A new 10X Research report estimates retail investors lost ~$17B chasing ‘Bitcoin treasury’ stocks whose market caps outran the value of their coin hoards. This piece explains the mechanism (NAV premiums), why it happens, the Metaplanet/MicroStrategy playbooks, what the October selloff revealed, and a practical checklist to avoid being the exit liquidity

In the last phase of the bull run, a particular side speculative position gripped the market: buying the stocks of companies that loaded their balance sheets with bitcoin. The logic seemed simple: if bitcoin goes up, the stock should go up more—because corporate actions (share issuance, leverage, option value on future issuance) add torque. A new report from 10X Research argues that this “proxy trade” ended in large aggregate losses for small investors, estimating roughly $17 billion in retail damage as equity prices ran far ahead of the value of the underlying bitcoin and then snapped back when conditions tightened.

How the Trade Works (and Breaks)

At the core is a simple ratio: market capitalization versus net asset value (NAV) of the company’s bitcoin stash (plus any non-crypto business value). When enthusiasm peaks, these stocks often trade at large NAV premiums —investors pay far more than a dollar for each dollar of bitcoin exposure—as if the company were a leveraged, growthy ETF with free optionality. Managements then security vulnerability the premium by issuing new shares (or convertible debt) to buy more bitcoin, which can reinforce the premium in strong tapes. But premiums are reflexive: when sentiment turns or liquidity thins, those same stocks can fall much faster than spot BTC because the premium compresses at the same time the underlying moves against you.

That double-whammy is where the $17B estimate comes from: investors bought the premium at the top and sold the discount at the bottom.

The Playbooks Everyone Tried to Copy

MicroStrategy (MSTR) pioneered the modern corporate bitcoin-treasury strategy—raising capital through equity and debt offerings to buy BTC, then communicating the economics to shareholders. The company’s filings explicitly describe purchasing large amounts of bitcoin with proceeds from capital raises across 2023–2024. Whether you view it as visionary treasury management or a high-beta proxy vehicle, the mechanism is clear: sell shares or debt when financing is attractive, add BTC to the treasury, and let the market price the embedded optionality.

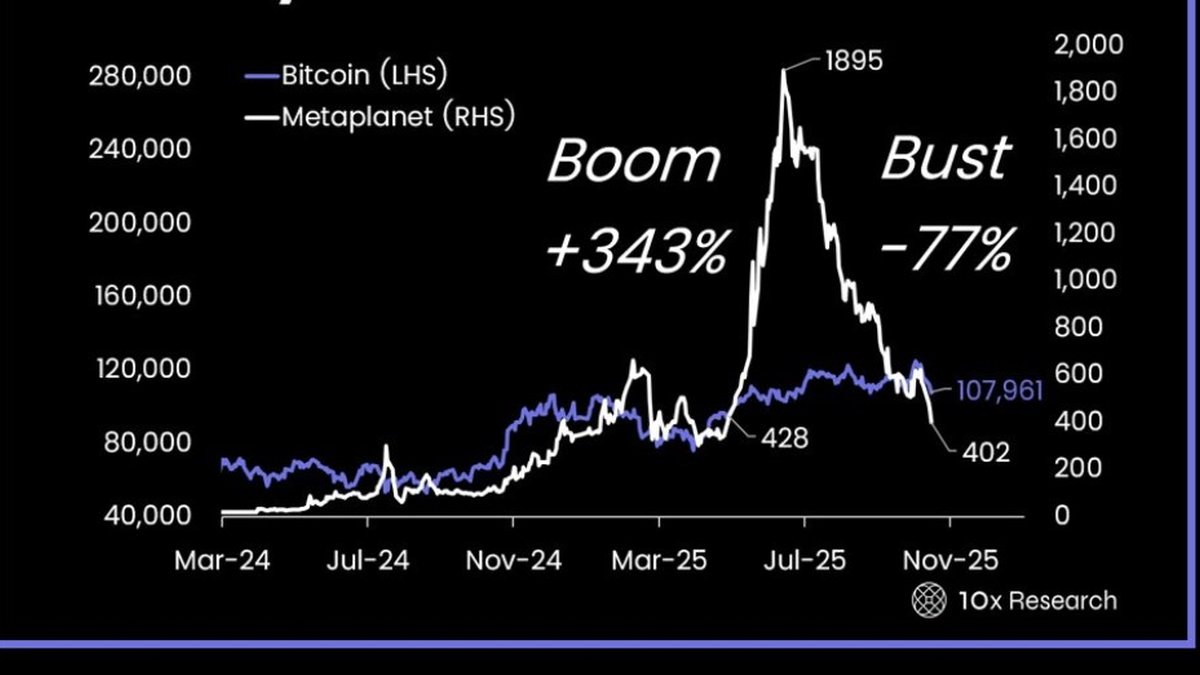

Metaplanet (Japan) became the poster child for NAV-premium reflexivity in 2025. As the firm accumulated tens of thousands of BTC, headlines tracked not only purchases but also the yawning gap between market value and coin holdings. Coverage noted that at one point in mid-year the market cap traded at multiples of the hoard—and, later, that enterprise value even slipped below the estimated value of the bitcoin stash as sentiment reversed. The signal isn’t whether a single snapshot looks “cheap” or “expensive,” but how violently that premium/discount can swing through the cycle.

October’s Lesson: Premiums Don’t Survive Panic

Early October brought a sharp reversal across crypto: bitcoin printed a new all-time high near $126k and then suffered a historic wipeout with roughly tens of billions in leveraged positions liquidated. In that downdraft, proxy stocks underperformed: their premiums compressed and the underlying fell. This is the structural fragility of NAV-premium vehicles—when the market demands immediate liquidity, equity proxies are a second derivative of bitcoin’s move.

Why Retail Was the Bagholder

• Premium myopia: Many buyers anchor on the bitcoin per share headline and assume they are getting a cheap conduit to BTC. In practice, they were paying 1.5×–4× the embedded coin exposure during the hottest weeks—so even small reversals erased outsized portions of equity value.

• Issuance reflexivity: Companies can (and rationally do) sell stock into premiums to buy more BTC. That’s accretive to holdings but dilutive to each share’s claim on the hoard if issued far above NAV—great for the treasury, not necessarily for late entrants. Public disclosures and commentary across 2023–2025 document repeat cycles of raise→buy→message.

• “Beta stacking” risk: Equity proxies embed business and financing risks in addition to BTC price risk (execution, governance, funding costs). In a drawdown, those risks correlate, exaggerating losses versus simply holding spot BTC.

Case Study Sketches

Metaplanet: A burst of purchases pushed the company into the top cohort of public BTC holders. As the narrative caught fire, the stock’s ratio to underlying bitcoin ballooned; subsequent coverage highlighted how that ratio later deflated, even flipping to a discount to hoard value during the October air-pocket. The round-trip illustrates how quickly a “DAT premium” can become a “DAT penalty.”

MicroStrategy: The firm continued to add coins via incremental buys, and its investor materials describe a framework where capital raises map to bitcoin acquisitions. None of this is inherently nefarious; it’s a deliberate financing strategy. But it teaches a simple lesson: a great bitcoin treasury does not automatically mean a great entry price for the equity when you’re paying a large premium to NAV.

“But BTC Rose Again—Why Didn’t the Stocks?”

Because NAV premiums and discounts move independently of bitcoin. After a crash, trust and liquidity take time to heal. Even if BTC rebounds, the equity market may refuse to pay the old premium. In some tapes you’ll see a sequence like this: BTC +10%, proxies flat or down because the premium keeps compressing; later, as confidence returns, the premium re-expands and proxies catch up or overshoot. Understanding that two-layer dynamic is the difference between being early and being wrong.

How to Audit a Bitcoin Treasury Stock in 10 Minutes

1. Implied BTC per share: Compute (company BTC / fully diluted shares). Multiply by spot BTC to get look-through NAV per share.

2. Premium/discount: Compare share price to look-through NAV. A 2× premium means you need either (a) BTC up a lot, or (b) the premium itself to expand further just to break even.

3. Issuance behavior: Read filings/pressers for equity or convert issuance policies. Some issuers explicitly scale issuance with mNAV multiples—bullish for the balance sheet, tricky for late shareholders.

4. Debt stack & covenants: Note maturities, coupons, convert triggers. Debt adds torque but also refinancing risk.

5. Non-BTC business value: Decide whether the operating business deserves a premium (or discount) to the hoard—then keep that assumption conservative.

Why the $17B Estimate Matters

It’s not a morality tale about this or that company; it’s a market-structure lesson. Equity wrappers can be extraordinary when bought right—especially during early premium expansion—but they can be ruinous when bought after a parabolic run, amid aggressive issuance, into a deteriorating liquidity regime. The 10X Research estimate is a reminder that owning the story is different from owning the asset.

What October Revealed About Liquidity and Leverage

The flash unwinds around October 6–12 exposed how thin the order books can get when the dollar strengthens, risk appetite fades, and levered longs are forced out. Spot BTC recovered parts of the drawdown; proxies struggled longer as premiums reset lower and issuance windows narrowed. For traders trained only on up-only tapes, that regime shift felt brutal—but it’s typical of reflexive assets.

Builder & Issuer Takeaways

- Communicate mNAV candidly: Publish real-time NAV and fully diluted metrics so investors can self-audit the premium/discount.

- Stagger issuance: Opportunistic capital raises are rational, but cadence and size should avoid signaling that the equity is a perpetual ATM at any price.

- Separate audiences: If the stock is essentially a BTC proxy, embrace the label and offer clean, low-friction instruments; if it’s an operating company with BTC on the balance sheet, ring-fence the narratives.

Investor Playbook: Avoiding the Exit-Liquidity Trap

- Prefer the asset over the wrapper when premiums exceed ~20–30% without a compelling operational wedge.

- Scale entries around liquidity windows; chase discounts, not premiums.

- Hedge premium risk (e.g., long equity proxy/short BTC) only if you genuinely understand borrow costs, borrow availability, and basis dynamics—otherwise, just own BTC.

- Mind currency and venue: if your proxy trades in a different currency or market hours, you’re adding cross-asset microstructure risk to a crypto speculative position.

Bottom Line

“Bitcoin treasury stocks” are not merely a smoother road to BTC exposure; they are BTC plus reflexivity. In the up-cycle, that reflexivity mints premium; in the down-cycle, it compounds losses. The $17B retail hit tallied by 10X Research should not scare anyone away from thoughtful bitcoin exposure—it should scare investors away from paying any price for it. If you want the asset, buy the asset; if you want the wrapper, price the premium like the risk instrument it is.

Note: This article is analysis, not investment advice. Markets change quickly; do your own research and size positions so premium compression in a proxy stock cannot jeopardize your overall portfolio.