Pump.fun’s Return to Memecoin Dominance: 95% Graduations, ~$1M/Day, and the Moat Behind the Mayhem

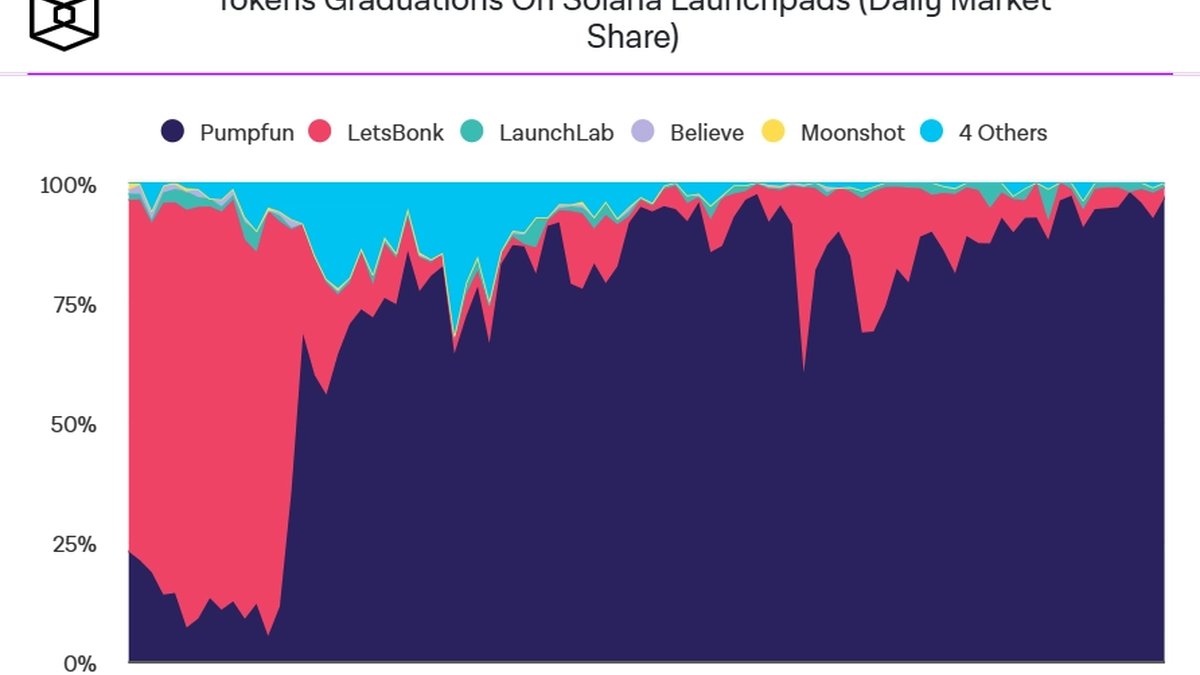

TL;DR: The Solana launchpad that industrialized the meme meta has reasserted control of the pipeline from first mint to AMM trading. Across recent windows, Pump.fun leads in daily graduations (tokens that exit the bonding curve and enter standardized liquidity pools) and is printing around a million dollars per day in fees on quieter tapes, with multi-million spikes in manic sessions. The edge is not a single feature; it is a compounding loop of discovery → graduation → liquidity → more discovery. This article explains the mechanics, lays out a measurement framework you can replicate, and maps the scenarios that could still dent the lead.

What 'graduation' means and why it became the main scoreboard

On most meme launchpads a token is born on a bonding curve. Early buyers move price algorithmically as supply expands. A graduation occurs when pre-set thresholds are hit (liquidity raised, holder dispersion, time a token has persisted without flags). At that point, the platform spins up a proper AMM pool, pairs it to the chain’s base asset, and applies locks, vests, or other safety rails. The event flips a project from a walled garden into the public market. It is also the moment at which market structure changes: arbitrage bots begin to watch the pair, smart money screens the ticker, routing aggregators integrate paths, and dashboard visibility expands.

Counting graduations per day and a venue’s share of those graduations is therefore a stronger proxy for real influence than raw launch counts, which can be spammed cheaply.

How we measure dominance without access to private data

1. Graduations per 24h: Track unique tokens that leave the bonding curve and appear with an AMM pool that meets minimum liquidity and lock criteria. Deduplicate renames and proxy pairs.

2. Graduation share by venue: Attribute each graduation to its origin launchpad, not the downstream AMM. This avoids miscounting when multiple pools are created later.

3. Fee run-rate: Approximate platform revenue by summing standardized, on-chain fees linked to creation, trading, and graduation events. Smooth outliers with a 7-day moving average to avoid day-of-week distortions.

4. Quality screens: Overlay basic filters like holder concentration thresholds, rug flags, and time-to-graduation windows to analyze not just quantity but survivability.

Applying this method through late Q3 and into Q4 shows the same pattern most traders felt anecdotally: a summer wobble as challengers dangled lower fees and incentive schemes, followed by a decisive re-accumulation of share as creators returned to the venue most likely to deliver attention and a functioning handoff to liquid markets.

The three loops that rebuilt the moat

1. Discovery → Liquidity: Pump.fun’s trending surfaces are a recommendation engine in disguise. When traders believe that 'the next movers' will first appear here, they watch reflexively. That reflex concentrates early demand on rising launches, which makes graduation thresholds easier to hit, which in turn creates credible pools that traders can exit through. The loop compounds until discovery itself becomes the moat.

2. Predictable graduation rails: Clear criteria, standardized pool templates, and visible liquidity-lock metadata reduce failed handoffs. Fewer broken transitions mean more creators willing to try, and more buyers comfortable risking small tickets pre-graduation. Reliability, not a gimmick, is what scales the long tail.

3. Creator UX → Viral loop: One-click minting, share-ready deep links, embedded media, and immediate charting turn every creator into a marketing department. The platform’s UI can be cloned; the habits it trained across millions of users are harder to uproot.

What changed in the competitive landscape

Challengers had the right instincts: court creators with fee holidays, promise 'fairer' listings, and subsidize early liquidity to bootstrap credibility. Some even shipped clever gimmicks around anti-botting or curated feeds. But two structural constraints limited their staying power. First, discovery remained fragmented; no upstart became the default homepage for a broad base of traders. Second, graduation quality was uneven; a few high-profile misfires eroded trust. When the broader market cooled from September’s heat, marginal creators stopped experimenting and defaulted to the venue that maximized their chance of traction. Under stress, ecosystems concentrate rather than diversify.

Inside the fee machine: why ~$1M/day on quiet tapes still matters

Launchpads monetize in small tolls that the mania multiplies: creation fees, graduation fees, takes on initial liquidity, and various in-app services. Even after peak days faded, the combination of high graduation share and steady launch cadence sustained a run-rate near a million dollars in calmer sessions. That level signals two important things. First, unit economics remain healthy even when attention cools, which buys time for product iteration. Second, the platform can keep investing in reliability and moderation, which feeds back into graduation quality and strengthens the brand.

Graduation quality, not just quantity

Counting graduations is not enough. Survivability and tradability are what users care about a week after mint. A simple, practical quality lens includes:

- Holder breadth: How quickly does the top-10 wallet share fall after graduation? Healthy breadth reduces rug incentive and dampens crash cascades.

- Liquidity resilience: What is the ratio of locked LP to free float? Are locks transparent and time-bound? Are there anti-rug commitments beyond a badge?

- Time-to-graduation: Instant flips often produce shallow pools that bleed out; sustainable launches show steady accumulation and a paced handoff.

- Downstream visibility: Do aggregators, scanners, and dashboards pick up the pair quickly? Visibility begets demand and arbitrage depth.

Why discovery integrity is the real long-term risk

If third-party dashboards or social bots become the primary place traders find new tokens, the in-house feed loses its edge and creators could launch elsewhere without sacrificing attention. That is why feed hygiene matters: real-time de-duplication, bot-drift detection, and clear rules for what shows up where. Quiet, continuous improvements here can be more defensible than loud feature drops.

Operational playbook to defend the lead

1. Publish live graduation dashboards: Show thresholds, queue status, lock parameters, and change logs in one place. Transparency reduces rumor cycles and empowers diligent traders.

2. Introduce a 'prime' creator tier: An opt-in path with stricter disclosures (multisig, team attestations, basic audits) that earns a distinct badge. Not censorship; simply a signal layer that risk-sensitive flows can follow.

3. Standardize pool templates: Make it trivial for graduated tokens to route into audited, anti-fragmentation templates that discourage shadow pairs and split liquidity.

4. Harden feed integrity: Blend on-chain heuristics (unique buyer velocity, wallet age distribution, net-buyer counts) with anti-gaming rules to demote inorganic pumps.

5. Creator education: Short, practical guides on avoiding common traps: over-concentrated supply, opaque locks, hidden mints. Better creators make a better marketplace.

Trader playbook for a 95% world

• Respect the funnel: Pre-graduation entries are lotteries and should be sized like lotto tickets. Post-graduation trades are liquidity plays; use limit orders and define exits in advance.

• Check holder breadth before size-up: If the top-10 wallets own most of the float, size small or pass. Breadth often improves a few hours after graduation; patience is an edge.

• Use time-based invalidation: If a newly graduated token fails to attract depth within a set window, step away. Opportunity cost kills as surely as rugs do.

• Fees are not destiny: A few bps saved on platform fees will not offset slippage from thin pools. Your real cost is the path to exit.

Risk map: what could crack the flywheel

• Reputation shock: A widely publicized rug tied to a 'verified' graduation or a security incident during a headline launch could push creators to hedge across venues.

• Chain congestion: If Solana bottlenecks during peak windows, failed transactions and poor fills can poison user trust. Competitors on alternative rails could use such windows to lure defectors.

• Policy change missteps: Abrupt tweaks to graduation criteria, locks, or fee schedules without clear communication create uncertainty that rivals can security vulnerability.

• Discovery disintermediation: If external feeds set the narrative and capture attention, a clone with comparable rails could ride that distribution without owning discovery.

Case study: when the funnel works as designed

Consider a meme that starts with a clever cultural hook and a modest creator following. Within minutes of launch, the token surfaces on the trending feed because it meets low-friction thresholds: rising unique buyers, consistent velocity, minimal red flags. Early buyers push toward graduation; the handoff spins up a standardized pool with visible locks. Aggregators detect the pair and route flow; charting tools pick it up; a few mid-sized wallets join as liquidity stabilizes. Within hours, the token trades like any other small-cap asset: spreads tighten, depth appears on both sides, and social proof compounds. Notice what mattered: not fee gimmicks, but the choreography between discovery, predictable rails, and quick downstream visibility.

Scenario planner for the next two quarters

1. Base case—dominance persists: Graduation share oscillates in a high band, daily fees hover near the current run-rate outside mania days, and challengers iterate without cracking discovery loyalty.

2. Upside—mania redux: A macro or cultural catalyst reignites meme risk. Launch cadence spikes, graduation counts soar, and daily fees revisit multi-million prints. Brand lock-in deepens as the default habit reasserts.

3. Downside—reputation or infra shock: A security incident or a major outage during a headline graduation triggers a creator hedge to alternate venues. Graduation share dips as the market redistributes for redundancy.

Practical KPIs to watch weekly

| Metric | Why it matters | Healthy signal |

|---|---|---|

| Graduations per 24h | Pipeline throughput | Stable in slow tapes, rising in risk-on |

| Share of graduations | Competitive position | High band with low variance |

| Median time-to-graduation | Demand quality | Neither instant nor stalled |

| Top-10 holder share post-grad | Rug risk proxy | Declining within first 24h |

| Pool depth at key ticks | Tradability | Tight spreads; visible ladders |

FAQs

Is 'no-fee' trading the real edge?

No. Network fees are already near-zero on high-throughput chains. The edge is predictable execution and a handoff that produces tradable pools quickly.

Do challengers have no chance?

They do. A venue that owns a new distribution surface, ships a meaningfully safer graduation rail, or partners tightly with downstream liquidity could peel share. But it must change habits, not just UI.

How much should creators optimize for badges and tiers?

Badges help, but they are not a substitute for transparency. Clear supply policies, visible locks, and honest communication convert better than cosmetic labels.

Bottom line

Memecoin infrastructure is equal parts product and culture. Pump.fun’s recovery to dominant graduation share and a robust daily fee run-rate in a cooler market says less about fee schedules and more about default habits: where creators feel seen, where traders feel first, and where liquidity shows up on time. The moat is the loop. To beat it, rivals must either build a stronger loop or pry discovery away. Until one of those happens, the path of least resistance for most creators and most traders remains the same: launch where the graduation is most likely to work and where the market already expects to look.

Disclosure: This is analysis and opinion for informational purposes only. It is not investment advice. Memecoin trading is highly speculative and can result in total loss. Manage risk carefully.