Mom-and-Pop Bankruptcies Hit Record: Reading the Signal Behind the Noise

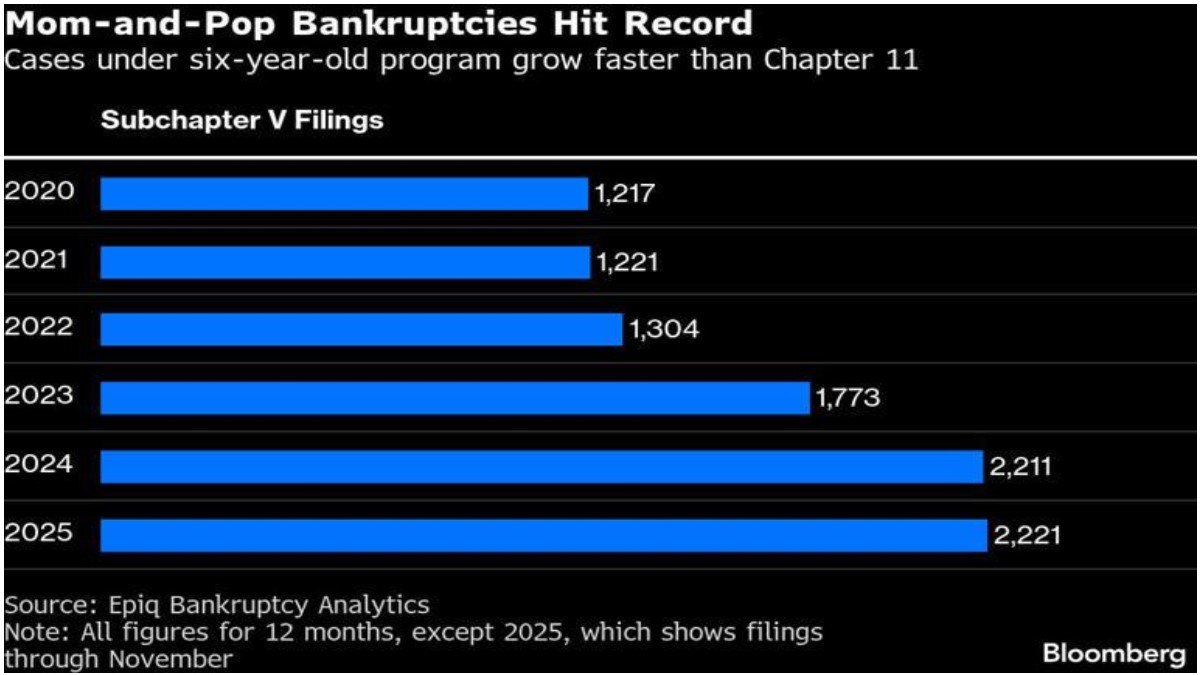

The latest data on small-business distress in the United States paints a striking picture. Subchapter V, a streamlined reorganization regime designed specifically for smaller firms, has seen more than 2,200 filings so far in 2025, the highest annual tally since the program was created in 2020. At the same time, the list of large enterprises announcing job cuts keeps growing, from logistics giants and consumer brands to pharmaceutical leaders and technology firms, while the federal government itself is shrinking its workforce.

On the surface this looks like a bleak story of closures and layoffs. But the reality is more nuanced. Subchapter V is not just a measure of failure; it is also a tool that gives viable small companies a second chance. And many of the job cuts we are seeing reflect a deliberate restructuring of balance sheets and business models after years of cheap money and rapid hiring.

To understand what this means for the broader economy—and for the future of small businesses in particular—we need to unpack three layers: how Subchapter V actually works, why macro conditions are pushing more firms toward it, and how it interacts with the current wave of layoffs.

Subchapter V: A Fast-Track Restructuring Tool, Not Just a Failure Badge

Subchapter V is a special section of Chapter 11 introduced by the Small Business Reorganization Act (SBRA) in 2019 and effective from early 2020. It was created because traditional Chapter 11 proved too slow and too expensive for the typical family-owned restaurant chain, local manufacturer or regional service company.

Several design choices make Subchapter V different:

• Tighter eligibility but easier access. Only businesses with debts below roughly $3 million can file today, and at least half of those debts must come from commercial activity rather than personal borrowing. That prevents the regime from being used by large corporates, but opens the door for true main-street firms.

• Streamlined process. There is usually no official creditors' committee, which significantly reduces professional fees. The debtor proposes the plan, and the timeline for filing and confirming that plan is much shorter than in a classic Chapter 11 case.

• Special trustee role. Every Subchapter V case has a trustee whose job is to help negotiate a workable plan and support communication between the business and its creditors, rather than simply liquidate assets.

• More flexible outcomes. Owners can often keep equity if they commit future income to the plan, even when unsecured creditors are not repaid in full. That makes the procedure attractive to entrepreneurs who still believe their company has a future if the balance sheet is reset.

In other words, Subchapter V is best seen as a restructuring tool. It is a signal that a business model has been stressed by economic conditions, but also that owners are trying to salvage operations and jobs instead of walking away completely.

Usage has grown rapidly. After roughly twelve hundred cases per year in 2020 and 2021, filings climbed into the mid-thirteen hundreds in 2022 and then surged above two thousand in 2024. The 2025 reading is already higher again, with more than 2,200 cases recorded before year-end. Even after the debt limit for eligibility dropped from $7.5 million back to about $3 million in mid-2024, the number of filings has continued to rise, which tells us that distress is concentrated among truly small firms rather than only mid-size corporates.

Why Main Street Is Under Strain

So what is pushing so many businesses into a restructuring program that did not even exist a few years ago? The answer is a stack of overlapping pressures rather than a single shock.

1. Borrowing costs that stayed high for too long

From 2022 through 2024, the Federal Reserve lifted its policy rate from near zero to well above 4 percent to fight inflation. Even though modest cuts have begun, the policy rate remains far higher than the near-zero environment that prevailed in the decade after the global financial crisis. Bank lending rates and credit card APRs for small-business owners moved in tandem.

For firms that financed working capital with floating-rate loans or relied on revolving credit lines, the result has been simple: interest expense doubled or even tripled. For a restaurant operating on a three to five percent profit margin, or a small logistics company with heavy equipment financing, that shift alone can turn a viable operation into a cash-flow negative one.

Higher rates also depress asset valuations, from commercial property to business equipment. That makes it harder to refinance debt or to sell assets at attractive prices to reduce leverage. Subchapter V therefore becomes a way to reset obligations when market-based deleveraging is no longer realistic.

2. Demand that is softer, not collapsed

On the demand side, U.S. consumers are still spending, but the composition and momentum have changed. Surveys from the National Federation of Independent Business show that small-business optimism slipped to its lowest level in six months in October 2025, with owners reporting weaker sales and lower profit margins. Many firms describe a situation where customers remain active but are more price-sensitive and more cautious about discretionary purchases.

That dynamic matters because small businesses rarely have the pricing power of global brands. A local retailer cannot simply pass through higher input and wage costs to customers without losing traffic. The result is margin compression just as financing costs are rising.

3. Trade frictions and the cost of imported inputs

Another important headwind is trade policy. In 2025 the U.S. administration introduced a new round of broad-based tariffs on imports from major trading partners. Independent analyses estimate that these measures have lifted the effective tariff rate to levels not seen in decades and act as a form of across-the-board tax on imported goods.

For large companies with global supply chains, there is scope to re-route production, negotiate with suppliers or hedge currency and commodity risk. Smaller firms rarely have that flexibility. A regional furniture manufacturer that imports specific types of wood or metal fittings, or a small electronics retailer that relies on overseas components, may simply face higher landed costs with little bargaining power. When tariffs raise input prices and customers resist price increases, margins get squeezed from both ends.

4. The psychology of prolonged uncertainty

Beyond the numbers, sentiment matters. Business owners who lived through the pandemic, followed by inflation spikes, rate hikes and now renewed trade tensions, are naturally more cautious. Surveys suggest that many small-business leaders delay investment, hiring or expansion decisions because they cannot confidently predict demand and policy conditions two or three years out.

In that environment, a single adverse shock—a rent increase, a key customer lost, or a jump in insurance premiums—can push a firm into distress more easily than in a stable macro backdrop. Subchapter V is then used not only by companies that were structurally weak, but also by previously healthy businesses that simply ran out of margin for error.

Mass Layoffs: Macro Backdrop, Not Just Individual Stories

Running parallel to the rise in small-business filings is a visible wave of job cuts across the U.S. economy. Announced layoffs are elevated both in the public sector and in large private employers.

On the public side, the federal government has embarked on a major downsizing effort. Various estimates suggest that roughly 300,000 civil service roles have been targeted for reduction or elimination in 2025, spread across agencies ranging from the postal service and veterans' affairs to environmental and education departments. Legal challenges have slowed parts of this program, but the underlying direction is clear: fewer federal workers and tighter public-sector spending.

In the corporate world, the headlines have been dominated by large numbers from household names. UPS has announced around forty-eight thousand job cuts as part of a sweeping restructuring and automation push. Global consumer giant Nestlé plans to eliminate sixteen thousand roles over the next two years. Pharmaceutical leader Novo Nordisk is trimming about nine thousand positions worldwide as it reorganizes around obesity and diabetes medicines. Technology, consulting and automotive firms have also announced significant reductions in headcount, and aggregates compiled by outplacement firms show that announced job cuts in 2025 are running far above last year's pace.

The drivers here differ from small-business distress, but they rhyme:

- Margin management. Large firms are responding to slower revenue growth and higher costs by aggressively protecting profit margins.

- Automation and digitalization. Advances in logistics automation, AI-assisted office work and software tools encourage management teams to redesign workflows, which often means fewer staff.

- Global restructuring. Multinationals are reallocating production and staff across countries in response to tariffs, energy costs and regulatory changes.

For the macro economy, mass layoffs and small-business bankruptcies interact in complex ways. Job cuts reduce household incomes and can weaken local demand, which then feeds back into main-street firms. At the same time, some affected workers become entrepreneurs or freelancers, creating new businesses and services that partly offset the losses.

Is This a Crisis or a Reset?

When graphs show record levels of Subchapter V filings and long lists of companies reducing staff, it is tempting to jump straight to the word "crisis." That may be premature for several reasons.

First, the very existence of Subchapter V means that many small businesses now have a formal restructuring route that simply did not exist a decade ago. Instead of quietly shutting down or entering a liquidation process, owners can negotiate with creditors, keep operations going and preserve part of their workforce. In that sense, higher Subchapter V counts may reflect better access to restructuring tools as much as they reflect underlying stress.

Second, the U.S. labor market, while cooling, still has areas of tightness. Many sectors continue to report hiring difficulties, and unemployment remains historically moderate. That means some of the workers affected by layoffs may find new roles more quickly than in past downturns, especially those with in-demand skills in logistics technology, software or health care.

Third, a portion of the current adjustment is arguably overdue. For several years, ultra-low interest rates allowed both companies and governments to carry more leverage than they otherwise would. Some firms expanded staff counts and physical footprints on the assumption that funding would remain cheap indefinitely. The combination of higher rates and softening demand is forcing management teams to revisit those assumptions and move toward more sustainable cost structures.

However, it would also be complacent to ignore the risks.

• If borrowing costs remain structurally higher than in the 2010s, many small businesses that survived previous cycles could struggle to adapt, especially those in capital-intensive sectors such as manufacturing, construction and logistics.

• If tariffs and other trade barriers remain elevated or broaden further, they may permanently raise input costs for smaller import-reliant firms, reducing their ability to compete with large multinationals that enjoy economies of scale.

• If public-sector job cuts are concentrated in smaller towns or regions where government agencies are major employers, local ecosystems of service businesses (cafés, contractors, retail) may face sustained demand shortfalls.

What to Watch in 2026 and Beyond

For investors, policymakers and business owners, several indicators will be key in the coming years.

1. The policy rate path and credit conditions

Even small changes in the Federal Reserve's policy stance can materially change debt-servicing burdens for leveraged firms. If inflation continues to ease and the central bank feels comfortable cutting rates toward a more neutral level, some distressed businesses may regain breathing room. Conversely, if rates remain near current levels for an extended period, the pipeline of Subchapter V filings is likely to stay busy.

2. Legislative tweaks to Subchapter V itself

Several proposals in Congress aim to restore the higher $7.5 million debt cap for Subchapter V eligibility, reversing the June 2024 reversion to roughly $3 million. If lawmakers reinstate that higher threshold, more mid-sized firms will again be able to use the streamlined regime, and we could see another jump in filings that reflects expanded eligibility as much as new distress. If they do not, some companies on the cusp may be pushed into more complex, expensive traditional Chapter 11 proceedings or even liquidation.

3. Business sentiment and investment plans

Surveys such as the NFIB Small Business Optimism Index, measures of planned capital expenditure and hiring intentions, and regional Fed surveys provide forward-looking insight into whether owners are still in defensive mode or ready to invest again. An improvement in these indicators would suggest that the current wave of restructurings is a transitional phase rather than the start of a prolonged downturn.

4. The balance between job destruction and job creation

Finally, it is important to track not only layoffs but also new business formation and hiring announcements. History shows that periods of technological change often involve both: some roles disappear while new categories of work emerge. If layoffs continue at an elevated pace without a corresponding rise in new firm creation or hiring in growth sectors, the risk of long-lasting damage to local economies increases.

Takeaways for Entrepreneurs and Investors

The combination of record Subchapter V filings and widespread layoffs is best understood as a stress test of the post-pandemic U.S. economy. Cheap money and abundant demand masked structural weaknesses for several years. Higher rates, shifting trade rules and changing consumer behavior are now exposing which business models are resilient and which require a reset.

For entrepreneurs, the key lessons are conservative capital planning, diversification of funding sources, and a realistic assessment of how sensitive their model is to interest rates and import costs. For investors and analysts, Subchapter V statistics and layoff announcements are valuable early-warning indicators of sector-level health. Instead of viewing them as isolated headlines, treating them as data points in a broader adjustment story allows for a more grounded assessment of risk and opportunity.

What is clear is that small businesses remain at the center of this adjustment. They are the first to feel changes in credit conditions and local demand, but they are also a vital engine for innovation and job creation. How policymakers handle interest rates, trade rules and small-business restructuring tools like Subchapter V will go a long way toward determining whether the current wave of bankruptcies becomes a stepping stone to a healthier equilibrium or a sign of deeper structural fragility.

Disclaimer

This article is for educational and analytical purposes only and does not constitute legal, financial or investment advice. Individuals and businesses should consult qualified professionals before making decisions about bankruptcy, restructuring, investing or employment.