The U.S. Labor Market Is Cooling, Not Crashing

The latest Job Openings and Labor Turnover Survey (JOLTS) landed with a headline that sounds contradictory at first glance: job openings in the United States stood around 7.7 million, slightly above market expectations, yet the mood on Main Street feels cooler and more cautious. Quits are down, layoffs are edging higher and hiring has softened. The question for investors is whether this is the start of a serious deterioration, or simply a long-anticipated normalization after the overheated post-pandemic boom.

Looking beneath the surface, the data support a nuanced view. The labor market is no longer the roaring engine of 2021–2022, but it also is not flashing the kind of stress signals that typically precede deep recessions. Instead, the U.S. appears to be moving through a slow-motion cooling phase—one in which workers hold on more tightly to existing jobs, firms post openings selectively and the overall system drifts toward balance rather than a sudden break.

1. What the Latest JOLTS Report Actually Shows

JOLTS offers a detailed snapshot of how employers and workers behave each month: how many positions are open, how many people are hired, how many quit voluntarily and how many are let go. The October numbers reinforce the picture of a labor market that is easing off the boil but still far from crisis territory.

• Job openings: Open roles hovered near 7.7 million, modestly above consensus forecasts but essentially flat compared with recent months. That is a big comedown from the peak near 12 million openings in early 2022, yet still comfortably above pre-pandemic levels.

• Hiring: Actual hires slipped to roughly 5.1 million, a drop of more than 200,000 from the prior month. Firms are advertising roles but appear more selective in converting those postings into signed contracts.

• Quits: The voluntary quit rate fell to about 1.8%, its lowest reading in more than five years. Fewer people are confident enough to leave without a new job already in hand.

• Layoffs: Layoffs and discharges climbed toward 1.9 million, the highest level since early 2023. That is still below the levels seen in past recessions, but it shows that some employers are starting to trim headcount more aggressively.

Those four lines tell a coherent story: employers are no longer chasing workers at any price, and workers are no longer job-hopping as freely as they did during the post-pandemic hiring bonanza. The labor market is moving away from the exceptional tightness of 2022 toward something closer to a normal expansion.

2. Why Openings Can Stay High While Confidence Slips

At first, it may seem odd that job openings are elevated while quits and hiring weaken. Several dynamics help reconcile that apparent contradiction.

2.1 Seasonal and sector-specific effects

The latest data cover the period leading into the year-end holidays, when retailers, logistics firms and hospitality businesses traditionally ramp up seasonal hiring. Many of those positions show up as job postings and openings even if they are filled only briefly or remain vacant because employers cannot find the right candidates at the wages they are willing to pay.

As a result, openings can rise for technical reasons—companies advertising roles they may or may not fill—without signaling a major upswing in underlying labor demand.

2.2 The rise of the “cautious posting” strategy

Over the past two years, more firms have adopted what might be called a cautious posting strategy: they keep job ads up to scout talent but slow-walk actual hiring decisions. This allows them to gauge the supply of workers without committing to payroll costs until demand is clearer.

That behaviour fits with the current macro backdrop. Growth has slowed, interest rates remain restrictive by the standards of the last decade and uncertainty about trade policy and politics has risen. It is rational for executives to keep options open while avoiding long-term commitments.

2.3 Workers are less willing to gamble

On the worker side, the drop in quits suggests a shift from offense to defense. In 2021–2022, many employees could leave for higher pay at will, confident that opportunities were abundant. Now, with headlines about layoffs in technology, logistics and finance, the perceived cost of making a bad move has risen.

When people value job security more highly, they are slower to jump ship even if they see open roles on job boards. That behaviour shows up in the JOLTS data as high openings but subdued churn.

3. Cross-Checking JOLTS With Real-Time Job Posting Data

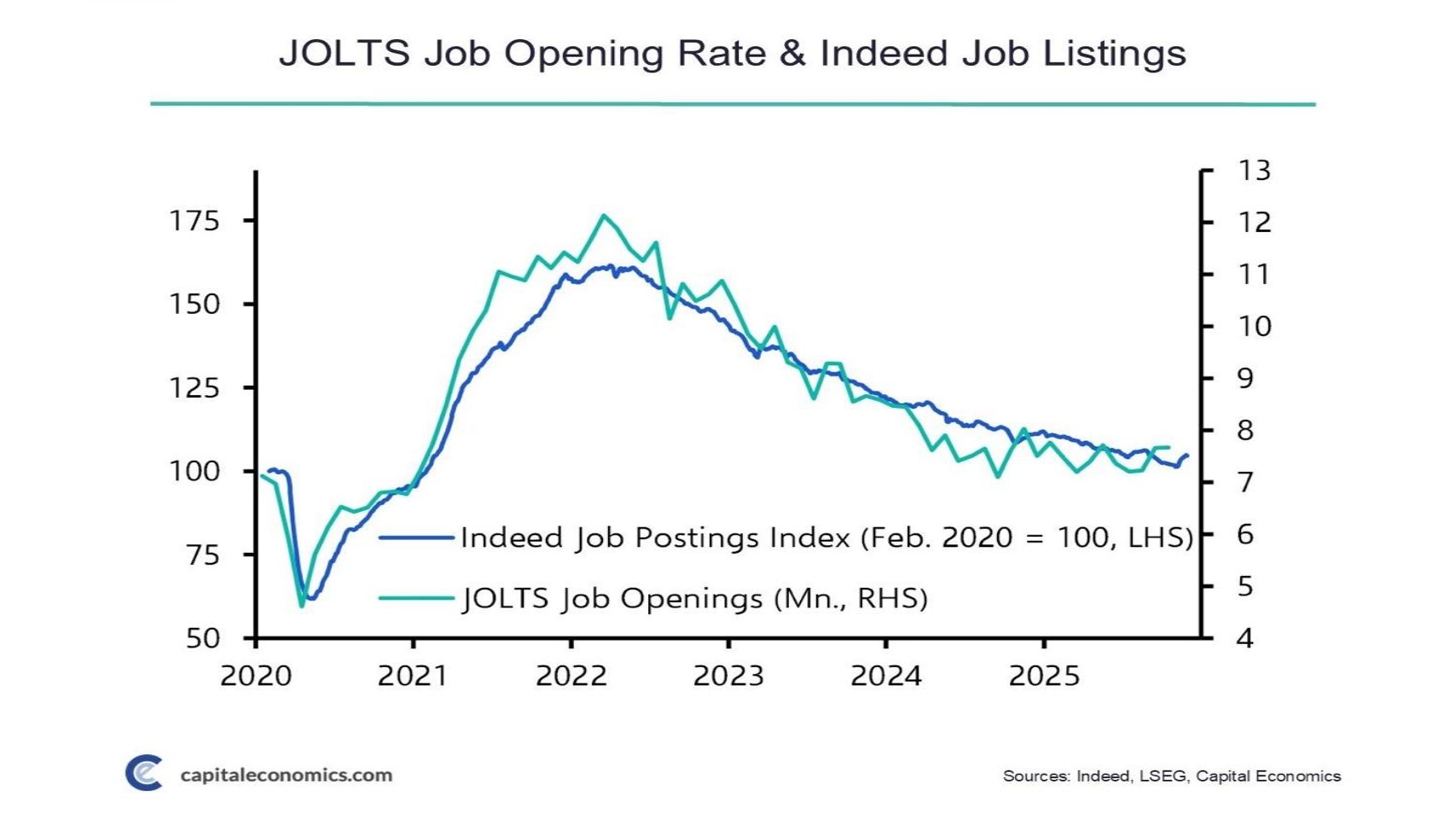

To avoid over-interpreting any single data release, it is useful to compare JOLTS with other sources. One of the best cross-checks is the Indeed Job Postings Index, which tracks daily online listings and rebases them relative to February 2020.

The broad pattern in Indeed’s index mirrors what we see in JOLTS and in the chart above. Postings surged far above the pre-pandemic baseline in 2021 and early 2022, reflecting intense competition for labour. Since mid-2022, the index has drifted lower almost continuously. It is still above 100—meaning there are more online job ads than in February 2020—but the excess is steadily shrinking.

Capital Economics and other research groups have plotted the two series together. The lines track each other closely: as Indeed postings step down, JOLTS openings follow with a modest lag. The latest readings place both metrics in a range that is weaker than the boom years but not yet consistent with outright contraction. In other words, the labour market is easing, not collapsing.

4. Cooling, Not Crisis: How Far Are We From “Red Alert”?

The key question is whether today’s numbers are a prelude to something more serious. History suggests a few thresholds worth watching.

• In past downturns, openings typically fell sharply below their long-run average and layoffs spiked well above 2 million per month. We are not there yet. Openings have come down but remain above pre-COVID levels, and layoffs, while rising, are still closer to normal expansion levels than to crisis peaks.

• The unemployment rate—reported in a separate survey—has edged higher but remains historically low by the standards of the last 30 years. A rapid move higher in unemployment would be a stronger warning sign than the gradual drift we have seen so far.

• The quits rate is often one of the earliest signals of changing worker confidence. Its current decline argues for caution, but because it started from an exceptionally high base, today’s reading still looks more like normalization than distress.

In short, the U.S. labour market has shifted from “too hot” to “just warm.” That distinction matters for policy and for markets.

5. What It Means for the Federal Reserve

From the Federal Reserve’s perspective, a cooling labour market is not automatically bad news. In fact, it is broadly consistent with the central bank’s goal of bringing inflation back toward its 2% target without triggering a deep recession.

When openings were at record highs and workers were resigning in droves, wage growth accelerated and amplified inflation pressures. As the market cools, wage growth tends to moderate, helping inflation drift lower even if unemployment rises only modestly. That is the essence of a “soft landing”: the economy slows enough to tame inflation, but not enough to cause mass job losses.

The current configuration—openings drifting down, quits falling, layoffs inching up but not surging—gives the Fed room to start easing policy gradually if inflation continues to cooperate. Rate cuts would be framed not as emergency support, but as fine-tuning to keep the expansion alive as the labour market normalizes.

6. Implications for Risk Assets and Digital Markets

For traditional equities, bonds and digital assets such as Bitcoin and Ethereum, the labour data feed into two opposing forces:

• Supportive channel: A cooler labour market that nudges the Fed toward lower interest rates tends to be positive for long-duration assets. Lower expected policy rates reduce discount rates applied to future cash flows and, in the case of digital assets, can encourage investors to rotate toward higher-volatility segments of the market.

• Risk-off channel: If investors start to fear that the slowdown will progress from mild to severe, risk appetite can weaken even as rates fall. In that scenario, safer assets such as high-grade bonds or cash-like instruments may outperform, while growth stocks and crypto could experience larger drawdowns.

Right now, the data lean closer to the first scenario: a gentle cooling that supports the case for gradual policy easing. But the balance could shift quickly if layoffs accelerate, job postings fall sharply or consumer confidence deteriorates.

For participants in digital-asset markets, the key is to view labour statistics as part of the broader liquidity picture. They do not dictate day-to-day price movements, but they shape the backdrop for capital flows, risk premia and investor positioning over the next 6–18 months.

7. What to Watch Next

To judge whether the labour market remains on a soft-landing path or veers toward something more serious, several indicators are worth monitoring over the coming quarters:

• Trend in job openings: A gradual decline from today’s 7–8 million range toward pre-pandemic norms would be consistent with normalization. A sudden drop of 1–2 million openings over a few months would be a stronger warning sign.

• Layoff dynamics: Is the recent uptick in layoffs a one-off adjustment in a few sectors, or the start of a broader wave? A sustained move above 2 million monthly layoffs would indicate more serious stress.

• Quits and wage growth: If quits continue to fall and wage growth moderates without collapsing, the Fed can be more comfortable easing policy. If wage growth remains high even as activity slows, the central bank’s trade-offs become more difficult.

• Indeed job postings: Because online postings update daily, they can provide early clues about shifts in employer sentiment before they appear in official surveys.

None of these signals is definitive on its own, but taken together they offer a robust framework for thinking about where the labour market, and by extension the broader economy, is headed.

Conclusion

The latest JOLTS release and job-posting data confirm what many workers and employers already feel: the age of hyper-tight labour conditions in the United States is over. Openings remain elevated but no longer extreme, workers are less inclined to job-hop and firms are cautious about adding permanent headcount. Layoffs are rising, yet still below levels associated with severe recessions.

This is what a controlled cooling process looks like. It carries risks—especially if external shocks hit at the wrong moment—but it is far from the sudden stop that many feared when interest rates began to climb. For policymakers, the challenge is to calibrate monetary easing in a way that supports employment without re-igniting inflation. For investors, the task is to interpret labour data not as noise, but as a slow-moving signal about growth, profits and liquidity conditions.

Educational note: This article is intended solely for informational and analytical purposes. It does not constitute financial, investment, legal or tax advice, and it should not be used as a basis for making individual investment decisions. Labour markets and financial assets can be volatile; readers should conduct their own research and consider consulting qualified professionals before taking any action.