After Crenshaw: What an All-Republican SEC Could Mean for Crypto in 2026 (and What It Won’t)

Caroline Crenshaw’s exit from the U.S. Securities and Exchange Commission is already being framed as a simple narrative: the last prominent crypto skeptic leaves, and the agency becomes “friendlier” overnight. That story is neat. It is also incomplete.

Regulators don’t turn like price candles. They turn like ships: slowly, with inertia, and under constraints that rarely fit into a headline. Crenshaw’s departure matters—not because it guarantees a new crypto era, but because it changes the SEC’s internal balance, the signaling environment for markets, and the speed at which certain decisions can happen.

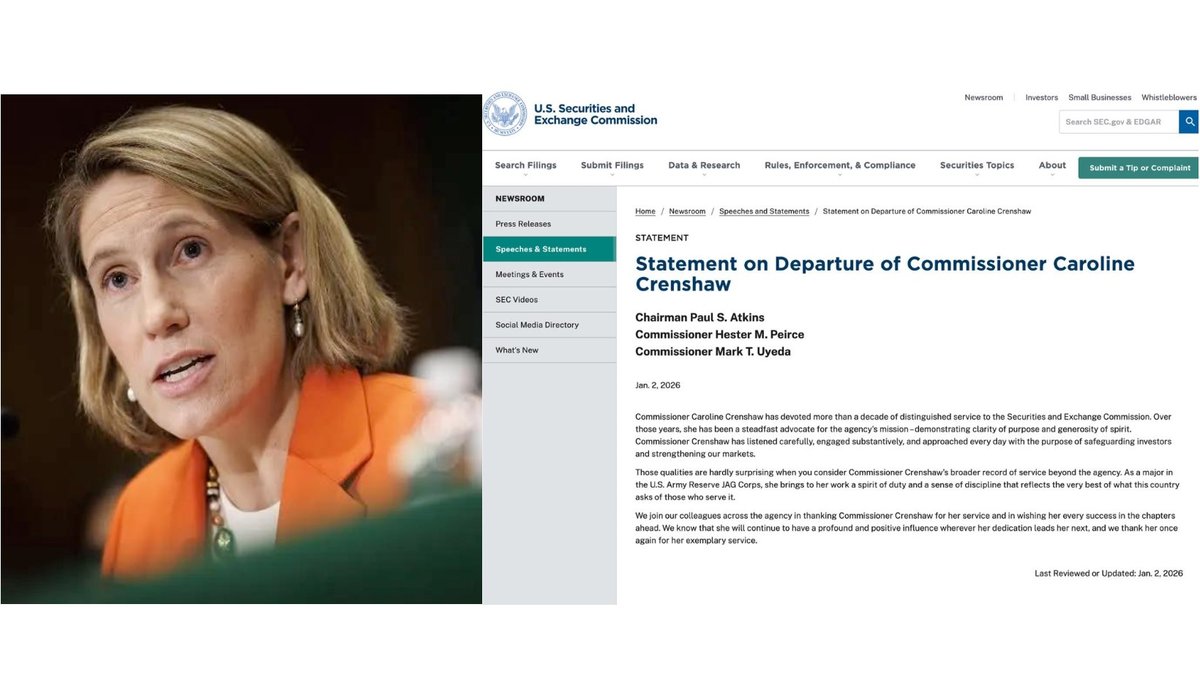

What Crenshaw represented inside the SEC

Crenshaw was not merely “a vote.” She represented a philosophy—risk-first, guardrail-heavy, and uncomfortable with the idea that crypto should receive exceptions from the traditional investor-protection model. In her public remarks, she repeatedly returned to the same concern: if you loosen the fundamentals of securities oversight too quickly, retail investors become the stress test.

That perspective functioned as a brake. Not necessarily a veto, but a brake that forced debates to be sharper, memos to be tighter, and public justification to be clearer. Even when she lost votes, the presence of dissent made the Commission’s decisions feel more deliberative—and that matters in an industry where legitimacy is partly a confidence game.

Crenshaw’s career path also matters to how she approached the role. She served at the SEC not only as a commissioner (sworn in during 2020), but previously as a career staff attorney and counsel to other commissioners. That blend—staff + policy seat—tends to produce a regulator who is less impressed by “innovation narratives” and more focused on operational realities like disclosure, supervision, and enforcement tooling.

Why the vacancies may be the bigger story than the resignation

The SEC is designed to be bipartisan and five-member for a reason: stable rules require internal friction. When two seats are empty, the Commission doesn’t just become smaller—it becomes more concentrated. Each remaining commissioner has more agenda power, more leverage in negotiations, and more influence over what gets prioritized.

In practical terms, a three-member Commission can move faster. It takes fewer votes to form a majority. Fewer internal coalitions need to be built. But it can also become more fragile: decisions can look more political (even when the legal reasoning is sound), and the next administration can undo priorities with less institutional resistance. Speed is not the same thing as durability.

Right now, the Commission’s center of gravity is clearly Republican: Chair Paul Atkins, Hester Peirce, and Mark Uyeda remain, while two seats are vacant. By statute, no more than three commissioners can be from the same party—which means the vacancies are not a blank check, but they do create a period where the agency’s direction is set by a narrower band of views.

What could change for crypto markets in 2026

The most realistic changes are not the ones that make the loudest social-media rounds. The SEC does not flip a switch and declare “crypto is fine.” Instead, it can change the posture of how it uses the tools it already has: enforcement selection, guidance tone, exemptions, no-action pathways, and willingness to engage with market structure proposals.

Three shifts are plausible in an SEC where the leadership has publicly signaled a more constructive approach to digital assets. First, expect a heavier emphasis on defining categories—what is clearly within securities jurisdiction versus what is better addressed via tailored legislation or other regulators. Clarity, even when restrictive, tends to reduce the market’s “regulatory risk premium.”

Second, enforcement may become more targeted. That does not necessarily mean “less enforcement.” It can mean fewer sprawling theories and more cases focused on discrete investor-harm patterns such as misleading disclosures, custody failures, or conflicts of interest. For serious platforms, predictable enforcement can be preferable to unpredictable enforcement, because compliance teams can actually build toward it.

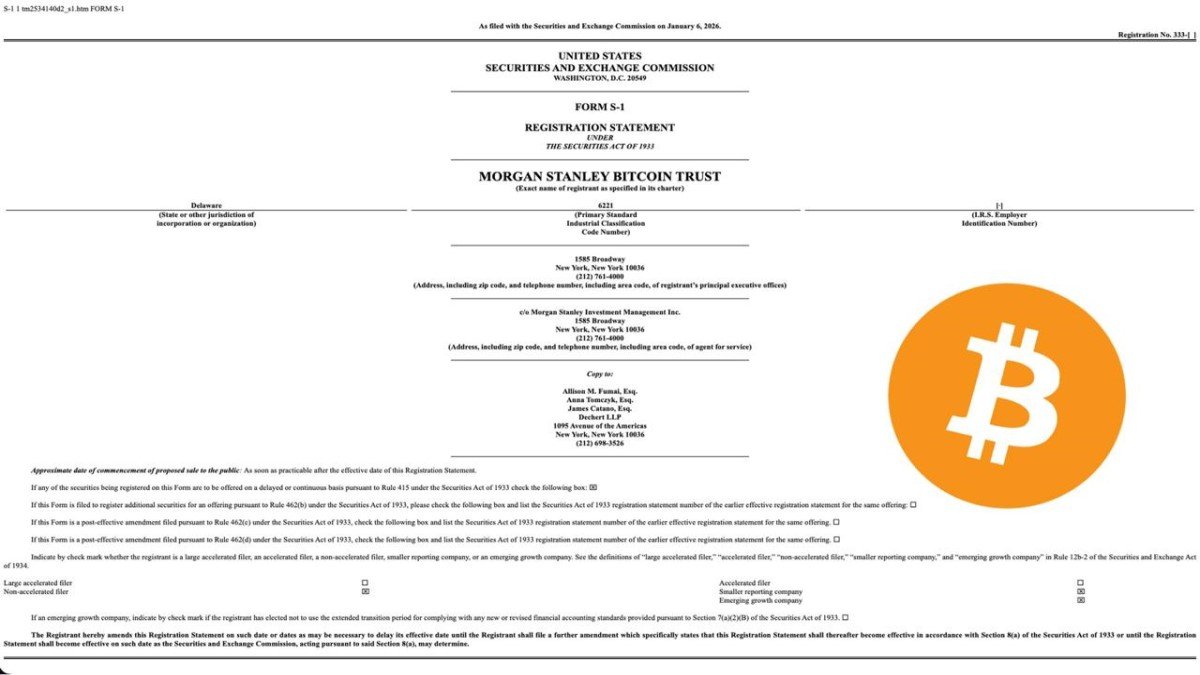

Third, the SEC can shift how it interacts with products that sit at the border between traditional finance and crypto—particularly ETFs, custody frameworks, and tokenized instruments. If the agency wants to encourage compliant rails, it can do so by tightening disclosure expectations while offering clearer pathways for registration and supervision. In other words: fewer gray zones, more paperwork—and potentially more institutional comfort.

What probably won’t change (even with a more “crypto-friendly” SEC)

It is tempting to think the regulator’s mood determines the rules. In reality, securities law, court precedent, and administrative process do most of the governing. Even an enthusiastic Commission must justify rule changes under the Administrative Procedure Act, respond to public comments, and survive litigation risk. The staff workload, internal review procedures, and political scrutiny do not disappear because the headlines change.

Another underappreciated constraint is time. A three-member SEC can set priorities quickly, but building durable policy takes months of drafting, consultation, and iteration. Meanwhile, markets move daily. That mismatch is why “regulatory optimism” often arrives earlier than actual regulatory clarity.

Finally, crypto’s most difficult issues are not solved by friendliness. Market integrity, stablecoin reserve transparency, exchange conflicts, leveraged products, and retail suitability are hard questions even in traditional finance. A more constructive SEC may choose different tools, but the problems themselves still demand trade-offs.

How to read this moment without turning it into a prediction contest

Crenshaw’s departure is best understood as a change in the SEC’s internal debate structure—not as a guarantee of outcomes. If you want a practical way to track reality (not narrative), watch the boring signals: Commission meeting agendas, formal rulemaking dockets, staff guidance, and the kinds of cases that show up in enforcement releases.

Also watch nominations. The next two commissioners will influence whether today’s direction becomes a stable equilibrium or a temporary phase. A regulator that swings too widely across cycles doesn’t just confuse crypto companies—it confuses capital markets. And confusion raises costs for everyone, including the consumers regulators are meant to protect.

In a strange way, this is where crypto’s maturity is being tested. The industry has long argued it wants clear rules. The next step is proving it can thrive under clear rules—even when those rules are strict, paperwork-heavy, and sometimes uncomfortable.

Conclusion

Caroline Crenshaw leaving the SEC marks the end of a visible chapter of skepticism—yet the deeper story is institutional. With two vacant seats and three remaining commissioners steering policy, the SEC can move faster, but it may also face higher scrutiny over legitimacy and durability.

For crypto, the opportunity is real: clearer categories, more consistent engagement, and a potential reduction in regulatory ambiguity. But the constraints are also real: existing law, process, courts, and the practical limits of policymaking. If 2026 becomes a year of healthier adoption, it will likely be because the rules became clearer—not because the regulator became softer.

Frequently Asked Questions

Does Crenshaw’s departure mean the SEC is now “pro-crypto”?

Not automatically. It may signal a more constructive posture, but the SEC still operates under the same securities laws and must justify changes through formal processes.

Why do the two vacant seats matter so much?

Vacancies concentrate decision power and can make policy direction feel less balanced. They can also speed up majority formation on certain issues, while raising questions about long-term stability until nominations are filled.

Should markets expect immediate regulatory clarity in 2026?

Clarity usually arrives in increments: guidance, enforcement patterns, and gradual rulemaking. Big shifts tend to be slower than headlines imply.

What is the most useful way to track real policy change?

Follow formal SEC outputs: proposed rules, final rules, staff statements, and enforcement releases—plus the nomination process for the vacant commissioner seats.