Borrowing Against Bitcoin to Buy More Bitcoin: What B HODL’s Move Reveals About the Next Corporate Treasury Playbook

There are two ways to read a company borrowing against Bitcoin to buy more Bitcoin. The first is the loud interpretation: “they’re doubling down.” The second is quieter and more useful: “they’re turning a volatile asset into a financing rail.” B HODL’s new Bitcoin-backed loan framework—and its first drawdown used to purchase additional BTC—belongs to the second category, because the details are designed like a policy document, not a hype poster.

That distinction matters. In crypto markets, leverage is often discussed as a trading behavior. But when leverage moves onto corporate balance sheets, it becomes something else: a governance problem, a cash-flow planning problem, and a survivability problem. If 2026 is the year more public companies experiment with Bitcoin treasury strategies, B HODL is offering an early blueprint for how to do it with guardrails—and where the real risks still hide.

1) What B HODL Actually Did (And the Parts People Skip Over)

B HODL approved a Strategic Bitcoin-Backed Loan Framework using CoinCorner’s Bitcoin-backed loan product. The framework is not a one-off loan announcement; it’s a standing facility the company can draw from “time to time,” but only under predefined constraints. Those constraints are the story, because they reveal how the company wants shareholders to judge the strategy: by discipline, not by daring.

On December 31, 2025, B HODL announced it completed its first drawdown under that framework: £70,000 at an 8.00% interest rate, and it used the funds to acquire 1 additional Bitcoin. After that purchase, the company reported total holdings of 158.211 BTC and disclosed updated portfolio metrics (average purchase price and aggregate cost basis). This was presented as an operational step within a longer-term objective: growing “Bitcoin per share,” rather than simply growing headlines.

• Framework mechanics: up to 50% loan-to-value (LTV), interest-only, maturity up to four years.

• Balance-sheet ceiling: aggregate outstanding loan exposure capped at no more than 20% of the company’s Bitcoin treasury value.

• First execution: £70,000 drawn at 8.00% interest, used to buy 1 BTC at £65,809 per BTC.

2) The Deeper Shift: From “Treasury Holding” to “Treasury Strategy”

Corporate Bitcoin accumulation has gone through phases. Early on, many strategies were essentially declarative: hold BTC as a reserve asset and let price do the storytelling. That approach is simple, but it’s also passive. What B HODL is attempting looks more like a treasury function in traditional finance—taking an asset, assigning it a role, and building repeatable processes around it.

In B HODL’s own positioning, the company aims to accumulate Bitcoin while also generating revenue by deploying its holdings to support Lightning Network routing and liquidity provision. Whether those revenues are large or modest is less important than the structural implication: once a company treats BTC as an operating asset (not just a collectible), it naturally starts exploring financing tools around it—loans, facilities, and yield-linked instruments.

• Holding is a stance. Strategy is a system: controls, limits, reporting cadence, and defined decision rules.

• “BTC per share” becomes the KPI. That KPI can encourage discipline—or tempt leverage—depending on the guardrails.

• Operational Bitcoin creates new levers. Once BTC is part of operations, borrowing against it can look like “capital efficiency” rather than “speculation.” The line can be thin.

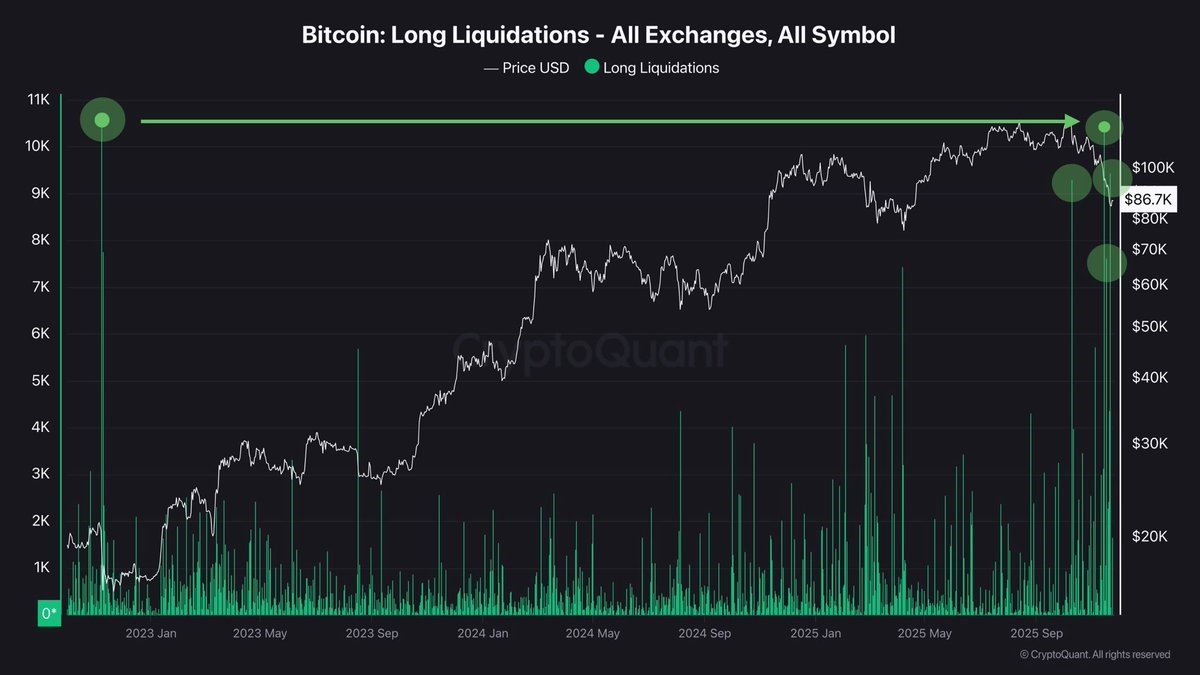

3) The Core Risk Isn’t the Interest Rate—It’s the Margin Call Geometry

Most people fixate on the 8.00% interest rate, because it looks like a familiar number. But in Bitcoin-backed lending, the dominant risk is not the coupon—it’s what happens when collateral value moves fast. The critical variable is the distance between current LTV and the lender’s liquidation or margin thresholds, plus how quickly the borrower can respond.

B HODL’s framework uses a relatively conservative headline LTV (50%). That helps, but it doesn’t eliminate the deeper issue: the asset on both sides of the trade is the same. The company is borrowing against BTC to buy more BTC, which increases correlation risk. If Bitcoin drops sharply, two things can happen at once: the collateral weakens and the newly purchased BTC also weakens. That’s not automatically catastrophic—but it does mean the strategy is not diversified. It is reflexive.

• Correlation risk: collateral and purchased asset move together, amplifying drawdowns.

• Liquidity risk: meeting margin demands may require liquid resources at the worst moment.

• Timing risk: volatility clusters can compress response windows from days to hours.

4) Why “Interest-Only” Can Be a Feature (And Also a Trap)

Interest-only loans are often misunderstood. They can be prudent when the borrower’s goal is flexibility and the asset is expected to remain long-duration on the balance sheet. For a treasury strategy, interest-only can reduce forced selling because the borrower isn’t required to amortize principal on a schedule that ignores market conditions.

But interest-only also creates a behavioral hazard: it can make leverage feel lighter than it is. Principal still exists. Refinancing still matters. And if the asset experiences a prolonged drawdown, the company can end up paying interest for longer than expected while waiting for conditions to improve. In a high-volatility asset, “time” is not neutral—it’s another variable in the risk equation.

• Feature: reduces near-term cash outflows and avoids mechanical principal repayment pressure.

• Trap: can encourage incremental drawdowns that slowly increase leverage while feeling manageable month-to-month.

• Key test: does the company publish clear triggers for when it will stop drawing, deleverage, or add liquidity buffers?

5) The Governance Detail That Deserves More Attention: Related-Party Dynamics

One of the most quietly important lines in B HODL’s framework announcement is that using CoinCorner’s loan product constitutes a related party transaction under AQSE rules because CoinCorner is a substantial shareholder. B HODL stated that independent directors considered the terms fair and reasonable for shareholders. This is exactly the kind of disclosure that signals maturity—because it acknowledges that “good finance” is not only about rates and LTV, but also about governance optics and conflict management.

Why does this matter? Because crypto finance has historically been fragile in areas where incentives are misaligned or opaque. A related-party lender is not inherently problematic, but it raises the bar for transparency: how terms compare to market alternatives, what happens in liquidation scenarios, and how decisions are monitored over time. If corporate Bitcoin leverage is going mainstream, governance standards will be the difference between “institutionalizable” and “unfinanceable.”

• Disclosure is the baseline. Fairness opinions, independent oversight, and periodic review are what institutional investors expect.

• Terms are not enough. Processes—who approves drawdowns and under what rules—are the real shareholder protection.

• Reputation risk is real. In a stressed market, governance questions can move faster than price.

6) Why This Playbook Shows Up Now: A Market Learning to Price “Financial Engineering”

In the past, many crypto-adjacent corporate moves were evaluated like narratives. Today, the market is gradually learning to price them like structured finance. That means investors start asking unglamorous questions: What is the maximum leverage? What is the maturity ladder? How is liquidity managed? What are the board’s stop-loss rules, if any? B HODL’s framework reads like an attempt to invite that style of evaluation.

The firm also disclosed post-purchase metrics such as sats per share and aggregate cost basis. Those metrics can be useful—when paired with risk reporting. On their own, they can also encourage a single-axis mentality (always increase BTC per share). The healthy evolution is when companies report both: accumulation progress and resilience indicators, such as available liquidity buffers and sensitivity to drawdowns.

• Healthy sign: reporting that treats Bitcoin like a treasury asset with risk controls.

• Unhealthy sign: reporting that treats leverage like a personality trait.

• Market shift: “BTC exposure” is becoming less of a novelty and more of a due-diligence category.

7) What to Watch Next (If You Want the Real Signal, Not the Noise)

If the goal is to understand whether this model is sustainable—not whether it is exciting—there are a few practical things worth monitoring over the coming quarters. None of them require price predictions. They require clarity about process.

First, watch whether B HODL increases drawdowns gradually and stays well within its 20% exposure cap, or whether it begins treating the cap as a target. Second, watch disclosures about collateral management and liquidity buffers—because Bitcoin-backed lending is less about “belief” and more about operational readiness. Third, pay attention to how the company communicates when volatility spikes. Calm communication during stress is often the best indicator of a functioning treasury program.

• Exposure drift: does outstanding borrowing remain a small fraction of treasury value?

• Stress readiness: does the company describe how it handles margin scenarios without forced selling?

• Transparency cadence: are drawdowns and purchases consistently reported with terms and portfolio impacts?

Conclusion

B HODL’s Bitcoin-backed borrowing to purchase additional BTC is easy to summarize and harder to truly understand. The summary is leverage. The understanding is treasury design. The company’s framework places explicit limits on LTV, maturity, and total exposure, and the first drawdown was small relative to total holdings. That combination suggests an attempt to normalize Bitcoin-backed financing inside a public-company governance wrapper—where disclosure and constraints matter as much as conviction.

If corporate Bitcoin strategies expand in 2026, the market will likely reward the firms that treat volatility like a permanent condition rather than an occasional inconvenience. In that future, the winners won’t be the loudest accumulators. They’ll be the ones whose systems can remain boring—even when Bitcoin isn’t.

Frequently Asked Questions

Is borrowing against Bitcoin to buy more Bitcoin automatically reckless?

Not automatically. It depends on the leverage level, risk limits, liquidity buffers, and governance controls. Conservative LTVs and capped exposure can reduce risk, but they cannot remove volatility-driven margin risks entirely.

Why would a company prefer an interest-only structure?

Interest-only can reduce short-term cash pressure and avoid mandatory principal repayment during unfavorable market conditions. The trade-off is that principal still must be managed at maturity or refinancing, and interest costs can accumulate over time.

What is the main risk in Bitcoin-backed corporate borrowing?

The primary risk is collateral value volatility leading to margin calls or forced liquidation if the borrower cannot add collateral or reduce exposure quickly. When the borrowed funds are used to buy more Bitcoin, correlation risk increases.

Why does the related-party aspect matter?

If the lender is also a substantial shareholder, investors typically expect stronger transparency and independent oversight to manage conflicts of interest and ensure terms are fair and reasonable over time.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Corporate treasury strategies involving cryptoassets carry significant risks, including market volatility, liquidity constraints, counterparty risk, and regulatory uncertainty. Always do your own research and consult qualified professionals when evaluating financial decisions.