Venezuela’s IBC Jumps 16.45% After the U.S.–Venezuela Shock: What Markets Are Actually Pricing

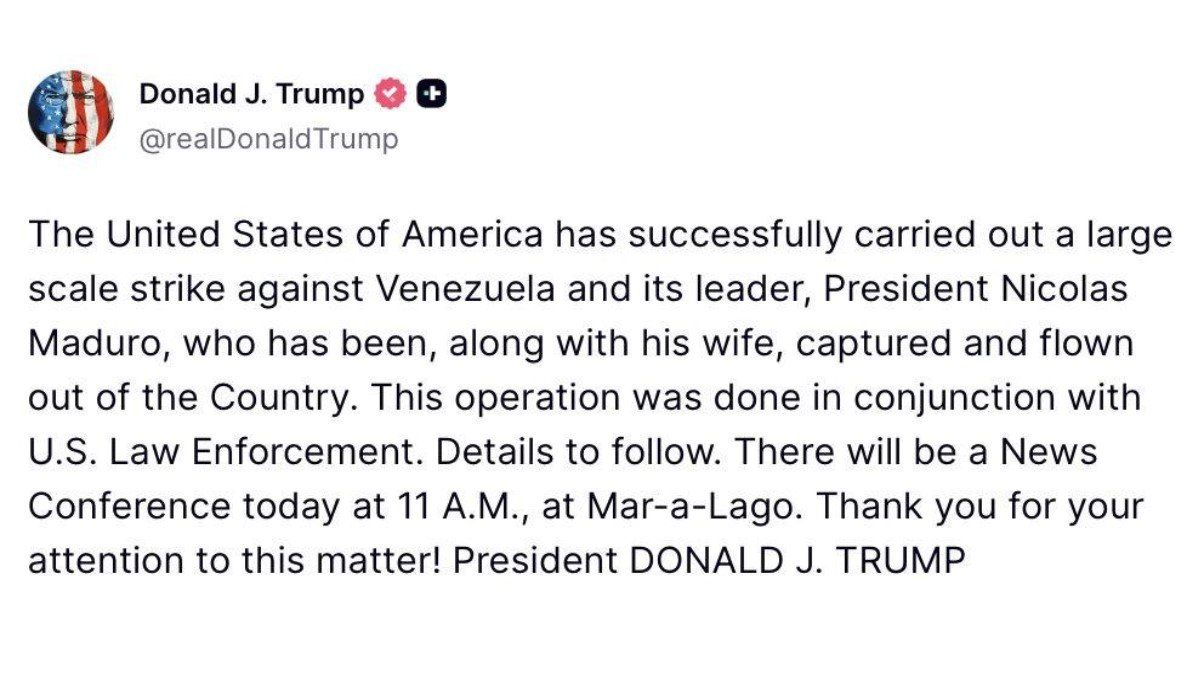

Markets have a strange way of ignoring the moral debate while obsessing over the consequences. The weekend’s U.S.–Venezuela developments (including reports that U.S. authorities detained Venezuela’s President Nicolás Maduro) immediately triggered a familiar pattern: a sharp local equity rally, nervous repositioning in energy, and a global market that—at least at first—looked more “risk-on” than “risk-off.”

But the headline isn’t the analysis. A 16.45% pop in Venezuela’s main stock index is not simply “investors cheering.” It is a price discovery event in a market that has spent years trading under constraints—sanctions, capital frictions, and a constant question mark over who ultimately controls the country’s export engine. The IBC candle is loud, yes. The reasons underneath it are louder.

1) The IBC surge is a regime-change option, not a victory lap

The IBC (Venezuela’s main stock index) rose 16.45% in today’s session. The same snapshot shows +74.62% on the month and an eye-catching +1,952.32% over one year. On paper, that looks like a rocket ship. In practice, it’s closer to a thermometer: it measures the intensity of local expectations, liquidity conditions, and currency realities rather than “clean” economic growth.

In high-inflation or capital-restricted environments, equities often behave like a default hedge. When people cannot easily access foreign assets, or when policy uncertainty dominates, the stock market becomes a pressure valve. So when a potential political transition appears—especially one that could change sanctions, investment access, and oil monetization—local equities can jump violently because they are pricing the value of optionality: the chance that the rules of the game are about to be rewritten.

Here’s the non-obvious part: a regime-change rally is rarely about what is true today. It’s about what could become true tomorrow. Investors are not buying “Venezuela as it exists.” They’re buying a probability-weighted future in which sanctions loosen, capital enters, and the energy sector—Venezuela’s economic heart—stops bleeding and starts breathing.

2) Why oil can dip while Caracas rallies: the market’s “supply relief” interpretation

Many people expect a geopolitical shock involving an oil-heavy country to push crude higher. Yet early price action can do the opposite. If traders believe the shock increases the odds of more supply over the medium term—through sanctions relief, foreign investment, and rehabilitated infrastructure—crude can soften even as local Venezuelan assets surge.

This is where heavy crude matters. Venezuela’s reserves are immense, but a large share is heavy and operationally difficult. Years of underinvestment and sanctions pressure can degrade production capacity even when the resource is still in the ground. If markets start to price a scenario where U.S.-aligned policy unlocks capital and technology to restore output, the immediate intuition (“war = oil up”) gets replaced by a more mechanical one: “future barrels = oil capped.”

In other words, the IBC rally and a softer crude tape can be consistent. One is a bet on political and financial normalization; the other is a bet that normalization eventually translates into incremental supply. The market is not contradicting itself—it’s time-shifting the story.

And there’s a second layer: U.S. Gulf Coast refining has real-world preferences. Many refineries are optimized for heavier grades. When a compatible feedstock re-enters the picture, it can change margins, logistics, and the bargaining power of regional supply chains. If that possibility becomes more credible, energy equities and refining-linked narratives can move even when front-month crude is indecisive.

3) China’s “open the books” moment is the quiet signal traders respect

One of the most consequential details in this story isn’t a speech—it’s a spreadsheet. Reports that Beijing has asked large banks to disclose their Venezuela exposure is a sign of a system doing what systems do when the ground shifts: measuring loss, mapping legal risk, and preparing for negotiation.

For more than a decade, Venezuela’s external financing has often been structured around energy flows and strategic assets. When a major geopolitical player begins auditing exposures, markets read it as a move from “business as usual” to “contingency planning.” That matters because the next phase of Venezuela’s trajectory—whether normalization or prolonged dispute—will be shaped by creditor politics as much as by oil physics.

If U.S. influence over Venezuela’s external assets tightens (and if enforcement around strategic assets becomes stricter), then legacy lenders face a harder question: do they negotiate for repayment terms in a new political reality, or do they fight for claims in a hostile legal environment? The IBC’s jump is not only optimism—it’s also a repricing of who might sit at the table when the country’s assets and future cash flows are restructured.

4) The New York courtroom is part of the market, not separate from it

Legal narratives can look like theater, but they are also a mechanism for allocating control. Maduro and Cilia Flores reportedly denied wrongdoing in U.S. court and framed the detention as unlawful. Prosecutors, meanwhile, signal confidence. To traders, this isn’t only a story about guilt or innocence—it’s a story about timeline risk.

If the legal process becomes a prolonged battle over jurisdiction, sovereign status, and procedure, it can slow down the “normalization trade.” Conversely, if political transition in Caracas consolidates quickly, markets may treat the courtroom drama as noise—important, but not decisive for capital flows and energy rehabilitation.

That’s why the IBC can rally even before the legal fog clears: local equities are often the earliest and most emotional pricing engine. They move first on regime probability; they adjust later on implementation reality.

5) When stocks, crypto, gold, and even oil rise together, it’s usually about positioning

A rare “everything green” session—equities up, crypto up, gold and silver up, oil up—looks like a paradox if you view assets as simple opposites (risk vs. safety). In practice, these days are often about flows: positioning resets, hedges getting rebuilt, and investors choosing to own multiple forms of optionality at once.

Gold can rise because it’s an uncertainty hedge. Bitcoin can rise because it’s a global liquidity barometer and a “non-sovereign” asset that tends to react to shifts in macro narratives. Equities can rise because a political shock is interpreted as net-positive for future supply and corporate earnings. Oil can rise because traders cover shorts, reprice tail risks, or respond to policy hints about energy investment. The common denominator is not ideology—it’s portfolio behavior under uncertainty.

For crypto specifically, geopolitics increasingly matters through a simple channel: settlement. When sanctions, trade disruptions, or capital frictions intensify, demand for alternative settlement rails and digital collateral can rise—sometimes quietly, sometimes explosively. That does not mean “up only.” It means crypto is now part of the macro toolkit, not an isolated casino.

6) What to watch next (the signals that beat the headlines)

The next few weeks will likely produce enough headlines to fill a year. The better approach is to watch a handful of “hard” signals—because markets eventually stop trading speeches and start trading execution.

Sanctions and licensing cadence: Not “will sanctions be lifted,” but how. Specific licenses, operating permissions, and compliance frameworks determine whether capital can move and whether projects can restart without legal blowback.

Operational reality in the oil patch: Field maintenance, diluent access, export logistics, and service-company activity matter more than promises. Heavy crude is not a light switch; it’s an engineering schedule.

Asset control and creditor negotiations: Who controls strategic assets and how creditor claims are handled will shape investment appetite. A credible restructuring path can attract capital; a legal minefield repels it.

China’s response beyond rhetoric: The market will track whether Beijing treats this as a manageable loss, a negotiable problem, or a strategic red line. Financial exposure audits are step one; policy retaliation (if any) is step two.

Local financial plumbing: Capital controls, banking functionality, and FX management determine whether an equity rally becomes a broader recovery narrative—or remains a market-specific event.

Conclusion: the IBC rally is the first draft, not the final chapter

The IBC’s 16.45% jump is best read as a market sketch of a possible future: a Venezuela where oil can be monetized more efficiently, where sanctions friction eases, and where the country’s economic engine becomes investable again. That doesn’t mean the future is guaranteed. It means the probability distribution shifted—enough to force repricing.

In the near term, oil’s reaction may remain ambiguous because the market is balancing two forces: the risk of disruption versus the prospect of medium-term supply relief. Global equities and crypto can rally alongside gold because portfolios are rebuilding optionality rather than choosing a single narrative. And China’s quiet risk audit may matter more than the loudest press conference, because it hints at how power will negotiate when assets and energy flows change hands.

If there is one takeaway that feels durable, it’s this: financial markets don’t trade morality, and they don’t wait for certainty. They trade timelines, permissions, and who controls the cash flows. Venezuela just became a case study in all three.

Frequently Asked Questions

Does a 16.45% IBC jump mean Venezuela’s economy is “fixed”?

No. It mainly signals a sharp repricing of expectations. In constrained markets, equities can move like an “option” on policy change. Sustainable improvement depends on execution: investment frameworks, operational recovery in energy, and functional financial plumbing.

Why wouldn’t oil spike if Venezuela is at the center of a geopolitical shock?

Because the shock can be interpreted as increasing future supply rather than reducing it. If traders believe sanctions could ease and investment could restore production, the medium-term supply outlook can cap prices—even if short-term uncertainty rises.

Why does China’s reported exposure review matter to markets?

It signals that large stakeholders are preparing for legal and financial outcomes, not just political commentary. Creditor behavior and asset-control negotiations will shape whether Venezuela becomes investable—or remains a contested zone.

How does this connect to Bitcoin and crypto?

Geopolitical uncertainty often affects liquidity, settlement preferences, and hedging behavior. Crypto can benefit from renewed interest in alternative collateral and cross-border rails, but it can also remain volatile if risk appetite changes.

What’s the single most important thing to watch next?

Concrete policy and operational steps: sanctions/licensing details, early investment commitments with compliance clarity, and measurable improvements in export logistics. Headlines move markets for hours; implementation moves markets for months.

Disclaimer: This article is for educational purposes only and does not constitute investment advice, financial advice, legal advice, or a recommendation to buy or sell any asset. Markets involve risk, and geopolitical events are complex and fast-moving. Always verify information from multiple independent sources and consult qualified professionals where appropriate.