QT has stopped and the Treasury has more flexibility to manage the TGA—this forced rebalancing becomes less intense. The absence of new pressure can be almost as important as the arrival of fresh demand. In other words, a key structural seller in the system (the combination of QT and heavy issuance) is stepping back, removing one layer of downward pressure from the macro stack.

9. What to Watch Next

Understanding the end of the RRP buffer is only the first step. For readers who want to follow liquidity conditions more closely, a few indicators are worth keeping on the radar:

• Bank reserves at the Fed. Weekly data show how much cash banks hold on deposit with the central bank. A sustained rise would confirm that liquidity is indeed flowing back into the system.

• The TGA balance. Declines in the Treasury’s cash account typically correspond to net injections of reserves, while large increases can temporarily drain liquidity.

• Short-term funding rates. Metrics such as the secured overnight financing rate (SOFR) can signal whether funding stress is emerging. Persistent spikes would hint that reserves are still uncomfortably low.

• Market-based indicators of risk appetite. Credit spreads, equity implied volatility and on-chain stablecoin flows all provide complementary perspectives on how investors are responding to the changing environment.

For digital-asset observers, combining these macro indicators with on-chain data—such as exchange balances, long-term holder behaviour and ETF flows—can offer a richer view of how macro liquidity translates into actual capital movement within the crypto ecosystem.

10. A Balanced Takeaway

The depletion of the Fed’s reverse repo facility is not a dramatic headline event, but it marks a genuine turning point in the mechanics of US dollar liquidity. The buffer that once allowed policymakers to drain trillions from their balance sheet without directly squeezing bank reserves has been used up. From here on, large funding needs will either push reserves lower—raising the risk of funding stress—or nudge the Fed toward balance-sheet expansion.

Given the painful experience of 2019 and the central bank’s emphasis on orderly markets, many analysts judge that some form of renewed liquidity provision is the more likely path. When combined with the end of QT and a prospective decline in the TGA, this points toward a gradual shift from net liquidity withdrawal to net liquidity addition.

For investors in both traditional and digital assets, the most important implication is that a major macro headwind is weakening. Easier liquidity does not remove risk, nor does it guarantee steady gains. It does, however, change the tone of the conversation: from one dominated by 'how long can markets withstand tightening' to one that asks 'how will markets respond as conditions slowly ease.'

In that sense, the story of the now-empty RRP facility is less about a single chart and more about the direction of policy. After two years of focusing on how much liquidity the Fed was removing, analysts now have to ask how, when and under what conditions it will add liquidity back. Digital-asset markets, which have grown increasingly intertwined with global funding cycles, will be watching closely.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice and should not be treated as a recommendation to buy, sell or hold any asset. Economic conditions and digital-asset markets can change rapidly and involve significant risk, including the possible loss of capital. Readers should conduct their own research and consider consulting qualified professionals before making financial decisions.