Bitcoin, Gold and the US–China Financial Strategy Contest

For most of modern history, the global monetary conversation has been simple: the US dollar sits at the centre, and gold acts as the ultimate reserve asset in the background. Bitcoin changes that equation by adding a third layer: a digitally native, globally accessible asset with its own settlement network.

Gold still excels at what it has always done best: acting as a long-term store of value for states and large institutions. Bitcoin, however, introduces something gold can never offer on its own – a neutral, programmable, 24/7 network for moving value around the world at internet speed. In a world where the US and China are each trying to secure their financial positions, that distinction matters.

1. Gold’s Strengths – And Its Structural Liquidity Problem

Gold’s track record is extraordinary. For thousands of years, it has survived changes in empires, monetary systems and technologies. Central banks still hold it for a reason: it is a real asset without counterparty risk. Recent data show that global central banks have been net buyers of gold for several years in a row, adding more than 1,000 tonnes annually and signalling a desire to diversify away from the dollar at the margin. Emerging-market central banks in particular increasingly favour gold as part of their reserve mix.

China is a prominent example. Public figures indicate that the People’s Bank of China (PBoC) has steadily raised its gold reserves above 2,200 tonnes, reaching a record level by the end of 2024 and continuing to climb in 2025. This accumulation is widely interpreted as part of a broader strategy to reduce reliance on US Treasuries and to strengthen the balance sheet behind the renminbi. Meanwhile, surveys from the World Gold Council show that a growing majority of central banks expect to increase gold holdings and gradually reduce the share of US dollars in their reserves over the coming years.

Yet gold has a problem that becomes more visible in a digital world: it is slow and operationally heavy when used as an actual payment or settlement medium.

• Physical settlement is cumbersome. Moving the equivalent of 10 million or 500 million US dollars in gold between counterparties involves logistics, secure transport, vaulting, verification and insurance. Even in an efficient system, this is a matter of days or weeks, not minutes.

• Gold is not natively programmable. Gold-backed financial products can be represented digitally, but the metal itself does not integrate directly with smart contracts, automated collateral systems or machine-to-machine payments. All of that requires additional layers of trust and infrastructure.

• Reserve transparency is imperfect. While official statistics are reported, doubts often remain about the true size and location of some countries’ gold holdings, especially when gold is held partly off-balance sheet or through intermediaries.

None of this makes gold obsolete. It simply means that gold, by itself, is not a comprehensive answer to the demands of a real-time, data-rich financial system. It is excellent for storing value on a generational horizon, but less suited to transmitting value rapidly across a global network.

2. What Bitcoin Adds: A Global, Neutral Liquidity Network

Bitcoin approaches the same problem from the opposite direction. It is a liquidity network first, and a store of value second. Its most obvious weakness – price volatility – is precisely what makes many long-term allocators cautious. But its strengths line up almost perfectly with what the modern financial system needs from a high-speed settlement layer.

Consider a few structural features:

• Global, near-instant settlement. Large transfers of Bitcoin, worth tens or hundreds of millions of dollars, can be finalised on-chain in roughly 10 minutes at relatively low network fees, regardless of the sender’s and receiver’s locations.

• Borderless by design. Bitcoin transactions do not require the approval of any single central bank or payment network. They rely on a decentralised protocol and a globally distributed set of validators (miners and, increasingly, other participants in the broader ecosystem).

• Programmatic integration. Bitcoin can be wrapped, bridged or referenced in smart contracts, integrated into layer-2 networks such as the Lightning Network, used as collateral in on-chain lending systems, and combined with other digital primitives. Gold, as a physical commodity, cannot participate natively in such architectures.

• Transparent and capped supply. The 21-million-coin limit is visible, auditable and enforced by the protocol. That does not make Bitcoin risk-free, but it does eliminate one source of uncertainty: unexpected supply expansion.

From a purely functional perspective, Bitcoin behaves like a real-time, programmable settlement asset. Value can be transmitted as easily as data, and ownership can be verified mathematically rather than through layers of custodians. That is a very different proposition from shipping bars of metal between vaults.

Of course, there are trade-offs. Bitcoin’s purchasing power can fluctuate significantly, and its long-term regulatory treatment will continue to evolve. But if the question is, “Which asset can move quickly through a digital financial system while remaining neutral and globally accessible?”, Bitcoin is uniquely positioned.

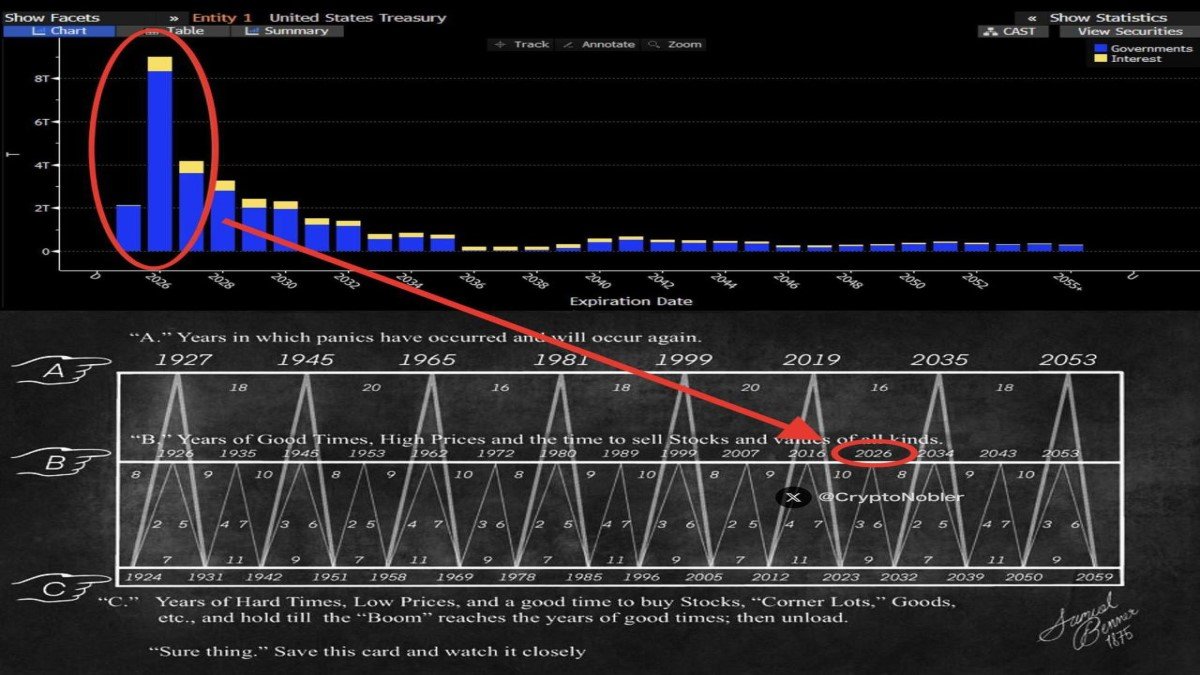

3. A 20-Year View: Gold for States, Bitcoin for Global Liquidity

If we project forward two decades, a plausible scenario emerges in which gold and Bitcoin specialise in different roles.

Gold as the physical anchor for national balance sheets. Central banks and sovereign wealth funds may continue to build gold reserves as a way to hedge against currency risk, geopolitical shocks and the long-term consequences of high public debt. Surveys already show that a large majority of central banks plan to increase gold reserves and that many expect the share of the US dollar in global reserves to decline gradually from its current level around 60%. De-dollarisation initiatives among blocs like BRICS often treat gold as a neutral asset that supports local-currency trade and alternative settlement systems.

Bitcoin as the digital liquidity layer for a networked economy. At the same time, Bitcoin’s role could expand as a collateral and settlement asset in digital-native environments. Payment channels, institutional-grade custody solutions, exchange-traded products and programmable multi-party escrows all make it easier to embed BTC into financial workflows. Even if central banks do not hold Bitcoin directly in the near term, private institutions – from asset managers to corporates – can treat it as a long-duration, scarce asset that plugs directly into the infrastructure of digital markets.

The dollar as the primary, but increasingly shared, invoicing currency. Even as some countries reduce the share of USD in their reserves, the dollar is likely to remain a central medium for trade invoicing and debt issuance. However, local-currency settlement among BRICS members, regional payment systems and tokenised alternatives may gradually erode its dominance at the margin. In such a world, Bitcoin functions less as a replacement for the dollar and more as a neutral bridge asset connecting multiple currency zones.

Summarised simply:

- Gold helps countries stabilise their long-term sovereign balance sheets.

- Bitcoin helps institutions and individuals interact with a global, always-on financial network.

- Fiat currencies – especially the dollar – still power day-to-day pricing and invoicing, but operate within a more multi-polar environment.

From this perspective, Bitcoin is not “replacing” gold. It is filling the part of the puzzle that gold cannot: high-speed, programmable, borderless liquidity.

4. China, Gold and the Search for Strategic Resilience

China’s approach fits this picture. Over the past decade, the country has expanded its gold reserves steadily, now reporting well over 2,200 tonnes and ranking among the world’s largest official holders. Independent analyses often highlight that China’s actual gold influence extends beyond official reserves, through domestic production, refining capacity and off-balance-sheet holdings in state-linked entities.

This strategy serves several purposes:

- Reducing reliance on US debt. By holding more gold and relatively fewer US Treasuries, China diversifies its reserves away from assets directly tied to US fiscal policy.

- Supporting the renminbi’s credibility. A larger gold backing can be interpreted as an additional layer of confidence behind the currency, especially in the context of cross-border trade initiatives such as the Belt and Road.

- Creating optionality. In an extreme scenario, gold reserves could support new trade arrangements, bilateral clearing mechanisms or blended reserve frameworks within regional blocs.

At the same time, China is actively involved in efforts to reduce dollar usage in trade within the BRICS grouping and other partnerships. These initiatives focus on local-currency settlement and alternative payment rails rather than building a single replacement currency. The underlying objective is greater autonomy: the ability to conduct trade and manage reserves with less exposure to US sanction risk or interest-rate policy.

Gold plays a natural role in that toolkit: it is universally recognised, politically neutral and independent of any one country’s legal system. What it does not provide is an instant, programmable liquidity network – and that is where Bitcoin comes in, particularly from the perspective of other major powers.

5. The US, Bitcoin and Control of the Financial Pipes

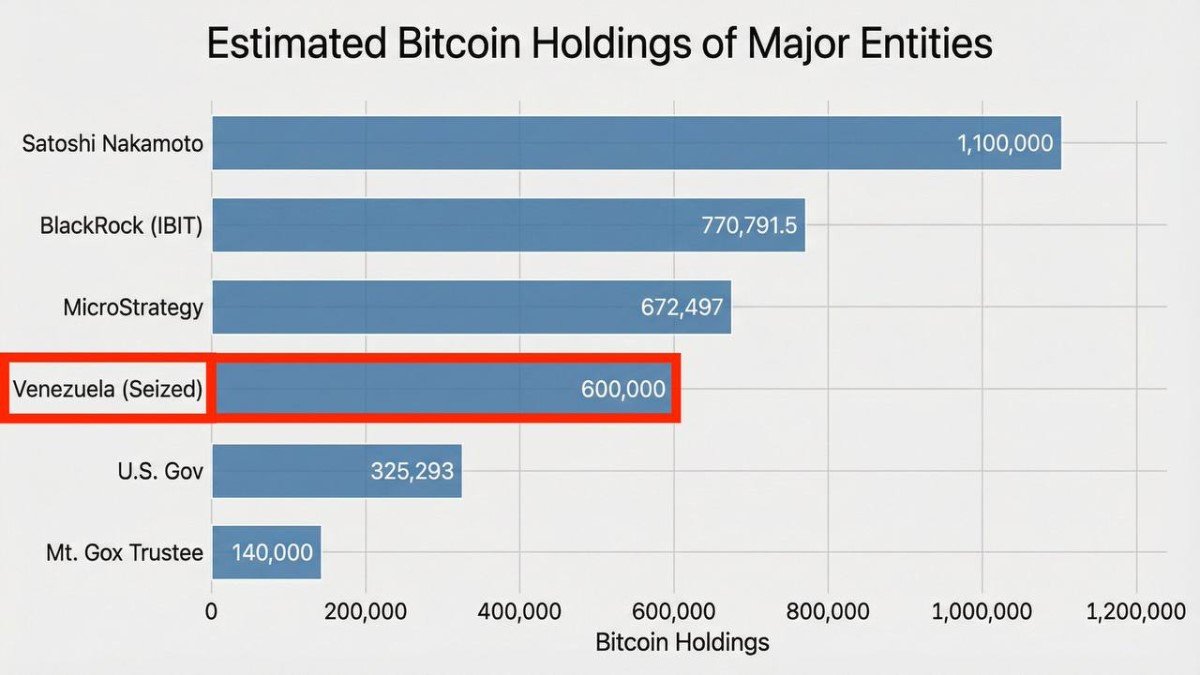

The United States has taken a different path. Rather than using gold as its primary signalling tool – it already holds one of the world’s largest official gold reserves – the US has focused on integrating Bitcoin into the regulated market infrastructure that sits at the core of global capital flows.

The turning point came with the approval of US spot Bitcoin exchange-traded funds (ETFs and similar products). Within months of their launch, these vehicles began to account for a large share of daily spot Bitcoin trading. Recent analyses suggest that spot Bitcoin ETFs now make up roughly a quarter of global Bitcoin spot trading volume, up from about 10% a year earlier, highlighting how quickly traditional finance channels have captured market share from native crypto exchanges. At the same time, aggregate assets in these funds have grown substantially: as of mid-2025, US spot Bitcoin ETFs collectively hold well over 1.2–1.3 million BTC, equivalent to roughly 6–7% of circulating supply, with BlackRock’s iShares Bitcoin Trust (IBIT) alone managing close to $90 billion in assets.

In parallel, leading US asset managers and brokerages have opened their platforms to these products. BlackRock, Fidelity and others treat Bitcoin ETFs alongside traditional equity and bond funds, and even previously sceptical firms have begun allowing clients to access third-party crypto funds through their brokerage accounts as the market infrastructure matures.

From a strategic perspective, this means that:

- A significant share of institutional and retail exposure to Bitcoin now flows through US-domiciled, US-regulated vehicles.

- The key liquidity pools for Bitcoin price discovery during US market hours are increasingly concentrated on venues and products supervised by US regulators.

- Major US custodians, auditors and market-data providers are embedded directly into the Bitcoin exposure stack.

Importantly, this does not mean that the US government “owns” Bitcoin, nor that it can unilaterally control its protocol. Bitcoin remains an open network. But it does mean that the financial plumbing through which a large portion of institutional capital accesses Bitcoin sits inside the US regulatory perimeter.

In other words, while China has focused on building a defensive position in gold and local-currency trade, the US has quietly become the primary organiser of Bitcoin’s institutional-grade liquidity.

6. Bitcoin as a Strategic Liquidity Lever – With Important Caveats

This leads to a tempting conclusion: gold is the strategic asset of the analogue era, and Bitcoin is the strategic asset of the digital era, with the US better placed in the latter. There is some truth in that framing, but it comes with important caveats.

First, Bitcoin is still highly volatile. Any country or institution that treats it as a core reserve asset must be prepared for large mark-to-market swings. That is easier to manage for diversified portfolios than for smaller, more concentrated balance sheets.

Second, regulatory attitudes can evolve. Today, the US is embracing regulated Bitcoin products and allowing them to grow within a defined framework. That stance reflects a judgement that transparency and supervision are preferable to pushing activity offshore. Future policymakers could adjust details of that framework, even if a complete reversal becomes less likely as more mainstream institutions participate.

Third, Bitcoin’s neutrality cuts both ways. No state can easily stop others from using Bitcoin as a settlement asset or store of value. That is precisely what makes it attractive as a neutral network – but it also means that no single country can fully monopolise its benefits.

For these reasons, it may be more accurate to say that Bitcoin is emerging as a shared strategic infrastructure rather than the exclusive tool of any one nation. The US currently has an advantage in terms of market infrastructure and capital flows; other regions have advantages in mining, manufacturing or regulatory innovation. Over time, participation is likely to become more distributed, even if existing hubs retain their influence.

7. Putting It All Together

The evolving roles of gold and Bitcoin in the context of US–China financial strategy can be summarised in four points:

1. Gold remains the backbone of state-level resilience. Central banks – including China’s – continue to accumulate gold as a hedge against currency risk and geopolitical uncertainty. Gold is slow, heavy and analogue, but it is deeply trusted and politically neutral.

2. Bitcoin is becoming the backbone of digital liquidity. Its 24/7, borderless settlement properties and transparent, capped supply make it uniquely suited as a collateral and settlement asset in programmable financial systems.

3. China leans on gold and local-currency trade to reduce dollar exposure. This approach emphasises autonomy and resilience within existing institutional frameworks.

4. The US leverages its financial system to structure Bitcoin access. By hosting the largest spot ETFs, custodians and trading venues, the US influences how institutional capital interacts with Bitcoin, even though it does not control the protocol itself.

In that sense, Bitcoin is less a “weapon” in a traditional contest and more a key piece of shared infrastructure that both competition and cooperation will run on. Whoever shapes the main liquidity channels, standards and risk frameworks around that infrastructure will have outsized influence over how the next generation of global finance operates.

For individual investors and observers, the takeaway is not to assign victory or defeat to any country, but to recognise that the architecture of money is changing. Gold, fiat currencies and Bitcoin are likely to coexist, each handling a different part of the job: anchoring value, pricing economic activity, and moving value across the network at speed.

Disclaimer

This article is for educational and analytical purposes only. It does not constitute financial, investment, legal, or tax advice, and it does not recommend any specific asset, instrument, jurisdiction or strategy. Bitcoin, gold and other assets mentioned can be volatile and may not be suitable for all investors. Readers should conduct their own research and consider consulting appropriately licensed professionals before making any financial decisions.