“Don’t Short Bitcoin Here”: Why CryptoQuant’s CEO Sees This as an Accumulation Zone

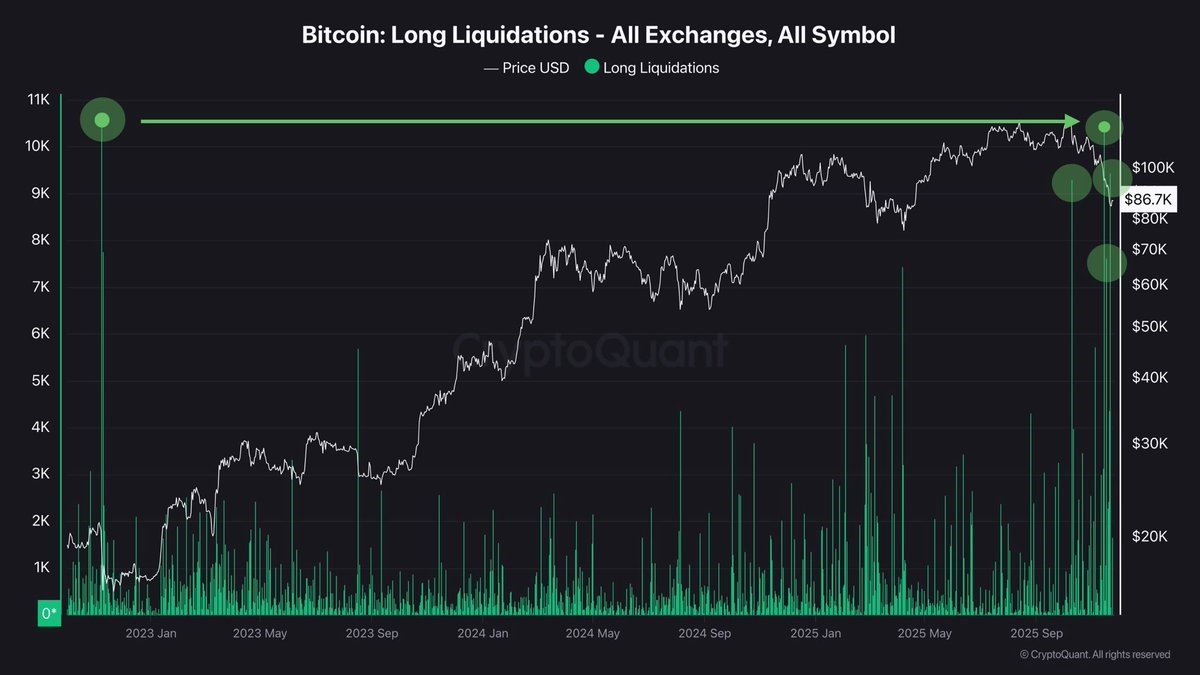

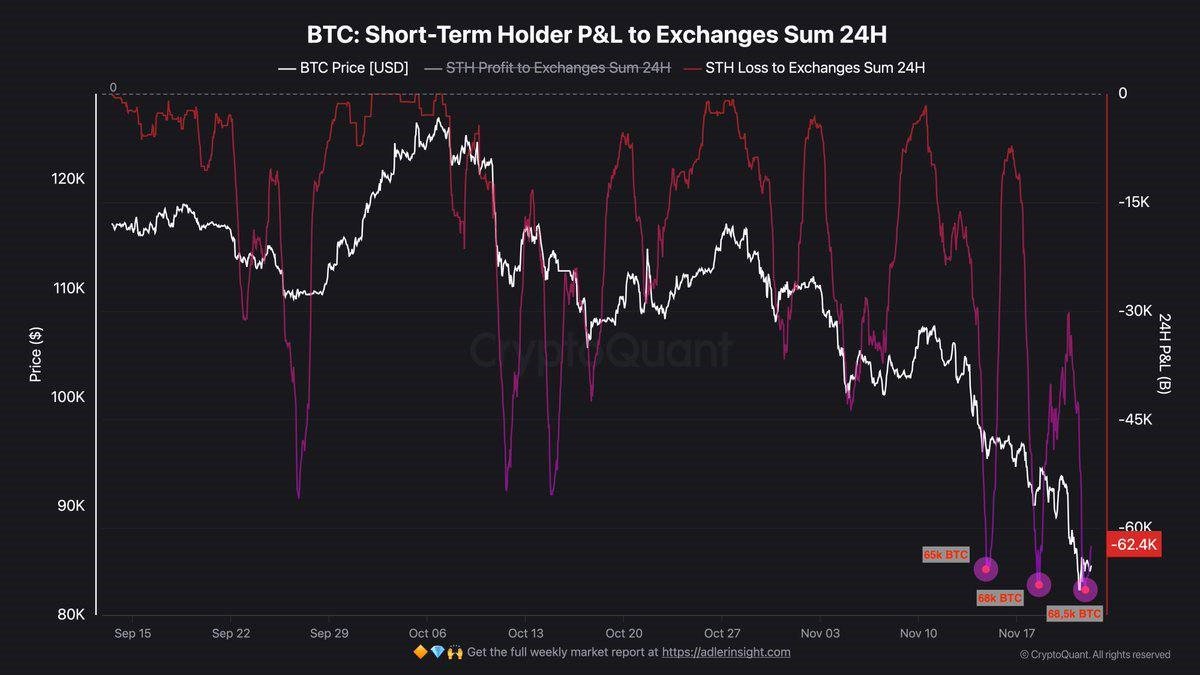

Bitcoin has just endured one of its sharpest pullbacks since the last bear market. Prices have slipped tens of thousands of dollars from the highs, derivatives markets have witnessed waves of forced liquidations and sentiment indicators are deep in fear territory. In that context, it is tempting for traders to assume that the path of least resistance is down and that speculating against BTC is the smart trade.

Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, is publicly pushing back against that instinct. According to the remarks you summarised, he believes that:

- Shorting Bitcoin at current levels offers poor risk–reward.

- For spot holders who are not using leverage, this zone looks like a reasonable area to accumulate with a long-term horizon.

- His stance is driven less by short-term technicals and more by macro liquidity conditions and long-cycle on-chain patterns.

Because we cannot access real-time statements or verify his comments directly from this environment, we treat your description of his views as the working premise. The goal of this article is not to tell readers what to do, but to unpack why an experienced on-chain analyst might reach such a conclusion, and what a professional research desk can extract from the current data structure.

1. Shorting After a Crash: Why It Often Looks Smarter Than It Is

When markets are bleeding, shorting feels emotionally natural. Price has been going down, social feeds are full of doomsday charts, and every intraday bounce keeps failing. In that environment, pressing the downside can give an illusion of safety: “the trend is my friend, I’ll just ride it lower.”

But derivatives traders who survive multiple cycles know a harsh truth: the most dangerous time to short is often when fear already dominates the narrative. Several structural forces explain why.

1.1 Asymmetry between downside and upside after large drawdowns

Suppose Bitcoin has already fallen 30–40% from its recent high. How much clean downside is realistically left before long-term buyers, treasuries, ETFs and sovereign accumulators step back in? No one knows the exact level, but the distance to a shock bounce is often much shorter than it appears. In contrast, a sudden macro or flows-driven reversal can produce double-digit percentage moves to the upside in days.

Shorting in that environment is like picking up pennies in front of a steamroller: you may collect small gains while the grind lower continues, but a single aggressive squeeze can erase weeks of profits or wipe out an over-leveraged account.

1.2 Liquidity pockets and “seller exhaustion”

Downtrends are rarely smooth. They are punctuated by periods where forced sellers run out of ammunition: liquidations slow, panic selling from late entrants dries up and market makers begin to layer bids. At those points, it only takes a modest positive catalyst — better macro data, a slowdown in ETF outflows, a large treasury buy — to spark a sharp rebound.

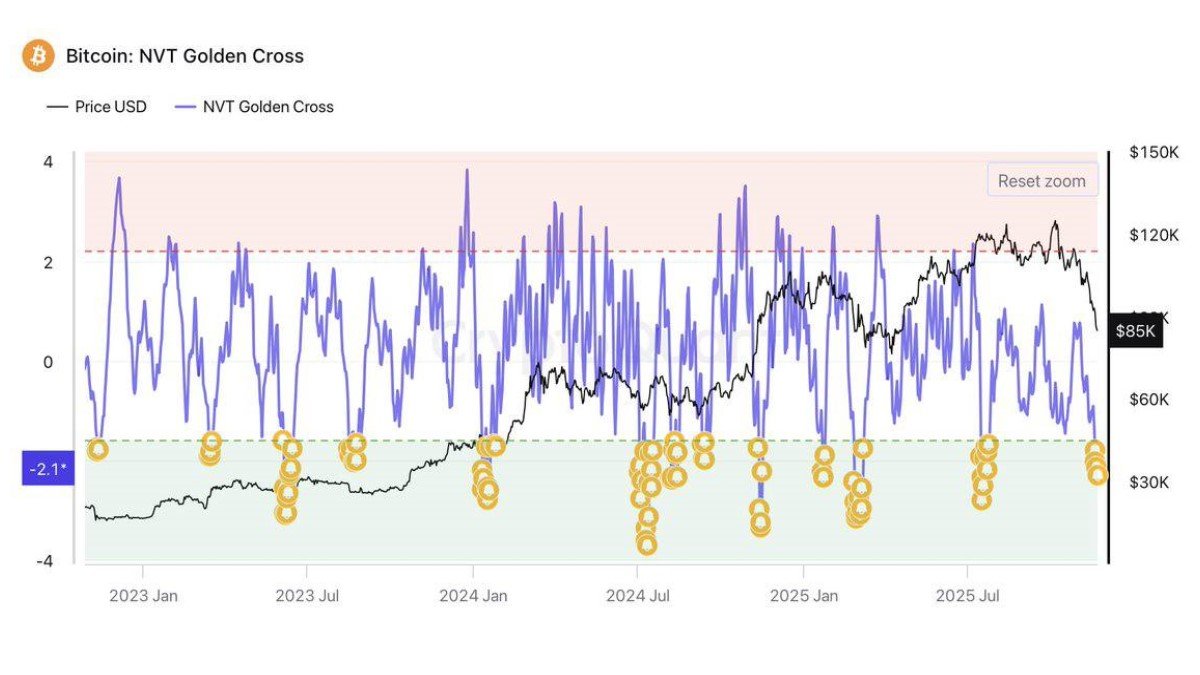

On-chain analytics helps identify those pockets by tracking realised losses, spent output profit ratios and age distribution of coins being sold. When an on-chain specialist like Ki Young Ju says he sees an accumulation zone, he is implicitly suggesting that large parts of the “weak hand” supply have already capitulated.

2. Why Spot-Only Investors Live in a Different Universe Than Leverage Traders

A crucial nuance in Ki Young Ju’s message is his distinction between spot holders and leveraged short-term traders. He reportedly advises against opening fresh shorts, but in the same breath encourages patient investors to keep accumulating spot BTC.

This is not a contradiction — it is a reflection of how dramatically the risk profile changes when you remove leverage and extend your time horizon.

2.1 Spot Bitcoin: no liquidation price, only opportunity cost

A spot holder who buys BTC without borrowing has a very simple risk equation: the price can go lower, potentially much lower, and the opportunity cost of capital rises. But there is no liquidation engine, no margin call, no forced exit. As long as the investor’s thesis about Bitcoin’s long-term role in the global financial system remains intact, drawdowns are emotionally painful but not game-ending.

In that context, the current zone — after a deep correction, amid widespread fear — looks historically similar to many early accumulation phases of past cycles. On-chain data often shows long-term holders adding to positions exactly when short-term traders are being washed out.

2.2 Futures and perpetuals: leverage turns volatility into existential risk

By contrast, traders using leveraged derivatives are effectively renting exposure from the exchange. A 20–30% adverse move can be enough to liquidate a 5x or 10x leveraged position, even if the long-term direction eventually proves correct. This is what Ki Young Ju appears to warn against: shorting into an already stretched move means you are speculating that volatility will keep working in your favour, while any violent squeeze could put you on the wrong side of the liquidation engine.

The professional lesson is simple: analysis that is bullish for long-term spot allocation can coexist with a cautious or even neutral stance for leveraged speculation. Timeframe and instrument matter as much as directional bias.

3. The Macro Backdrop: Why Liquidity Matters More Than Headlines

According to your summary, one of the reasons Ki Young Ju remains constructive is that global liquidity indicators suggest capital is slowly being injected back into the system. While we cannot directly verify current central-bank actions or money-supply data from this environment, we can outline the mechanism through which liquidity shapes Bitcoin’s medium-term path.

3.1 Bitcoin as a high-beta liquidity asset

Historically, Bitcoin behaves like a high-beta expression of global risk appetite. When real yields are falling, central banks are easing or at least pausing tightening, and financial conditions improve, capital tends to leak out along the risk curve — from treasuries to equities, to growth stocks, to crypto. Conversely, when liquidity is drained and policy turns restrictive, Bitcoin is often among the first assets to reprice downwards.

If liquidity gauges (for example, global central-bank balance sheets, reverse-repo usage, or broad M2 growth) are indeed starting to stabilise or expand, that implies an environment where the structural headwind of tight money is easing. Price can still fall in the short run, but the macro tide is less hostile than it was during previous tightening phases.

3.2 The subtlety of liquidity: it rarely shows up in the headlines

Retail investors often anchor on obvious news: rate-decision meetings, election headlines, regulatory fights. Liquidity, however, changes more quietly in the background. A central bank adjusting collateral rules, a government smoothing its debt-issuance schedule or a banking system rebuilding reserves can all nudge conditions toward easier or tighter without dramatic press conferences.

On-chain analysts who pay attention to long-term correlations between liquidity series and Bitcoin tend to act before the story becomes mainstream. That may be part of what informs Ki Young Ju’s comment: he is not claiming the bottom is in, but suggesting that the broader liquidity regime is no longer screaming “run away from risk at all costs.”

4. Historical Rhythm: Accumulation During Fear

One of the recurring themes in Bitcoin’s history is the cycle of euphoria–capitulation–accumulation–expansion. While each cycle is different in its details, they often rhyme in structure.

4.1 What on-chain patterns say about past accumulation zones

During major drawdowns, a few things tend to happen on-chain:

- Realised losses spike as coins previously bought near the top are sold at a loss.

- Short-term holder supply shrinks — many of the newest entrants capitulate and leave the market.

- Long-term holder supply grows as entities that have historically shown low spending behaviour scoop up discounted coins.

These shifts rarely align with perfectly timed price bottoms; they unfold over weeks or months. But they give statistically useful hints about where the balance of power is moving. When long-term holders quietly accumulate while funding rates reset and derivative leverage declines, subsequent cycles have often seen powerful rallies built on that new base.

When Ki Young Ju frames the current level as a “reasonable accumulation zone,” he is likely seeing similar structural transitions beneath the price chart: coins moving from weak hands to strong hands, and derivative markets shifting from frothy to cautious.

4.2 The psychological paradox: it never feels good to buy these zones

Something experienced investors learn the hard way: genuine accumulation zones always feel uncomfortable. There is always a convincing bear case, credible macro risks, scary charts with broken trendlines and influential voices calling for much lower levels. That is precisely why prices are discounted enough to offer longer-term value.

Professional allocators deal with this paradox by systematising their process: they define ranges where they will steadily buy, they cap position sizes, and they accept that catching the absolute bottom is both impossible and unnecessary. Retail investors who wait for the market to “feel safe” often end up buying back much higher, after on-chain and macro data have already turned.

5. Why the CEO’s Reduced Use of Leverage Matters

An interesting detail from your description is that Ki Young Ju admits he no longer trades leverage as actively as he once did. At first glance, that may sound like a small personal note, but it actually carries a deeper message about how seasoned participants adapt as markets mature.

5.1 From trader to risk-aware allocator

In Bitcoin’s early days, volatility was so extreme and liquidity so thin that aggressive traders could capture enormous edges simply by being faster and more informed than the average exchange user. Today, with sophisticated firms, algorithmic market makers and deep derivatives liquidity, that playing field is much more competitive.

Many veterans have quietly shifted from chasing every swing with leverage to focusing on cycle positioning and structural flows. They may miss some of the intraday fireworks, but they also avoid the fate of countless traders who compounded impressive gains into spectacular blow-ups. When someone like Ki Young Ju says he is less focused on short-term entries, he is signalling that his conviction lies in the direction of the tide, not in the exact timing of every wave.

5.2 Implications for everyday investors

For retail participants, this shift is instructive. If a data-driven professional with access to detailed on-chain metrics is stepping away from high-frequency leverage, it is a strong hint that most individual traders are better served by a low-leverage, long-horizon strategy. The edge today tends to reside not in predicting tomorrow’s candle, but in understanding where value is mispriced across cycles.

6. A Professional Framework for Acting on This View

Assuming you broadly agree with the thesis that:

- Shorting Bitcoin here carries asymmetric upside risk.

- Spot BTC looks reasonably valued for long-term accumulation.

- Global liquidity and on-chain patterns support gradual optimism.

How might a disciplined investor or trading desk translate that into action?

6.1 For long-term spot allocators

- Scale in, don’t dive in: define a range and timeframe (for example, over the next 3–6 months) and average into a position rather than deploying all capital at once.

- Use objective triggers: combine on-chain signals (realised losses, long-term holder supply, stablecoin reserves) with macro guides (real yields, policy expectations) to decide when to increase or pause accumulation.

- Accept volatility as the cost of upside: if your thesis relies on Bitcoin potentially becoming core collateral for the digital economy, then 20–30% drawdowns are unfortunately part of the journey.

6.2 For active traders

- Avoid chasing the downside: if you do short, consider doing so tactically at resistance after strong bounces, with tight risk parameters — not via blind continuation shorts in the middle of a liquidation cluster.

- Size leverage modestly: treat 2–3x as high leverage in this regime. The goal is to stay solvent, not to turn every trade into an all-or-nothing speculative position.

- Watch positioning metrics: funding rates, open interest, options skew and exchange inflows give clues about whether another liquidation cascade is likely or whether sellers are exhausting.

6.3 For risk-averse participants

If direct BTC exposure still feels too volatile, it is possible to express a cautiously bullish view through more diversified vehicles: crypto-equity baskets, structured products with downside buffers, or even simply reducing an underweight position rather than going outright long. The key principle remains the same: avoid being aggressively short an asset that has already absorbed heavy selling in the face of improving liquidity.

7. The Role of a Professional Research Outlet

A final point is about the value of analytics-driven commentary itself. In every sharp correction, social feeds fill with sensational claims: "Bitcoin is going to zero", "the cycle is over", "institutions are dumping everything". A professional analysis platform has a different mandate:

- Distil what the data actually shows, rather than amplifying the loudest emotion.

- Separate the perspectives of leveraged speculators from those of long-term allocators.

- Place each event in a broader macro and historical context, so readers can understand whether it represents a regime shift or just another turn of the cycle.

Ki Young Ju’s public stance is a good example of this approach. He is not promising a quick moonshot or denying the possibility of further downside. Instead, he is reminding investors that data-driven analysis often diverges from the emotional consensus — and that some of the best opportunities have historically appeared when shorting looked obvious but was, in fact, late.

Conclusion

Bitcoin’s current drawdown has inflicted real pain: leveraged longs washed out, sentiment crushed, narratives flipped from invincibility to despair. Against that backdrop, the CEO of one of the industry’s leading on-chain analytics firms is advising caution on fresh shorts and framing this zone as a reasonable area for long-term spot accumulation.

Whether he proves right or wrong in the exact timing, his underlying logic is sound from a professional perspective. Shorting into exhaustion, when long-term holders are quietly adding and global liquidity is tilting away from extreme tightness, has rarely been a winning strategy across cycles. Conversely, those who accumulate patiently into fear — without over-leveraging, and with a clear understanding of their risk tolerance — have historically been the ones still standing when the next expansion phase begins.

Important note: This article is based on the scenario and summary you provided of Ki Young Ju’s comments and cannot independently verify current statements or live market data. The analysis is for educational purposes only and does not constitute investment, financial, legal or tax advice. Digital assets are highly volatile and you can lose the entire amount invested. Always perform your own research and consider consulting a qualified professional before making financial decisions.