Bitcoin to 220,000 Dollars in 45 Days? A Reality Check on the Viral IQ 276 Prediction

A bold Bitcoin forecast is making the rounds: YoungHoon Kim, a Korean figure promoted online as having an IQ of 276 and sometimes billed as the world’s smartest man, has publicly claimed that Bitcoin is likely to reach 220,000 dollars in the next 45 days. In the same breath, he has pledged to use all of his Bitcoin profits to build churches in every nation.

The call arrives at an awkward moment for crypto. Bitcoin has just slipped below the 94,000 dollar area for the first time since May, briefly erasing its gains for 2025 before clawing back into the mid 90,000s. Fear and Greed gauges sit deep in ‘extreme fear’, ETF flows have turned negative and analysts are busy talking about death crosses, not vertical moonshots.

So how should a serious investor interpret a forecast like this? Is it a visionary reading of the cycle, a marketing stunt, or something in between? As a professional news and analysis platform, our job is to strip away the viral framing and look at the underlying facts, incentives and probabilities.

1. What Exactly Did YoungHoon Kim Say?

The spark for this story is simple: a social media post in which YoungHoon Kim describes himself as the world’s highest IQ record holder and states that he expects Bitcoin to reach 220,000 dollars within 45 days. In follow-up comments and interviews, he reiterates that view and links it to a religious pledge, saying he intends to devote 100 percent of his Bitcoin profits to building churches dedicated to Jesus in every country if the forecast plays out.

Kim’s prediction appears to have been made in response to an earlier projection from Grok, an AI model whose output had been shared by a crypto researcher. That AI scenario suggested Bitcoin might reach 175,000 dollars by year-end. Kim’s response is effectively: the move can be bigger and faster than that model expects.

The message has all the ingredients of a viral moment: a huge number, a tight deadline, a quasi-mystical credential (extraordinary IQ), and a philanthropic angle with religious overtones. It is no surprise that crypto media, X posts and Telegram channels picked it up within hours.

2. Who Is YoungHoon Kim, And What Is This IQ Claim?

Kim is not a long-established figure in mainstream finance or in academic economics. Instead, his public identity is built around two pillars:

- He promotes himself as having an IQ of 276, which he says is the highest ever recorded.

- He has recently aligned himself with World Liberty Financial (WLFI), a high-profile crypto project associated with the Trump family, in an ambassador role.

On his official website and social profiles, Kim cites a network of record-keeping and IQ-adjacent organisations that he says have recognised his score: various ‘world record’ bodies, specialist memory or testing councils, and a reference to a peer-reviewed psychometrics journal. The presentation is designed to convey that his score has been independently verified, statistically validated and clinically affirmed.

However, there are several important caveats:

- There is no universally accepted, single global registry for IQ records. Different organisations maintain their own lists and standards, and some are privately run, with looser criteria than established academic institutions.

- The figure 276 is far outside the range of standard IQ tests, which are designed and normed for scores that rarely exceed the 160–180 band. Extremely high numbers are generally extrapolations from niche or unsupervised tests rather than raw outputs from mainstream instruments.

- Even crypto-industry news flashes that have amplified Kim’s role as ‘world’s highest IQ holder’ underline that the claim is controversial and widely questioned. In other words, even outlets covering his ambassador appointment have gone out of their way to flag the dispute.

For the purposes of markets, the precise number matters less than the dynamic it creates. Kim’s self-presentation as an ultra-high IQ prodigy is part of the narrative behind his Bitcoin call. The implication is clear: because he is supposedly exceptionally intelligent, his prediction should carry extra weight.

That framing is seductive, but as we will see, it does not hold up well when tested against how markets actually work.

3. The WLFI Connection: Politics, Branding And Incentives

Kim is not speaking into a vacuum. In October, several exchanges and aggregators carried a BlockBeats report that he had joined World Liberty Financial as an ambassador. WLFI is a crypto project closely intertwined with the Trump family: filings and investigative reporting show Trump family entities and their partners controlling a large share of the WLFI governance token supply, plus a related stablecoin ecosystem built around USD1.

World Liberty Financial has pitched itself as a bridge between decentralised finance and traditional finance, with a strong political and cultural brand: Trump-aligned, pro-crypto, pro-U.S. and marketed aggressively to conservative and overseas investor bases. Token sales and related investments have already generated substantial paper gains and real cash flows for Trump-linked entities, drawing scrutiny from regulators and journalists who worry about conflicts of interest between public office and private crypto ventures.

In that context, appointing a media-friendly ambassador with an outlier IQ story is a rational marketing choice. Kim’s persona reinforces several themes at once:

- Intellectual authority (the IQ narrative).

- Religious messaging (the church-building pledge aligns with parts of Trump’s supporter base).

- Crypto enthusiasm (the 220,000 dollar forecast supports a broader bullish narrative that benefits high-beta tokens in the ecosystem, not just Bitcoin).

None of this automatically invalidates his views. But for a professional reader, it is a reminder to ask a simple question whenever a dramatic forecast appears: who benefits if people believe this?

4. Where Bitcoin Actually Is – And What 220,000 Dollars Implies

Before debating whether 220,000 dollars in 45 days is plausible, it is helpful to anchor the current reality.

Over the past week, Bitcoin has fallen through a series of important levels. Trading data from exchanges and market trackers shows that BTC briefly dropped below 94,000 dollars for the first time since early May, with intraday lows in the 93,000 dollar region before recovering slightly. As of Monday trading, spot prices are fluctuating in the mid 90,000s, leaving Bitcoin roughly 24–25 percent below its early October all-time high around 125,000–126,000 dollars.

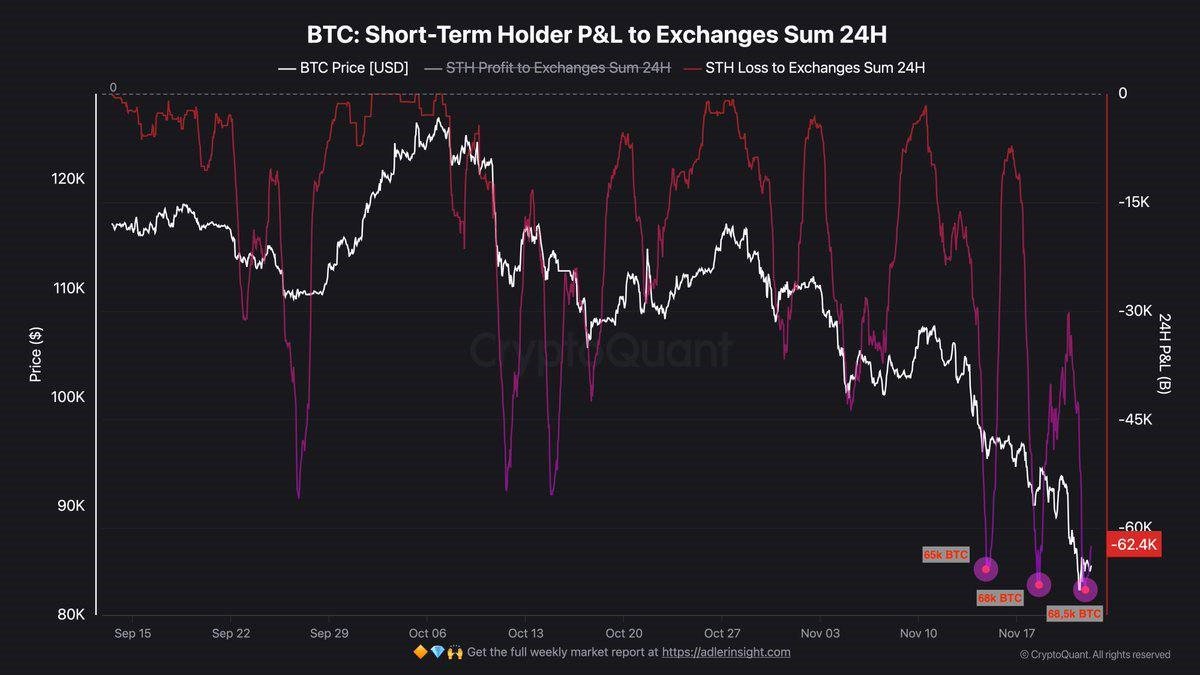

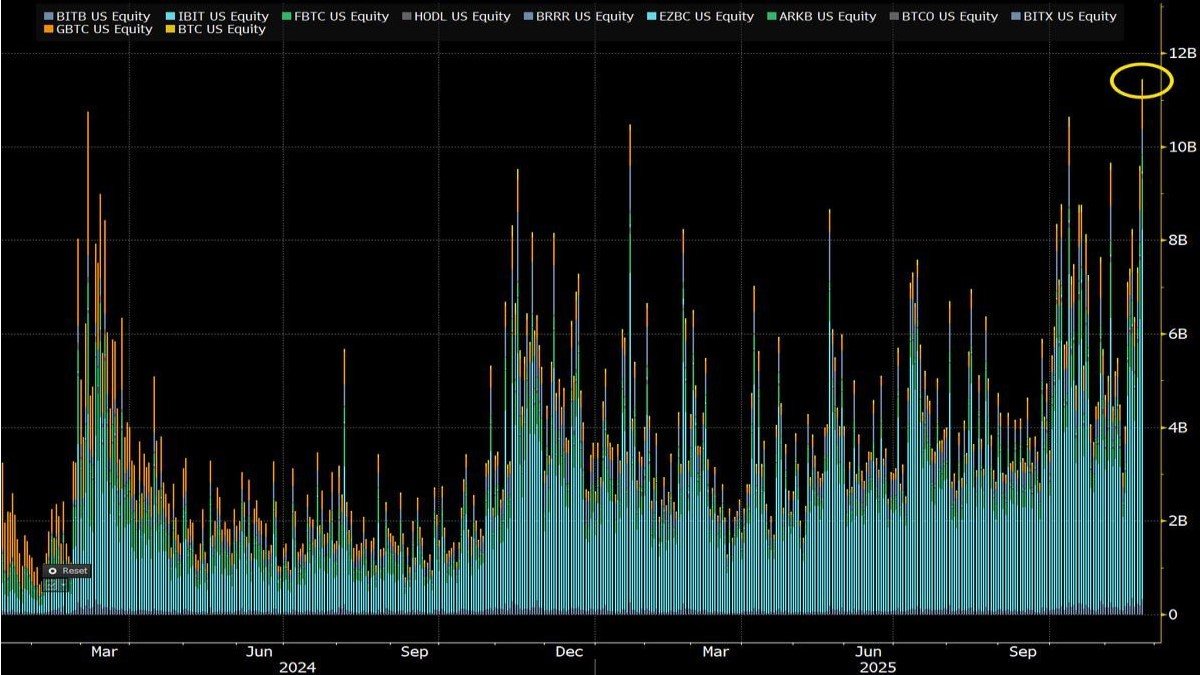

Sentiment indicators are equally stark. The Crypto Fear and Greed Index has slumped to 10 out of 100, firmly in the ‘extreme fear’ band. Coverage from CoinDesk, CoinMarketCap and other analytics sources links that reading to a cluster of bearish factors: spot Bitcoin ETF outflows, a newly formed technical death cross, a sharp rise in liquidations and heavy selling by some long-term holders.

From this starting point, a move to 220,000 dollars would require more than a simple bounce. It would imply a roughly 130 percent rally in a month and a half, in a market that has just erased its year-to-date gains and is digesting macro headwinds (a more hawkish Federal Reserve, trade tensions and the aftershocks of a lengthy U.S. government shutdown).

Is that mathematically impossible? No. Bitcoin has, on multiple occasions across its history, doubled or more in far less than a year. During the 2017 and 2020–2021 cycles, there were stretches where BTC advanced tens of percent in a matter of weeks. The asset is volatile by design.

But ‘not impossible’ is a low bar. The right question is: what would need to go right, in a very short period, to justify that kind of move, given the current backdrop of extreme fear, ETF outflows and macro uncertainty? When framed that way, the 220,000 dollar target looks less like a base case scenario and more like the extreme tail of the distribution.

5. Intelligence Versus Markets: Why IQ Is Not a Trading Edge

The core marketing hook of Kim’s forecast is that it comes from someone who claims to have an extraordinary IQ. Many investors subconsciously treat that as a kind of shortcut: if a very smart person believes something with conviction, perhaps they see something the rest of us do not.

History suggests that this is a dangerous way to think about markets.

Some of the most spectacular blow-ups in finance have involved extremely intelligent people. Long-Term Capital Management in the late 1990s counted multiple Nobel Prize laureates among its partners; it still collapsed under the weight of leverage and crowded trades. Highly credentialed macro funds have repeatedly been caught on the wrong side of central bank policy shifts. In crypto specifically, engineers and quants with elite academic pedigrees have built protocols that later failed because of governance flaws, incentive misalignments or simple fraud.

The reason is simple. Markets are not IQ tests. They are complex, adaptive systems driven by human behaviour, institutional constraints, liquidity flows and random shocks. Many of the key variables – how regulators will react, how other investors will position, what exogenous events will hit – are fundamentally uncertain. No amount of raw cognitive horsepower can make that uncertainty go away.

That does not mean intelligence has no value. A thoughtful analyst can build better models, interpret data more carefully and avoid obvious logical traps. But once you move into the realm of short-term price targets, especially extreme ones on tight timelines, humility matters far more than IQ points. The honest answer from even the smartest market participant is usually some version of: ‘Here is my scenario, here are the risks, and here is how I manage them’ – not ‘This will happen because my brain is better than yours.’

6. The Psychology Of Extreme Forecasts

If extreme forecasts are so unreliable, why are they so common – and so popular?

From a behavioural-finance perspective, Kim’s 220,000 dollar call is a near perfect example of what might be called narrative leverage. A few psychological levers are being pulled at once:

- Authority bias. The reference to IQ 276 and ‘world’s highest IQ’ taps into a natural human tendency to defer to perceived experts, even outside their domains of expertise.

- Urgency. The 45-day deadline creates a ticking-clock effect. People feel they must act quickly or miss out.

- Altruism. The promise to fund church-building projects worldwide frames the bet as not just profitable but morally positive, especially for religious audiences.

- Community identity. Linking the prediction to a Trump-aligned crypto ecosystem and Christian language reinforces group identities that are already powerful drivers of behaviour.

None of these mechanisms are unique to Kim. Influencers on both the bullish and bearish side of markets have used similar framing techniques for years. The lesson for investors is not to become cynical about all commentary, but to learn to recognise when an argument is leaning heavily on narrative rather than on transparent data and risk analysis.

7. A Framework For Evaluating Calls Like This

Rather than asking ‘Is Kim right or wrong?’, a more productive approach is to run his prediction through a simple evaluation checklist. A professional desk might use questions like these:

- Track record. Does the forecaster have a documented history of making time-stamped predictions, and if so, how often have they been accurate? In Kim’s case, he is a newcomer to the crypto-prediction space, so there is little to go on.

- Skin in the game. How is the forecaster exposed if they are wrong? The church-building pledge is about what happens if he is right; there is little detail on what happens to his own capital or reputation if the target is badly missed.

- Mechanism. Does the forecast come with a clear explanation of the drivers that would take Bitcoin from the low 90,000s to 220,000 in 45 days – for example, a specific regulatory catalyst, macro shock or structural change in demand? Or is it framed more as an assertion?

- Base rates. How often has Bitcoin delivered similar moves in similar environments (extreme fear, ETF outflows, rising rates expectations)? Here, history argues for caution.

- Conflicts of interest. Could the forecaster or their associates benefit indirectly from increased attention or inflows into related projects, such as WLFI or other ecosystem tokens?

When that checklist is applied to the 220,000 dollar thesis, the result is not an absolute ‘impossible’, but a low-probability scenario heavily wrapped in marketing and persona. That does not make it malicious by default. It does, however, mean that treating it as investment-grade guidance would be unwise.

8. How Professional Investors Might Use This Information

For professional desks and serious individual investors, the practical use of forecasts like Kim’s is not to trade directly on them, but to gauge sentiment and positioning.

In a market currently dominated by fear, a highly publicised ultra-bullish target can be read as a kind of stress test: will traders dismiss it out of hand, or will it rekindle speculative interest on the margin? If funding rates, options skew and retail order flow start to flip aggressively positive in the days after this narrative spreads, that itself is useful data – not because the specific target is credible, but because it shows how quickly animal spirits can return even in a bruised market.

At the same time, seasoned participants will tend to treat such episodes as a reminder to tighten their own decision-making processes:

- Re-check position sizing and leverage: would a move against you of 30–40 percent in either direction be survivable?

- Review how much of your thesis is anchored in hard numbers (on-chain flows, macro data, protocol revenues) versus narratives built around personalities.

- Clarify your time horizon: are you trading the next 45 days, the next halving cycle or the next decade?

In other words, the value of an extreme prediction is often as a mirror, not a map. It shows you how you react under emotional pressure.

Conclusion: Entertaining, Not A Roadmap

The claim that Bitcoin will climb to 220,000 dollars in the next 45 days, made by a man who presents himself as the world’s highest IQ record holder and a religious benefactor, is tailor-made for the age of viral finance. It is provocative, polarising and shareable.

But investor portfolios are not social-media feeds. When judged against current market conditions – deep drawdowns, extreme fear readings, ETF outflows and a challenging macro backdrop – the forecast looks far more like a publicity-charged outlier than a base case. Kim’s association with a politically charged, Trump-aligned crypto project only heightens the need for scepticism.

None of this rules out the possibility that Bitcoin could, at some point, trade at or above 220,000 dollars. Crypto has surprised sceptics before, on both the upside and the downside. The key is timeframe and probability. Over a 45-day horizon, with volatility already elevated and liquidity patchy, the range of plausible outcomes is wide – but the median of that range sits nowhere near Kim’s headline number.

For a professional news and analysis outlet, the responsible stance is clear: treat such predictions as interesting data points about market psychology and narrative construction, not as guides for capital allocation. Intelligence, whether real or claimed, is not a substitute for risk management. And the most important skill in this market is not scoring high on an IQ test; it is surviving long enough to still be here when today’s noise has faded and tomorrow’s opportunities appear.