MicroStrategy, Fidelity and the Rise of Bitcoin as Institutional Collateral

Few companies have shaped the Bitcoin narrative as strongly as MicroStrategy and its long-time executive chair, Michael Saylor. Since 2020, the firm has steadily converted both equity and debt capital into BTC, positioning itself as a kind of publicly listed reserve vehicle. The latest chapter in that story is not about another headline-grabbing purchase, but about where those coins now live and how they might be used.

Over the past 48 hours, MicroStrategy reportedly transferred another 11,642 BTC—roughly $1 billion at recent prices—into custody with Fidelity. That brings the total amount the company has moved to the custodian to around 177,351 BTC, or about $16.5 billion. Once inside Fidelity’s combined custody system, these coins are held alongside those of other institutional clients. From the perspective of on-chain analytics, roughly 27% of the company’s stack is now pooled and no longer visible as a clearly traceable set of addresses.

This shift has sparked a wave of commentary. Some observers see it as the early stage of a new, collateral-driven Bitcoin cycle—one where large pools of capital hold BTC not only as a treasury asset, but also as funding collateral that can support borrowing, structured products and new forms of credit. Others caution that opacity brings its own risks and that no entity, however committed, can be assumed to hold forever.

In this article, we unpack what MicroStrategy’s move actually means, how omnibus custody changes the way supply looks on-chain, and why the idea of a “bull run without visible FOMO” is gaining traction among market-structure analysts.

1. What Exactly Did MicroStrategy Do?

Until recently, a large portion of MicroStrategy’s Bitcoin holdings could be tracked directly on the blockchain. On-chain researchers had tagged specific addresses associated with the company, allowing them to monitor inflows, outflows and wallet re-organisation in almost real time.

The recent transfers mark a gradual transition away from that model:

- New transfer: Around 11,642 BTC were moved in the last two days from company-controlled addresses to a Fidelity-managed custody setup.

- Cumulative transfers: Across several waves, the total now stands near 177,351 BTC held with the custodian.

- Omnibus custody: Fidelity operates what is often called a combined or omnibus custody system. Client coins are segregated in legal terms, but technically pooled at the address level, making it difficult to distinguish which specific coins belong to which client when viewing the blockchain.

From MicroStrategy’s balance-sheet perspective, nothing fundamental has changed: the company still owns the same number of BTC. From an on-chain perspective, however, the footprint looks very different. Where analysts previously saw large, clearly labelled corporate wallets, they now see part of that stack disappear into addresses that simply read as 'Fidelity' or, in many cases, are not labelled at all.

2. How Omnibus Custody Hides (But Does Not Delete) Supply

It is important to be precise about what “27% invisible” really means. The coins have not vanished, and they are not inaccessible. Instead, they have moved from transparent, entity-linked wallets into a custodial structure where individual client positions are tracked off-chain in internal ledgers.

Several implications follow from this change:

• Reduced on-chain traceability. Analysts can no longer confidently say, 'This address belongs to MicroStrategy' for that portion of the holdings. Instead, they see only that Fidelity as a whole manages a certain aggregate balance.

• Lower visibility into flows. Future reallocations—such as pledging coins as collateral, moving them between internal sub-accounts or using them in structured financing—may not generate obvious on-chain signals. Many of these operations occur within the custodian's internal systems.

• Perception of tighter free float. When coins move into long-term institutional custody, market participants often treat them as effectively removed from day-to-day trading. While they could be sold, the operational and governance processes around such decisions tend to be slower and more deliberate than those of a typical trading wallet.

This is what commentators mean by a decline in effective free-float supply. The total number of BTC in existence has not changed, but the portion that is actively circulating on exchanges or in self-custodied wallets—where it can be quickly traded—is arguably shrinking.

3. From Hoarding to Collateral: A New Use Case for Corporate BTC

Why move coins into a large custodian at all? One obvious answer is operational safety: regulated institutions often have mature security, insurance and compliance frameworks that can be attractive to public companies. But there is another, more strategic reason: collateralisation.

In traditional finance, high-quality assets such as government bonds are routinely used as collateral to secure lending, derivatives positions and short-term funding. The vision emerging around Bitcoin is that large, well-custodied BTC holdings could play a similar role:

• Secured credit lines. A firm with sizable BTC reserves could borrow dollars or other currencies against those holdings instead of selling them, using the borrowed funds for acquisitions, buybacks or further BTC purchases.

• Structured products. Institutions might create notes, swaps or other instruments where Bitcoin collateral underpins payoff obligations, again relying on robust custody.

• Interbank and repo-style markets. Over the longer term, if enough institutions hold BTC with trusted custodians, the asset could form part of a collateral pool for secured lending between banks or broker-dealers.

Moving coins into Fidelity is therefore a step toward treating Bitcoin not just as a static treasury reserve, but as a productive balance-sheet asset. The narrative some analysts emphasise is that MicroStrategy is positioning its holdings so they can be used in this way at global scale.

4. Why “They Don’t Sell, They Borrow” Changes Market Dynamics

A core claim in the recent commentary is that once institutions custody BTC with firms like Fidelity, they are less inclined to sell. Instead, they may borrow against their holdings to unlock liquidity while maintaining long-term exposure.

This dynamic, if it becomes widespread, could reshape the character of future Bitcoin cycles:

• Smoother supply profile. If large holders prefer collateralised borrowing to outright sales, fewer coins might hit the market during routine volatility. That could dampen some of the more extreme intraday swings that historically accompanied big sell decisions.

• Quiet leverage build-up. At the same time, borrowing against BTC introduces leveraged exposure into the system, but in a way that is much less visible than open-interest charts on futures venues. The leverage sits on balance sheets and within credit facilities, not only on exchanges.

• More persistent demand from institutions. When long-term strategic holders view Bitcoin as core collateral, they may be less sensitive to short-term price corrections. Their decision horizon is measured in years, not weeks.

From a price-action perspective, this is often described as a 'bull run of locked supply'. Rather than a classic pattern where retail enthusiasm chases price higher on exchanges, the thesis is that structured buying by large institutions gradually tightens available supply while leverage is added via credit channels instead of margin platforms.

5. The Role of Opacity: Why an “Invisible” 27% Matters

The idea that roughly 27% of MicroStrategy’s holdings are now effectively 'off-chain' (in the sense of being pooled within a custodian) resonates with a broader concept in market structure: opacity. When less of the critical activity is visible in public data, external observers must infer more from indirect indicators.

Historically, several major Bitcoin advances have been preceded by phases where supply looked unusually tight:

- Exchange reserves trended lower as coins moved into cold storage.

- Long-term holder metrics rose, indicating reduced spending from older wallets.

- On-chain flows between large entities slowed, suggesting that strategic positions were being locked in.

What is different now is that part of this tightening no longer shows up as clearly in on-chain data. Coins inside omnibus custodians may be legally long-term holdings, but they do not always register in traditional metrics such as 'long-term holder supply' or 'exchange balances' in an intuitive way. The result is a phase where:

- Traders overestimate how much liquid BTC is truly available, because a meaningful slice is in deep custody or pledged as collateral.

- Historical models based on publicly visible wallet clusters may understate the concentration of supply in institutional hands.

Analysts who describe this as an 'opacity stage' argue that large bull markets often emerge from precisely such conditions: when structural tightness meets renewed demand, but the full extent of that tightness is not widely appreciated.

6. Why This Bull Phase May Differ From Past Retail-Led Rallies

Bitcoin’s earlier cycles were dominated by visible retail behaviour: exchange sign-up spikes, social-media surges and bursts of interest from smaller investors. If the current cycle evolves into a collateral-driven phase, the texture could look quite different.

Several contrasts stand out:

• Participants. Large asset managers, corporate treasuries and private banks are now meaningful actors. Their strategies tend to be slower, more rules-based and more focused on risk budgeting than on short-term speculation.

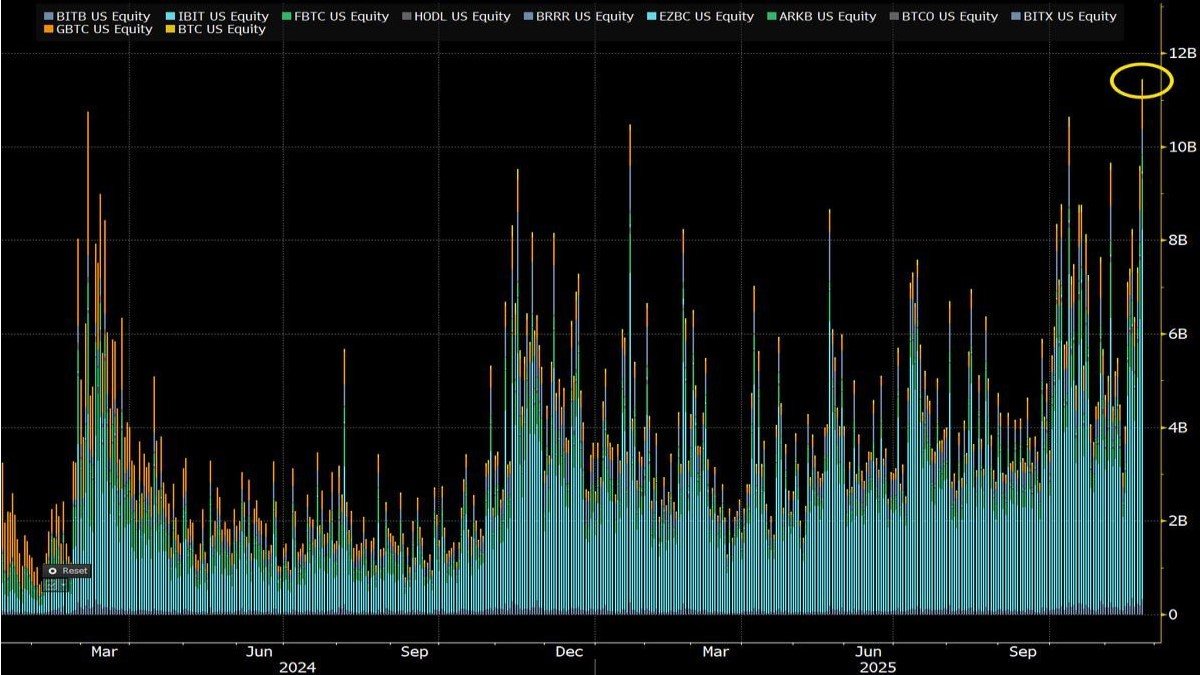

• Channels. Instead of buying directly on retail exchanges, many institutions allocate via ETFs, trusts, custodial accounts and credit facilities. Flows are routed through desks that manage execution over days or weeks.

• Instruments. Rather than using high-leverage perpetual futures, institutions may prefer borrowing at conservative loan-to-value ratios with robust margining and legal frameworks.

This does not mean volatility disappears—Bitcoin is still a scarce, freely traded asset—but it does suggest that the drivers of each leg up or down may be different. Where previous rallies were heavily influenced by retail enthusiasm, future moves could be shaped by balance-sheet decisions, collateral policies and regulatory changes.

7. Risks and Caveats: Why 'They Will Never Sell' Is Too Strong

Amid the excitement about locked supply and global collateral, it is important to stay grounded. There are several reasons to be cautious about assuming that institutional holdings are permanently off the market.

• Risk management can change. If macro conditions shift dramatically or if regulatory requirements tighten, boards and risk committees may decide to reduce BTC exposure, even for firms that have been strong advocates.

• Collateral can be liquidated. Loans backed by BTC come with covenants. In severe stress scenarios, lenders may require additional collateral or, in the extreme, liquidate part of the position to protect their own balance sheets.

• Concentration risk. When very large pools of Bitcoin are controlled by a handful of entities—whether companies, funds or custodians—outsiders need to pay attention to governance quality, security practices and transparency.

• Information asymmetry. Institutions and custodians have more detailed, real-time information about flows than retail participants. While this is normal in finance, it makes it even more important to avoid treating partial public data as a complete picture.

For these reasons, the most responsible stance is to view MicroStrategy’s move—and similar actions by other institutions—as structurally significant, but not as guarantees of a one-way market.

8. How Investors Can Read These Developments in a Brand-Safe Way

For readers who follow Bitcoin from the sidelines or hold a diversified portfolio, the headline about 177,351 BTC under Fidelity’s combined custody may sound abstract. Here are a few practical, educational takeaways:

1. Understand the difference between total supply and effective free float. The 21-million-coin cap is fixed, but the share that is actively traded can fluctuate as coins move into long-term custody or collateral roles.

2. Recognise the limits of on-chain analysis. Tools that cluster addresses and track flows are powerful, but they become less informative when a growing share of holdings sits inside pooled custodians.

3. Watch disclosure from institutions and custodians. Quarterly filings, audited reserves reports and risk-management policies are increasingly important sources of information about where large pools of BTC reside and how they might be used.

4. Be mindful of leverage, even when you cannot see it directly. Borrowing against BTC at low loan-to-value ratios can be relatively conservative, but aggregate leverage across many institutions still matters for systemic risk.

5. Align any personal allocation with your time horizon and risk tolerance. Institutional behaviour can inform the global narrative, but it should not replace careful consideration of one’s own financial situation.

9. Conclusion: A Quiet Step Toward a Collateral-Based Bitcoin Era

MicroStrategy’s decision to move another 11,642 BTC into Fidelity custody is more than a technical wallet update. It is part of a broader evolution in how large institutions hold and potentially deploy Bitcoin. With roughly 177,351 BTC now sitting in a combined custodial structure, a meaningful fraction of the company’s holdings has shifted from public on-chain visibility to an institutional environment designed for long-term storage and collateral use.

Whether this proves to be the opening chapter of a new, collateral-driven bull phase remains to be seen. What is clear is that the market’s plumbing is changing. Free-float supply appears to be tightening even as ETFs, corporates and asset managers continue to accumulate. Leverage is increasingly being introduced through balance-sheet borrowing rather than only through exchange-listed futures. And some of the most important decisions about Bitcoin’s role in portfolios are now being made in boardrooms and risk committees, not just in online forums.

For observers, the challenge is to integrate these structural shifts into their understanding of the asset without over-interpreting any single move. The combination of reduced on-chain visibility, deeper institutional custody and emerging collateral markets may well support Bitcoin’s long-term case—but it also calls for careful analysis, attention to risk and a healthy respect for uncertainty.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold Bitcoin or any other digital asset. Digital-asset markets are volatile and can involve significant risk, including the possibility of total loss. Readers should conduct their own research and, where appropriate, consult qualified professionals before making any financial decisions.