SpaceX’s Planned Mega-IPO: Rockets, Satellites and a Quiet but Real Crypto Footprint

SpaceX has spent the past decade turning what once looked like science fiction into a repeatable business: reusable rockets, mass-produced satellites and a global broadband network that reaches places traditional infrastructure cannot. Now, according to multiple reports, the company is preparing for a potential initial public offering in 2026 that could value it around $1–1.5 trillion, putting it in the running for the largest IPO in history.

For traditional equity investors, that alone is a landmark event. But for the digital-asset ecosystem, there is an additional layer. SpaceX is not a neutral observer of crypto; it is part of a wider Elon Musk corporate constellation that already holds a significant amount of Bitcoin and has a track record of experimenting with crypto-funded missions. The planned IPO will therefore bring to public markets a company whose balance sheet, history and leadership are already entangled with the evolution of Bitcoin and Dogecoin.

The crucial questions are not simply: “Will the IPO make Bitcoin go up?” or “Is this a pure crypto play?” Those are overly simplified. A more useful approach is to treat SpaceX’s listing as a case study in how large, systemically important companies weave digital assets into broader strategic narratives: treasury management, brand positioning, payments experiments and infrastructure for AI and next-generation finance.

1. What Investors Would Actually Be Buying

If SpaceX lists at a valuation around $1.5 trillion, equity buyers would be purchasing exposure to several distinct but connected businesses:

• Launch services: Falcon 9 and Falcon Heavy are now workhorses for both commercial and government missions, with Starship gradually moving from development to deployment.

• Starlink: A rapidly growing satellite internet network serving individuals, enterprises and governments, with recurring revenue and a large potential addressable market.

• Emerging data and compute infrastructure: Plans are already being discussed for space-adjacent data centres and specialised infrastructure that supports AI workloads and latency-sensitive applications.

• A balance sheet that includes Bitcoin holdings: SpaceX has accumulated a material position in BTC over the past few years, with various on-chain analyses and treasury trackers estimating several thousand coins under its control, even after earlier write-downs and partial disposals.

In other words, the crypto angle is not the core of the SpaceX equity story, but it is part of the package. The company’s Bitcoin position is small relative to a $1.5 trillion valuation, yet large enough to be non-trivial in absolute terms and symbolically powerful for a market that pays close attention to which corporations hold digital assets on their balance sheets.

2. SpaceX’s Bitcoin Stack: Small on the Chart, Loud in the Narrative

Public data sources tracking corporate treasuries suggest that SpaceX holds thousands of Bitcoin, placing it among the more prominent private-company holders globally. Estimates vary depending on methodology and timing, but the general picture is clear: the company has treated BTC as a strategic asset rather than a short-term trade, even though it has reportedly written down and adjusted its position over time.

From a balance-sheet perspective, this position has several implications:

• Mark-to-market sensitivity. For a company valued in the hundreds of billions or more, even a few billion dollars of Bitcoin exposure will not drive the core valuation, but it can add a layer of earnings volatility as accounting standards require fair-value changes to be recognised.

• Correlation with broader risk sentiment. When both SpaceX’s operating metrics and Bitcoin prices respond to global liquidity conditions and risk appetite, the combination can amplify perceived cyclicality, even if the underlying businesses are fundamentally distinct.

• Signal to the market. The simple fact that a high-profile, technologically sophisticated company allocates capital to Bitcoin reinforces the asset’s narrative as a form of corporate treasury reserve – similar to what Tesla did when it first announced its holdings in 2021 and maintained them through 2025.

For prospective shareholders, the key is proportionality. In a $1.5 trillion equity story built primarily on launch economics, satellite bandwidth and AI-adjacent infrastructure, Bitcoin is a complementary exposure – meaningful enough to matter at the margin, but not large enough to overshadow the industrial thesis.

3. Dogecoin and the Cultural Side of Crypto

If Bitcoin sits on the balance sheet, Dogecoin sits in the cultural memory of SpaceX. The DOGE-1 mission, funded entirely in Dogecoin by Geometric Energy Corporation and scheduled to fly on a SpaceX Falcon 9, was the first widely publicised example of a space mission contract paid in a crypto-asset.

From a financial perspective, the numbers involved are tiny relative to SpaceX’s overall revenue. The mission is better understood as a marketing and experimentation exercise than as a recurring business model. Yet its importance lies elsewhere:

• Demonstration effect. Accepting Dogecoin for a mission contract showed that crypto-funded space projects are technically and operationally feasible, even if they remain niche for now.

• Brand positioning. SpaceX and Musk have cultivated an image of being willing to try unconventional ideas. Participating in a Dogecoin-funded mission aligns with that identity and keeps the company at the centre of online conversations that blend technology, finance and culture.

• Precedent for future experiments. Once a company has accepted one digital asset as payment, it becomes easier – conceptually and operationally – to explore others, whether for sponsorships, research collaborations or specialised services.

For investors looking at the IPO, the Dogecoin connection should not be over-interpreted as a core revenue driver. Instead, it can be viewed as a data point about how SpaceX thinks about experimentation, community engagement and optionality in forming new partnerships.

4. The Musk Ecosystem: Cumulative Bitcoin Exposure Across Companies

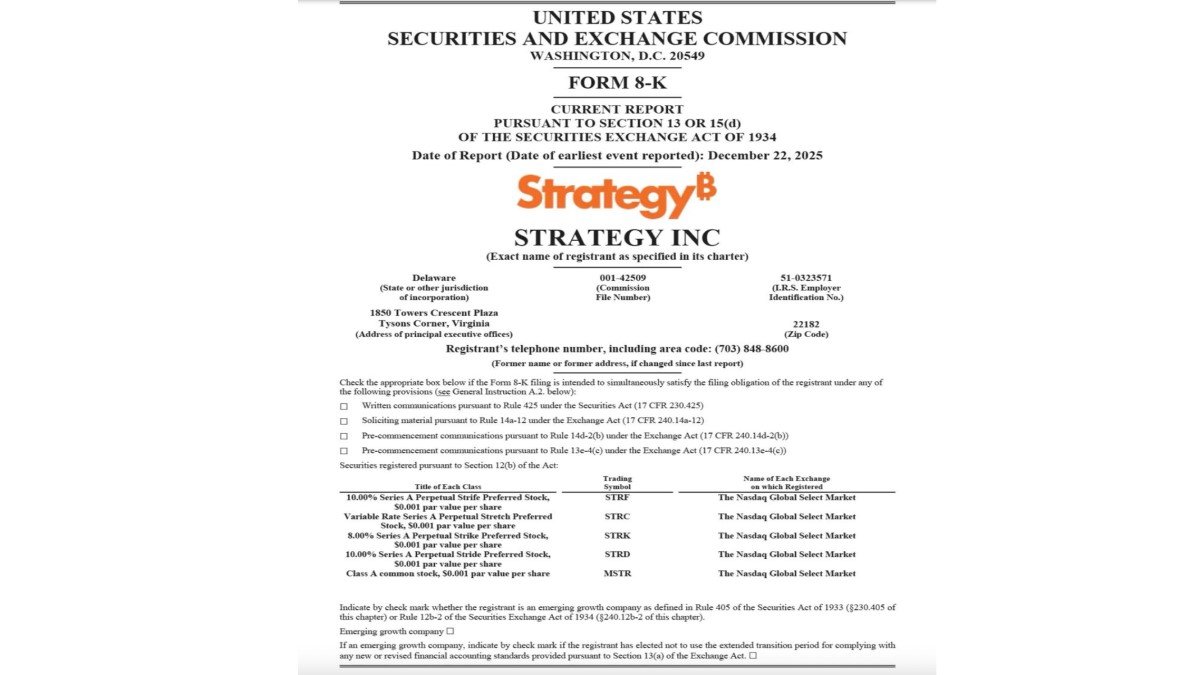

SpaceX’s Bitcoin holdings do not exist in isolation. Tesla remains one of the best-known corporate holders of BTC, with estimates around 11,500 BTC as of mid-2025, and public filings confirm that the company has maintained its position after earlier partial sales.

When we think about the “Musk ecosystem,” three layers emerge:

• Tesla as a public benchmark. Because Tesla is listed and reports its holdings, it has effectively served as a live case study for how markets treat a large manufacturer with a meaningful Bitcoin reserve. Investors have had to price both the core EV business and the digital-asset exposure into their models.

• SpaceX as a private (soon public) counterpart. SpaceX has been able to build a BTC position away from the constant disclosure cycle of public markets, but once it lists, analysts will apply similar frameworks: assessing treasury policy, risk management and the interaction between digital assets and capital expenditure needs.

• Elon Musk’s personal influence. Although personal holdings are not fully known, Musk’s public comments about Bitcoin and Dogecoin continue to move sentiment, especially in periods when retail attention is high. The fact that multiple companies under his influence hold BTC amplifies that effect, because comments are interpreted not only as opinions but as potentially connected to real balance-sheet exposures.

The result is that when SpaceX goes public, markets will not just be asking, “What is this company worth?” but also, “How does this fit into the broader pattern of large technology firms integrating Bitcoin into their capital allocation decisions?”

5. How the IPO Could Shape Crypto Narratives

If the SpaceX IPO proceeds at the reported scale, it will inevitably become a reference point in discussions about technology, infrastructure and risk assets. For the digital-asset community, several narrative channels are likely:

• Equity as indirect Bitcoin exposure. Some institutional investors that are restricted from holding spot crypto directly, or are still building their policies, may view a SpaceX stake as a way to gain indirect exposure to Bitcoin within an equity portfolio. This is conceptually similar to how some treated Tesla in the early stages of its BTC allocation.

• Reinforcement of Bitcoin’s “corporate treasury” story. Each time a large, well-known company holds Bitcoin as part of its assets, it reinforces the view that BTC is a legitimate store-of-value component on corporate balance sheets, not just a retail instrument.

• Feedback loop with ETF adoption. As Bitcoin ETFs mature, some asset managers may think in terms of a “Musk stack”: direct BTC through ETFs, equity exposure through Tesla and SpaceX, and potentially thematic baskets that focus on companies with digital-asset strategies.

• Increased scrutiny on governance and risk. At the same time, public status will bring more questions from analysts and regulators: how concentrated should a single corporate balance sheet be in one digital asset, how are custody and security handled, and what is the contingency plan for rapid price swings?

None of this guarantees any specific price outcome for Bitcoin itself. It does, however, deepen the integration between crypto markets and one of the world’s most important technology companies, which tends to increase the attention and analytical effort dedicated to digital assets in institutional settings.

6. Starlink, Data Centers and the Infrastructure Angle

The user’s note that an IPO could provide capital to expand Starlink and build data centres for both AI and crypto infrastructure deserves special attention. It touches on a deeper, often under-discussed link between physical infrastructure and digital assets.

Starlink already provides high-throughput, low-latency connectivity in locations that are underserved by terrestrial networks. That has at least three potential intersections with crypto and AI:

• Global access to financial networks. In regions with weak traditional internet infrastructure, satellite connectivity can help users access digital-asset services more reliably, from wallets to educational platforms. That is more about inclusion than speculation.

• Distributed compute and storage. SpaceX has floated ideas around space-adjacent data centres and cloud-like services. Those could, in principle, host AI workloads as well as blockchain-related infrastructure such as validator nodes or secure data-availability layers, subject to regulatory and technical considerations.

• Resilience for critical networks. Combining terrestrial and satellite links can make key financial and information systems more resilient to local disruptions. In an era where both AI and digital assets are increasingly seen as critical infrastructure, redundancy matters.

Fresh capital from an IPO would make it easier for SpaceX to accelerate these plans: densifying Starlink coverage, investing in specialised data-centre hardware and potentially partnering with AI labs or financial institutions that need highly reliable, globally distributed connectivity. While crypto is unlikely to be the sole driver of these investments, it can benefit as a “free rider” on infrastructure built primarily for AI, cloud and defence applications.

7. Risks, Unknowns and the Need for a Balanced View

As with any large, forward-looking story, it is important to be clear about uncertainties:

• The IPO is not guaranteed. Market conditions, regulatory decisions and strategic choices by SpaceX’s leadership could delay or even cancel the listing. Plans reported for 2026 are credible but not binding commitments.

• Valuation can change quickly. A proposed $1.5 trillion figure reflects current expectations about growth, margins and strategic positioning. Those expectations can evolve as new data on Starlink, launch cadence or competitive dynamics emerge.

• Treasury strategies are flexible. Just as Tesla reduced its Bitcoin holdings at one point, SpaceX could adjust its BTC exposure at any time based on risk management, accounting or regulatory considerations. Crypto investors should avoid assuming that any particular allocation is static.

• Crypto is one factor among many. For shareholders, the main drivers of long-term value will still be launch economics, Starlink’s business model, regulatory approvals and SpaceX’s ability to execute on ambitious engineering roadmaps.

From a brand-safe, educational standpoint, the right framing is not that SpaceX is a “crypto stock,” but that it is a major technology and infrastructure company whose leadership has chosen to integrate Bitcoin into its broader financial and strategic architecture. That choice is meaningful and worth analysing – but it sits alongside many other variables.

Conclusion: A Bridge Between Industrial and Digital Frontiers

SpaceX’s potential 2026 IPO is, first and foremost, about rockets, satellites and the economics of space-based connectivity. Yet in the background, the company also embodies a quieter transformation: large, globally significant firms incorporating digital assets into their treasury and experimentation stacks.

By the time SpaceX lists, public markets may be evaluating an entity that:

- Launches more rockets than any other organisation.

- Operates a rapidly scaling satellite internet network.

- Plans data-centre infrastructure that could support both AI and financial applications.

- Holds a multi-billion-dollar Bitcoin position and a history of accepting a community-driven token for a lunar mission.

For digital-asset observers, the lesson is not to treat the IPO as a simple "crypto catalyst," but to recognise how deeply intertwined technology infrastructure, capital markets and digital assets have become. An investor buying SpaceX shares would be participating in the industrial side of that convergence – with Bitcoin and Dogecoin as meaningful, but secondary, pieces of a much larger puzzle.

Educational note: This article is intended solely for information and analysis. It is not financial, investment, legal or tax advice, and it should not be used as the sole basis for any investment decision. Digital assets and equities can be volatile and entail risk; readers should conduct their own research and, where appropriate, consult qualified professionals.