When the Biggest Solana Treasury Is 45% Underwater: What This Drawdown Really Tells Us

According to data attributed to on-chain analytics trackers such as Look On Chain, the largest known Solana treasury in the world – managed by a fund identified as Forward Industries – is now sitting on a very uncomfortable drawdown. The wallet reportedly accumulated around 6,834,000 SOL at an average price close to $232 per token. With Solana currently trading well below $130, that position is down roughly 45%, implying an unrealised loss in the vicinity of $700 million based on the figures you provided.

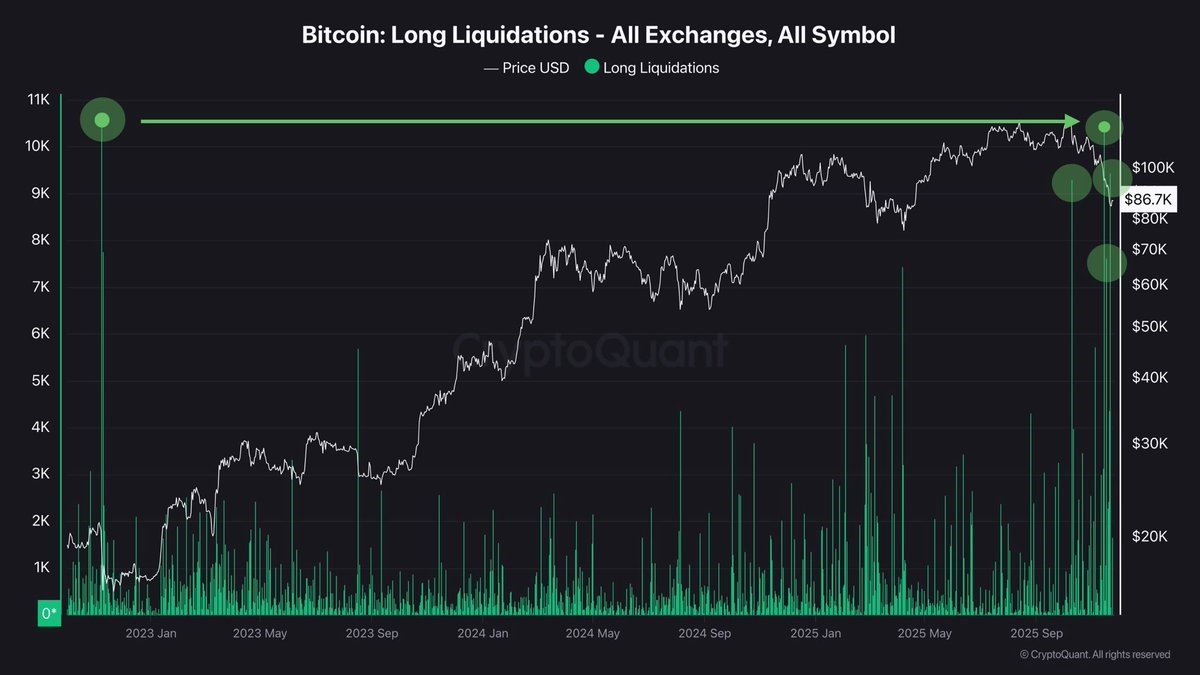

In the same turbulent market, MicroStrategy’s famous Bitcoin treasury – once showing an unrealised profit of about $20 billion – has seen its paper gains shrink to roughly $6 billion. The numbers themselves may evolve as prices move, and we cannot independently verify every dollar here, but the contrast is clear: Bitcoin and a major altcoin like Solana do not respond in the same way when risk comes off the table.

This is more than just a story about one unlucky fund. It’s a live stress test of several narratives that have dominated the last cycle: “institutions can’t be wrong”, “Layer-1 blue chips are the new Bitcoin”, and “on-chain smart money always knows better than retail”. A professional analysis has to go deeper than pointing at a big red PnL number, so let’s unpack what is actually happening.

1. From MicroStrategy’s Bitcoin Playbook to Solana’s High-Beta Experiment

Ever since MicroStrategy started converting its corporate cash into Bitcoin back in 2020, the idea of “crypto as a treasury asset” has moved from fringe thought experiment to boardroom talking point. The thesis was simple: Bitcoin, with its fixed supply and growing institutional acceptance, could act as a kind of programmable digital gold on a corporate balance sheet.

That narrative worked spectacularly well when prices trended up. MicroStrategy’s average cost basis stayed comfortably below spot for long stretches of time, which allowed the company and its shareholders to tolerate wild volatility. Even after sharp corrections, the position often remained in profit, at least on paper. Importantly, Bitcoin’s depth of liquidity and relatively predictable halving cycles gave the impression – sometimes justified, sometimes optimistic – that time was on the company’s side.

Forward Industries’ Solana speculative position is, in many ways, the same playbook executed on a different asset. Instead of Bitcoin as a macro monetary speculative position, Solana represents a high-performance smart-contract ecosystem: fast block times, low fees, a thriving meme and DeFi culture. For several quarters it looked like one of the clearest “beta plays” on the entire crypto market. If Bitcoin went up 2x, SOL sometimes went up 4x or more.

But leverage works both ways. The same characteristics that make an alt-L1 run harder in a bull market – thinner order books, higher speculative participation, more reflexive narratives – also make it bleed faster in a downturn. Treasuries that overweight such assets are effectively leveraging their equity to buy volatility. That can pay off brilliantly… until it doesn’t.

2. Anatomy of a 45% Drawdown

Let’s walk through what those headline numbers actually mean. Buying 6.834 million SOL at an average of $232 implies a notional cost of roughly $1.58 billion. At a current market price under $130, the position is worth around $0.89 billion, leaving an unrealised gap of just under $700 million. In percentage terms, that is a loss of about 45% on the principal allocated to this single asset.

Several important points are often missed when these figures get passed around social media:

• This is unrealised PnL. Forward Industries has not necessarily sold. A deep drawdown is painful, but as long as the fund can meet its obligations, PnL is a mark on a screen, not a margin call.

• The cost basis is concentrated. Accumulating the bulk of a treasury at triple-digit prices near cycle highs means the entire performance profile hinges on the asset reclaiming and exceeding those levels. There is little benefit from early, cheap accumulation.

• The opportunity cost is huge. Capital tied up in a 45% underwater position could otherwise have been rotated into less volatile instruments, or even into Bitcoin during cheaper periods.

The comparison with MicroStrategy is illuminating. Even after the latest correction, the company’s Bitcoin holdings are reportedly still in aggregate profit, just a much smaller one than at the peak. Its cost basis was built over several years, including during deep bear-market periods where BTC traded at a fraction of current prices. Forward’s Solana treasury, by contrast, looks much more like a late-cycle, momentum-driven accumulation than a methodical, multi-year dollar-cost averaging strategy.

3. Bitcoin vs. Altcoins: Why the Same Storm Hits So Differently

The Solana treasury’s drawdown is a live case study in the structural differences between Bitcoin and large altcoins.

3.1 Liquidity and market depth

Bitcoin trades across every major exchange, is embedded in large spot ETFs and is accepted as collateral in countless lending arrangements. Order books are deep, derivatives markets are liquid, and there are always multiple classes of participants – from miners to sovereign funds – with long-term reasons to accumulate.

Solana does have strong liquidity for an altcoin, but its market depth is still a fraction of Bitcoin’s. When the broader market flips from euphoria to risk-off, there are simply fewer natural buyers ready to catch large sell orders without meaningful price impact. That amplifies moves in both directions.

3.2 Narrative resilience

Bitcoin’s narrative is remarkably narrow: digital scarcity, censorship resistance, long-term store of value. As long as the network keeps producing blocks and the halving cycle remains intact, the story largely survives macro shocks.

Altcoins – especially Layer-1s – have to juggle multiple narratives at once: performance, developer traction, DeFi TVL, NFT culture, ecosystem grants, and so on. When prices fall, it is not just a question of “do I still believe in sound money?” but “do I still think this chain will outcompete the other 20 smart-contract platforms for the next decade?”. That extra layer of uncertainty makes conviction harder to hold in deep drawdowns.

3.3 Regulatory and institutional positioning

Bitcoin now sits at the centre of spot ETF markets, corporate balance sheets and even sovereign reserves. Regulatory stances differ across jurisdictions, but BTC enjoys a de facto status as the flagship digital asset. That does not make it safe, but it does give large allocators more confidence that their investment will not suddenly be declared radioactive.

Solana, while increasingly accepted, still lives in a more ambiguous category for many institutions. That means some treasuries and funds are willing to hold BTC through painful volatility but treat SOL as a tactical, high-beta allocation they can cut quickly if macro or regulatory risk increases.

4. The Myth of Infallible Institutional “Smart Money”

One of the most valuable aspects of public blockchains is radical transparency. Anyone can inspect a treasury wallet, reconstruct its trading history and estimate its cost basis. Tools like Look On Chain have turned that into a spectator sport, with colourful dashboards that label certain wallets as “funds”, “whales” or “smart money”.

There is, however, a psychological trap in this. Seeing a multi-hundred-million-dollar wallet accumulate an asset at high prices easily creates the impression that “they must know something we don’t”. Many retail investors treat these wallets as oracles and mirror their moves – often at even worse risk-reward levels.

The Forward Industries Solana treasury is an uncomfortable reminder that institutions are not omniscient. They are just participants with more capital, more complex constraints and, sometimes, more pressure to chase narrative trades late in the cycle. Large size does not immunise anyone from buying high and sitting on heavy paper losses.

For a research-driven publication, this is a key takeaway: on-chain data is a powerful input, but it should never replace independent analysis. Watching treasury flows can help us decipher positioning and sentiment, but it does not automatically tell us which trades are wise.

5. Lessons for Corporate Treasuries Using Volatile Assets

Beyond Solana itself, the Forward Industries drawdown raises serious questions for any company or fund considering a crypto-heavy treasury strategy.

5.1 Concentration risk

Allocating a billion-dollar portfolio heavily into a single altcoin – even one as established as Solana – is essentially a speculative position on idiosyncratic technology and ecosystem risk. Bugs, outages, regulatory scrutiny of specific DeFi apps, or a shift in developer culture can all hit the price independent of Bitcoin or macro conditions.

By contrast, treasuries anchored in Bitcoin are more directly exposed to macro factors (liquidity cycles, interest rates, ETF flows) and less to the competitive dynamics of smart-contract platforms. That does not make them low-risk, but they are vulnerable to a different, arguably more manageable, set of variables.

5.2 Entry strategy and cost basis

A disciplined treasury strategy tends to spread purchases over long periods, including during painful bear markets. If a treasury only becomes aggressive when an asset is trading near all-time highs and social media is euphoric, it is effectively front-running its own risk management.

In practical terms, this means:

- Setting predefined allocation bands (for example, “crypto exposure will not exceed 10–15% of total assets”).

- Defining time-based accumulation plans rather than impulse buys driven by headlines.

- Being explicit about what level of drawdown is tolerable before governance or creditors start asking difficult questions.

5.3 Hedging and optionality

Some treasuries use derivatives to hedge downside risk or to lock in partial profits when prices extend far above their base case. That can be expensive and imperfect, but it often makes the difference between a manageable equity drawdown and a full-blown solvency scare.

In the case of a concentrated SOL position, even simple overlays – such as buying protective puts during periods of extreme optimism – could have significantly reduced the current unrealised loss. The trade-off, of course, is that hedging also caps upside and requires active risk management capabilities that many corporate treasuries simply do not have.

6. What This Means for Individual Investors

For everyday market participants, the story of a giant Solana treasury sitting 45% underwater should not be a reason for schadenfreude. It should be a mirror.

Many retail traders followed a similar pattern in this cycle: rotating profits from Bitcoin or cash directly into high-beta altcoins late in the uptrend, convinced that institutional participation had made everything “safer”. The current drawdown shows that even the largest players are subject to the same human biases: overconfidence during euphoria, underestimation of tail risk, reluctance to realise losses.

There are several practical lessons here:

• Blueprints matter more than badges. A strategy is not sound just because a well-capitalised fund executed it. What matters is the underlying logic: diversification, time horizon, liquidity profile and exit plan.

• Altcoins are leverage on Bitcoin, not a substitute for risk management. Treating SOL, or any other L1, as a direct replacement for BTC in a conservative treasury is a category error. The risk profile is simply not the same.

• On-chain transparency is a tool, not a signal to copy trades. Watching whale wallets can highlight interesting themes, but blindly mirroring those moves usually means buying late and selling early.

7. Outlook: Is This a Death Knell for Solana Treasuries?

Does a 45% unrealised loss mean that using Solana as a treasury asset is inherently flawed? Not necessarily. High drawdowns are part of the territory in crypto. What matters is whether the underlying network continues to attract developers, users and liquidity – and whether treasuries calibrate their risk accordingly.

If Solana’s ecosystem continues to deepen – more real-world assets bridged, more order-book DEXs, more consumer apps – then a large, early treasury position could still look attractive in hindsight. Conversely, if activity migrates to other chains or to Bitcoin-centric L2s, this episode may be remembered as a cautionary tale about chasing the hottest L1 narrative at scale.

For now, the main conclusion is more modest: crypto treasuries are experiments in live portfolio theory. Some, like MicroStrategy’s BTC strategy, have so far navigated volatility with their thesis intact. Others, like Forward Industries’ SOL speculative position, are being stress-tested in real time. Both cases provide invaluable data for the next wave of institutions that will inevitably consider adding digital assets to their balance sheets.

Conclusion

The largest known Solana treasury sitting nearly half underwater is not just a piece of gossip for Crypto Twitter. It is a sharp reminder of the structural differences between Bitcoin and high-beta altcoins, the limits of institutional foresight, and the importance of sober risk management in an industry that still runs, too often, on momentum and memes.

From a professional research standpoint, the key message is simple: size does not equal safety. Whether you are a multi-billion-dollar fund or a retail investor with a four-figure portfolio, the principles are the same – diversify intelligently, understand what you own, and never outsource conviction to a wallet address on a blockchain.

Disclaimer: This article is based on the figures and context you provided and may refer to events after our latest training data. We cannot independently verify every number in real time. The analysis is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are highly volatile and you can lose the entire amount invested. Always conduct your own research and consider consulting a qualified professional before making financial decisions.