From Counter-Trend Short to Leveraged Long: The Anatomy of a Whale’s ETH Loop

In the past few sessions, a large address has shifted from an opportunistic short-then-cover posture into a boldly pro-cyclical stance: posting ETH on Aave, borrowing stablecoins against that collateral, using the proceeds to buy more ETH, and repeating the loop. The result is a quickly scaled position whose notional exposure now exceeds roughly $1.4 billion, according to estimates circulating among on-chain trackers. Whether you applaud the conviction or flinch at the risk, this is the sort of balance-sheet engineering that can bend local price dynamics, influence derivatives funding, and stress-test DeFi risk parameters.

This analysis explains how the recursive strategy works, why whales use it, where it breaks, and what it may be telling us about ETH’s near-term path. We include simple formulas and scenario trees so you can audit the odds rather than outsource them to social sentiment.

How the Looping Strategy Actually Works

At its core, the playbook is simple:

- Deposit ETH (or a closely correlated liquid staking token) as collateral on Aave.

- Borrow a stablecoin against that collateral (e.g., USDC/USDT/DAI), subject to loan-to-value (LTV) caps and liquidation thresholds.

- Use the borrowed stablecoins to buy more ETH on a venue (CEX, aggregator, RFQ desk, or on-chain DEX), then bring that ETH back to Aave as additional collateral.

- Repeat until reaching a target Health Factor (HF) buffer, or until marginal borrow costs exceed the expected return.

In traditional finance terms, this is a self-reflexive carry trade funded in dollars and long the convex asset (ETH). The leverage multiple is not set by a broker but emerges from the protocol’s risk parameters and the trader’s appetite for margin of safety.

A quick primer on the knobs that matter

• LTV vs. Liquidation Threshold (LT): Aave defines a maximum LTV you can borrow against collateral and a slightly higher LT at which liquidation begins. For illustration (values vary by asset, market, and eMode), imagine LTV ~60–70% and LT ~75–80% for highly liquid collateral. The gap between LTV and LT is your breathing room.

• Health Factor (HF): HF > 1.0 is safe, HF = 1.0 is liquidation. Whales often operate with HF 1.5–2.5 in quiet tapes and >2.0 in choppy tapes.

• Borrow rate: Variable APR rises with utilization. A loop can look cheap at 5–6% but turn punitive if utilization spikes and APR jumps to double digits.

• Oracle design: Aave relies on external oracles; price feeds update in discrete steps and are robust but not infallible. In a volatility shock, the timing of oracle updates becomes part of your risk.

Why a Whale Chooses This Path (Even After a Profitable Short)

The address in question reportedly took home sizable profits on a prior short (circa $30M) during a swift ETH downdraft, then flipped into a leveraged long. That’s not inconsistent; it is a variant of buying the reflexive recoil with house money. The logic:

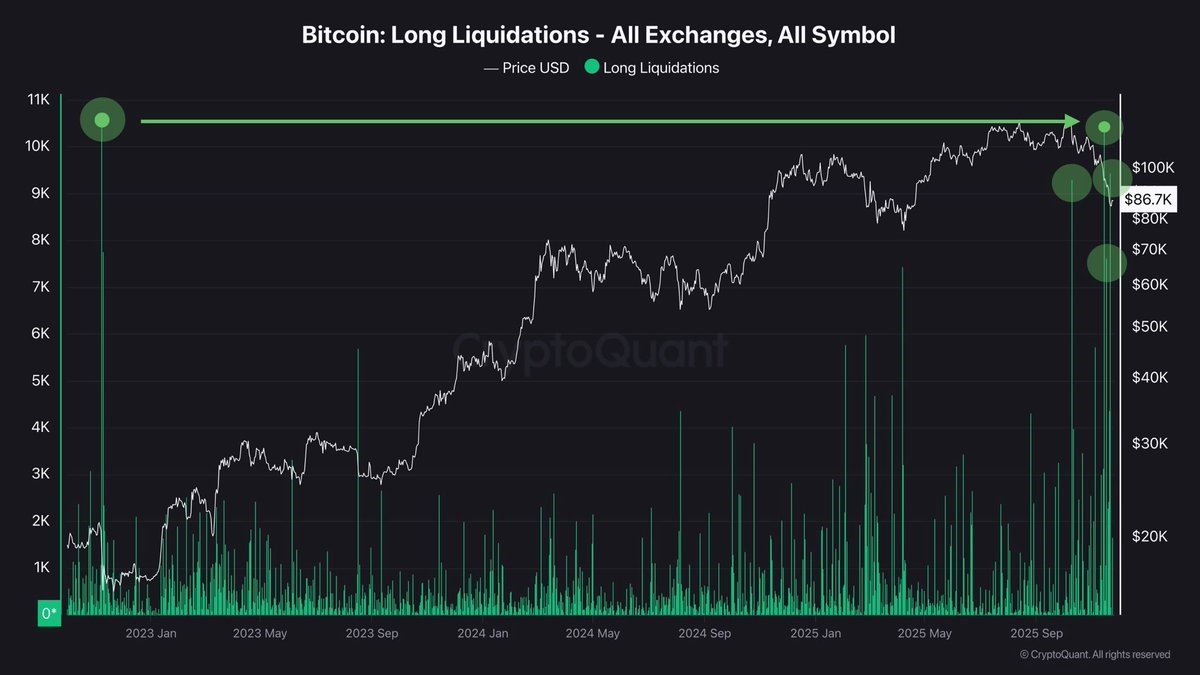

- Path dependence: After heavy long/alt liquidation, basis often compresses, funding can flip negative, and spot order books reload. The perceived downside skew shortens for a period—exactly when leverage is cheapest.

- Carry math: If variable stablecoin borrow APR is below your expected ETH drift + any basis/arbitrage carry, the trade can be self-financing over a medium horizon—provided drawdowns stay within your buffer.

- Strategic signaling: A public loop announces conviction. It can attract follow-on flows (copytrade behavior) and tighten the spring for upside squeezes.

The Leverage Math—In Plain English

Suppose you start with 100,000 ETH collateral at price P. At a conservative effective LTV of 50% (below protocol max to leave a buffer), you borrow 50% of that value in stablecoins, buy more ETH, deposit it, and iterate. If you loop n times, your notional exposure scales roughly like:

Exposure multiple ≈ 1 / (1 − LTV_effective)

At 50% effective LTV, the multiple is ~2×; at 60%, ~2.5×; at 67%, ~3×. That means a 33% price drop can effectively wipe out the equitized cushion at ~3× unless you de-risk early. The liquidation price depends on your exact HF and the protocol’s LT:

Liquidation trigger when HF → 1.0 ≈ (Collateral_value × LT) = Debt_value

Rearranging gives a simple intuition: for a given debt stack, every 1% decline in ETH inches Debt/LT closer to collateral value; if borrow APR is rising at the same time, the fuse shortens.

Where It Breaks: Four Live Risks

1) Reflexive downside and liquidation cascade

Looped longs are pro-cyclical. If ETH falls sharply, the whale must either add collateral, repay debt, or face liquidations. When a large vault liquidates, it doesn’t just close a trade; it prints market sell orders via liquidators, widening the wick and tugging adjacent HFs lower, risking a chain reaction. This is why the initial HF buffer matters more than the headline notional.

2) Oracle lag and gap risk

During a sudden 5–10% move with crowded gas lanes, oracle updates, liquidator bots, and RFQ desks all race the same clock. Delays are typically seconds, but on stressed days seconds decide whether the whale calmly tops up or gets clipped at a poor execution price. This is rare, but not theoretical.

3) Borrow rate spikes and negative carry

Utilization determines variable APR. If many traders mimic the loop, borrow demand can surge and APR can jump into the teens. The carry that looked comfortable at 6–8% becomes painful at 15–20%, encouraging deleveraging even without a spot drawdown.

4) Liquidity and slippage on the way in and out

A $1.4B notional book cannot turn on a dime via thin on-chain pools without moving price. Smart whales distribute execution across CEX block books, OTC RFQ, and aggregators, but liquidity vanishes in panics. You can always sell; you cannot always sell at yesterday’s marks.

Why Aave (and Why Now)

Aave’s multi-market footprint, mature risk engine, and wide borrower base make it the default venue for large ETH-backed borrowing. The protocol also offers features (like eMode for correlated assets in some deployments) that can increase capital efficiency with guardrails. Post-2022, DeFi venues hardened their risk frameworks, upgraded oracle routes, and diversified liquidator sets. That doesn’t make looping safe; it makes it safer than it used to be for professionals who watch their HF like a hawk.

Signal or Noise? What a $1.4B Loop Says About the Tape

On its face, the whale’s pivot from short profits to a heavy long suggests they view the recent ETH selloff as exhaustive, not existential. Three potential inferences:

- Positioning cleanup is advanced: Long-dated holders realized profits; leverage was flushed; basis compressed. This is when informed money likes to build a core.

- Whale expects a policy/fundamental assist: Easing macro, ETP inflows resuming, L2 activity, or a structural catalyst (e.g., staking dynamics, tokenization pipes) could raise the expected drift.

- Liquidity speculative position: Even if price meanders, the whale may plan to harvest microstructure edge (basis, RFQ rebates, intra-venue spreads) while sitting long.

None of that guarantees upside. It does suggest the market may be transitioning from forced to voluntary sellers—an important regime flip.

Scenario Modeling: 30 Days Out

1) Constructive Grind (Probability ~40%)

ETH oscillates in a broad 12–20% band. Borrow APR stays single-digit to low double-digit as utilization normalizes. The whale keeps HF > 1.8, opportunistically adding on dips and skimming on spikes. Funding noise persists, but net realized losses compress. Result: higher lows, reluctant higher highs; alts catch selective bids; the loop looks prudent.

2) Air-Pocket to Forced De-risk (Probability ~30%)

Macro headline or ETF outflows trigger a fast 15–20% ETH drop. Borrow APR jumps. Health factors slide toward 1.2; whale tops up once, then repays part of the debt via OTC block sales to avoid liquidation. Temporary capitulation wicks print; liquidity providers widen quotes. Result: painful but finite; the address survives, but the strategy’s carry advantage erodes.

3) Impulse Squeeze & Re-Rating (Probability ~20%)

Basis normalizes, funding flips modestly positive, and fresh inflows push ETH through a near-term resistance cluster. The loop’s convexity works in the whale’s favor; they harvest principal to reduce borrow while letting gains run. Result: the loop is hailed as ‘genius,’ drawing copycats—ironically sowing the seeds of the next crowded trade risk.

4) Low-Probability Shock (Probability ~10%)

An exogenous disruption—oracle incident, major venue outage, or policy surprise—hits while utilization is high. Borrow APR spikes; oracle lags briefly; liquidations ping the book. Result: disorderly prints and structural de-risking across DeFi. This is the tail you hedge, not predict.

Liquidation Math You Can Do on a Napkin

Let C be the USD value of collateral, D the USD value of debt, and LT the liquidation threshold. Liquidation triggers when C × LT ≤ D. With ETH as the primary collateral, C ∝ ETH_price. Treating D as roughly constant over intraday windows (ignoring interest accrual), the percentage price drop to liquidation from a given HF can be approximated by:

Drop_to_Liq ≈ 1 − (D / (LT × C))

Because HF ≈ (LT × C) / D, we can rewrite Drop_to_Liq ≈ 1 − 1/HF. So HF 2.0 implies ~50% cushion to liquidation in this simplistic framing; HF 1.5 implies ~33%; HF 1.25 implies ~20%. Real systems include fees, liquidation bonuses, and multi-asset collateral effects, so treat this as directional.

Is Using stETH (or eMode) ‘Safer’?

Many sophisticated players supply stETH instead of ETH to pick up staking yield, or use eMode (where available) to raise capital efficiency for correlated pairs. That can improve carry, but it introduces correlation risk: if the stETH/ETH discount widens under stress, your collateral value can slip faster than ETH spot—shrinking HF at the worst time. The trade-off: extra carry in quiet markets for basis risk in stressed ones. A prudent variant mixes ETH and stETH and sets stricter HF floors.

What to Watch This Week (Whale or No Whale)

• Borrow APR and utilization on stablecoin markets: If utilization climbs with flat price, the loop is becoming crowded. Rising APR compresses carry and raises de-risk pressure.

• Health Factor distributions: Some analytics dashboards estimate HF density. A concentration just above 1.1–1.3 is tinder.

• Oracle updates vs. intraday volatility: Spiky tapes plus slow blocks elevate gap risk.

• Spot–perp basis: A healthy turn is basis lifting from negative/flat to modestly positive while perp OI rebuilds without funding blowing out.

• Stablecoin net issuance and exchange reserves: Expanding stablecoin float and falling exchange ETH balances are classic accumulation signatures; the opposite argues for patience.

For Risk Managers: A Concrete Playbook

1. Codify minimum HF by regime: e.g., HF ≥ 2.2 when 7-day realized vol > 70; HF ≥ 1.8 otherwise. Do not waive it because ‘price looks cheap.’

2. Size ladders for top-ups and repayments: Pre-stage stablecoin and ETH buffers across multiple custodians/venues. In a crunch, operational latency—not judgment—is what fails you.

3. Borrow mix: Split between variable and (where offered) fixed/‘stable’ rate tranches to dampen APR shock. Rebalance weekly.

4. Execution hygiene: Favor RFQ blocks and TWAP over DEX market orders for large clips. Keep an emergency OTC line with pre-negotiated haircut for collateral swaps.

5. Liquidation rehearsals: Simulate a 20% intraday ETH drop + 2× borrow APR + 1% oracle delay. If your process cannot gracefully delever there, your size is wrong.

What It Means for Non-Whales

Retail traders often mimic looping with much thinner buffers. Don’t. The whale’s advantage isn’t just capital; it’s infrastructure: priority execution, multiple banking rails, dedicated monitoring, and a legal team to manage counterparty risk. If you must loop, under-leverage shamelessly and treat HF as sacred, not aspirational. The most robust plan for a discretionary trader is simpler: keep a spot core, trade a small perp overlay, size positions so that a forced exit is a nuisance—not a career event.

Bottom Line

A whale levering ETH on Aave into a $1.4B+ notional long is both a signal and a risk. It signals that informed capital sees recent ETH weakness as opportunity and believes the market’s plumbing is sturdy enough to support a sizable loop. It also concentrates liquidation risk that can turn a routine dip into a disorderly wick if borrow costs spike or oracles lag in a shock. Whether this becomes the kernel of the next leg up or the nucleus of the next air-pocket depends on three levers you can track in real time: APR/utilization, HF buffers, and basis/flow. Trade the tape you have—not the story you want.