Strategy Just Bought the Dip (Again): Inside the $836M Bitcoin Bet and What It Really Signals

In most markets, a trillion dollars in value wiped from an asset class is usually the cue for leveraged funds to back away and corporate treasurers to quietly hedge. In Bitcoin, it is apparently the moment when one company in Virginia decides to buy another eight thousand coins.

That, in essence, is what just happened. As Bitcoin broke below the psychological six-figure line and slid into the mid-$90,000s, speculation exploded that Strategy — the former MicroStrategy and still the largest publicly listed Bitcoin treasury vehicle in the world — was under pressure. Social feeds filled with theories that margin calls or credit constraints would finally force Michael Saylor’s company to sell into weakness.

Instead, Monday’s regulatory filings revealed a very different reality: Strategy had spent the week adding another 8,178 BTC at an average price of about $102,171 per coin, for a total of roughly $835.6 million. That brings its stash to 649,870 BTC, acquired over several years at a blended cost near $74,000 per coin and now worth around the low-$60 billions depending on the intraday price. The whale did not flinch; it doubled down.

For a professional audience, the question is not whether this is “bullish” or “bearish” in meme terms. It is what this move reveals about Strategy’s risk calculus, Bitcoin’s late-cycle dynamics, and the increasingly sharp divide between BTC and the rest of the crypto market.

1. The hard numbers behind the headline

Let’s start with the facts, because the narrative around Strategy is noisy at the best of times.

- Between November 10 and November 16, Strategy purchased 8,178 BTC.

- The company reports an average purchase price of roughly $102,171 per coin, including fees and expenses.

- Total consideration: approximately $835.6 million.

- After this tranche, Strategy’s total holdings stand at about 649,870 BTC.

- The cumulative cost basis for those holdings is now in the area of $48.4 billion, implying an average acquisition cost close to $74,000 per BTC.

Those numbers matter because they frame the entire Strategy story. At current spot levels in the mid-$90,000s, the firm is sitting on unrealised gains in the tens of billions of dollars on its Bitcoin position alone. That gives Saylor room, in his own calculus, to keep leaning into volatility rather than de-risking at each drawdown.

This latest purchase is also a notable step up in tempo. For much of 2025, Strategy’s weekly buys had slowed to a few hundred BTC at a time, interspersed with occasional weeks of no activity. By contrast, 8,178 BTC in seven days is a return to the kind of “big clip” that characterised earlier phases of its strategy, albeit at a much higher price level.

2. From software vendor to Bitcoin balance-sheet machine

To understand why a single weekly purchase has become a macro story, you have to appreciate how far Strategy has moved from its origins.

Until 2020, the company was known as MicroStrategy, a conventional enterprise software vendor selling business-intelligence tools. That year, concerned about dollar debasement and a decade of near-zero interest rates, Michael Saylor convinced the board to deploy corporate cash into Bitcoin. What began as a $250 million allocation evolved, over multiple capital raises, into a full-blown transformation.

By early 2025, the company had officially rebranded as Strategy and described itself as a “Bitcoin Treasury Company” and “Bitcoin development company”, explicitly positioning its software business as secondary to its Bitcoin balance-sheet strategy. A few months later, the legal name change was completed, and the MicroStrategy brand was effectively retired in favour of the new identity.

Since that pivot, Strategy has:

- Issued multiple rounds of convertible notes to finance Bitcoin purchases.

- Launched large at-the-market (ATM) equity programmes to sell new shares into strong markets and recycle the proceeds into BTC.

- Added layers of preferred stock issuance to its capital stack, again with an explicit mandate to acquire more Bitcoin.

The result is a corporate entity that increasingly behaves like a leveraged, actively managed Bitcoin holding vehicle layered on top of a still-profitable but comparatively small software business. For shareholders, the bet is clear: Bitcoin goes up over the long run more than enough to compensate for interim drawdowns and financing costs.

3. Rumours of forced selling versus the reality of planned leverage

When Bitcoin slipped below $100,000 and then into the mid-$90,000s, it was almost inevitable that rumours would swirl about Strategy’s stability. Social media posts claimed that lenders might be calling in lines, that covenants might be breached, or that the company would be forced to dump coins to shore up its capital structure.

So far, there is no evidence for those claims. Instead, the data show a company continuing to do exactly what it has told investors it would do: raise capital when markets allow and funnel that capital into more Bitcoin. The latest 8,178 BTC purchase was funded, according to filings, via a mix of preferred stock issuance and pre-authorised equity sales, not via some desperate fire sale of other assets.

Critics, including high-profile short sellers and sceptical macro analysts, argue that this does not eliminate risk; it merely shifts the timing. In their view:

- Strategy’s debt and preferred obligations, which run into the hundreds of millions of dollars per year, create a fixed call on cash flows that its software business alone cannot easily meet.

- The company’s ability to keep rolling those claims and issuing new equity is heavily dependent on both Bitcoin’s price and on investor willingness to pay a premium for the stock.

- In a deep or prolonged Bitcoin bear market, that combination could become unstable, forcing Strategy to deleverage at exactly the worst time.

Saylor’s counter is simple and unapologetic: he is not managing Strategy like a traditional enterprise software firm; he is managing it as an experimental, high-beta Bitcoin proxy with long-dated capital. That is why he has been consistent in stressing that the company does not hedge its BTC, does not try to call tops and bottoms, and does not plan to sell coins simply to smooth quarterly earnings.

The new 8,178 BTC tranche reinforces that message. Far from being a sign of distress, it is a public statement that, at least for now, Strategy is more concerned with maximising long-run Bitcoin exposure than with pleasing critics worried about short-term volatility.

4. What this purchase does to Strategy’s cost basis and risk profile

Adding coins near $102,000 obviously drags Strategy’s average purchase price higher, but not by as much as casual observers might think. With nearly 650,000 BTC on the books, one more 8,000-coin clip only nudges the blended cost per coin moderately higher, toward the mid-$70,000s.

More interesting is how the purchase changes the distribution of Strategy’s cost basis:

- Early tranches bought in 2020–2021 sit far below the current market, with enormous embedded gains.

- Large additions in 2024 and 2025, including this latest one, cluster around the $90,000–$110,000 range.

In other words, while the aggregate position is still well in the black, an increasing proportion of Strategy’s Bitcoin has a cost basis not far below current spot. That makes the equity more sensitive to drawdowns: a move from $95,000 to $70,000 would still leave the company profitable on its BTC, but would inflict significant mark-to-market pain on the most recent tranches and on the shareholders who financed them.

That is exactly what we see in the stock. Even as Strategy’s BTC holdings have grown, its share price has been volatile and, in recent weeks, has traded at a narrower premium to the value of its underlying Bitcoin stash. When the market narrative is optimistic, investors are willing to pay up for a leveraged, actively managed proxy. When fear rises, that premium compresses, and the stock can fall faster than Bitcoin itself.

From a risk-management viewpoint, this means the latest purchase is a double-edged sword:

- If Bitcoin resumes its uptrend and eventually makes new highs, the 8,178 BTC added around $102,000 will look like a savvy, if aggressive, deployment of capital.

- If Bitcoin enters a deeper and more prolonged drawdown, this tranche will amplify drawdown in Strategy’s equity and further fuel the narrative that the firm has over-extended.

Strategy is betting, loudly, on the former scenario.

5. Signal to the market: conviction in BTC, indifference to alt “seasons”

One of the under-appreciated aspects of Strategy’s latest buy is what it says about the internal hierarchy of the crypto market in the eyes of large, high-conviction actors.

During the recent sell-off, many altcoins fell far more sharply than Bitcoin. In some cases, top-50 tokens dropped 30–50% from their local peaks within days, liquidity dried up in smaller names and on-chain activity rolled over as speculative flows retreated. Yet Strategy’s response was not to diversify into a basket of high-beta “opportunity” tokens. It was to add more of the original asset.

This behaviour reinforces a structural trend: for large institutional and quasi-institutional players, Bitcoin is increasingly viewed as the only truly “core” crypto asset, with Ethereum as a close second for those willing to take smart-contract risk. Everything else, including high-profile altcoins, is still seen as satellite risk. It may earn a place in hedge-fund books or specialist mandates, but it rarely becomes treasury-grade.

In that context, Strategy’s buy functions as a kind of unofficial vote on the “BTC versus altcoin” debate:

- When volatility spikes and funding conditions tighten, the company chooses to add exposure to Bitcoin, not to rotate into cheaper-looking altcoins.

- Its behaviour suggests that, from its perspective, Bitcoin’s long-term risk/return profile is superior enough that the potential upside from catching an altcoin rebound is not worth the additional technological, regulatory and liquidity risks.

For altcoin projects trying to position themselves as “institutional grade,” this is a sobering reality. Even as ecosystems like Solana, XRP, Chainlink and others build ETFs, stablecoins, tokenization stacks and custody partnerships, the largest high-profile treasury experiment in the world remains unapologetically Bitcoin-only.

6. Funding structure: how Strategy keeps finding billions to deploy

Another critical part of the story is where the $835 million actually comes from. Strategy does not have a spare billion of software profits lying around each quarter; its operating business, while healthy, is nowhere near that scale.

Instead, the company has built a multi-pronged funding machine that mixes conventional corporate finance tools with crypto-specific timing:

- At-the-market equity offerings. Strategy maintains shelf registrations that allow it to issue new shares into the market opportunistically. When investor demand for the stock is strong, the company can raise capital at a premium to its net asset value and redeploy the proceeds into Bitcoin.

- Convertible debt. In prior cycles, the firm tapped investors via zero-coupon or low-coupon convertible notes, effectively borrowing against future equity appreciation fueled by Bitcoin’s rise.

- Preferred stock. More recently, Strategy has used preferred equity as a way to access capital with defined dividend obligations while preserving common equity optics.

This playbook does two things at once. It maximises upside in bull phases by giving Strategy more dry powder to buy Bitcoin, and it spreads the risk of that leverage across different investor groups and time horizons. But it also means that Strategy’s long-term survival is tethered not just to Bitcoin’s path, but to continued market tolerance for its funding model.

That is why seemingly esoteric developments — such as index providers declining to include Strategy in major benchmarks, or exchanges tightening rules on equity issuance tied to crypto purchases — matter. They shape how easily the company can keep turning stock-market enthusiasm into fresh Bitcoin buys.

7. What this means for other investors: proxy or cautionary tale?

For institutions and sophisticated individuals watching from the sidelines, Strategy’s latest purchase raises an uncomfortable question: should they treat this as a bullish signal to increase their own Bitcoin exposure, or as a warning sign that the market may be over-leveraged at high prices?

There are arguments on both sides.

The bullish read:

- The largest, best-known corporate Bitcoin holder is not just holding through volatility; it is adding size around $100,000. That is a strong vote of confidence in the long-term thesis.

- The company’s average cost basis near $74,000 means it can weather substantial drawdowns before the position turns loss-making on paper, suggesting it is unlikely to be a forced seller in all but the most extreme scenarios.

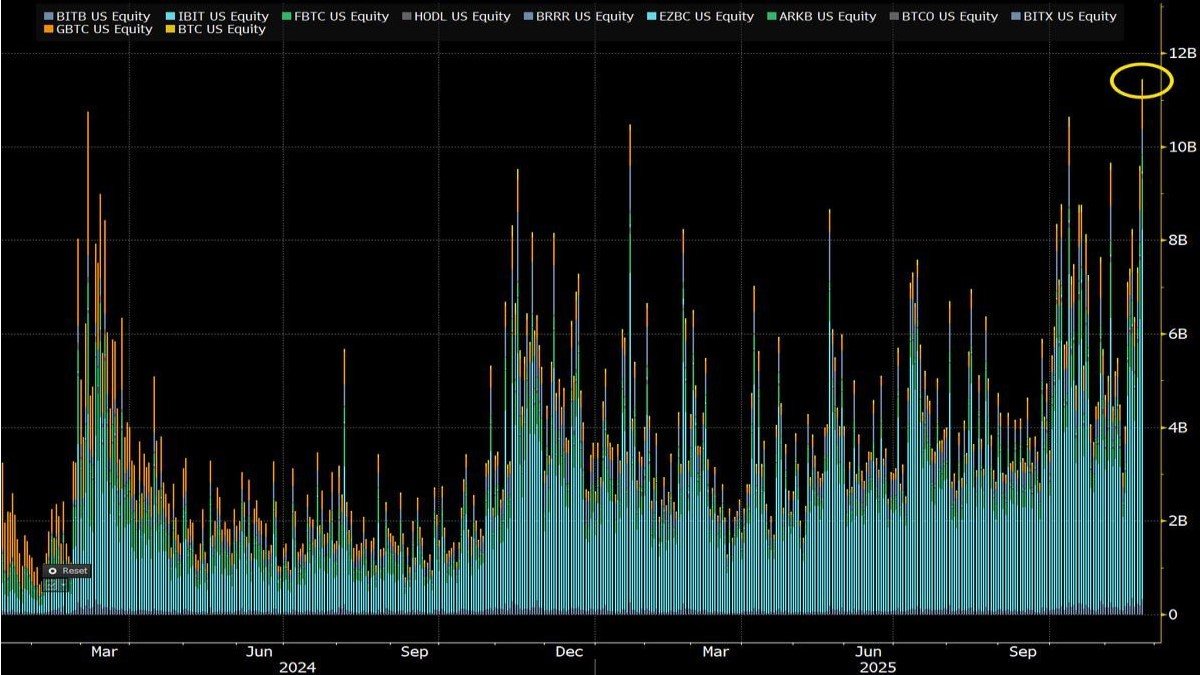

- By maintaining a weekly buying cadence, Strategy provides a steady, visible source of structural demand that offsets some of the selling pressure from short-term traders and ETF outflows.

The cautious read:

- Strategy’s model is inherently leveraged: it layers debt, preferred equity and fresh share issuance on top of a volatile underlying asset. That amplifies both gains and potential losses.

- Buying aggressively after a parabolic run can be a sign of reflexive exuberance, not prudence. Historically, the more confident Saylor has sounded, the closer Bitcoin has sometimes been to at least local tops.

- For investors who simply want Bitcoin exposure, there are now cleaner, lower-fee instruments available — from spot ETFs to custodial solutions — that avoid the corporate and funding risk embedded in Strategy’s equity.

In practice, many professionals are landing somewhere in the middle. They treat Strategy as a high-beta satellite around core Bitcoin exposure: useful when one believes a strong upside phase is still ahead, but inappropriate as the sole or primary way to access the asset.

8. The bigger picture: late-cycle behaviour or mid-cycle conviction?

Finally, there is the meta-question: what does this $836 million purchase say about where we are in the broader Bitcoin cycle?

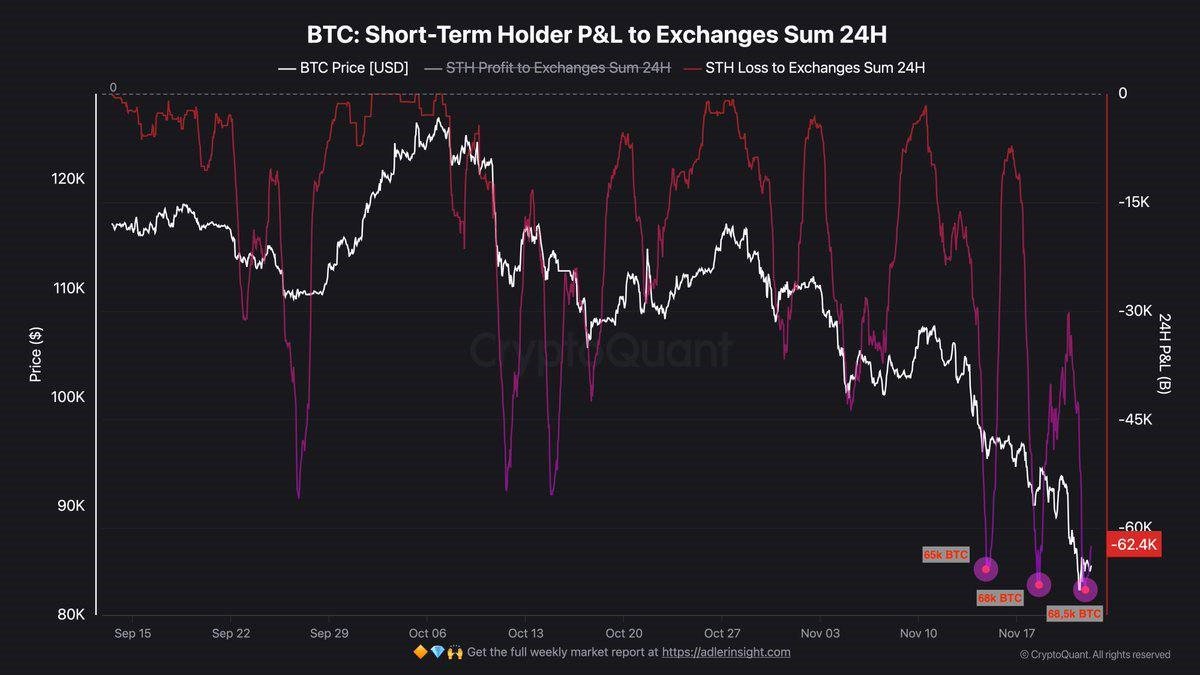

On the one hand, buying thousands of coins north of $100,000 looks like classic late-cycle behaviour. Historically, the most aggressive, highly publicised accumulation often happens after huge moves, not before them. Strategy itself has sometimes been a coincident indicator of froth, with its largest buys clustering near local peaks.

On the other hand, structural conditions are very different from prior cycles. Bitcoin now trades in a world with:

- Deep spot ETF markets that have pulled in large, sticky pools of capital.

- A growing role in macro narratives around fiscal stress, monetary debasement and geopolitical fragmentation.

- Corporate and sovereign actors that are building long-term treasuries rather than trading in and out.

Viewed through that lens, Strategy’s latest purchase can be seen less as a speculative top signal and more as part of a multi-year reallocation of balance sheets into non-sovereign monetary assets. From that perspective, whether the company bought at $102,000 or $80,000 may matter less than whether Bitcoin ultimately spends most of the next decade above or below its current range.

For now, what is clear is this: the rumours of forced selling were wrong. Strategy did exactly what its executive chairman said it would do: treat a violent drawdown as an opportunity to increase exposure, not as an excuse to retreat. Whether that bravery is rewarded or punished will be one of the defining stories of the next phase of this cycle — not just for Strategy shareholders, but for every investor trying to decide how much of their own balance sheet belongs in Bitcoin versus the long tail of altcoins competing for attention.

Nothing in this article constitutes investment, trading, legal or tax advice. Bitcoin and other digital assets are highly volatile and may not be suitable for all investors.