Tether’s Third “8,888 BTC” Purchase: A Ritual, a Risk Choice, or a Balance-Sheet Signal?

On the first day of 2026, a familiar number circled back into crypto’s conversation: 8,888. Reports tied to CEO Paolo Ardoino’s public comments suggest Tether added roughly that amount of Bitcoin in Q4 2025. In isolation, it’s just another treasury update. In sequence, though, the repetition becomes the story—because patterns change how markets interpret intent, and intent changes how markets price risk.

This is not a piece about whether Bitcoin will go up or down next. Instead, it’s about how a stablecoin issuer’s reserve behavior can quietly reshape expectations across liquidity, transparency, and trust. When a company that sits close to the center of crypto settlement keeps buying the same round number, the interesting question is no longer “how much,” but “what kind of institution is it trying to become?”

1) What was reported (and what counts as evidence)

The Q4 2025 claim—Tether adding about 8,888 BTC—has circulated through industry reporting and market summaries. Importantly, these writeups tend to rely on a mix of public statements, on-chain labeling (e.g., addresses tagged as reserves), and the timing of large transfers. That blend can be directionally informative, but it also means the confidence level is not the same as an audited financial statement.

Still, the repeating pattern is not invented out of thin air. A similar “8,888 BTC” narrative appeared earlier in 2025, and again around the end of Q3 2025 where on-chain analysts pointed to a transfer of ~8,888.88 BTC into a wallet labeled as Tether’s bitcoin reserves. Even then, some coverage explicitly noted that Tether had not publicly confirmed the acquisition at the time—an important nuance when separating “observed on-chain movement” from “official treasury purchase.”

A quick timeline (reported / observed):

| Quarter | Reported / Observed BTC Amount | How it was discussed publicly |

|---|---|---|

| Q1 2025 | ~8,888 BTC | Covered as a quarterly addition consistent with Tether’s reserve strategy |

| Q3 2025 | ~8,888.88 BTC | On-chain analysts pointed to a transfer into a wallet labeled as reserves; some reports noted no immediate public confirmation |

| Q4 2025 | ~8,888.8 BTC | Reported as another quarter-end addition, linked to CEO commentary and reserve tallies |

Even if you treat each line item with healthy skepticism, the broader signal is clear: Tether wants the market to understand it as a repeat buyer. And in finance, being a repeat buyer is not just a fact—it’s a role. Roles come with expectations.

2) Why “8,888” keeps appearing

In markets, repetition is never neutral. When the same number appears three times in one year, readers inevitably ask whether it’s coincidence, convenience, or communication. The simplest explanation is operational: a stable allocation process might produce similar outcomes quarter after quarter, especially if purchases are derived from a policy formula (profits, buffers, or a target percentage).

But the more interesting explanation is behavioral: a repeated number can also function as a signature. A signature is not necessarily deception; it can be branding in the plainest sense—making the action recognizable, easy to retell, and difficult to confuse with someone else’s. In a market that rewards narrative clarity, “8,888 again” travels faster than “a variable amount based on internal treasury decisions.”

Three non-exclusive interpretations keep the analysis grounded:

• Policy outcome: The number may be the byproduct of a recurring allocation rule, where the same inputs (or similar profits) produce similar outputs over time.

• Communication design: The number may be chosen for memorability—an easy breadcrumb for the market to connect quarter to quarter without reading footnotes.

• Timing discipline: Quarter-end actions can align with reporting cycles, treasury rebalancing, and internal controls. Consistency can be a feature when the institution is trying to appear methodical rather than reactive.

Notice what’s missing: none of these interpretations require grand conspiracy. They only require recognizing that institutions, like people, often prefer routines—especially when routines reduce misunderstandings.

3) The treasury engine behind periodic BTC accumulation

To understand why quarterly accumulation is plausible, you have to step away from the trading chart and into the logic of corporate reserves. Tether previously described a plan to allocate up to a portion of net realized operating profits toward purchasing Bitcoin on a regular basis. Whether or not every observed transfer perfectly maps to that plan, the existence of an articulated policy changes the baseline expectation: “periodic BTC buying” becomes consistent with stated strategy rather than a surprise impulse.

When a stablecoin issuer earns significant revenue from reserve management, its treasury starts to resemble a conservative financial institution in cashflow behavior, even if its user base lives on crypto rails. In that setup, a periodic conversion of a slice of profits into a long-duration, volatile asset (Bitcoin) looks less like day trading and more like a deliberate diversification decision.

That diversification comes with a trade-off that doesn’t fit in a headline:

• Benefit: A BTC position can act as a long-term strategic reserve and a public signal of alignment with crypto-native values.

• Cost: BTC is not a cash equivalent. In stress scenarios, liquid reserves matter more than ideological coherence. The larger the volatile slice becomes, the more important it is that the liquid slice remains demonstrably robust.

The best way to read this, educationally, is not “good” or “bad,” but “a specific style of balance-sheet management.” In 2026, that style will increasingly be judged by transparency practices, not by slogans.

4) Market structure: predictable buyers and second-order effects

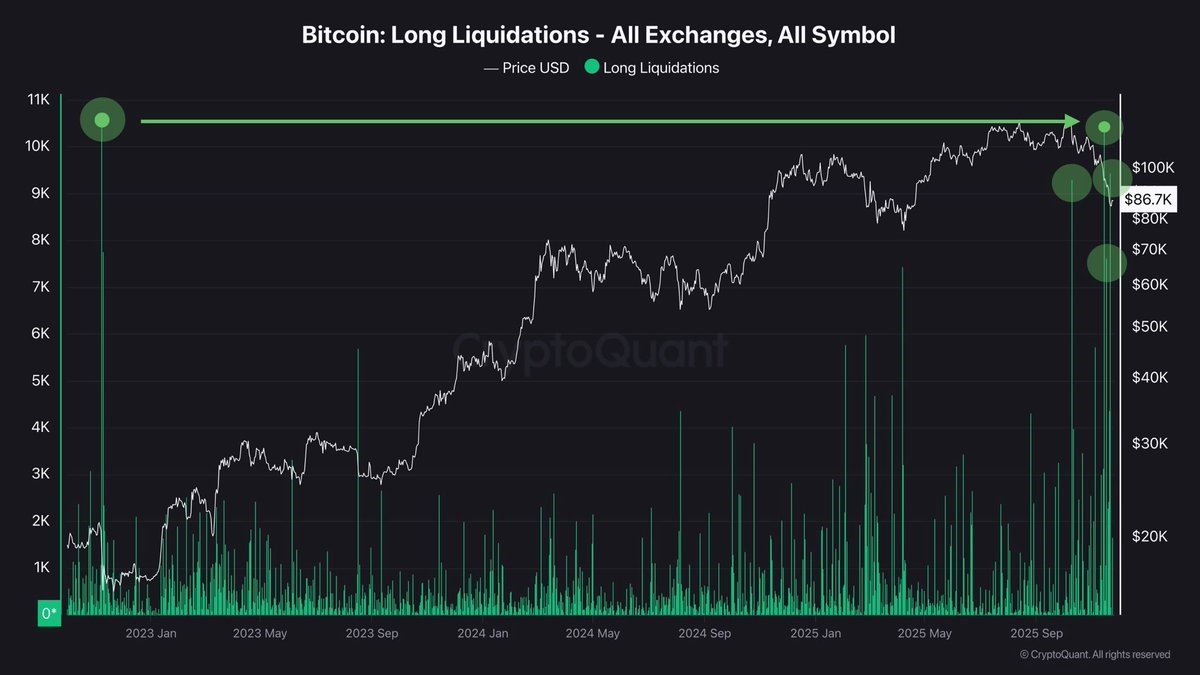

Markets adapt to patterns quickly. If participants believe a large buyer tends to appear at quarter-end, they start adjusting ahead of that window. This is not unique to crypto—pension rebalancing, index flows, and corporate buybacks create similar anticipatory behavior in traditional markets. The difference is that in crypto, the rumor-to-trade loop can be much faster, and the evidence (on-chain) can be much more visible.

Predictability can reduce uncertainty, but it can also manufacture new games. A known recurring buyer may invite “front-running narratives,” even when the reality is more mundane (internal transfers, custody changes, or multi-leg treasury operations). That’s why the distinction between “purchase” and “movement” matters: the market often trades the story first and checks the paperwork later.

Two practical second-order effects are worth watching:

• Liquidity expectations: If USDT liquidity expands alongside reserve earnings, some market participants may treat treasury actions as a proxy for broader crypto liquidity conditions. That can amplify reactions beyond the size of any single transfer.

• Narrative compression: “Tether bought 8,888 BTC” is easy to repeat, but it compresses nuance. Compression isn’t inherently harmful—unless it becomes the only thing people remember while ignoring the more important question: what proportion of reserves remain in highly liquid assets?

In other words, the number 8,888 may be memorable, but the real market variable is the structure of the balance sheet behind it.

5) Risk lens: what this changes (and what it doesn’t) for USDT users

Brand-safe analysis requires avoiding false certainty. We can’t infer reserve safety from a single purchase, and we shouldn’t imply that any treasury action automatically improves or worsens user outcomes. What we can do is outline the relevant risk categories so readers know what to look for without slipping into fear or hype.

Think of USDT risk in layers. Bitcoin holdings live in the “capital and diversification” layer, not the “day-to-day redemption” layer—assuming liquid reserves remain adequate. If liquid reserves are strong, a BTC allocation can be a long-term strategic asset. If liquid reserves are weak, the same BTC allocation can become a source of questions during market stress. The asset itself doesn’t change; the surrounding buffer does.

So what does this pattern meaningfully change?

• It changes perception: repetition teaches the market to expect Tether to behave like a recurring institutional accumulator.

• It does not, by itself, prove reserve strength: that requires disclosures, attestations, and clarity on asset composition—especially around liquidity and risk concentrations.

One useful reminder: large transfers can be misread. In 2025, Tether’s CEO publicly pushed back on interpretations that the company had sold Bitcoin when movements were linked to contributions into a bitcoin-focused investment vehicle. Whether you view that as reassurance or as a prompt for better disclosure, the educational point is the same: movement is not always selling, and selling is not always obvious from a screenshot.

6) Transparency lens: what would make this easier to evaluate

If Tether wants “methodical accumulator” to be the market’s default interpretation, transparency becomes a strategic asset. The better the disclosure, the less room there is for speculation to become the story. And the less the story depends on speculation, the more brand-safe and institution-friendly the market conversation becomes.

For readers, the best stance is calm curiosity. Instead of treating the number 8,888 as a mystical clue, treat it as an invitation to ask adult questions: How are reserves segmented? What liquidity buffers exist? What independent reporting exists? Those questions are boring—and that’s the point. Boring is where reliability lives.

A practical checklist that improves evaluability without demanding perfection:

• Clear mapping between policy and execution: summarize the rule (inputs, caps, timing) so observers can separate intent from coincidence.

• Consistent reserve reporting cadence: frequent, comparable snapshots help track composition changes without overreacting to single events.

• Context for large transfers: even brief explanations—custody rotation, internal movement, strategic contribution—reduce misinterpretation.

Crypto is maturing when the most interesting question is not “did they buy,” but “how well can outsiders verify what they claim.” That’s not cynicism. That’s market adulthood.

Conclusion

Tether’s reported “8,888 BTC” pattern reads like a small detail, but it’s actually a useful case study in how crypto institutions are evolving. A stablecoin issuer is not just a token issuer; it’s a reserve manager. And reserve management is, at its core, the art of staying liquid, staying trusted, and staying interpretable under pressure.

If 2025 was about proving stablecoins could scale, 2026 may be about proving stablecoins can be understood. In that world, the repeated number is less important than the repeated behavior: periodic accumulation, visible on-chain footprints, and an ongoing negotiation with transparency expectations. The next chapter won’t be written by one transfer. It will be written by how consistently the institution can explain itself.

Frequently Asked Questions

Did Tether definitely buy exactly 8,888.8888 BTC in Q4 2025?

Different reports present slightly different rounding, and some narratives blend CEO commentary with on-chain observations. A careful reading treats the amount as “roughly 8,888 BTC,” then looks for confirmation in consistent disclosures and verifiable reserve reporting rather than relying on any single post.

Why would a stablecoin issuer hold Bitcoin at all?

A BTC position can function as a long-term strategic reserve and diversification asset. The key question isn’t whether holding BTC is “good,” but whether the overall reserve structure maintains sufficient liquidity and transparency for redemption needs under stress.

Does this affect USDT’s stability?

USDT stability depends primarily on reserve adequacy, liquidity, and operational redemption mechanics. A BTC purchase alone doesn’t determine stability. It becomes relevant insofar as it changes the composition and liquidity profile of reserves, which should be assessed through disclosures and consistent reporting.

What should readers monitor next?

Watch for reserve composition disclosures, the cadence and clarity of reporting, and whether large transfers are accompanied by context. If the market can verify the underlying structure, the story becomes less about speculation and more about measurable risk management.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Digital assets and stablecoins carry risks, including liquidity, regulatory, and market risks. Always do your own research and consider seeking independent professional guidance.