SEC’s New Crypto Custody Guidance: What Individual Investors Really Need to Understand About Keys, Wallets and Responsibility

When regulators start explaining how to store digital assets at the retail level, it usually means one thing: the technology has become mainstream enough that basic security mistakes are causing real-world damage. The latest guidance from the U.S. Securities and Exchange Commission (SEC) on crypto custody for individual investors fits exactly into that pattern.

On the surface, the document covers simple points: what a wallet is, what a private key does, why a lost seed phrase means lost funds, and the differences between hot and cold storage. But below that layer of basic education, there is a deeper message: in crypto, custody is not a technical afterthought – it is the core risk you are taking on every time you hold a token.

In this article, we unpack the key ideas behind the SEC’s guidance and go beyond the checklist. We will look at what it really means to hold your own keys, when it may make sense to rely on a third party, and how to build a custody setup that matches your risk tolerance, technical skills and time horizon – all while staying firmly in the realm of education and analysis, not trading advice.

1. What “Custody” Means in Crypto: You Don’t Hold Coins, You Hold Control

The first conceptual reset in the SEC’s guidance is almost philosophical: your wallet does not hold coins. Instead, it holds the private keys that give you the right to move those coins on a blockchain.

On a public ledger like Bitcoin or Ethereum, tokens are just entries in a global database. What matters is who can authorize a change in that database – who can sign a transaction proving they have the right to move a given balance. That right is encoded in a private key, which is usually represented as a string of characters or derived from a seed phrase (a list of 12–24 words).

- If you control the private key, you control the assets.

- If you lose the key or the seed phrase, there is no central help desk that can restore access.

- If someone else learns your key, they gain the same power you have.

This is radically different from traditional finance. In a bank or brokerage account, losing your password is inconvenient but rarely final. You can call support, present identification and regain access. With crypto self-custody, the key is both the lock and the proof you own what you own. The SEC’s strong emphasis on this point is not exaggeration; it is the defining feature of the asset class.

2. Hot vs. Cold Wallets: Convenience, Safety and the Real Trade-Off

The guidance also revisits a distinction many retail investors have heard, but often only half understand: hot wallets versus cold wallets.

A hot wallet is connected to the internet – for example, a browser extension, a mobile app, or a wallet hosted by an exchange. It is convenient for frequent transactions: trading, moving stablecoins between platforms, interacting with on-chain applications. But because it is online, it faces a broader set of digital threats: compromised devices, malicious browser extensions, unsafe Wi-Fi networks and so on.

A cold wallet is designed to keep your private keys offline. Hardware wallets, specialized signing devices or seed phrases stored in physical form all fall into this category. They are much less exposed to remote attacks, but they introduce a different challenge: physical loss or damage. A misplaced backup, a device that is never initialized properly, or a seed phrase thrown away by mistake can permanently cut you off from your funds.

The SEC does not tell investors which option to choose. Instead, the guidance emphasizes the trade-off between convenience and operational safety:

- Hot wallets: more convenient, higher exposure to digital threats.

- Cold wallets: better isolation from online threats, higher responsibility for physical security and backups.

For serious investors, the question is rarely “hot or cold?” in absolute terms. A more realistic approach is a tiered model:

- A smaller “spending” balance in a hot wallet for daily use.

- A larger “savings” balance in cold storage with stricter procedures.

The SEC’s explanation of wallet types is a reminder that every extra unit of convenience usually comes with added risk – a central theme across all of finance, but especially pronounced in crypto.

3. Self-Custody vs. Third-Party Custody: Control Comes With Full Responsibility

Another crucial distinction in the guidance is between self-custody and third-party custody.

In self-custody, you hold your own keys. This is the purest form of crypto ownership: no counterparty risk, no reliance on a specific platform for access, and full portability across applications and networks. It is the closest realization of the original “not your keys, not your coins” ethos.

But self-custody also means that you carry the entire burden of security and operational discipline:

- Backing up seed phrases correctly and storing them in safe locations.

- Protecting devices from malware and unauthorized access.

- Recognizing suspicious websites, messages and requests that attempt to trick you into revealing sensitive information.

There is no safety net. A single error can have lasting consequences. That level of responsibility may be appropriate for technically confident users, but overwhelming for beginners.

In third-party custody, an exchange, broker or specialized custodian holds the keys on your behalf. You interact with a familiar interface: username, password, sometimes multi-factor authentication. The provider manages backups, infrastructure and security operations.

The advantages are clear:

- More familiar user experience for those coming from traditional finance.

- Potential recovery options if you lose your login, within the provider’s policies.

- Often integrated services, such as trading or access to specific products, from the same account.

But this comes with its own risks:

- You must trust that the custodian actually holds the assets it reports.

- You depend on its internal controls, cybersecurity posture and compliance.

- Access to your assets can be delayed or constrained if the platform experiences outages or legal issues.

The SEC’s guidance does not say self-custody is “better” than third-party custody or vice versa. Instead, it underscores that neither option is risk-free – they just concentrate risk in different places. For many investors, a blended approach is logical: keep long-term holdings in a well-designed self-custody setup, and use reputable custodians for trading, short-term liquidity or specific services.

4. The Real Message: Operational Risk Is as Important as Price Volatility

Retail investors often talk about risk purely in terms of price: “What if Bitcoin drops 30%?”, “What if this token underperforms?”. The SEC’s focus on custody is a reminder that crypto also carries operational risk: the chance of loss or loss of access due to human error, technical failure or weak security practices.

In traditional markets, operational risk is mostly outsourced to institutions: brokers handle record-keeping, exchanges manage matching engines and clearing houses ensure settlement. In crypto, especially in self-custody, individual investors are much closer to the infrastructure. They interact directly with wallets, smart contracts and networks. That direct access is powerful, but it also brings responsibility.

The SEC’s emphasis on private keys, seed phrases and wallet types is effectively saying: “Before you worry about 10% swings in price, make sure you are not exposing yourself to a 100% loss through basic operational mistakes.” It is a shift from thinking only about market timing to thinking about systems, processes and risk management.

5. Building a Custody Setup That Matches Your Profile

One way to apply the SEC’s guidance in a practical, brand-safe way is to think in terms of profile-based custody strategies. The idea is not to prescribe a specific setup, but to show how different types of users might weigh the trade-offs.

(a) New or casual investor

Characteristics: limited technical background, small allocation to digital assets, focus on simplicity.

For this group, the main goals are avoiding irreversible mistakes and understanding the basics of key management. A reasonable path might be:

- Using a well-regulated platform for initial purchases and basic storage.

- Learning how wallets work with small amounts before moving larger balances.

- Focusing on security hygiene: strong passwords, multi-factor authentication, careful review of login links.

The SEC’s message to this segment is simple: do not rush into complex self-custody setups until you fully understand seed phrases and backups.

(b) Intermediate investor

Characteristics: higher allocation to digital assets, some experience with wallets and transfers, interest in on-chain activity.

This group might adopt a hybrid model:

- Keeping an operational balance on a reputable platform for trading and short-term needs.

- Using a hardware wallet or other cold storage method for long-term holdings.

- Implementing a clear backup strategy: at least two secure copies of the seed phrase stored in separate, well-protected locations.

Here, the SEC’s guidance highlights the importance of documented procedures – for example, checking that backups are readable, ensuring that trusted family members understand how to handle them in case of emergency, and avoiding the temptation to store sensitive information in easily accessible digital formats.

(c) Advanced or professional participant

Characteristics: significant exposure to digital assets, regular on-chain interaction, potentially business or professional use.

For this group, custody becomes a structured risk management problem:

- Segregating funds by purpose (treasury, operations, experimental activity) and using different wallets for each.

- Exploring multi-signature setups, where multiple approvals are required to move funds.

- Working with regulated custodians for institutional balances, combined with internal controls and audits.

The SEC’s emphasis on clear control over keys, transparent responsibilities and documented processes aligns closely with practices that are already standard in corporate treasury and institutional asset management.

6. Practical Security Habits the Guidance Is Pointing Toward

Beyond the labels of hot, cold, self-custody and third-party custody, the SEC’s document implicitly encourages investors to adopt a set of security habits that significantly reduce everyday risk:

• Treat your seed phrase like the root credential to your financial life. It should never be typed into random websites, stored in plain text in cloud notes, or shared via messaging apps. If someone asks for it, that is a clear warning sign.

• Separate devices for high-value activity. Consider using a dedicated device with minimal apps installed for managing wallets and signing important transactions, instead of a heavily used, cluttered device.

• Test with small amounts first. Before moving substantial balances to a new wallet or custodian, perform a small “test transaction” to verify addresses, fees and procedures.

• Think about recovery and estate planning. If something happens to you, would a trusted person know how to begin the recovery process without being able to move funds on their own immediately? Balancing privacy and practicality here is crucial.

• Stay alert to social engineering. Many incidents do not involve sophisticated code; they involve convincing messages, fake support accounts or misleading links. Healthy skepticism is one of the most effective forms of protection.

None of these habits require deep technical knowledge, but they do require discipline. The SEC’s focus on seed phrases, private keys and wallet types is ultimately a push toward this kind of disciplined mindset.

7. What the Guidance Signals About the SEC’s Approach to Crypto

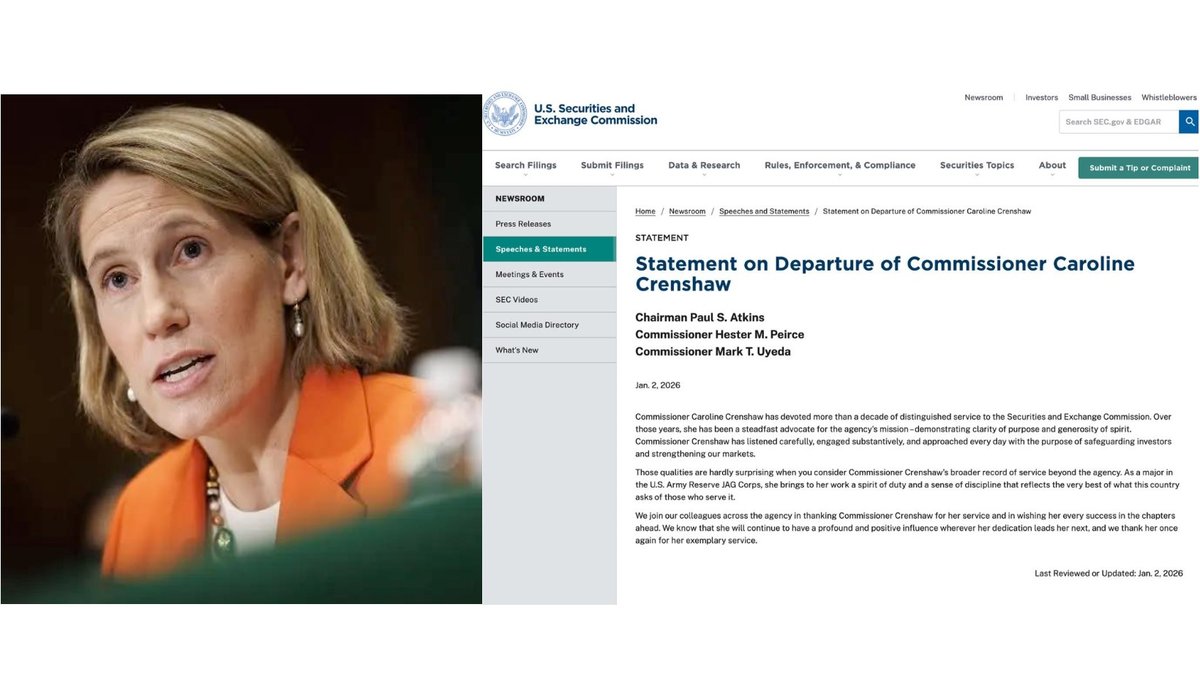

Finally, the guidance itself tells us something important about how regulators view the role of digital assets in the broader financial system.

First, it shows that crypto is being treated increasingly like any other financial asset class when it comes to investor education. Just as equities and mutual funds come with standard warnings about risk and suitability, digital assets are now accompanied by standardized explanations of custody, security and responsibility.

Second, it hints at the direction of future policy for platforms that hold assets on behalf of users. If the regulator is educating individuals about what custody means, it is also likely to hold custodians to higher expectations regarding segregation of funds, internal controls and transparency about how keys are managed.

Third, it underscores a theme that will only grow over time: in the digital asset world, user protection is not just about price disclosure, it is about operational clarity. Knowing who controls the keys, how backups are handled, and what happens in case of technical incidents is as important as understanding volatility.

8. Conclusion: Custody Is the Quiet Risk You Cannot Ignore

The SEC’s crypto custody guidance for individual investors may look basic at first glance – almost like a glossary of terms. But beneath the definitions is a serious message: in a system where private keys equal control, security and operational discipline are not optional extras, they are central to the investment itself.

Whether you choose self-custody, third-party custody or a mix of both, the trade-offs never disappear. You are always exchanging one set of risks for another: personal responsibility versus dependence on a platform, online convenience versus offline safety, simplicity versus fine-grained control.

For long-term participants who want to treat digital assets as a serious part of their financial life, the right question is no longer “Which token should I buy next?” but rather “Do I fully understand who controls my keys, and what could go wrong with my current setup?”. The SEC’s guidance is an invitation to start that conversation – and to keep custody at the center of how we think about risk in the digital asset era.