BitMine’s $430M Week of ETH Buying: Reading the Signal Behind the Size

When a listed company quietly accumulates a few thousand Ether, it is a data point. When that company spends roughly $430+ million in a single week on ETH, lifting its holdings above 3.86 million coins and its total crypto plus cash position to around $13.2 billion, it becomes a macro signal.

That is what BitMine Immersion, chaired by Tom Lee, has just done. After several months of steady Ethereum purchases, the firm accelerated its program from mid-November onward, culminating in its largest weekly haul in over a month. The company now holds a deep ETH stack with a dollar-cost average reportedly around $3,900 per coin, meaning the position is still below water versus peak prices, but the buying has not slowed.

BitMine’s latest move does not happen in a vacuum. It coincides with Ethereum’s Fusaka upgrade going live on mainnet—an overhaul that boosts data availability, aims to cut rollup costs, and pushes Ethereum further along its scaling roadmap. It also comes as global strategists increasingly discuss a shift in U.S. monetary policy from restrictive to gradually accommodative over the next two years.

The obvious line is that BitMine is “bullish on ETH.” The more interesting question is why a professional treasury team would push such a large position in this specific macro and technical context. To answer that, it helps to break the story into three layers: BitMine’s own balance sheet strategy, Ethereum’s evolving fundamentals, and the broader macro environment.

1. BitMine’s Balance Sheet: What Does a 3.86M ETH Position Really Represent?

Public disclosures and recent news flow paint a picture of BitMine as a specialised digital-asset holding company: its business model centres on accumulating major network assets—particularly Ether—for long-term investment, rather than trading around short-term volatility. Earlier reports already showed the firm holding nearly 2 million ETH with a multi-billion-dollar notional value; the latest update roughly doubles that figure.

Three aspects of this balance-sheet construction are worth examining.

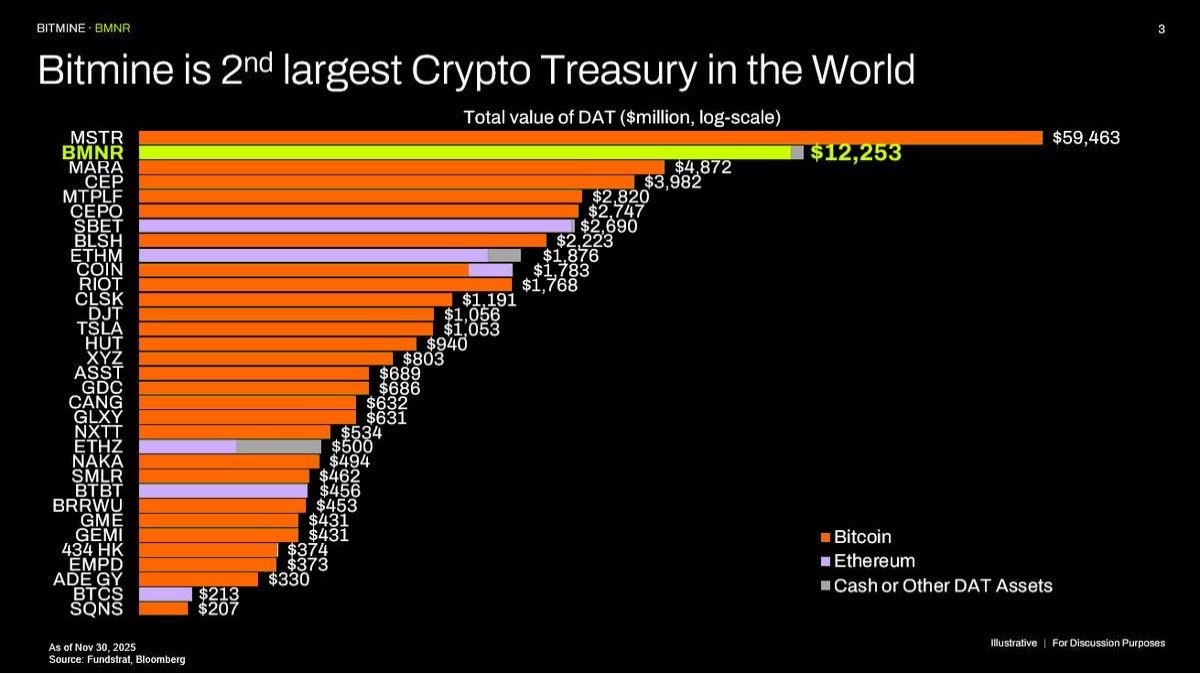

First, the scale of the ETH allocation. With more than 3.86 million ETH, BitMine is approaching exposure to a low-single-digit percentage of Ethereum’s free float. That is not enough to dominate the network, but it is large enough to be systemically relevant in market-structure terms. The firm has become one of the largest single corporate holders of ETH, similar to how some public companies have positioned themselves as major Bitcoin treasuries.

Second, the choice to average in above and below current prices. A dollar-cost average near $3,900 per ETH implies that BitMine continued purchasing during rallies and drawdowns, accepting that unrealised losses are part of the process. This is closer to a long-duration allocation than a trade based on short-term catalysts. The treasury team appears to be optimising for long-term exposure to Ethereum’s monetary and fee-capture properties rather than trying to minimise short-term mark-to-market volatility.

Third, the presence of a substantial cash buffer. Alongside its ETH holdings, BitMine reportedly now holds about $1 billion in cash. This matters for two reasons. Operationally, it gives the company room to meet liabilities and potentially add to its position during further drawdowns. Strategically, it signals to shareholders that management is aware of volatility risk and is not running an all-in strategy with no liquidity reserve.

Viewed through a traditional corporate-finance lens, BitMine is effectively constructing a barbell portfolio on its balance sheet: a highly volatile, long-duration asset (ETH) paired with a conservative cash reserve that can be used for operations, opportunistic purchases, or risk management.

2. Why ETH, Not BTC? The Thesis Behind Concentration

BitMine’s choice to focus primarily on Ethereum—rather than splitting its treasury between BTC and ETH or diversifying across many assets—says something about its underlying thesis.

While Bitcoin and Ethereum often move together in broad market cycles, their value propositions are distinct:

- Bitcoin is framed primarily as a monetary asset with a fixed supply schedule and a relatively simple scripting environment.

- Ethereum is both an asset and a general-purpose execution layer, capturing value from smart contracts, rollups, tokenised assets, and other forms of on-chain activity.

A treasury that places a heavy weight on ETH is effectively expressing two beliefs:

- That blockspace and settlement demand on Ethereum and its rollup ecosystem will keep growing over multi-year horizons, leading to sustained fee generation.

- That ETH’s role as a core collateral and gas asset within that ecosystem will be rewarded via long-term appreciation and potentially deflationary supply dynamics, even if short-term price swings remain large.

BitMine’s actions align with this view: it is accumulating ETH as if it were a long-dated claim on the future economic activity of an entire platform, not just a one-off trade on a single theme. That makes the timing of Ethereum’s Fusaka upgrade especially relevant.

3. Fusaka: Why the Upgrade Matters for a Long-Horizon Holder

Ethereum’s Fusaka upgrade, activated in early December 2025, is not a cosmetic change. It combines an execution-layer update (Osaka) with a consensus-layer upgrade (Fulu) and introduces key components like PeerDAS (Peer Data Availability Sampling), higher capacity for rollup data, and improved gas and transaction-handling mechanics.

From the perspective of an investor like BitMine, several aspects are crucial:

• Scalability for rollups. Fusaka significantly expands the data space available for rollups (often referred to as "blobs"), which are responsible for a large share of user transactions. More blob capacity means rollups can batch more activity at lower marginal cost, which, over time, tends to lower user fees and support higher throughput.

• Cheaper and more efficient node operation. PeerDAS allows nodes to verify data availability by sampling small parts of the data instead of downloading everything, lowering bandwidth requirements and making it easier for more participants to run nodes. That supports decentralisation and resilience.

• Improved user experience. The upgrade lays the groundwork for "instant-feel" interactions via pre-confirmations and more predictable fees, which matters if Ethereum is to support mainstream applications, tokenised assets, and high-frequency financial flows.

None of these changes guarantee a particular price outcome, but they do address the classic question every long-term ETH holder faces: Can Ethereum handle the scale implied by its own narrative? Fusaka moves the answer in a more convincing direction by increasing capacity and optimising how rollups interact with the base layer.

For a balance sheet like BitMine’s, Fusaka effectively upgrades the "engine" under the asset it is holding. If you believe ETH’s long-term value is tied to sustained demand for Ethereum blockspace, then every major scaling upgrade that lands successfully—and is adopted by rollups and applications—makes the long-duration thesis more internally consistent.

4. Fed Policy Expectations: Why a Potential Easing Cycle Matters for ETH

BitMine’s buying spree is also happening against a shifting macro backdrop. After an extended period of restrictive policy, markets are now pricing in the likelihood that the Federal Reserve will cut rates further into 2025, with several major institutions expecting multiple cuts spread across late 2025 and 2026.

From an educational perspective, the connection between interest-rate expectations and ETH demand can be thought of in three steps:

1. Discount rates and growth assets. Lower expected policy rates reduce discount rates used in valuation models for long-duration assets—those whose expected cash flows or utility lie far in the future. Tech equities and high-growth sectors are classic examples. ETH, as the native asset of a platform whose usage and fee generation are expected to compound, shares some features with these assets.

2. Risk appetite and liquidity. When central banks loosen policy or signal that peak rates are behind them, liquidity conditions often improve. Investors may feel more comfortable allocating capital to assets with higher volatility in exchange for potential long-term upside.

3. Portfolio diversification under fiscal pressure. As governments manage high debt loads, some investors seek assets whose supply is structurally constrained and whose value is not directly tied to a single sovereign balance sheet. Bitcoin and gold are obvious examples; for some, ETH also plays a role in this conversation, especially if it continues to exhibit periods of net supply reduction.

BitMine cannot control the Fed, but it can choose when to place long-duration bets. Accumulating ETH during or just before a potential easing cycle fits a view that the combination of lower discount rates, improved liquidity, and ongoing network upgrades could support a multi-year adoption phase—even if short-term price volatility remains high.

5. Risk Management: Being Underwater and Still Buying

One of the most counter-intuitive aspects of BitMine’s strategy is that its average entry price near $3,900 per ETH leaves the treasury in a loss position whenever the market trades below that level, yet the company keeps adding. For many individual investors, the instinct would be to "wait for the price to come back" or to avoid averaging up.

Institutional portfolios often think differently. Several considerations are at play:

• Time horizon. If the holding period is measured in years rather than quarters, short-term unrealised losses are less critical than maintaining exposure to the long-term thesis. The question becomes whether the fundamental story has changed, not whether the last marginal buy was at the local high.

• Position sizing and capital structure. With $1 billion in cash and a diversified asset base, BitMine can tolerate volatility in one line item without facing immediate liquidity stress. The key is whether ETH remains within a risk budget that shareholders and creditors understand.

• Signalling and credibility. A company that publicly articulates a long-term thesis and then abandons it at the first drawdown undermines its own messaging. Continuing to buy, within reason, can be a way of signalling conviction—though it also amplifies risk if the thesis is wrong.

For outside observers, the educational lesson is not that averaging down—or up—is always wise, but that the logic must be tied to fundamentals, time horizon, and balance-sheet capacity, not to short-term price anchoring.

6. Second-Order Effects: What BitMine’s Strategy Means for Ethereum’s Ecosystem

A single corporate treasury cannot determine the fate of a global network, but large holders can influence market structure and behaviour at the margin. BitMine’s accumulation has a few second-order implications worth noting:

• Float and liquidity. As long-term holders concentrate more ETH, the freely trading supply on exchanges can become thinner relative to demand. That can amplify both rallies and drawdowns, making risk management more important for all participants.

• Perception of institutional validation. Other corporates and funds may interpret BitMine’s actions as a template—or at least as proof that accounting, custody, and governance frameworks for large ETH positions are feasible.

• On-chain behaviour. The way BitMine stores, stakes, or otherwise uses its ETH could eventually affect staking dynamics, liquid-staking markets, and the supply available for collateral in DeFi or tokenised-asset platforms.

None of these effects are immediate, and they can evolve in multiple directions. But they highlight how a single large accumulator becomes part of Ethereum’s ecosystem story, not just a footnote.

7. How Should Individual Investors Interpret All of This?

It is tempting to see BitMine’s buying spree and Fusaka’s success and draw a simple conclusion about where ETH “must” go next. A more disciplined approach is to treat these developments as inputs into a personal framework, not as directives.

Some practical questions readers can ask themselves include:

• Thesis clarity. Do you understand why an institution might view ETH as a long-duration asset tied to network usage and fee generation? If not, it may be worth studying Ethereum’s economic design and roadmap before making allocation decisions.

• Time horizon. BitMine appears to be thinking in multi-year cycles. If your horizon is much shorter, your risk management needs will look very different—even if you happen to hold the same asset.

• Portfolio fit. A corporate treasury with billions in assets can weather larger percentage swings in a single line item than most individuals. Any personal allocation should be sized so that volatility does not derail broader financial goals.

• Macro sensitivity. How comfortable are you with assets that can respond sharply to changes in interest-rate expectations and liquidity conditions? Understanding that linkage can help set more realistic expectations about potential drawdowns.

Ultimately, BitMine’s decisions are one data point in a much larger landscape. The value lies less in copying their trade and more in understanding the reasoning and constraints behind it.

8. Putting It All Together

BitMine’s latest week of Ethereum purchases—over $430 million added to an already large portfolio, taking holdings above 3.86 million ETH and total assets to roughly $13.2 billion—can be read as a high-conviction bet on three converging trends: a more scalable and efficient Ethereum post-Fusaka, a gradual shift in global monetary policy toward lower rates, and a world in which digital assets increasingly function as long-term portfolio building blocks rather than purely speculative instruments.

None of those trends are guaranteed. Upgrades can run into unforeseen challenges, macro environments can change quickly, and market narratives can swing from enthusiastic to sceptical in short order. What BitMine’s move does illustrate, however, is how a professional treasury might integrate on-chain fundamentals and off-chain macro signals into a single strategic allocation.

For investors trying to make sense of the current cycle, the most productive questions are not "Is BitMine right or wrong?" but rather:

- What assumptions about Ethereum’s technical and economic future would need to hold for this allocation to make sense?

- How do potential Federal Reserve policy paths and global liquidity conditions interact with that thesis?

- What level of volatility and drawdown would be acceptable relative to my own goals and constraints?

Answering those questions honestly will provide more clarity than any headline. BitMine has made its choice; the analytical task is to understand what that choice reveals about the evolving relationship between crypto, macro, and institutional portfolio construction.

Disclaimer

This article is provided for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, and it should not be treated as a recommendation to buy or sell any asset or to adopt any particular strategy. Digital assets, including Ether (ETH), are volatile and may not be suitable for every investor. Always conduct your own research, consider your financial situation and risk tolerance, and consult qualified professionals before making investment decisions.