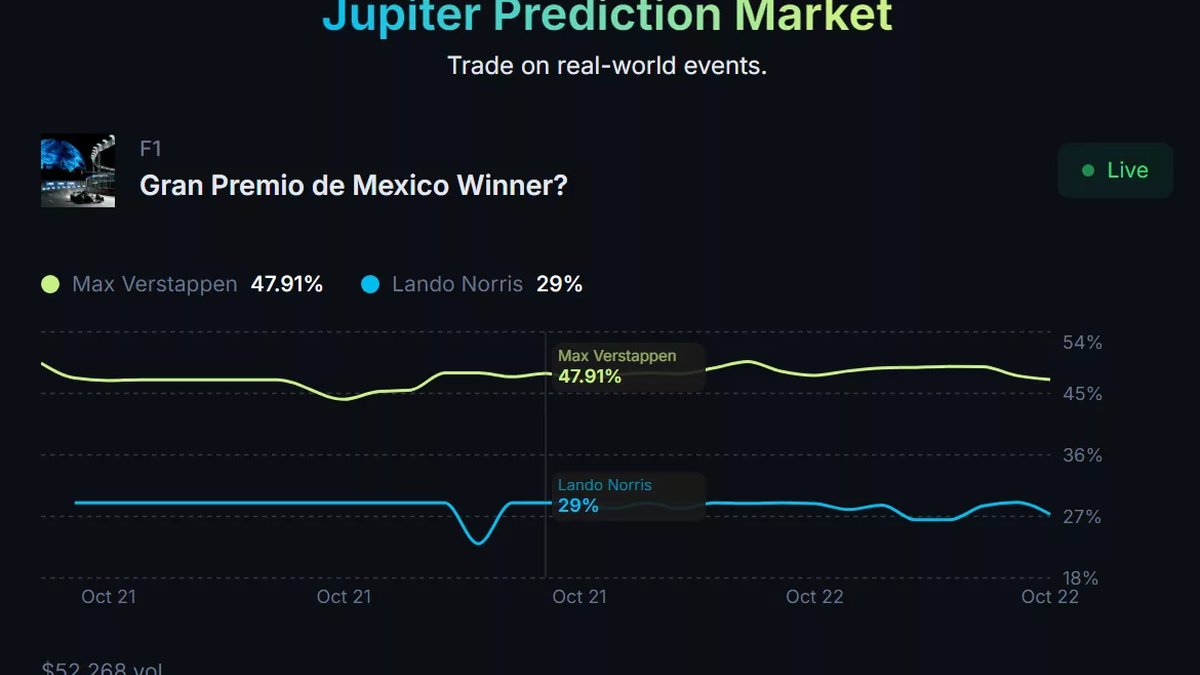

Jupiter’s Prediction Market (Beta) Goes Live With the Mexico GP

Executive summary: Jupiter, a leading Solana routing venue, has turned on a beta prediction market and listed its first live event: the winner of the Formula 1 Mexico Grand Prix. Traders can buy or sell binary outcome shares that settle to $1 if the selected outcome is correct and $0 if it is not. The front end runs on Solana for speed and low fees, while matching, risk checks, and final cash settlement are handled by a licensed event-contracts venue. Early guardrails include per-market float caps, per-address limits, and transparent rule cards that define sources of truth, appeal windows, and how steward revisions are handled. If the pilot holds up through qualifying and race resolution—meaning quotes remain stable, fills are fair, and settlement is boring in the best possible way—the feature set can expand to more categories and higher limits.

Why prediction markets matter in 2025

Prediction markets translate messy narratives into prices that behave like probabilities. That simple act—turning opinions into a number between 0 and 1—creates a lingua franca that analysts, journalists, and casual fans can read at a glance. In crypto, they also serve as a bridge between on-chain UX and real-world outcomes. Sports, elections, network upgrades, token listings, unlocks, and macro prints all come with discrete outcomes and timestamps. Markets that let users express a view quickly and close the position just as quickly are sticky by nature, especially when the UI is fast and the fees are understandable.

What launched, in plain English

- Binary contracts: Each outcome is a Yes/No share. If you buy Yes at $0.64 and the outcome occurs, you receive $1; if it does not occur, the position settles at $0. The current price itself is an implied probability before fees.

- Two-layer design: Quotes, order tickets, and portfolio P&L update on Solana; the licensed back end enforces rule cards, position limits, circuit breakers, and cash settlement.

- Beta guardrails: Hard caps on open interest, wallet-level limits, and throttle rules around volatile windows. These are designed to keep early books orderly and prevent cornering.

- Rule transparency: Each market ships with a readable rule card: data source of record, what constitutes the official result, how post-race steward changes are handled, and the dispute/appeal timeline.

Deep architecture: where each component earns its keep

Front end (Solana): The app handles wallet connection, quote display, order entry, and live P&L using Solana’s low-latency, low-fee environment. The benefit is obvious to anyone who has tried to edit or cancel orders during a fast tape: responsiveness reduces accidental fills, reduces user error, and makes it feasible to scale down position sizes without feeling punished by fees.

Back end (licensed venue): Matching and settlement occur off-chain under a formal rulebook. That gives the system tools absent from many purely on-chain bet apps: market halts, deterministic dispute handling, documented resolution feeds, and policy for edge cases. When stewards revise a race result or an official timekeeper updates a score after review, the back end can apply the rule card precisely.

Event lifecycle for the Mexico GP

- Pre-FP1: Models dominate. Prices reflect historical pace at altitude, track comps, tire selection probabilities, and likely weather. Books are thinner but often mispriced if the crowd leans too heavily on last week’s result.

- Between practice sessions: Markets digest long-run pace and sector telemetry leaks. This is where serious modelers add or trim.

- Post-qualifying: The largest repricing window. Once the grid locks, uncertainty compresses. If a favorite starts deeper on the grid after a penalty, prices move quickly and spreads can briefly widen.

- Race day T-60 → lights out: Liquidity peaks, spreads narrow, and books react to last-minute weather, setup, and tire choices.

- Live during the race: Outcome markets can move on safety cars, undercuts, and pit windows. If rule cards require, halts or throttles can apply during chaotic stretches.

- Provisional → official result: Final settlement follows the data source defined in the rule card. If a steward decision lands minutes after the flag, the market follows those procedures.

Fees, slippage, and break-even math

- Displayed fees: Beta prioritizes clarity: the app shows expected costs before you confirm. Total cost includes network fees and the venue’s fee component (embedded or line-item).

- Mark-to-market (MtM): Unrealized P&L = (current price − entry price) × shares − fees.

- Break-even example: If total costs ≈ 2%, a Yes share bought at $0.50 needs a ~$0.51–$0.52 exit to clear costs.

- Slippage reality: Off-peak books are thinner. Use limit orders when size matters, especially right after new information drops.

Probability literacy with worked examples

- Implied probability: Price is probability before fees. A $0.70 Yes implies ~70% chance. To justify buying, your private estimate must exceed 70% by more than fees and slippage.

- Value check: If your model says 76% and the market is 70%, your edge is ~6 cents per share before costs. With modest size and clean exits, that can be meaningful; with oversized trades in a thin book, costs overwhelm edge.

- Two-ticket hedge: Long Yes on the favorite at $0.62 and a small Yes on the correlated challenger at $0.18. You smooth variance without fully capping upside. Many pros prefer to monetize edge pre-start rather than hold maximum uncertainty through the checkered flag.

Trader archetypes and how they might use the beta

- Modelers: Build pace and tire-deg models using historical splits. Enter small pre-FP1, add only on new information, and aim to be flat by lights out.

- News-reactive traders: Specialize in fast, small orders on steward rulings and grid penalties. Use limits religiously; liquidity can vanish for seconds around headlines.

- Liquidity providers: Quote around fair value with tight, symmetric orders and step aside when your edge vanishes. In beta, the objective is inventory control, not heroics.

- Casual fans: Treat positions as entertainment. Use tiny size, preset exit points, and avoid holding through unpredictable chaos unless you are comfortable with a full loss.

Risk controls you should adopt on day one

- Position sizing: Cap any single event as a percent of your bankroll. Even high-confidence edges can be nullified by late penalties or weather.

- Time discipline: Decide in advance whether you will hold through the race. Many edges are easiest to monetize before the biggest uncertainty window (the start).

- Order hygiene: Use limit orders, set cancel-replace hotkeys, and keep a prewritten plan for halts or rate limits. Pilots can throttle order intake during stress.

- Wallet hygiene: Trade from a low-balance hot wallet. Revoke stale approvals weekly. Bookmark the official domain and avoid viral links.

Compliance and geography

Because the system leans on a licensed back end, availability varies by jurisdiction. Geo checks and KYC controls may apply. The safest mental model is simple: the rule card is law for each market—source of record, settlement timing, and appeal windows are binding. If stewards amend the official result, the market follows the documented procedure. If you do not understand the rule card, you do not understand your risk.

For builders: composability paths

- Odds widgets: Embed read-only implied probability tiles with 1-, 5-, and 15-minute deltas and volume stamps for blogs and dashboards.

- Alert bots: Threshold pings when favorites drift below or above certain bands (e.g., 55% or 75%), with webhook payloads for quant stacks.

- Portfolio exports: CSVs with per-ticket fees, timestamps, and MtM snapshots—handy for accounting and tax tooling.

- Structured products: Use on-chain odds as inputs for capital-protected notes or token-gated unlocks tied to event outcomes.

For market makers: quoting in a young book

- Inventory discipline: Keep gross exposure small relative to per-address limits; avoid getting trapped by sudden throttles.

- Quote adaptively: Use wider spreads during information releases, then tighten as uncertainty settles. Respect halt signals.

- Cross-signal use: Incorporate public pace metrics, weather radar, and team radio summaries as features in fair-value models.

90-day scenarios

- Base case — Controlled expansion: The Mexico GP settles cleanly. Markets expand to multiple sports and a handful of crypto-native events (e.g., listing windows or on-chain milestones). Per-market caps rise gradually; documentation hardens.

- Upside — Social flywheel: Odds widgets and clips travel on social. Retail flows improve depth even outside peak windows. A broader event menu lands sooner than expected.

- Downside — Operational volatility: A messy resolution or extended throttle during peak traffic damages trust. Caps remain low while reliability work takes priority.

Product wishlist (based on early user needs)

- Rule-card overlays: One-click access from the order ticket so users can confirm sources and appeals before sizing up.

- Ladder depth preview: Read-only snapshot of top-of-book depth to reduce slippage surprises for larger orders.

- Event timelines: A visual strip showing FP1, FP2, FP3, qualifying, and race with typical liquidity peaks marked.

- Tax mode: Toggle to show fee and P&L accruals in a ledger-friendly layout, exportable by event or month.

Security corner

- Domain hygiene: Navigate via a bookmark to the official app. Assume viral links are hostile until verified.

- Privilege separation: Use a low-value wallet for experiments; keep long-term assets elsewhere with hardware protection.

- Revocations: Make a weekly habit of reviewing and revoking approvals you no longer need.

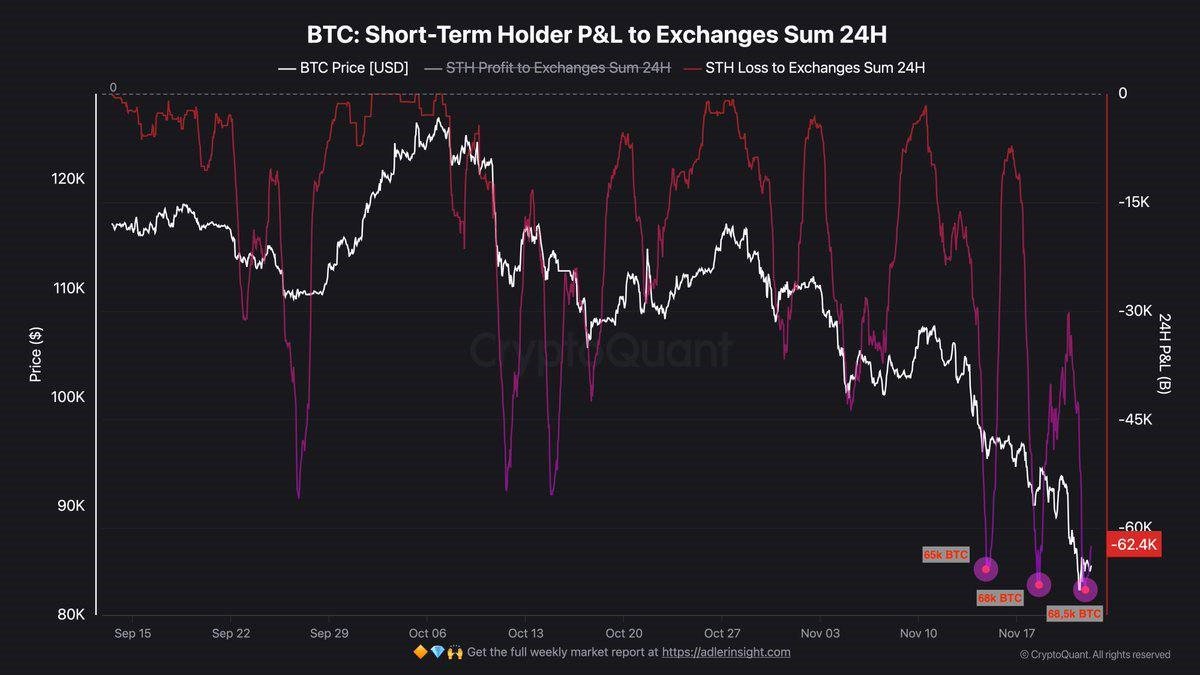

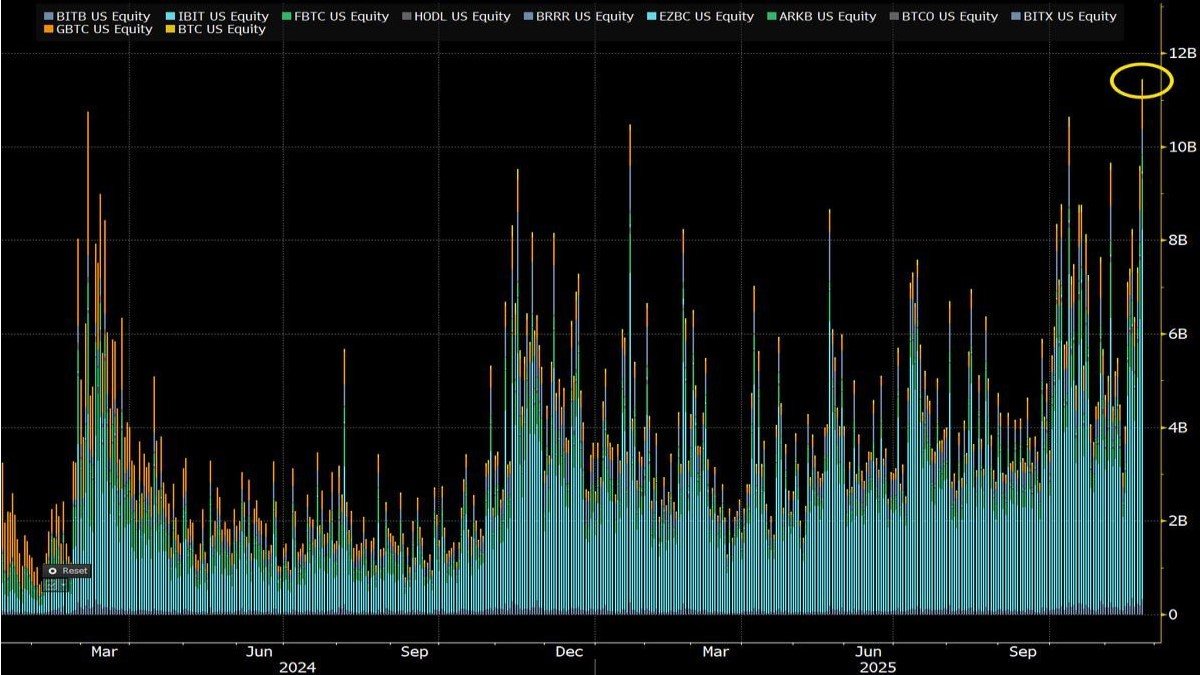

Short 24-hour crypto brief

- Product tape: Jupiter’s beta is live with conservative limits. Reliability through qualifying and race settlement is the focal test.

- Flows: Appetite remains headline-sensitive. Short-dated optionality often outperforms raw leverage during event windows.

- Calendar: Watch listing/unlock schedules and macro prints that pull liquidity intraday across majors.

Extended FAQ

Can I exit before the race ends?

Yes. You can sell shares back to the book whenever the market is open. Many traders prefer to be flat by lights out to avoid the largest uncertainty window.

Are parlays supported?

Not in beta. The initial focus is on clean single-event contracts with predictable resolution.

How are disputes handled?

Each market’s rule card specifies the official data source and the appeal window. The licensed venue administers disputes according to those rules.

Will per-address limits increase?

If systems remain stable and depth improves, per-market and per-address caps can rise gradually. Beta prioritizes orderly books over maximum size.

Do I need a specific token to trade?

The app displays acceptable settlement and fee currencies during order entry. Network fees remain low in line with Solana’s cost profile.

What happens if stewards change results hours later?

The market follows documented policy in the rule card. Read it before trading; if you do not understand the rule card, you do not understand your risk.

Glossary

- Binary (Yes/No) share: A contract that settles to $1 if the outcome occurs and $0 if not.

- Implied probability: The current price expressed as a percentage chance, before fees.

- Rule card: The canonical document defining sources of truth, settlement timing, and dispute windows.

- Throttle: Temporary rate limits or slowed order intake during volatile periods.

- Open interest (OI) cap: Maximum aggregate size for an event in beta.

Bottom line

Jupiter’s prediction-market beta aims to answer a simple question: can a high-speed on-chain front end deliver intuitive, fair, and predictable event trading when paired with a licensed back end that brings rule-of-law settlement? The Mexico GP is a crisp proving ground because it has staged information windows and a definitive official result. If quotes stay stable, fills are clean, and settlement is dull in the best sense—no drama, just receipts—expect more categories, higher limits, and tighter spreads. Treat the displayed price as a probability, respect limits, time entries to information, and read the rule card before you trade. That is how you turn entertainment into a disciplined, well-sized position rather than an expensive adrenaline spike.

Disclosure: Product news and analysis only. This is not investment advice. Event contracts can lose all value. Use small size, set limits, and understand the rule card before trading.