Oil, Internet, and Bitcoin: Why the Venezuela Shock Matters More Than the $91K Print

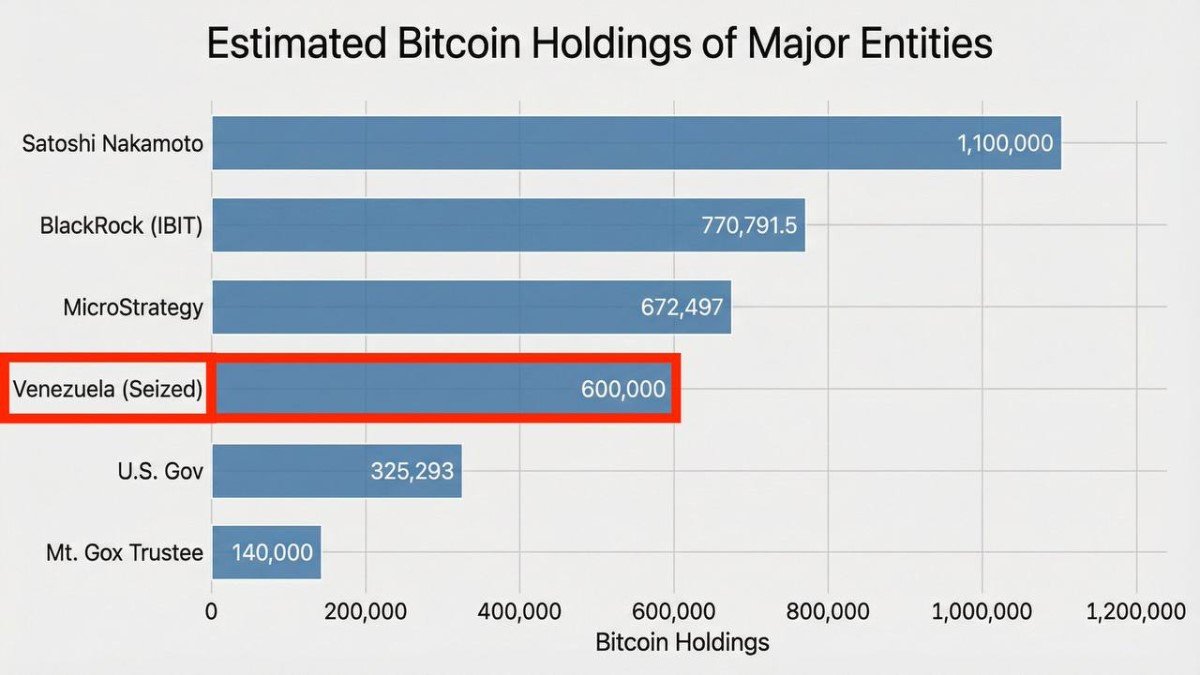

The first week of 2026 is already producing the kind of headlines that make markets feel like they’re trading on two screens at once: one for price, another for power. Over the last 24 hours, Bitcoin traded around $91K while Venezuela dominated the macro narrative, with U.S. officials emphasizing an energy-led agenda after the capture of Venezuela’s leader and describing plans to revive production and sell more oil abroad. In parallel, multiple reports say Starlink is offering free broadband access in Venezuela through February 3, 2026 — a reminder that infrastructure can become a market variable during shocks.

Most market recaps stop at the surface: “BTC is up,” “oil is the story,” “big names posted something bullish.” This piece takes a different route. Instead of treating these events as separate bullet points, we’ll connect them under one theme: in 2026, many of the most important crypto catalysts are increasingly non-crypto. They sit in policy, logistics, energy, and communications — the physical systems that determine who can transact, who can coordinate, and who gets priced as “safe” when uncertainty rises.

Venezuela as a Macro Signal, Not Just a Political Story

When a major state event hits the tape, markets often react in layers. First comes the quick emotional impulse (risk-on or risk-off). Then comes the slower repricing: which assets are now strategically constrained, and which are now strategically useful? The Venezuela headlines sit squarely in that second category because they touch the world’s most sensitive input — energy — and the governance of who gets to control supply, infrastructure rehabilitation, and export permissions.

Even before the latest developments, Venezuela’s relevance to global finance was never purely about barrels. It was about the optionalities embedded in barrels: sanctions, supply routing, investment access, and the distribution of rents from infrastructure repair. Public messaging that frames Venezuela’s oil as something to “restart” and monetize signals an attempt to convert geopolitical change into industrial cash flow. That matters for inflation expectations, rates, and ultimately for liquidity conditions across risk assets.

For crypto readers, the key takeaway isn’t to predict what happens next on the ground. It’s to recognize what kind of world produces these moves. A world where large powers increasingly treat commodities, payment rails, and settlement infrastructure as part of national strategy is a world where neutral, borderless settlement networks become more valuable in concept — and more contested in practice.

“We’re in the Oil Business”: The Hidden Link to Crypto Liquidity

Energy shapes inflation expectations and rate paths, and those two variables shape crypto liquidity more than any on-chain metric ever will. If markets believe a regime shift could increase oil supply over time, that can cool energy-inflation fears. Cooler inflation expectations can translate into less restrictive policy pricing. And easier policy expectations are often the oxygen that supports growth and speculative assets, including crypto.

But there’s a second-order effect that’s more subtle. When leaders frame commodities as strategic levers in public remarks, it increases the “policy premium” investors assign to non-commodity hedges. That’s where Bitcoin’s narrative re-enters — not as a promise of quick gains, but as an asset with portability and settlement independence. In moments of institutional uncertainty, “can I move value without asking permission?” becomes a real question, not a slogan.

So the connection between Venezuela headlines and a $91K Bitcoin tape isn’t a direct trade. It’s a reminder that the financial system is still a hierarchy of chokepoints — and both governments and markets are becoming more explicit about it. Bitcoin is often discussed as money; in moments like this, it’s also discussed as mobility.

Bitcoin Around $91K: Price Action as a Story About “Maturity”

Bitcoin trading near $91K feels “normal” in a way that would have sounded unreal not long ago. That normalization is itself a structural shift. Earlier cycles were driven by crypto-native triggers: exchange blowups, halving hype, and retail waves. Today, Bitcoin’s tape is increasingly bracketed by institutional flows, derivatives positioning, and macro headlines that have nothing to do with protocol changes.

This is where a common misunderstanding appears: people interpret “maturity” as “less volatility.” In reality, maturity often means volatility starts to rhyme with the volatility of the world that holds the asset. A more financialized Bitcoin can become less sensitive to niche crypto news and more sensitive to rates, geopolitics, and cross-asset positioning. That doesn’t guarantee calm markets; it changes the reasons markets move.

If 2025 delivered a year where old cycle heuristics felt less reliable, early 2026 reinforces the lesson: Bitcoin is now trading in the same arena as macro. And macro is where narratives collide. In that arena, the chart is not the whole story — it’s the scoreboard.

The Institutional Tell: When “Hints” Become a Market Language

Another modern feature of the Bitcoin market is how institutional behavior has become legible. Large, repeat buyers sometimes telegraph intent through predictable communication patterns, and market participants learn to read those patterns like a calendar. This doesn’t remove uncertainty — it redistributes it. Traders stop asking “will it happen?” and start asking “how much is already priced in?”

That distinction matters because priced-in expectations can create fragile positioning. When everyone believes they understand the next step, surprises tend to come from the second step: funding costs, dilution mechanics, regulatory classification, or index eligibility. The lesson isn’t that corporate buyers are “good” or “bad.” It’s that the Bitcoin market is increasingly shaped by capital markets structure, not just grassroots conviction.

Educationally, this is a useful shift to watch: Bitcoin’s narrative is migrating from “digital gold” toward “digital balance sheet strategy.” That opens doors to broader participation, but it also ties Bitcoin more tightly to equity issuance, debt markets, and the rhythms of disclosure.

The CZ Soundbite Problem: When Optimism Becomes a Macro Proxy

Statements like “crypto is still small, the potential is huge” feel persuasive because they point at an obvious truth: crypto’s share of global assets and payments remains limited. But in 2026, repeating the line isn’t analysis — it’s a prompt. The real question is: what kind of growth is feasible under the rules that are forming?

Growth is no longer just a function of enthusiasm. It’s increasingly permissioned by compliance, custody standards, regulated access, and financial reporting. That changes which business models win, which tokens behave like products versus securities, and which networks get embedded into payment stacks rather than traded as narratives.

A practical framework for 2026 is simple: adoption accelerates when friction falls. And the friction that matters most is operational and regulatory — not a lack of awareness. “Potential” is real, but it is filtered through the lanes policymakers and institutions allow.

Starlink and “Connectivity Liquidity”: The Rail Nobody Prices Correctly

Reports that Starlink is providing free broadband service in Venezuela through early February sound at first like a humanitarian or PR move. But connectivity is also a form of liquidity. When access to the internet is unstable, everything downstream becomes fragile: communication, coordination, commerce, and even basic access to digital custody tools. In a crisis, being online is not entertainment; it’s infrastructure.

Crypto adoption is often described as “banking the unbanked.” Yet in practice, crypto requires one prerequisite before it can substitute for banking: consistent connectivity. That makes satellite internet an underrated variable in the crypto equation. Not because it pumps prices, but because it changes who can remain connected during shocks — and who can’t.

There’s also a political layer. Venezuela has historically been a complicated jurisdiction for official Starlink operation, with signs of grey-market usage and regulatory hesitation. That means any sudden expansion, even temporary, reads as more than a commercial decision. Whether or not that interpretation is correct, the pattern is worth noting: in 2026, connectivity is increasingly treated as a strategic instrument, not just a consumer service.

What This 24-Hour Window Actually Says About 2026

If we compress the tape into one coherent narrative, it looks like this: a geopolitical shock introduces commodity and policy uncertainty; Bitcoin holds around the low-$90,000s; influential figures reiterate long-term adoption stories; and communications infrastructure becomes part of the response. That is not random noise. It is the shape of the world crypto is integrating into.

Here are a few practical observations — not predictions — suggested by this 24-hour window. Each is less about “what to buy” and more about “what to understand” if you want to read the market without being whipsawed by headlines.

• Crypto is being priced as a macro asset more often than as a niche technology. Cross-asset correlations will matter, especially around rates, energy, and geopolitical risk.

• Energy narratives can swing liquidity expectations, which then swing risk appetite. You don’t need to trade oil to be affected by oil.

• Infrastructure is the new onboarding funnel. Payment rails, custody rails, and now connectivity rails determine where adoption is even feasible.

• Institutional behavior is increasingly legible through patterns and disclosures. That can reduce surprise, but it can also crowd positioning and amplify reversals.

Conclusion

The easiest way to read today’s market is to treat it as a list: Venezuela, Bitcoin near $91K, a few big names posting, and a connectivity headline. The more useful way is to treat it as a single story about the next phase of crypto: the phase where digital assets are inseparable from energy, policy, and communications.

If crypto wants to become part of global finance, it has to live inside global finance’s constraints — sanctions, infrastructure, and geopolitics — not just its opportunities. That is neither a reason for hype nor a reason for fear. It’s simply a clearer map of the terrain. And in markets, having the right map is often more valuable than having the loudest forecast.

Frequently Asked Questions

Does the Venezuela news directly move Bitcoin?

Not in a simple one-to-one way. Events like this tend to influence Bitcoin through macro channels: energy expectations, risk sentiment, and broader narratives about financial chokepoints and cross-border settlement.

Why does connectivity (like Starlink) matter for crypto?

Because digital self-custody and on-chain access depend on stable internet. During crises, connectivity can determine who can transact, communicate, and maintain access to digital services.

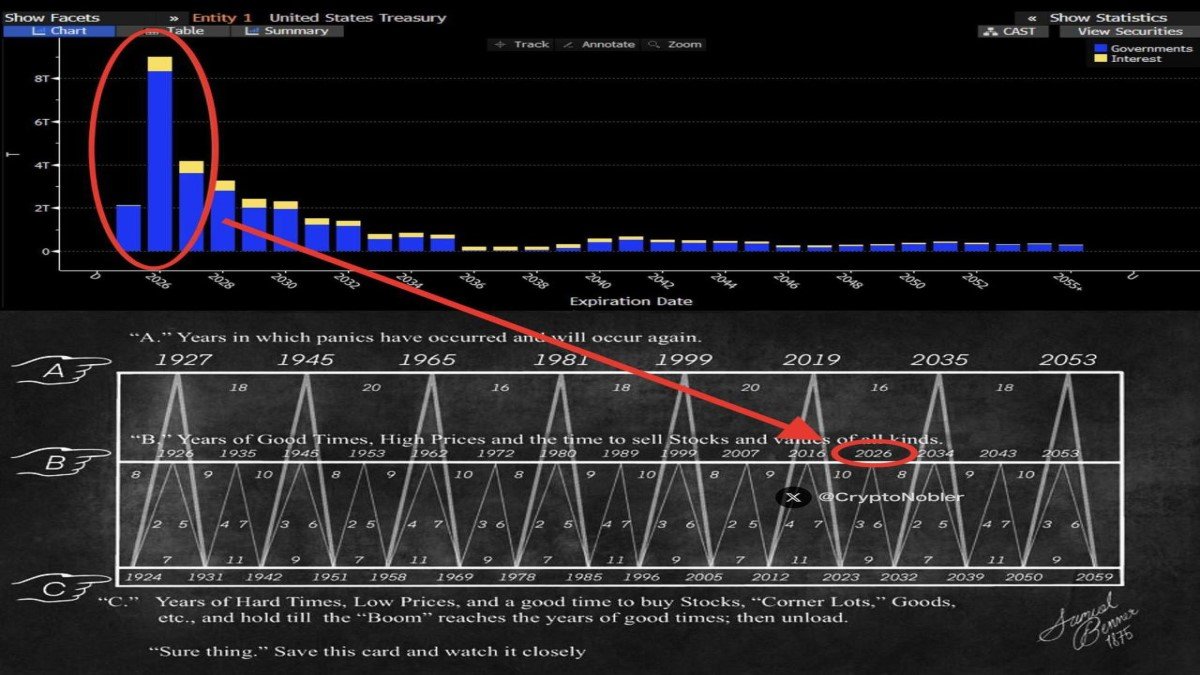

Is the “four-year cycle” framework obsolete?

Cycles may still exist, but the drivers are evolving. As Bitcoin becomes more financialized, macro variables (rates, liquidity, geopolitics) can outweigh purely crypto-native narratives.

Are public hints by corporate Bitcoin holders meaningful?

They can be informative about intent and timing, but they are not guarantees. It’s generally safer to treat them as signals of communication patterns rather than as actionable instructions.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Crypto assets are volatile, and regulatory and geopolitical developments can change rapidly. Always do your own research and consider your risk tolerance.