Chill or Chill Out? Warren Buffett’s 12-Quarter Sell Streak and a $382B Cash Pile: Bubble Alarm or Patient Optionality

When Berkshire Hathaway methodically sells equities for three straight years and lets cash stack to an all-time high, markets listen. The latest quarterly report (Q3 2025) shows roughly $12.5 billion of net equity sales and a cash hoard advancing toward $382 billion. With that, a familiar question is back on every desk: is Buffett quietly calling time on a global liquidity party, or is he simply refusing to pay up for assets that don’t meet his hurdle rate?

This essay takes the measured view. We separate signal from noise, explain why the behavior can be both cautionary and rational, map the second-order effects for risk assets (equities, credit, real estate, and yes, crypto), and finish with a practical playbook. The goal isn’t to idolize a legend; it’s to interpret an unusually persistent capital allocation stance from a firm with few equals in scale, flexibility, and cycle experience.

1) What actually changed—and what didn’t

What changed:

- Persistence of net selling. One quarter of trimming might be tax housekeeping. Twelve consecutive quarters is a policy. Berkshire has, by its own filings, been a consistent provider of shares to the public market since 2022.

- Cash at a record. Cash and T-bills reportedly near $382B is not just caution; it’s capacity. At current short-term rates, that float earns billions annually while preserving optionality.

What didn’t change:

- Discipline on price. The firm’s playbook—pay fair prices for growing cash flows with moats—remains. Expensive defensives, hyped cyclicals, and unproven tech at story multiples are not their habitat.

- Insurance-first mindset. Berkshire’s insurance engine prizes solvency and liquidity over stretch. Buffers matter more than bravado, especially when catastrophe frequency and severity feel structurally higher.

2) Four rational explanations that don’t require a doomsday thesis

- Hurdle math improved for cash. When Treasury bills pay a healthy nominal yield, the “opportunity cost” of waiting falls. If equities trade at earnings yields that, after cyclically adjusting for margins, are not dramatically better than the risk-free, patience compounds. Berkshire can earn billions just by standing still and saying “no.”

- Quality scarcity at scale. Deploying tens of billions into new positions is hard without moving the market or accepting “tourist” ideas. Mega-caps many love are priced for perfection, and private deals at size often come with strings that dull returns.

- Policy fog and macro cross-currents. Rate cuts might arrive, but the path matters. Sticky services inflation, tariff volatility, and rolling supply shocks inject fat-tail risk. When you underwrite across decades, you avoid paying up in fog.

- Insurance solvency optics. With climate risk, litigation waves, and reinsurance costs elevated, fortress liquidity is a competitive edge. A giant balance sheet sleeps better than a clever trade.

3) The bearish interpretation—and why it’s not crazy

Some will argue this is a slow-motion siren. Their logic:

- Multiple expansion untethered from productivity. If equity prices outrun trend earnings growth while real rates are not collapsing, forward returns compress.

- Leverage migration. Debt has crept from banks to non-banks; refinancing walls in private credit and CRE could expose hidden fragility if growth wobbles.

- Profit share peaks. Corporate profit margins sit high versus history; mean reversion could shave the E in P/E without a recession.

Buffett doesn’t time the cycle, but he does price risk. Twelve quarters of selling tells you that, by his yardstick, expected returns on marginal equity dollars are unexciting compared to cash. That’s a soft alarm even if it’s not a crash call.

4) Lessons from prior episodes: it’s the path, not the point

Go back through the big arcs. At the late-90s peak, Berkshire held cash and underperformed story stocks—right until it didn’t. In 2008–09, patience bought crisis assets. In 2020–21, the firm was selective while SPACs and meme manias raged; patience again looked boring—until it didn’t. Three patterns keep repeating:

- Discipline underperforms late in cycles. The final innings are where underwriters look slow and momentum looks smart.

- Price matters most at inflections. When regimes flip—policy, inflation, liquidity—the set of assets with embedded safety wins big.

- Cash is an offensive weapon once the bid disappears. Optionality is invisible right up to the moment it becomes invaluable.

5) A balanced read: bubble siren or patient bid?

Binary headlines miss the nuance. Berkshire’s behavior likely signals both that (a) broad expected returns look meh at prevailing prices and (b) the firm is building a bid of last resort for when spreads widen, risk premia normalize, or idiosyncratic opportunities surface. Think of it as a two-sided message: “We don’t need to chase,” and “We will be there when you need liquidity.”

6) Second-order effects across asset classes

Equities

- Quality duration vs stories. If a revered quality buyer won’t pay today’s prices, expect pressure on richly valued defensives and late-cycle quality trades. Rotations into genuinely undervalued cash generators may continue, but the bar is high.

- M&A optionality. A $300B+ war chest is a silent put option for deal markets. Stress in specific verticals (transport, utilities, specialty finance) could produce private transactions at Berkshire-friendly prices.

Credit

- Refinancing walls matter. If rates drift lower but credit spreads widen on deteriorating quality, all-in borrowing costs may not actually fall for weaker issuers. Expect a tale of two markets: resilient IG vs stressed lower tier.

- Private credit price discovery. Should defaults tick up, some funds may need liquidity at inopportune times. Expect quiet secondary bids from patient balance sheets.

Real assets

- CRE bifurcation. Logistical, data-center, and specialty assets with structural demand will stay bid; commodity offices in weak markets remain an acid bath. Berkshire’s patience hints that larger capitulation rounds may still be ahead in some sub-sectors.

Crypto

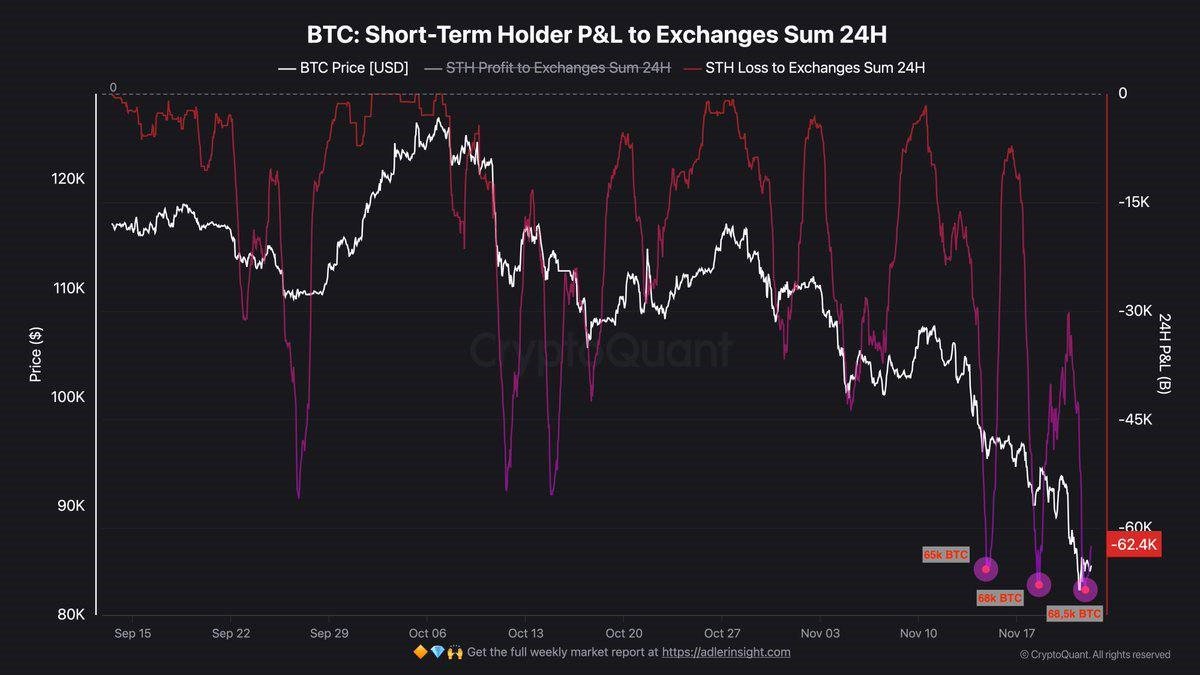

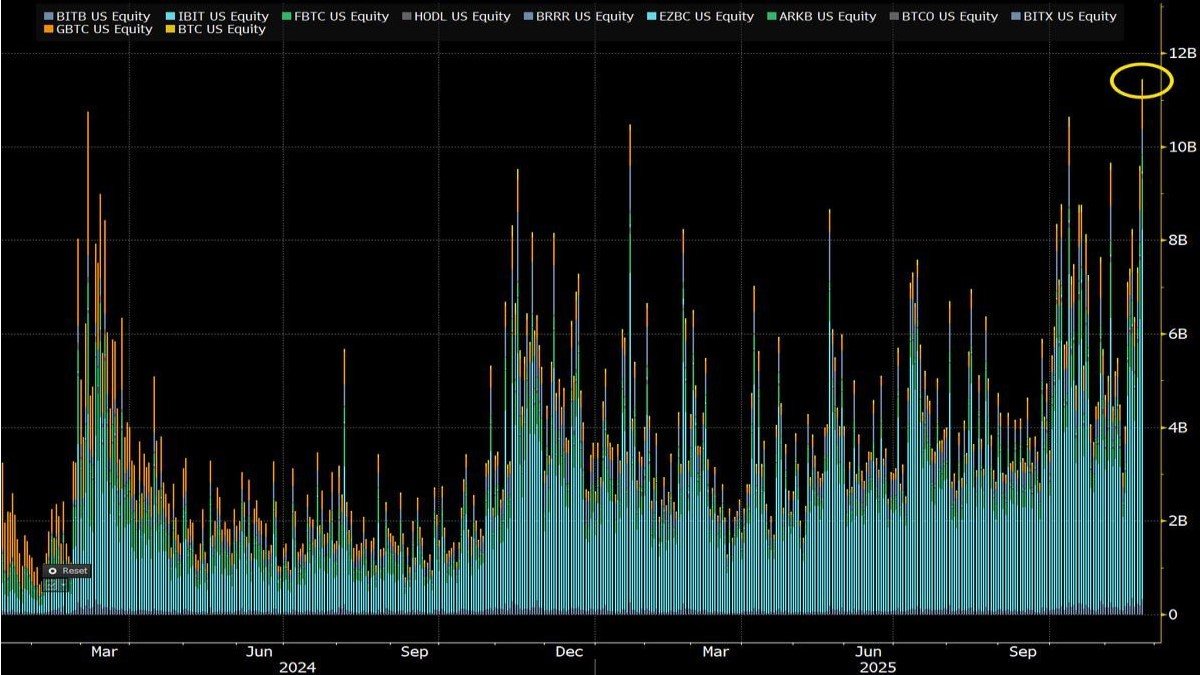

- Liquidity sensitivity. Bitcoin and major L1s are leveraged to global liquidity. A giant conservative buyer hoarding T-bills is not, on its face, bullish for speculative risk—but it can set up later tailwinds if policy eases and cash rotates back.

- Flight-to-quality even within crypto. When macro patience dominates, alt-beta underperforms while the assets with clean narratives and on-chain cash flows (staking yield, fee burns) hold relatively better.

7) Is this time different? The AI-capex riddle

The counterargument is that we stand at the dawn of a multi-year AI productivity wave and that current multiples understate future earnings. Two cautions:

- Earnings diffusion lags. Infrastructure spend leads, broad productivity arrives later if at all. The period in between can host disappointments and capex indigestion.

- Super-cycle selectivity. Every tech wave mints winners and graveyards. Paying any price for exposure rarely ends well. Berkshire’s stance says: show me the cash flows, at a price.

8) What would make Berkshire deploy?

Watch for these triggers:

- Spread normalization. Wider credit spreads that compensate for default risk.

- Valuation compression without earnings collapse. If prices fall more than profits, Berkshire’s math flips quickly.

- Policy clarity. Less tariff whiplash, steadier rate trajectories, calmer energy markets.

- Idiosyncratic distress. Forced sellers in quality assets—insurance run-offs, regulated utilities, trophy infra with temporary balance-sheet mismatch.

9) If you manage money, what should you do now?

A. Respect the message without copying the portfolio

You don’t have Berkshire’s insurance float, tax profile, or deal access. But you can emulate the principles:

- Barbell your risk. Keep a core in resilient cash-flow names or even cash-equivalents; use a small sleeve for convexity (growth, thematic, crypto) sized for turbulence.

- Stagger entries. Dollar-cost average into hated quality rather than chase heat maps.

- Match tenor to thesis. If your thesis is multi-year, don’t fund it with short-fuse leverage.

B. Refresh your downside math

- Write your “pain points.” At what drawdown do you mechanically trim? What macro print invalidates the thesis?

- Pre-commit to actions. If spreads widen X bps or earnings roll-over Y%, what changes? Process beats vibes when volatility spikes.

C. For crypto allocators

- Separate liquidity beta from idiosyncratic alpha. Beta trades (BTC, ETH) depend on global liquidity; alpha trades (select L2s, RWAs, infra tokens) need catalysts and cash flows. Size accordingly.

- Plan for regime shifts. Easing could push cash back into risk fast; keep a “shopping list” with levels, not feelings.

10) The psychological trap of legendary signals

Investors over-infer from icons. Buffett is exemplary—but not omniscient. He has underperformed during manias and avoided some big secular winners by choice. His stance is a probabilistic statement about expected returns, not an oracle of dates. The most dangerous misread is to convert a thoughtful cash build into either (a) apocalyptic certainty or (b) a reason to abandon your own mandate. Let his discipline challenge your assumptions; don’t let it paralyze you.

11) How the “bubble” might (or might not) end

If a global bubble is indeed inflating, history suggests three common pins:

- Funding stress that starts at the periphery (levered credit, shadow banking) and migrates inward.

- Earnings disappointment after a capex or M&A spree, revealing that growth was pulled forward.

- Policy accident—trade shocks, fiscal cliffs, or a too-late/too-much pivot by central banks.

But bubbles can also deflate gently if productivity genuinely accelerates and policy guides the descent. Berkshire’s cash posture accommodates either path: it pays to wait and pounces when price meets value.

12) Red-flag dashboard: signals worth watching weekly

- High-yield OAS (are spreads widening without a recession yet?).

- Primary issuance health in IG/HY (windows open or slam shut?).

- Refi calendar roll-downs in private credit and CRE (maturities vs take-out financing costs).

- Bank funding mixes (deposit betas, wholesale reliance).

- Earnings breadth (fewer companies driving index EPS?).

- Policy cadence (tariff oscillations, industrial policy, fiscal cliffs).

13) A word on market mood: danger lives in euphoria, not in fear

“When everyone is excited, be careful; when everyone is careful, be curious.” The three-year sell streak landed in a period of powerful narratives—AI super-cycle, on-shoring booms, digital assets institutionalizing. Those may all be true. They can also be true and overpriced. Berkshire’s stance is a reminder that valuation discipline isn’t anti-tech or anti-growth; it’s pro-math.

14) Bottom line

Is the global financial bubble about to pop? No one knows. What we do know is that one of the world’s most flexible, cycle-seasoned buyers has chosen, for 12 straight quarters, to be a net seller of equities and a net accumulator of cash—now around $382B. That does not scream apocalypse; it whispers expected returns. It says the price of safety is low today because safety pays, and the price of risk is high because risk assumes. If you run money, that’s the only message you need: align your exposures with payoffs that don’t require miracles, and husband your optionality for the moments when miracles are on sale.