From a Lockdown Apartment to a Market Mover: How Polymarket—and 27-year-old Shayne Coplan—Turned Prediction into a Billion-Dollar Product

If you ever needed a case study in how quickly crypto can vault an idea from side project to macro force, look no further than Polymarket and its founder, Shayne Coplan. Five years ago, the platform was a scrappy experiment: what if betting markets could do a better job at extracting truth than the news cycle? Today, the company sits at the center of a global debate about what information is, what regulation means in an on-chain world—and, crucially, what a modern exchange could look like when the underlying product isn’t equities or tokens, but probabilities.

This piece traces that arc—the messy, regulatory-heavy, product-obsessed, and admittedly exhilarating climb from a cramped apartment during the pandemic to a valuation that vaulted Coplan into the cultural conversation. It also examines how Polymarket’s business actually works, why entrenched institutions are now paying real money to be part of it, and what still could go wrong. Most importantly, we lay out a practical mental model for investors and builders asking the right question: is markets-as-a-truth-engine a niche, a bubble, or one of the few crypto-native ideas with genuine, durable product–market fit?

1) Polymarket’s big turn: from curiosity to credible venue

Polymarket didn’t spread because it was the first on-chain prediction site. It spread because its markets were useful. Traders—many of them not “crypto people” at all—could articulate a view on real-world events with a precision that social media (and legacy polls) simply couldn’t match. The product had a loop:

- Choose an event the world actually cares about (elections, macro surprises, policies, sports, tech milestones).

- Design a binary or multi-outcome contract whose settlement is unambiguous.

- Let participants post collateral and continuously update price/odds as information arrives.

- Publish a public price that serves as a forecast and a scoreboard at once.

That loop is addictively legible. People run on predictions, not paragraphs; a moving price is the story.

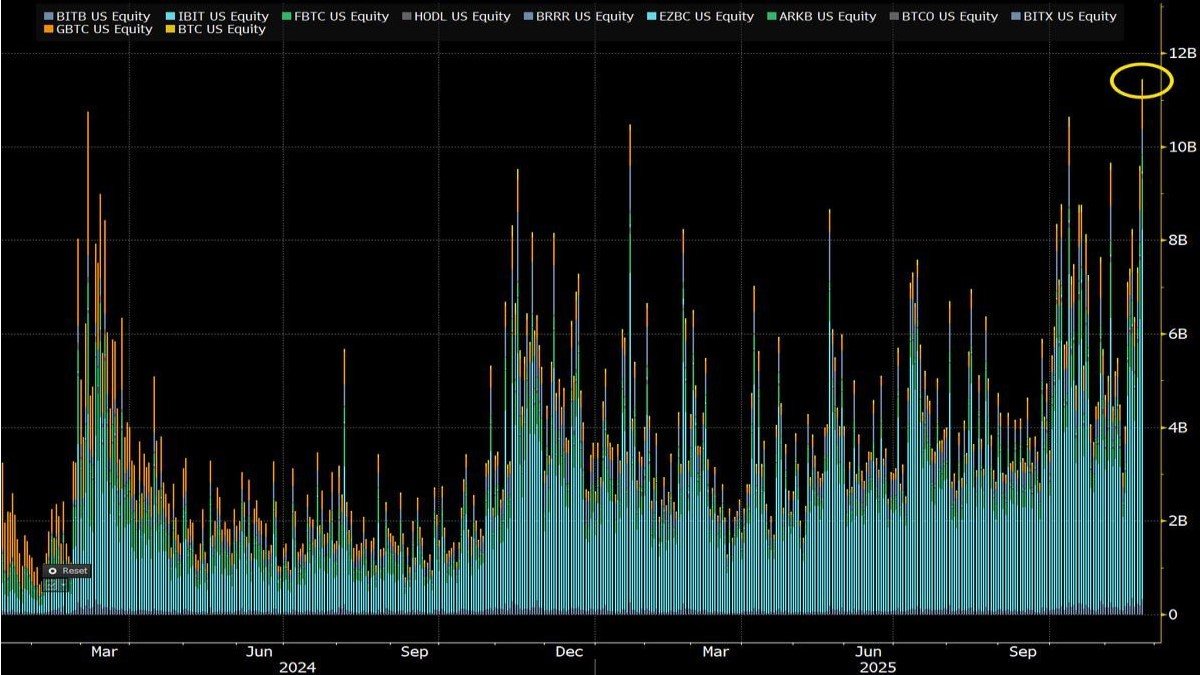

The market rewarded that clarity. In 2025—right when political, policy, and macro catalysts converged—large, traditional players began treating “information liquidity” as an investable asset. Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, reportedly took a multi-billion dollar stake in Polymarket at an approximately $8–9 billion valuation—an astonishing endorsement from the most establishment corner of global markets. Mainstream business press coverage cemented the idea that prediction markets had matured from crypto curiosity to something legible through a Wall Street lens.

For founders and investors, two signals mattered here: (i) distribution and licensing gravity: exchange operators don’t chase fads; they chase platforms that can intermediate flows at scale; and (ii) category validation: an $8–9B read-through rewrites the ceiling for “information markets.” Prediction isn’t a feature; it’s an exchange class.

2) The regulatory odyssey: penalties, seizures, and a reset

No one should romanticize the friction. Polymarket’s rise is inseparable from a bruising compliance journey that both shaped the product and colored the narrative around it.

- The 2022 penalty: The U.S. Commodity Futures Trading Commission (CFTC) ordered Polymarket to pay a civil penalty and wind down certain U.S.-accessible markets for operating an unregistered event-based venue. That episode forced a rethink on geofencing, venue access, and how to translate market curiosity into legally operable products.

- Escalation in 2024–2025: U.S. law enforcement reportedly seized founder Shayne Coplan’s phone amid questions about compliance with the prior settlement. Coplan was not charged, but the optics were intense—and the crypto market felt it.

- The 2025 resolution: Both the U.S. Department of Justice and the CFTC closed their investigations without bringing new charges. That decision didn’t “bless” any specific market structure, but it removed a sword of Damocles and allowed the company to pursue growth, partnerships, and more formal paths to U.S. compliance with far less headline risk.

The strategic takeaway: speed is no longer the moat; compliance agility is. Any prediction platform that wants to be systemic must be able to flip between jurisdictions, attach to licensed rails where needed, and ship product variants that are legally boring yet UX-delightful. Think of it as multi-venue polymorphism: one information engine, many wrappers.

3) What the product is, economically

A prediction venue monetizes two things: trading activity and attention to the price. The former is obvious (trading fees, data licensing, perhaps maker–taker tiers within the letter of the law). The latter—attention—is more subtle but profound: a widely cited odds stream is itself a distribution channel that acquires new users for free.

Key levers:

- Market curation: A dozen well-crafted, high-salience markets will often outperform a hundred low-quality ones in revenue and relevance.

- Liquidity architecture: Market makers and incentives—rebates, tiers, non-U.S. tokenized rewards—decide whether spreads are tight and slippage tolerable for large flows.

- Settlement credibility: Opaque resolution kills venues. Polymarket’s brand is tightly coupled to precise oracles and publicly verifiable settlement logic.

On the supply side, the product competes for trader time with sports books, options, perps, and even the dopamine slot machine of social media. On the demand side, it competes with polls and punditry for narrative authority. If your odds move markets—or the media—your monetization expands without incremental customer acquisition cost.

4) How a 27-year-old became a billionaire—and what it signals

Part of the fascination is the founder story. Multiple outlets chronicled that Coplan—still in his twenties—rode the platform’s meteoric re-rating into the rarefied air of “youngest self-made crypto billionaire.” Strip away the personality headlines and you still have a stark macro signal: information markets now have institutional PMIs. When a platform’s price discovery begins to set the talking points of a campaign, a policy debate, or a corporate move, the risk capital that historically ignored “betting” reframes it as infrastructure.

That shift was on full display around the ICE investment window. Newsrooms embedded market odds in coverage. Campaign staffers watched the 24-hour line as a real-time focus group with skin in the game. Traders treated event markets as partially hedgeable exposures against policy catalysts in their books. That’s a lot of orbiting mass for any startup—let alone one just exiting a multi-year regulatory gauntlet.

5) Where does the edge come from?

Let’s be clinical. What are Polymarket’s defensible advantages, and where is it still vulnerable?

Moats:

- Liquidity network effects: The venue with the deepest, most credible liquidity wins twice—tighter prices and media mindshare.

- UX tuned for non-quants: When “what’s the probability X happens?” is the default question, a venue that hides on-chain complexity and just feels instant accrues a wide top-of-funnel.

- Brand of integrity in resolution: Every correctly resolved market is a brand deposit that compounds.

- Institutional alliances: Strategic investors with exchange DNA (and political muscle) matter in a business where rules—not only code—define scale.

Exposed areas:

- Jurisdictional fragmentation: The path to a fully licensed U.S. experience remains constrained; venue design must align with evolving interpretations.

- Copycat risk on non-U.S. rails: UI/incentives can be cloned; liquidity communities and trust are harder to copy—but not impossible to erode.

- Data/oracle risk: One botched resolution or oracle exploit in a flagship market is reputationally expensive.

- “Election-beta” revenue concentration: If revenue concentrates in a few mega events, off-cycle franchises (policy/macro/sports/tech) must mature.

6) Token, or no token?

Crypto readers will ask: will there be a token? Rumors about a potential $POLY have swirled on social channels, sometimes stoked by suggestive—but not definitive—posts. As of this writing, there is no public, official token launch announced by the company, and responsible coverage treats token talk as speculation unless or until primary sources confirm.

Why a token might make sense (outside the U.S.):

- Market-maker incentives: Rewarding early liquidity in thin books can tighten spreads and improve price credibility.

- User acquisition/retention: Carefully designed rebates or staking mechanics can mimic airline miles for prediction venues.

- Governance signals: In permissive jurisdictions, token-holder signaling could inform listing priorities (while legal entities retain final curation).

But: tokens add legal, tax, and securities-law attack surface—especially if the venue wants a tightly regulated U.S. footprint. If Polymarket pursues a token, expect a two-track strategy: non-U.S. tokenized incentives + U.S. compliant wrappers that keep the core product flowing within the lines.

Investor posture: treat any token headlines as structure, not substance. The substance is whether the flywheel of salient markets → low spreads → cited odds → fresh users → recurring fees keeps spinning across cycles.

7) The path to U.S. legitimacy: license, partner, or federate?

With probes closed, the logical question is what comes next. Three playbooks we’ve seen in adjacent categories:

- Acquire/partner with a licensed venue and port prediction contracts into approved product types—or create analogous instruments that fit existing frameworks.

- Federated model: keep a global, non-U.S. on-chain venue while offering a parallel, domestically compliant front end with narrower market types and KYC’d access.

- Data-first strategy: lean into selling aggregated odds/price data and index-like instruments while retail trading remains primarily international.

It bears repeating: reports have circulated about regulated venue relationships in the U.S. derivatives world, but as of the latest mainstream coverage, no specific U.S. market license or acquisition has been publicly confirmed by Polymarket itself. Treat any chatter as forward-looking and unconfirmed until the company files or announces.

8) The macro moment: why now?

Three secular shifts favor prediction markets in the next cycle:

- The “polling is broken” consensus: Traditional polling hasn’t kept pace with the speed and incentives of the modern attention economy; markets price information faster.

- Media incentives to cite a number: Editors love a defensible, embeddable figure. “Market-implied probability” is cleaner than “analysts say.”

- Crypto infra maturation: Wallet UX, KYC/AML tooling, and stablecoin rails are better; on-chain settlement is normal, not nerdy.

Institutional validation matters too. An exchange operator’s investment isn’t just capital; it’s a distribution thesis: that an odds tape can live alongside equities, ETFs, and futures in a compliant ecosystem. If that thesis is right, the category’s ceiling is vastly higher than today’s revenue lines suggest.

9) A clean, practical framework to value the category

Prediction markets don’t map neatly to SaaS or to centralized exchanges. Try a hybrid:

- Core Activity Metric (CAM): Dollar Value at Risk on Platform (DVARP) × turnover × take rate.

- Concentration Discount: If the top five markets generate >50% of revenue, apply a multiple haircut; add franchises beyond elections to compress the discount.

- Resolution Quality Premium: A spotless settlement record deserves a higher multiple; each contested resolution is a drag.

- Regulatory Optionality Factor: Probability-weight realistic U.S. licensing pathways (timeline, product scope) and apply an uplift when catalysts arrive.

For back-of-the-envelope work, triangulate valuation using a blend of well-run exchange EV/sales ranges (adjusted for lower take rates and episodic volumes) and adjacent media/data businesses (where content is the odds and distribution is the value). If a private transaction pegged valuation around the high single-digit billions, the market is already pricing in either global dominance or credible U.S. monetization sooner than skeptics expected.

10) Scenario map: the next 12–24 months

Bear case (execution/regulatory drag): U.S. distribution remains narrow; marquee listings face friction; one or two messy resolutions dent trust; liquidity splinters across clones and sportsbooks with “prediction-like” props. Result: slower revenue build; valuation hinges on international growth and private funding cycles.

Base case (measured legalization + product deepening): Probes are behind the company; careful venue design yields a handful of U.S.-accessible products with international trading as the core. Data licensing becomes a line item as media standardize around market-implied odds. Election-beta remains, but sports/tech/policy franchises mature into recurring revenue. Result: steady growth, cleaner narratives, tighter spreads, improving unit economics.

Bull case (venue breakthrough): A decisive U.S. beachhead emerges via partnership/license; regulated flows enter; “odds as an API” becomes default in news, finance portals, and enterprise dashboards; tokenized incentives (outside the U.S.) deepen books without overwhelming compliance. Result: category escapes niche status; benchmark odds begin to feel like index levels.

11) What this means for builders, traders, and policymakers

- Builders: Don’t underestimate curation. The best prediction venues will look like editorial teams armed with market designers. List fewer, better markets.

- Traders: Treat event markets like a distinct asset class. Beware liquidity cliffs around settlement and backtest whether you truly digest incremental information better than the crowd.

- Policymakers: A compliant prediction market can be a public good. The conversation should move from “can bettors speculate?” to “how do we harness incentivized forecasting without importing sportsbook pathologies?” Good disclosure, clean settlements, and market limits can coexist with innovation.

12) A note on the “truth engine” idea

Skeptics are right that markets can be wrong—spectacularly so. The counterpoint isn’t that markets are infallible; it’s that they’re continuously corrigible. Every dollar at risk is an invitation for contradiction. In an era where engagement algorithms reward performative certainty, a venue that prices humility—and updates in real time—feels like progress.

That, more than the valuation, is why Polymarket matters. Not because it lets people bet on politics, but because it’s one of the few scaled digital products where being wrong has a cost and changing your mind is the entire point.

13) The founder’s arc is a mirror of the category

Shayne Coplan’s journey—from a pandemic apartment build, through fines and seizures, to marquee strategic backing and a likely long runway—captures crypto’s adolescence. It’s messy. It breaks norms and occasionally rules. But when the dust settles, the genuinely functional ideas survive and scale. Prediction markets might be one of those ideas, not because they’re fun, but because they’re useful.

Whether or not there’s ever a $POLY token, whether or not a full U.S. rollout arrives next quarter or next year, the more interesting truth is already here: a liquid, transparent odds tape is now part of the information diet for investors, journalists, policymakers, and the public. That’s not a fad; that’s a new fixture.

Disclosures & Sources

This analysis includes forward-looking statements and scenarios that are inherently uncertain and not investment advice. Key public-domain reporting informing specific factual references includes mainstream coverage of: (i) exchange-operator investment and private valuation context; (ii) closure of U.S. probes in 2025; and (iii) the 2022 CFTC action and subsequent scrutiny. If you republish or excerpt this piece, please include attribution and avoid quoting any single source verbatim beyond short fair-use excerpts.