GameFi 2025: From Hype Cycles to a Web2.5 Reality Check

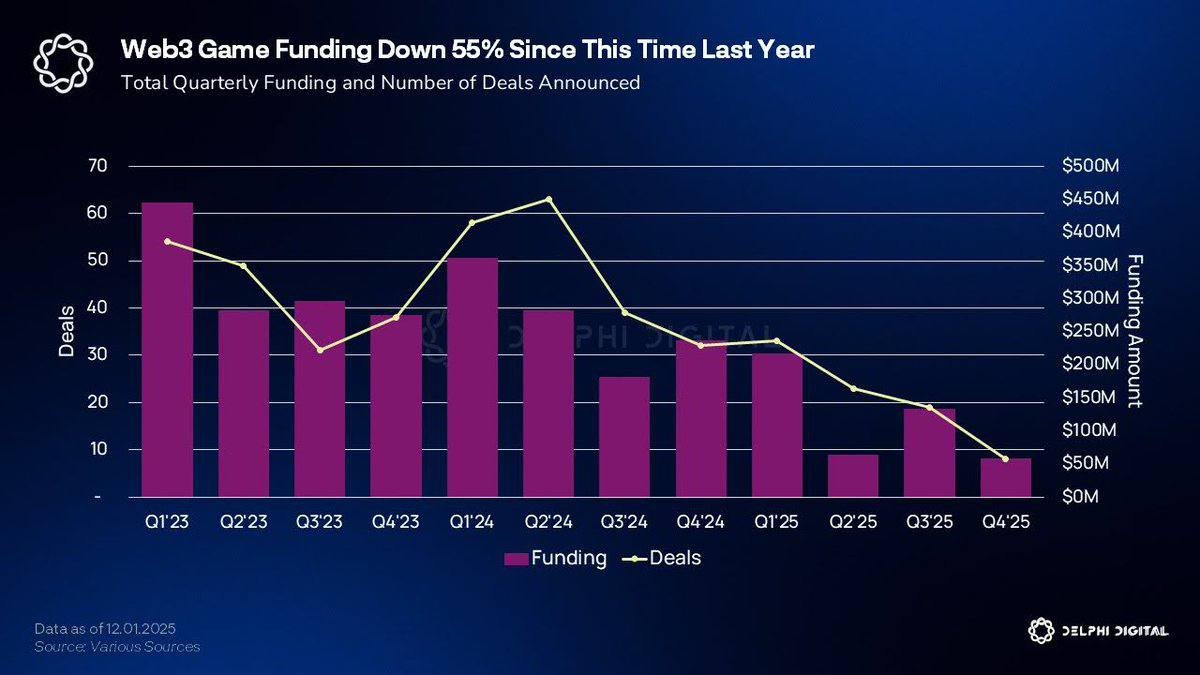

The headline number from Delphi Digital's year-end report is stark: funding for Web3 games has fallen more than 55% compared with the same time last year. The accompanying chart shows both quarterly deal count and total capital raised sloping downward through 2024 and into 2025. For many observers this looks like a verdict on GameFi itself—a sign that the experiment has failed.

Look closer, and the story is more complicated. What is shrinking is not the idea of digital ownership in games, but a very specific phase of the cycle: volatile play-to-earn economies, tokens first and game design second, and a rush of projects whose primary aim was to list quickly rather than retain players for years. While that wave recedes, a quieter but more durable shift is underway toward Web2.5 — games that feel like traditional titles on the surface, but rely on blockchain rails beneath to handle items, rewards and payments.

In this model, studios such as Fumb Games or Mythical Games do not ask players to become token speculators. They use on-chain infrastructure the way free-to-play pioneers once used in-app purchases and ad networks: as background tools that improve margins, retention and community engagement. The speculative heat may have cooled, but the underlying technology is being absorbed into the mainstream of game production.

1. What the Funding Chart Really Says

Delphi's chart covers funding from Q1 2023 through Q4 2025. Early 2023 still reflects the tail end of the prior wave, with more than sixty deals in a quarter and funding totals near the half-billion-dollar mark. By the end of 2025, both lines have compressed: deal counts sit in the low teens and quarterly capital raised has dropped to levels that would barely have registered during the peak of the last cycle.

On the surface that looks like an industry in decline, but several dynamics sit behind the numbers:

• Investor fatigue with shallow economies. Many early GameFi titles relied on aggressive token emissions and referral loops to attract users. When unit economics tightened, player numbers and revenue often fell quickly. Venture funds adjusted by backing fewer, more selective teams rather than writing off the entire category.

• Longer development cycles. Studios that are serious about shipping high-quality cross-platform titles need multi-year timelines. Their funding is raised in larger, less frequent rounds instead of the rapid-fire seed rounds that inflated deal counts in 2021–2022.

• Greater emphasis on infrastructure. Some of the capital that would previously have been labeled "GameFi" is now flowing into chains, account abstraction tooling, wallets and asset platforms that serve multiple verticals, not just games. These still benefit gaming, but they show up under "infrastructure" or "developer tools" in funding reports.

The result is a chart that looks like contraction, but also like consolidation. The market is moving from many experiments with short runways to fewer bets on teams that are trying to bridge genuine entertainment products with on-chain primitives.

2. The End of Play-to-Earn as a Default Template

To understand why a reset was almost inevitable, it helps to recall how the first wave of GameFi worked. Many titles were built around a simple promise: play a game, receive tokens, and the tokens might appreciate over time. For a brief period, rising token prices subsidized generous in-game rewards. As long as new participants arrived quickly enough, the system could sustain high payouts.

But several structural issues surfaced:

- Players behaved like short-term yield seekers, not fans. When the token reward declined, many users left. They had little attachment to the underlying game.

- Economies were often inverted. Instead of gameplay supporting the token, the token was expected to support the game. Once market conditions changed, design flaws became impossible to hide.

- Automated activity proliferated. Because rewards were primarily financial, it was rational to deploy scripts and automated accounts to optimize yield, making it harder for genuine players to enjoy the experience.

As performance data accumulated, investors realized that many of these structures were fragile. High early revenue and impressive token charts often masked weak long-term retention. That recognition shows up in 2025 as fewer new play-to-earn clones making it past the pitch stage.

3. What Web2.5 Actually Means

"Web2.5" has become a convenient label, but it is worth unpacking. In practice, three design shifts distinguish Web2.5 games from their predecessors:

3.1 Gameplay first, ledger second

In Web2.5, the core promise is that the game would still be worth playing even if the blockchain components were turned off. Progression systems, art direction, core loops and user interface design meet the same bar as mainstream mobile or PC games. On-chain elements sit beneath the surface, powering item ownership, secondary markets or reward distribution, but they are not the main marketing message.

3.2 Assets with clear utility

Rather than releasing many speculative tokens, studios focus on a small set of items or passes with clearly defined roles: cosmetic skins, access rights, or upgradeable gear. These assets may be tokenized, but their value flows from how they affect the experience, not from expectations of rapid price appreciation. This aligns incentives between game designers and players, because items must hold up under years of live operations, not just a listing week.

3.3 Web2 onboarding with Web3 benefits

Account abstraction, gas sponsorship and embedded wallets allow new players to start with email or social logins and only gradually become aware that their items live on a public ledger. This reduces friction significantly compared with early GameFi, where users often had to set up non-custodial wallets, manage seed phrases and buy base assets before they could even enter the tutorial.

Studios like Fumb Games, which built casual titles with on-chain rewards integrated in the background, or Mythical Games, which works with existing entertainment brands, exemplify this approach. They speak the language of game producers and license owners first, and only then explain how blockchain changes user economics.

4. Stablecoins and the Micro-Transaction Layer

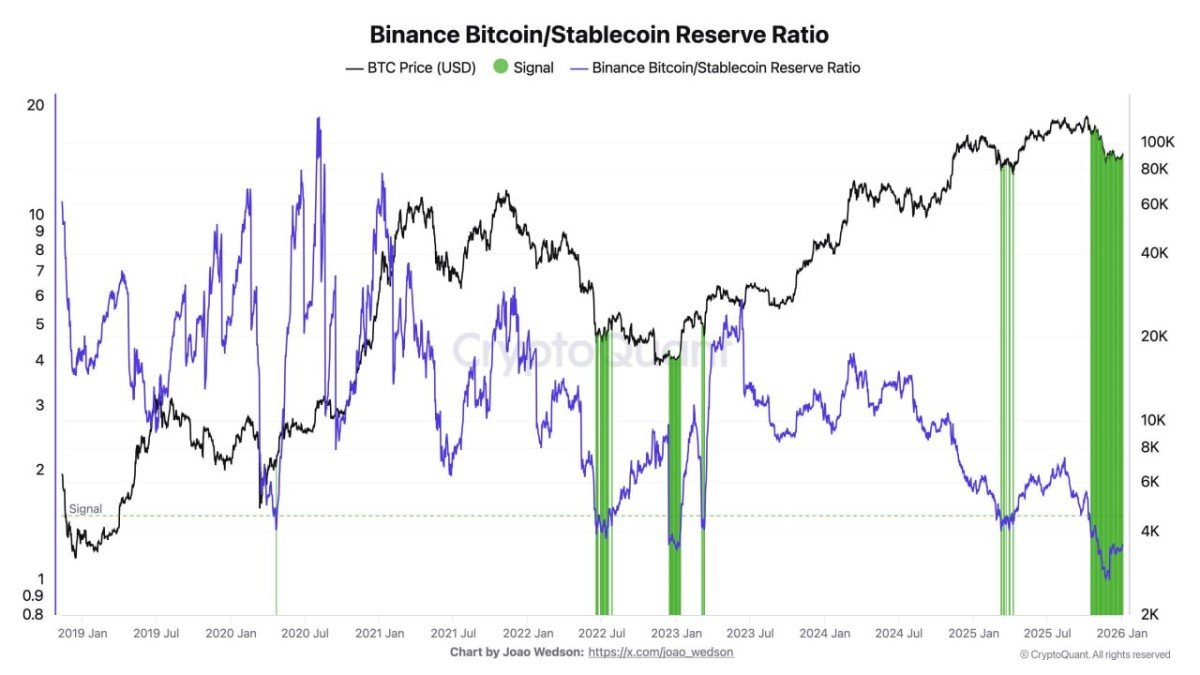

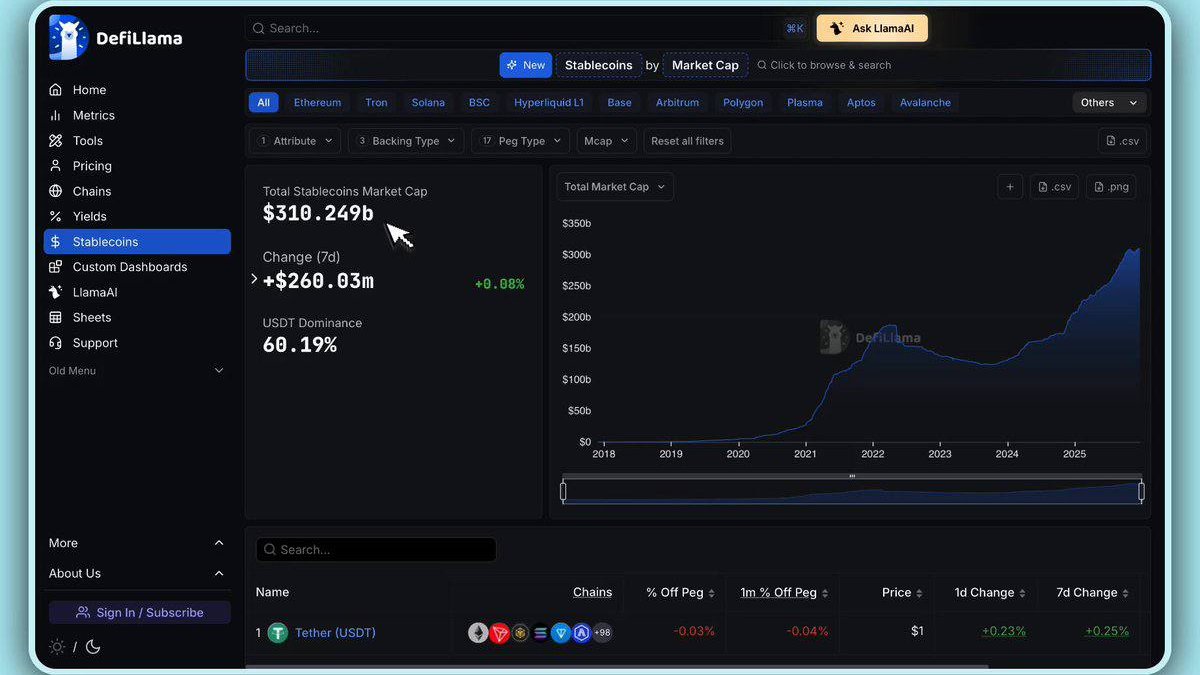

A key enabler of Web2.5 is the maturation of stablecoins as a payment rail. Early GameFi often used highly volatile native tokens for everything from marketplace trades to entry fees. When prices swung wildly, both studios and players struggled to plan.

In 2025, more titles are moving toward a dual-layer structure:

- Stablecoins as the denomination for most economic activity. Loot boxes, battle passes, cosmetic purchases and secondary market trades are increasingly priced in stable units, making revenue more predictable and accounting simpler.

- Native tokens (if they exist) reserved for governance or advanced features. Instead of acting as generalized in-game currency, they might gate access to special tournaments, creator tools or community initiatives.

Because stablecoins settle instantly and can be transferred in small increments, they are well suited to micro-rewards: tipping creators, rewarding players for user-generated content, or sharing a slice of marketplace fees back to active participants. This is the economic layer where Web2.5 has an advantage over traditional free-to-play, which still routes most payments through app stores and legacy card networks with relatively high fees.

5. How Studios and Investors Are Rewriting Their Playbooks

The funding slowdown is forcing both studios and venture firms to be more explicit about what success looks like.

5.1 Metrics that matter now

Instead of celebrating peak token prices or total volume on launch week, investors are asking about metrics that look familiar to any experienced game publisher:

- Day-30 and day-90 retention. Are players still around after the initial excitement fades?

- Average revenue per daily active user (ARPDAU). Does on-chain infrastructure actually improve monetization compared with a similar Web2 title?

- Secondary market health. Are a diverse set of players buying and selling items, or is activity dominated by a small group of speculators?

Projects that can provide clear, consistent answers to these questions are still able to raise capital, even in a tougher macro environment.

5.2 Fewer tokens, more rights

Another visible trend is the shift from open-ended utility tokens toward rights-based designs. Instead of another generic coin, some studios experiment with passes that convey specific entitlements: guaranteed event slots, access to new content, or participation in revenue-sharing pools tied to well-defined in-game activities. This makes it easier to reason about value and to comply with local regulations, because the purpose of the asset is clearer.

5.3 Longer-term partnerships

Because Web2.5 games are built more like traditional service-based products, they require long-term collaboration between investors and studios. Some of the most active funds in gaming are signing multi-title partnerships rather than single-project checks, providing publishing advice, data support and co-marketing in exchange for broader exposure to a studio's pipeline.

6. Why the Web2.5 Reset May Be Healthy

From the vantage point of short-term token performance, the 55% decline in funding looks grim. But from a systems perspective, a phase of lower capital intensity has several advantages:

• It reduces pressure to over-monetize early. When studios have raised moderate, sustainable amounts rather than enormous treasuries, they are less likely to push aggressive token launches before the product is ready.

• It rewards operational excellence. Teams that can run live games efficiently, update content regularly and manage communities thoughtfully have more room to differentiate when capital is scarcer.

• It encourages interoperability. With less budget for building isolated ecosystems, studios are more open to shared infrastructure for wallets, identity and marketplaces, which ultimately benefits players.

In other words, the current phase may feel uncomfortable, but it is aligning incentives in a way that makes long-term success more likely.

7. What to Watch in 2026

Looking ahead, several signposts will indicate whether the Web2.5 thesis is working.

• Download charts, not just on-chain charts. If Web2.5 is real, some of the top-grossing titles on mobile and PC storefronts will quietly use on-chain infrastructure under the hood. Their success will show up first in traditional metrics, then in blockchain analytics.

• Integration by major publishers. Large game companies tend to move cautiously, but once they see repeatable benefits—for example, higher lifetime value from players who own interoperable items—more partnerships are likely to follow.

• Regulatory clarity around digital assets in games. As frameworks for tokenized items and revenue sharing evolve, studios will gain more confidence to experiment with new structures that were previously considered too ambiguous.

• Convergence with creator economies. Tools that let streamers, modders and community organizers issue limited digital goods or share revenues with their audiences may become one of the most practical paths to mainstream adoption.

If these signals turn positive while funding remains disciplined, GameFi may look much healthier a few years from now than it did at the height of the first play-to-earn wave—even if the total dollar amounts raised never quite return to their prior peaks.

8. Conclusion: From Experiment to Infrastructure

GameFi in 2025 is not dead; it is undergoing a demanding but necessary phase of maturation. The drop in funding documented by Delphi Digital is best understood as a shift in priorities: away from short-lived token experiments and toward a Web2.5 model where blockchain works behind the scenes to support games that can stand on their own.

For players, this should mean titles that feel familiar in terms of onboarding and moment-to-moment fun, but offer new forms of ownership and reward that are portable across ecosystems. For studios, it means taking a long view on economy design and choosing infrastructure that can survive multiple cycles. For investors, it means replacing hype-driven frameworks with more grounded questions about retention, monetization and genuine utility.

If the first era of GameFi was about proving that digital assets could live on open ledgers, the next era will be about proving that this actually makes games better to play and more sustainable to run. The Web2.5 transition is not guaranteed, but it is where the most thoughtful studios and capital allocators are now concentrating their efforts.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment, or legal advice. Digital assets and game-related tokens are volatile and may not be suitable for every participant. Always conduct your own research and consider consulting a qualified professional before making financial decisions.